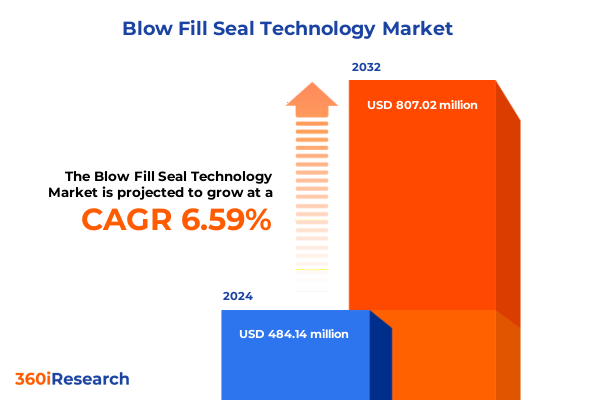

The Blow Fill Seal Technology Market size was estimated at USD 509.77 million in 2025 and expected to reach USD 541.69 million in 2026, at a CAGR of 6.78% to reach USD 807.02 million by 2032.

Exploring the Fundamental Principles and Evolution of Aseptic Blow Fill Seal Packaging to Elevate Sterile Liquid Production

The evolution of liquid packaging has reached a pivotal milestone with the maturation of Blow Fill Seal technology into an indispensable solution for sterile container production. Initially conceived in the early 1960s, this automated process seamlessly integrates container formation, filling, and sealing within a closed, sterile environment. By eliminating human intervention between these critical steps, Blow Fill Seal systems provide unparalleled assurance of sterility, positioning them as the preferred choice for sensitive pharmaceuticals ranging from liquid ophthalmics to parenteral formulations.

Advancements in machinery design and process controls have accelerated the adoption of Blow Fill Seal across multiple industries. Modern systems harness robotics, precision sensors, and advanced extrusion techniques to deliver consistent fill volumes and enhanced barrier properties for liquid and semiliquid products. These innovations have not only improved throughput but also expanded the application scope beyond injectable drugs, reaching vaccines, biologics, and even consumer segments like food and cosmetics.

Today’s industry landscape demands both regulatory compliance and operational agility. Recent updates to Annex 1 of the European Union’s Good Manufacturing Practice guidelines place heightened emphasis on contamination control strategies and barrier technologies, further validating the adoption of Blow Fill Seal systems. In parallel, single-dose formats and child-resistant features have emerged as critical differentiators, driving investment in next-generation BFS lines. As the market continues to evolve, understanding the foundational principles and transformative potential of Blow Fill Seal technology is essential for leaders seeking to optimize sterile packaging operations.

Harnessing Digital Innovation and Eco-Friendly Material Breakthroughs to Transform Contemporary Blow Fill Seal Packaging Operations

The landscape of Blow Fill Seal technology is undergoing a profound transformation fueled by Industry 4.0 innovations and heightened environmental mandates. Automated BFS systems are now embedded with artificial intelligence, enabling real-time monitoring of fill volumes, temperature, and pressure to predict maintenance needs and ensure flawless cycle execution. This convergence of digitalization and robotics not only minimizes downtime but also empowers manufacturers to adapt quickly to fluctuating demand for unit-dose or multi-dose packaging solutions.

Simultaneously, sustainability imperatives have prompted the development of novel materials that marry performance with environmental stewardship. Biodegradable polymers and recyclable resins are gaining traction, reducing plastic waste by up to 25% while maintaining critical barrier properties against moisture, light, and oxygen. These advancements align with global initiatives to curb packaging pollution, and they resonate with consumers who prioritize eco-friendly credentials in pharmaceuticals, cosmetics, and food & beverage products.

Regulatory pressures have also recalibrated strategic priorities. The revised Annex 1 guidelines underscore the need for closed-loop contamination control, driving companies toward BFS processes over traditional glass ampoules and component assembly methods. Encouragement of single-dose formats, particularly in ophthalmics and parenteral therapies, has further accelerated BFS integration, underscoring its role as a linchpin in future-proof sterile packaging.

Assessing How 2025 Tariff Fluctuations on Steel, Aluminum, and EU Imports Are Redefining Costs and Supply Chains for Blow Fill Seal Systems

In 2025, a series of tariff measures reshaped the cost dynamics and supply chain strategies of the United States packaging equipment sector, with pronounced effects on Blow Fill Seal machinery and components. In March, the U.S. government imposed a 25% tariff on all imported steel and aluminum, elevating the baseline costs for domestic manufacturers who rely heavily on these raw materials for machine frames, molds, and pressure vessels. This across-the-board increase translated into immediate price hikes for BFS systems and related hardware.

