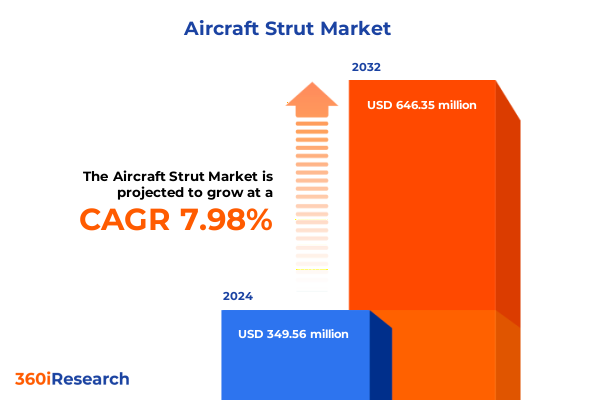

The Aircraft Strut Market size was estimated at USD 377.28 million in 2025 and expected to reach USD 405.55 million in 2026, at a CAGR of 7.99% to reach USD 646.35 million by 2032.

Unveiling the Critical Role of Aircraft Strut Technologies in Ensuring Structural Integrity Across Diverse Aviation Platforms Amid Evolving Operational Demands

The integrity and performance of aircraft strut systems underpin every successful flight, serving as vital components that bear significant loads, absorb shocks during landing, and ensure seamless actuation of control surfaces. As aviation stakeholders pursue greater safety margins, enhanced durability, and reduced lifecycle costs, the role of strut technologies has expanded beyond traditional metal alloys into advanced composites and hybrid material solutions. This introduction offers a vantage point into how modern engineering, regulatory evolution, and sustainability imperatives converge to redefine the strategic importance of strut systems within the global aerospace value chain.

Throughout the past decade, the drive toward lighter, stronger, and more corrosion-resistant structures has propelled manufacturers to adopt innovative design philosophies and material formulations. At the same time, heightened focus on maintenance, repair, and overhaul efficiency has elevated the economics of strut lifecycle management. By tracing the lineage of strut development from legacy steel and aluminum assemblies to today’s carbon fiber, titanium, and novel composite hybrids, readers will gain clarity on the forces shaping current market dynamics. This context lays the groundwork for a deeper exploration of transformative shifts, tariff implications, segmentation insights, regional disparities, and strategic imperatives that follow in the subsequent sections.

Navigating Rapid Technological Advancements and Supply Chain Resilience Strategies That Are Redefining Aircraft Strut Engineering and Production

The aircraft strut landscape is currently experiencing a wave of transformation driven by convergence of technological breakthroughs, geopolitical realignments, and evolving sustainability standards. Advanced manufacturing techniques such as additive manufacturing and high-precision machining are enabling geometries and load-bearing features previously unattainable with conventional methods. Digital simulation tools, including real-time digital twins, now allow engineers to predict fatigue behaviors, optimize structural layouts, and reduce development cycles, thereby compressing time to deployment for next-generation strut designs.

Simultaneously, the aftermath of recent supply chain disruptions has prompted a strategic pivot toward resilience. Manufacturers are diversifying their sourcing networks, pairing global raw material suppliers with regional fabrication centers to mitigate logistic bottlenecks. This approach dovetails with growing regulatory pressure to lower carbon footprints, as producers integrate eco-friendly resin systems and lightweight metallic alloys to achieve both performance and environmental objectives. As these forces intersect, the strut market is set to reflect a more agile, digitally enabled, and sustainability-focused ecosystem-establishing new benchmarks for aerospace structural components.

Examining How Recent 2025 US Tariff Measures Are Altering Material Sourcing, Cost Structures, and Competitive Dynamics in the Aircraft Strut Sector

In 2025, a series of tariff adjustments on key aerospace-grade materials implemented by the United States has introduced fresh complexity to the strut supply chain. Levies on specialty aluminum alloys and certain grades of steel and titanium have elevated base-metal costs, compelling manufacturers to reassess sourcing strategies and cost management frameworks. As raw material expenses swell, a growing number of suppliers are exploring alternative alloy formulations, increasing recourse to domestic production, and reconsidering import-dominated procurement models.

These tariff-driven shifts are not merely tactical; they carry longer-term strategic ramifications. Firms that invest in vertically integrated processing capabilities or localize advanced composite resin production stand to insulate themselves from future trade policy volatility. Concurrently, collaborative R&D initiatives between OEMs and material scientists are gaining momentum, aimed at unlocking novel substitute materials that deliver equivalent structural performance while mitigating exposure to high-duty imports. By understanding how these tariff developments recalibrate competitive dynamics and influence material innovation pipelines, industry participants can better navigate the evolving cost-structure landscape.

