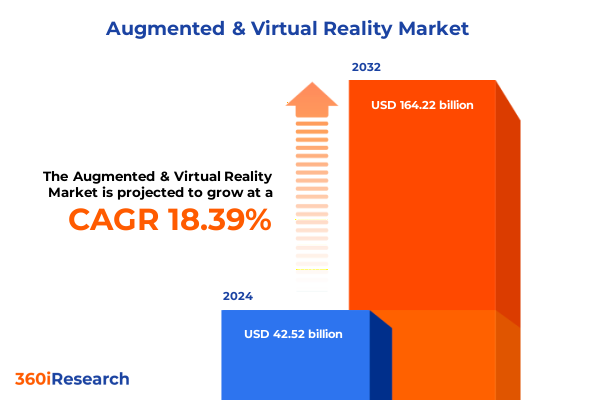

The Augmented & Virtual Reality Market size was estimated at USD 50.12 billion in 2025 and expected to reach USD 59.09 billion in 2026, at a CAGR of 18.47% to reach USD 164.22 billion by 2032.

Harnessing the Convergence of Real and Virtual Worlds to Drive Strategic Innovation and Competitive Advantage in Emerging Immersive Technologies

The immersive technology sector is undergoing an unprecedented convergence of advanced hardware, sophisticated software, and a rapidly expanding array of applications. Augmented reality (AR) and virtual reality (VR) solutions have transitioned from niche experimental tools to mainstream platforms, reshaping the competitive landscape across multiple industries. In this context, organizations must adopt a strategic mindset that balances technological possibilities with practical business imperatives. As investment flows into immersive experiences grow, the imperative to articulate clear strategic objectives and evaluate technology fit becomes paramount.

Adoption patterns are increasingly driven by tangible use cases that demonstrate return on investment, such as enhanced training simulations, remote collaboration environments, and customer engagement enhancements in retail and real estate. Decision-makers are now compelled to integrate immersive experiences into broader digital transformation initiatives, ensuring these solutions align with existing IT architectures and operational workflows. Meanwhile, evolving standards and interoperability frameworks are reducing integration complexity, fostering a more cohesive ecosystem. In this introduction, we establish the foundational context for understanding how AR and VR technologies are advancing strategic innovation, supporting enterprise objectives, and unlocking competitive advantage across sectors.

Unveiling the Technological and Market Dynamics That Are Reshaping Augmented Reality and Virtual Reality into Ubiquitous Enterprise Tools

Recent technological breakthroughs and shifting market dynamics have catalyzed a transformative shift in the immersive landscape. Advancements in computer vision, real-time rendering, and 5G connectivity have enhanced both the fidelity and accessibility of AR and VR experiences. New lightweight headsets and mobile device–powered configurations have broadened user adoption beyond case-specific scenarios, enabling more seamless integration into everyday business operations. At the same time, improvements in spatial computing algorithms have expanded the potential for markerless and projection-based interactions, creating richer, context-aware experiences across industries.

Concurrently, the democratization of development tools and content creation platforms has lowered barriers to entry, empowering a diverse community of innovators and developers. This surge of activity has fostered an ecosystem where hardware manufacturers, software publishers, and service providers collaborate through open architectures and shared development kits. As the market structure evolves, interoperability standards are gradually coalescing around common protocols, simplifying integration among disparate systems. Taken together, these forces are reshaping the AR and VR markets into vibrant, interconnected environments where enterprise use cases can scale rapidly, driving deeper engagement and measurable business outcomes.

Analyzing the Ripple Effects of 2025 United States Tariff Policies on Hardware Production, Supply Chains, and Cost Structures in Immersive Technologies

The introduction of new tariffs by the United States in 2025 has introduced both challenges and strategic opportunities for immersive technology stakeholders. Tariffs on critical hardware components, particularly sensors, displays, and tracking modules, have increased procurement costs and spurred supply chain diversification strategies. In response, many manufacturers have pursued geographic reallocation of production facilities, seeking to mitigate elevated duty burdens by sourcing from regions with preferential trade agreements or domestic production incentives.

These shifts have led to a nuanced recalibration of cost structures within the AR and VR supply chain, compelling component suppliers and device assemblers to optimize manufacturing footprints and renegotiate distribution agreements. While short-term cost pressures have prompted some firms to adjust pricing models, the imperative to maintain competitive entry points for enterprise customers has incentivized investment in automation and scale efficiencies. Moreover, the tariff landscape has stimulated innovation in modular design approaches that enable hardware components to be interchanged based on sourcing economics. Taken together, these measures reflect a proactive industry response that aims to preserve unit margins, safeguard product availability, and accelerate time to market despite evolving trade constraints.