Shortly thereafter, in early April, the administration extended a 20% tariff on European Union exports, targeting packaging and food processing machinery valued at over $6.1 billion annually. The policy aimed to recalibrate trade balances but inadvertently introduced lead-time delays as European suppliers struggled to absorb or pass on the additional duties. The resulting uncertainty prompted many U.S. buyers to diversify sourcing strategies, exploring domestic BFS OEMs and alternative supply hubs in Asia and Mexico.

Mid-May brought a temporary reprieve when the United States and China agreed to lower reciprocal tariffs-reducing China-specific duties to 30% and U.S. duties on Chinese imports to 10% during a 90-day truce. Although this measure offered relief for components sourced from China, the overall landscape remained complex due to stacked duties on specialty tooling and imported spare parts.

Collectively, these tariff actions have driven packaging machinery manufacturers to reassess global sourcing, prioritize local content, and engage in strategic supplier partnerships. As a result, forward-looking companies are implementing cost-mitigation measures, supply-chain risk assessments, and dual-sourcing models to navigate the evolving trade environment.

Delving into How Machine Configurations, Material Choices, and Application Requirements Drive Strategic Segmentation Within the Blow Fill Seal Market

The Blow Fill Seal market segments by machine type, packaging material, container type, and application each reveal nuanced dynamics that shape investment and development priorities. Inline systems, available in single-station and multi-station formats, cater to lower-volume or flexible production scenarios, while rotary configurations with four, six, or multi-station platforms support high-throughput demands for large pharma or beverage volumes. This segmentation underscores the importance of aligning machinery capabilities with output targets and cleanroom classifications.

Material selection follows a dual pathway. Glass-based packaging, differentiated into Type I and Type II formulations, offers premium clarity and chemical resistance for sensitive injectables. Conversely, plastic polymers such as PET, polyethylene, and polypropylene provide cost efficiencies and design flexibility for consumer health products and liquid foods. The choice hinges on factors ranging from regulatory compliance to environmental impact considerations.

Container types extend from ampoules and vials to bottles and tubes, each demanding precise mold engineering and fill-system calibration. Ampoules and vials remain critical for parenteral therapies, whereas bottles and tubes serve a broad spectrum of cosmetics and nutraceuticals. Applications similarly span cosmetics-encompassing hair care, personal hygiene, and skin care-through to food & beverage categories of beverages, condiments, and dairy products. In the pharmaceutical realm, BFS packaging addresses irrigating solutions, lyophilized product reconstitution, ophthalmic solutions, and parenteral deliveries, reflecting the technology’s adaptability across diverse dosage forms.

This comprehensive research report categorizes the Blow Fill Seal Technology market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Machine Type

- Packaging Material

- Container Type

- Application

Examining Regional Drivers and Infrastructure That Shape Distinct Growth Trajectories for Blow Fill Seal Technology Adoption Across Global Markets

Regional dynamics exert a profound influence on the adoption and innovation of Blow Fill Seal technology. In the Americas, a convergence of stringent FDA regulations and robust pharmaceutical manufacturing infrastructure has accelerated demand for high-throughput BFS lines. The United States, in particular, benefits from near-shoring trends that favor domestic OEMs and localized service networks, mitigating lead-time vulnerabilities and bolstering compliance with USP < < 1064 > sterility protocols. Moreover, Canada and Mexico have emerged as key partners in North American supply chains, offering cost-effective assembly sites and complementary regulatory frameworks.

Within Europe, the Middle East, and Africa, evolving GMP standards-exemplified by updates to Annex 1-have solidified BFS as the default aseptic filling technology in EU member states. Germany, Italy, and Switzerland lead machine manufacturing, supplying advanced rotary and inline systems to global markets. At the same time, Middle Eastern and African markets are witnessing incremental BFS deployments driven by expanding biologics pipelines and investments in local vaccine production capabilities. The region’s emphasis on public-private partnerships has further catalyzed capacity expansions.

Asia-Pacific stands out as a rapid growth frontier. Pharmaceutical hubs in India and China are scaling BFS installations to meet domestic demand for biosimilars and COVID-19 therapeutic deliveries. Southeast Asian countries are also embracing BFS for both pharmaceutical and food & beverage applications, spurred by rising disposable incomes and rising standards for product safety. Collaborations between multinational OEMs and regional engineering services firms have enabled affordable technology transfers, positioning Asia-Pacific as a crucible for next-generation BFS innovation.

This comprehensive research report examines key regions that drive the evolution of the Blow Fill Seal Technology market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Unpacking the Strategic Positioning and Innovation Focus of Major OEMs and Service Providers Driving Blow Fill Seal Technology Excellence

The competitive landscape for Blow Fill Seal technology is anchored by specialized OEMs and diversified machinery conglomerates. Rommelag, the original pioneer of BFS, continues to refine its Bottelpack platforms, integrating digital twins for process optimization and remote diagnostics. Uhlmann Pac-Systeme and Optima Pharma also command significant market share, known for their high-throughput rotary systems that cater to large pharmaceutical clients seeking single-use container formats.