Deep Dive Into Material Composition, Application Demands, and Aircraft Type Requirements Revealing Distinct Drivers Shaping Strut Market Dynamics

Material selection remains a core driver of strut system performance, with aluminum achieving widespread use for its balance of strength and machinability, while carbon fiber is increasingly favored in weight-sensitive applications where fatigue resistance and stiffness are paramount. Composite struts, blending fibers and resins, enable tailored behavior under complex loading, and steel continues to serve in roles demanding exceptional toughness under impact. Titanium struts, though more costly, unlock superior high-temperature stability and corrosion resistance for specialized mission profiles.

Application-specific demands further differentiate strut technologies. Control surface struts and linkage struts must offer precise actuation under fluctuating aerodynamic loads, whereas engine mount struts necessitate rigorous vibration dampening to protect critical propulsion systems. Fuselage struts integrate internal structural support for cabin pressurization and passenger safety, and landing gear struts are engineered to absorb high-energy impacts during touchdown sequences. Wing struts and bracing struts provide essential load transfer and stiffness for wing assemblies, directly influencing flight dynamics.

Finally, aircraft type delineates priority requirements and approval pathways. Commercial aircraft demand high-volume scalability, consistent quality, and rapid service turnarounds, while military platforms often specify bespoke materials, tighter security of supply chains, and more rigorous qualification protocols. Recognizing these distinct drivers across material type, application, and aircraft class allows manufacturers to refine product offerings to exacting performance and certification standards.

This comprehensive research report categorizes the Aircraft Strut market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Application

- Aircraft Type

Regional Variations in Manufacturing Expertise, Regulatory Frameworks, and Demand Patterns Highlighted Across Americas, Europe Middle East & Africa, and Asia-Pacific

Regional production ecosystems exhibit pronounced disparities in advanced strut component capabilities, reflecting divergent OEM concentrations, engineering talent pools, and regulatory milieus. In the Americas, a robust cluster of aerospace hubs-anchored by leading US and Canadian manufacturers-hosts extensive R&D laboratories and forging facilities that emphasize lightweight aluminum and emerging composite structures. This ecosystem benefits from an integrated network of certified suppliers and streamlined logistics corridors supporting both domestic demand and export channels.

Europe, the Middle East and Africa collectively present a tapestry of established aerospace centers and growing defense programs. European OEMs maintain rigorous certification processes and collaborate closely with research institutions to pioneer hybrid material systems. In parallel, Middle Eastern operators are investing in regional assembly and maintenance capabilities, while select African nations are exploring joint ventures to foster indigenous strut fabrication competencies. The resulting ecosystem is one in which environmental regulations and defense procurement priorities intersect to shape technology adoption.

Asia-Pacific is marked by rapid capacity expansion in China and India, underpinned by national initiatives to cultivate domestic aerospace industries. Japanese and South Korean manufacturers contribute high-precision metalworking expertise, while Southeast Asian nations partner with global OEMs to establish integrated supply chains. Across the region, cost efficiency objectives drive adoption of automated production lines and locally sourced raw materials to meet both commercial and military platform requirements.

This comprehensive research report examines key regions that drive the evolution of the Aircraft Strut market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Component Suppliers Advancing Innovation Through Strategic Acquisitions, Technology Alliances, and Integrated Production Solutions

Leading strut system providers are distinguishing themselves through strategic investments in digital engineering, partnership ecosystems, and advanced production methods. Established incumbents have expanded capabilities via targeted acquisitions of precision metal fabricators and composite specialists, thereby broadening their service portfolios from design consultation to turnkey manufacturing. These integrations allow companies to offer end-to-end solutions, seamlessly transitioning from prototype validation to full-scale series production.

Simultaneously, a number of agile Tier-One suppliers are forging alliances with material innovators to trial next-generation resins, high-strength alloys, and smart-embedded sensor technologies for structural health monitoring. By embedding predictive maintenance functionalities directly into strut assemblies, these pioneers are catalyzing a shift toward condition-based overhaul intervals and enhanced in-service reliability. Furthermore, select firms are collaborating with additive manufacturing partners to produce complex, weight-optimized geometries that were previously infeasible with subtractive machining.

As competitive intensity intensifies, differentiation is increasingly tied to the agility of research pipelines, the breadth of certification credentials, and the resilience of global supply footprints. Companies that can demonstrate robust quality systems, rapid adaptation to regulatory changes, and integrated digital platforms for lifecycle data management are best positioned to capture evolving customer requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aircraft Strut market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AAR Corp.

- AMETEK, Inc.

- CIRCOR International, Inc.

- Crissair, Inc.

- GKN Aerospace Services Limited

- Heroux-Devtek Inc.

- Hyundai Motor Group

- Kawasaki Heavy Industries, Ltd.

- Liebherr-Aerospace Lindenberg GmbH

- Magellan Aerospace Corporation

- Meggitt PLC

- Mitsubishi Heavy Industries, Ltd.

- Moog Inc.

- Parker Hannifin Corporation

- Safran Landing Systems

- Senior plc

- Shimadzu Corporation

- Triumph Group, Inc.

- UTC Aerospace Systems

- Woodward, Inc.