Illuminating Critical Perspectives on How Technology Architecture, Component Ecosystems, Application Use Cases, and End-User Needs Intersect to Drive Growth

The market’s underlying architecture and component ecosystems paint a rich portrait of how AR and VR solutions are constructed and deployed. Based on technology, solutions are distinguished by augmented reality configurations and virtual reality platforms. Augmented reality offerings encompass location-based implementations, marker-dependent content overlays, markerless projections, projection-based scenarios, and superimposition engines that layer digital elements onto physical spaces. On the virtual reality side, experiences range from non-immersive desktop environments to fully immersive or hybrid semi-immersive installations, each tailored to specific use-case requirements and user preferences.

Component segmentation drives further insight into value creation mechanisms. Hardware assemblies incorporate accessories, advanced camera arrays, various display solutions including both head-mounted and heads-up variants, as well as position trackers and sophisticated sensor suites. Service portfolios have expanded to cover strategic consultation, deployment and integration processes, and ongoing support and maintenance frameworks. Meanwhile, software underpins content pipelines, with dedicated toolsets for augmented reality content authoring and comprehensive platforms for immersive virtual environments. This multifaceted segmentation underscores the complexity of solution development and the need for integrated vendor offerings that align technology, services, and software under cohesive value propositions.

This comprehensive research report categorizes the Augmented & Virtual Reality market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Component

- Application

- End-User

Evaluating Regional Variations in Adoption Rates, Regulatory Frameworks, and Growth Catalysts across the Americas, EMEA, and Asia-Pacific Blocks

Understanding how regional attributes influence market dynamics is essential for global strategy formulation. In the Americas, early uptake of immersive technologies is fueled by robust enterprise budgets, strong venture capital ecosystems, and progressive commercial pilots in sectors such as manufacturing, healthcare, and retail. The presence of leading technology hubs and an extensive partner network further accelerates solution deployment, while regulatory frameworks continue to evolve in support of digital innovation and workforce transformation.

Europe, the Middle East, and Africa present a diverse mix of regulatory landscapes and adoption rates. Western European nations benefit from high levels of digital maturity and coordinated government initiatives promoting immersive learning and industrial digitalization. In contrast, emerging economies in Eastern Europe and select Gulf states are experiencing rapid growth in niche segments, often supported by public-private partnerships and incentives to develop digital tourism and smart infrastructure projects. Across Africa, localized innovation is surfacing through targeted pilots that address education, agriculture, and healthcare challenges.

Asia-Pacific stands out for its expansive consumer markets, advanced manufacturing base, and aggressive technology investments. Markets such as China, Japan, South Korea, and Australia are at the forefront of headset production, 5G network rollouts, and immersive entertainment. Moreover, governments in this region are integrating AR and VR into educational curricula and industrial automation programs, creating a fertile environment for solution providers to scale rapidly and adapt offerings to localized requirements.

This comprehensive research report examines key regions that drive the evolution of the Augmented & Virtual Reality market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Mapping Strategic Trajectories of Leading Industry Players Demonstrating Innovation, Partnerships, and Differentiation in the Competitive Immersive Technology Landscape

Leading organizations in the immersive technology domain are differentiating through innovation roadmaps, strategic alliances, and domain-specific solutions. Hardware pioneers are pushing the envelope with ergonomic form factors, lightweight materials, and extended battery lives to address enterprise mobility demands. Simultaneously, software developers are enhancing content creation platforms with intuitive interfaces and AI-driven asset generation capabilities, reducing time to market and enabling rapid iteration of immersive scenarios.

Partnerships between OEMs, cloud service providers, and systems integrators are also reconfiguring the competitive environment. Collaborative ventures are delivering turnkey offerings that bundle devices, networking infrastructure, and managed services, easing procurement decisions for enterprise buyers. Niche startups are disrupting the space with specialized modules for real-time collaboration, haptic feedback, and advanced spatial analytics. Meanwhile, established technology conglomerates are leveraging scale to provide end-to-end ecosystems, from hardware manufacturing to global support and maintenance networks. These strategic trajectories reflect a maturing market where differentiation is achieved through both technological prowess and ecosystem orchestration.

This comprehensive research report delivers an in-depth overview of the principal market players in the Augmented & Virtual Reality market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amazon Web Services, Inc.

- Apple Inc.

- Atheer, Inc.

- Blippar Group Limited

- Capermint Technologies Pvt. Ltd.

- Cisco Systems, Inc.

- CyberGlove Systems Inc.

- EON Reality, Inc.

- Google LLC by Alphabet Inc.

- Hewlett-Packard Development Company, L.P.

- HTC Corporation

- Inglobe Technologies Srl

- Innovega Inc.

- Intel Corporation

- International Business Machines Corporation

- KT Corporation

- Lenovo Group Limited

- LG Corporation

- Magic Leap, Inc.

- Marxent Labs LLC

- MAXST Co., Ltd.

- Meta Platforms, Inc.

- Microsoft Corporation

- Niantic, Inc.

- NVIDIA Corporation

- PTC Inc.