Implementing Strategic Partnerships, Digital Lifecycle Management, and Geographic Diversification to Capitalize on Emerging Trends and Mitigate Supply Chain Risks

Industry leaders should prioritize strategic investment in material innovation programs, focusing on hybrid composites and next-generation alloys that balance performance with supply chain security. By establishing collaborative R&D partnerships with universities and specialized research institutes, firms can accelerate the translation of novel materials into certified strut applications, reducing dependence on high-duty imports and insulating against tariff volatility.

Concurrently, adopting comprehensive digital lifecycle management platforms will enable real-time monitoring of strut condition and predictive maintenance scheduling. Integrating embedded sensors with analytics engines empowers maintenance teams to preemptively address fatigue hotspots, minimizing unscheduled groundings and optimizing component turn cycles. Leaders are encouraged to pilot these smart strut concepts in select fleets to quantify reliability improvements and fine-tune data models before broader rollout.

Finally, geographic diversification of production and assembly footprints can mitigate regional disruptions. Establishing modular manufacturing cells in strategic markets provides flexibility to shift capacity in response to local demand surges, regulatory changes, or logistic bottlenecks. Executing these action steps will enhance resilience, foster innovation, and solidify competitive position in the evolving aircraft strut domain.

Comprehensive Hybrid Research Approach Combining Direct Expert Interviews, Secondary Data Validation, and Independent Peer Review for Robust Market Insights

This analysis employs a hybrid methodology integrating in-depth primary research with exhaustive secondary data triangulation. Primary inputs were gathered from structured interviews with aerospace OEM engineering leaders, Tier-One component suppliers, material science experts, and regulatory body representatives to capture firsthand perspectives on technological advancements, policy impacts, and certification challenges.

Secondary research leveraged reputable industry journals, white papers, and technical standards to contextualize findings and validate quantitative observations. Information from public filings, patent databases, and engineering databases was synthesized to map material innovation trajectories and adoption rates. Each data point was cross-verified through multiple sources to ensure consistency, while any discrepancies were resolved via follow-up consultations with domain experts.

The resulting insights were then subjected to a rigorous validation process involving peer reviews by independent aerospace analysts. This multi-layered approach ensures that the conclusions and recommendations presented herein rest on a solid foundation of empirical evidence and expert consensus.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aircraft Strut market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aircraft Strut Market, by Material Type

- Aircraft Strut Market, by Application

- Aircraft Strut Market, by Aircraft Type

- Aircraft Strut Market, by Region

- Aircraft Strut Market, by Group

- Aircraft Strut Market, by Country

- United States Aircraft Strut Market

- China Aircraft Strut Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 636 ]

Synthesis of Insights Underscoring Strategic Imperatives and Future Trajectories Amid Material Innovation, Digitalization, and Evolving Trade Policies

The convergence of material innovation, digital engineering, and strategic supply chain realignment has reshaped the aircraft strut market’s competitive landscape. Manufacturers who harness advanced composites, optimize through digital twins, and adapt to evolving trade regulations are establishing new benchmarks for structural performance and operational efficiency. Meanwhile, regional dynamics continue to diversify, with traditional aerospace hubs coexisting alongside rapidly expanding Asia-Pacific ecosystems.

Key opportunities lie in the acceleration of smart-enabled struts that facilitate condition-based maintenance and in the development of hybrid materials that reduce exposure to tariff-impacted imports. However, challenges persist in certification complexity, supply chain fragmentation, and regulatory variability across regions. Navigating this terrain demands a balance of innovation investments, data-driven lifecycle management, and flexible manufacturing footprints.

As the industry charts its course through emerging requirements-from environmental mandates to next-generation aircraft concepts-the insights and recommendations outlined in this report provide a strategic compass. Embracing agility, fostering collaborative networks, and maintaining an unwavering focus on performance integrity will be critical to capitalizing on the transformative currents shaping the future of aircraft strut systems.

Secure Comprehensive Market Intelligence From Ketan Rohom to Elevate Your Strategic Decision-Making in the Aircraft Strut Market

To unlock the full potential of your strategic initiatives in the aircraft strut ecosystem, reach out for an exclusive consultation and access to unparalleled market intelligence. Ketan Rohom, Associate Director of Sales & Marketing, offers tailored insights and in-depth analysis designed to sharpen your competitive edge. Engage directly with Ketan to explore customized research deliverables that address your specific challenges, from material innovation pathways to tariff impact scenarios and regional expansion blueprints. His comprehensive understanding of industry dynamics ensures you receive actionable recommendations and bespoke data sets that accelerate decision-making and drive growth. Whether you are evaluating new partnerships, assessing supply chain resilience, or fine-tuning your product portfolio, leverage Ketan’s expertise to translate complex data into strategic wins. Secure your purchase of the full market research report today to gain an authoritative resource guiding your next move in the evolving aircraft strut landscape.

- How big is the Aircraft Strut Market?

- What is the Aircraft Strut Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?