- Qualcomm Incorporated

- Samsung Electronics Co., Ltd.

- Seiko Epson Corporation

- Sony Group Corporation

- Toshiba Corporation

- Trimble Inc.

- Vuzix Corporation

- Zugara Inc.

Outlining Practical Strategies for Industry Leaders to Capitalize on Emerging Trends, Navigate Policy Shifts, and Enhance Market Penetration in XR Sectors

To thrive in the evolving immersive technology landscape, industry leaders must adopt a multifaceted approach that balances short-term agility with long-term vision. First, organizations should establish cross-functional innovation labs that integrate R&D, product management, and customer success teams to accelerate proof-of-concept deployments. This structure fosters rapid experimentation while ensuring alignment with strategic business objectives. Second, executives must engage proactively with policymakers to shape standards and regulations, advocating for frameworks that support data privacy, interoperability, and workforce reskilling initiatives.

In parallel, companies should explore collaborative manufacturing partnerships and dual-sourcing strategies to mitigate tariff impacts and strengthen supply chain resilience. From a go-to-market perspective, tailored solutions designed for high-value sectors such as healthcare training and industrial maintenance can yield accelerated adoption and premium pricing. Finally, investing in talent development programs that upskill internal teams in immersive design, spatial analytics, and human-computer interaction principles will be critical to sustaining competitive differentiation as the market continues to evolve.

Detailing Rigorous Mixed-Method Approaches Combining Quantitative Data Analysis and Qualitative Expert Interviews to Ensure Research Integrity in XR Markets

This analysis leverages a mixed-method research framework, combining quantitative market data with qualitative insights from industry experts. Primary research included structured interviews with device manufacturers, software developers, and enterprise adopters across multiple verticals, ensuring a representative sample of perspectives. Secondary data sources comprised corporate filings, patent dashboards, and publicly available trade statistics related to import-export duties and tariff schedules.

Data collection was complemented by an in-depth review of technical white papers, interoperability standards, and academic publications to validate emerging technology trends and use-case viability. Analytical methodologies included trend mapping, cross-segment correlation analysis, and scenario planning exercises to forecast potential evolution pathways. Throughout the process, rigorous quality control protocols, such as triangulation of independent data points and peer reviews by subject-matter experts, were applied to safeguard research integrity and accuracy.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Augmented & Virtual Reality market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Augmented & Virtual Reality Market, by Technology

- Augmented & Virtual Reality Market, by Component

- Augmented & Virtual Reality Market, by Application

- Augmented & Virtual Reality Market, by End-User

- Augmented & Virtual Reality Market, by Region

- Augmented & Virtual Reality Market, by Group

- Augmented & Virtual Reality Market, by Country

- United States Augmented & Virtual Reality Market

- China Augmented & Virtual Reality Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1908 ]

Synthesizing Key Insights to Highlight Core Themes and Future Imperatives Guiding Decision-Making in the Rapidly Evolving Augmented and Virtual Reality Ecosystem

The augmented and virtual reality markets are at an inflection point, propelled by technological advances and strategic commercial deployment. Key themes emerging from this analysis include the imperative for seamless integration across hardware, software, and service layers, the strategic importance of supply chain diversification in response to evolving trade policies, and the need for regionally tailored go-to-market models. Moreover, the symbiotic relationship between technological innovation and regulatory evolution underscores the complexity of navigating this rapidly changing landscape.

Looking ahead, organizations that successfully harness interoperable architectures and foster collaborative ecosystems will be best positioned to capture value. The interplay between immersive experiences and adjacent technologies such as artificial intelligence, edge computing, and digital twins presents a compelling opportunity to create differentiated offerings. As adoption accelerates, the ability to demonstrate clear return on investment through case studies and performance metrics will become increasingly central to driving scale. Ultimately, the insights synthesized here provide a strategic roadmap for industry participants seeking to lead in the next chapter of immersive technology innovation.

Engaging Industry Stakeholders with a Tailored Call-To-Action to Unlock In-Depth Market Intelligence Through a Personalized Consultation Session

We invite decision-makers, innovators, and visionaries to explore the comprehensive immersive technology market research report through a personalized consultation with Ketan Rohom, Associate Director of Sales & Marketing. During this session, stakeholders will gain clarity on emerging trends, regulatory developments, and competitive dynamics shaping the augmented and virtual reality ecosystem. The discussion will be tailored to address your organization’s strategic priorities, whether you seek to optimize supply chain resilience, evaluate new partnership opportunities, or refine customer engagement strategies. Participants will leave with actionable insights and a clear roadmap for leveraging immersive technologies to enhance operational efficiency and drive revenue growth. To secure your consultation and acquire the full report, contact our team today and unlock the detailed analysis that will empower your next phase of innovation and market leadership.

- How big is the Augmented & Virtual Reality Market?

- What is the Augmented & Virtual Reality Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?