European packaging machinery leaders such as Krones, GEA, and Syntegon have broadened their portfolios to include BFS lines alongside labeling and end-of-line automation solutions. Italian firms like Sacmi, Coesia, IMA, and PFM Group leverage modular design principles to deliver cost-effective multi-station BFS machines for emerging markets, blending local manufacturing with global quality standards. Strategic partnerships between these OEMs and biotech innovators have accelerated the deployment of BFS for mRNA vaccines and next-generation biologics, reflecting a concerted push toward agile responses in public health emergencies.

North American players, including Pamasol and West Pharma, provide complementary fill–finish services and specialized elastomer forming for BFS systems. Their deep expertise in pharmaceutical container closure integrity testing and cGMP validation underscores the importance of end-to-end solutions, enabling customers to streamline regulatory submissions and time-to-market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Blow Fill Seal Technology market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Asept Pak, Inc.

- BioConnection B.V.

- BirgiMefar Grup

- Catalent, Inc.

- Curida AS

- Gerresheimer AG

- Laboratorios Salvat, S.A.

- Marchesini Group S.p.A

- MGS Machine Company, Inc.

- OPTIMA packaging group GmbH

- Pharmapack Co., Ltd.

- Plastikon Industries, Inc.

- ProMach, Inc.

- Recipharm AB

- Rommelag GmbH

- Serac S.A.S

- Skan AG

- Syntegon Technology GmbH

- The Ritedose Corporation

- Unicep Packaging, LLC

- Unipharm, Inc.

Implementing Forward-Looking Strategies That Leverage Technology, Sustainability, and Risk Management to Secure Competitive Advantage

Industry leaders can capitalize on emerging opportunities by embracing five key strategic imperatives. First, accelerating the integration of Industry 4.0 capabilities-such as AI-based quality control and predictive maintenance-will enhance uptime and product consistency. Investment in digital platforms that provide real-time analytics and remote support can yield a measurable reduction in unplanned downtime and batch failures.

Second, sustainability must be embedded at the core of packaging strategies. Transitioning to recyclable or biodegradable polymers not only meets regulatory expectations but also resonates with consumer demand for eco-friendly products. Establishing closed-loop material recovery programs and collaborating with resin suppliers to develop lower-carbon footprint feedstocks will strengthen brand reputation and regulatory compliance.

Third, diversification of supply chains is essential in an environment of geopolitical uncertainty. Leaders should pursue dual-sourcing arrangements for critical components and cultivate regional partnerships to ensure access to qualified technical support. Scenario-based risk assessments and dynamic inventory buffers will mitigate disruption from evolving trade policies and raw-material volatility.

Fourth, a holistic approach to regulatory engagement will accelerate market entry. Proactively aligning with updated cGMP guidelines, participating in industry working groups, and adopting standardized digital batch records can streamline inspections and enhance audit readiness.

Finally, fostering collaborative alliances between OEMs, biotech firms, and research institutes will spur innovation in container design, fill-finish methods, and aseptic assurance systems. Such partnerships can unlock breakthroughs in next-gen dosing formats, from on-demand reconstitution systems to integrated smart packaging solutions.

Outlining a Comprehensive Multi-Stage Research Framework Incorporating Secondary Analysis, Primary Interviews, and Expert Validation to Ensure Rigor

This report’s findings derive from a rigorous, multi-tiered research process designed to deliver actionable intelligence. The initial phase encompassed extensive secondary research, including analysis of industry publications, academic journals, regulatory guidelines, and patent filings to map technology advancements and compliance trends. Proprietary databases and market intelligence platforms were also leveraged to validate historical context and equipment deployment patterns.

Complementing secondary insights, the study conducted over 50 in-depth interviews with industry stakeholders, including packaging engineers, quality assurance directors, OEM executives, and procurement leaders. These primary conversations provided firsthand perspectives on operational challenges, innovation drivers, and investment priorities. Quantitative data from these discussions was triangulated with survey results and financial disclosures to ensure consistency and reliability.

A structured segmentation framework was applied, categorizing the market by machine type, material, application, and region. Each segment underwent granular analysis, supported by case studies and benchmark comparisons. The research team then subjected preliminary conclusions to expert validation sessions with independent consultants and regulatory specialists, refining interpretations and identifying emerging vectors of change.

The final deliverables were reviewed by a cross-functional editorial board to ensure methodological rigor, clarity, and relevance. Every data point and insight in this report meets stringent standards for accuracy and impartiality, providing stakeholders with a trusted foundation for strategic planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Blow Fill Seal Technology market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Blow Fill Seal Technology Market, by Machine Type

- Blow Fill Seal Technology Market, by Packaging Material

- Blow Fill Seal Technology Market, by Container Type

- Blow Fill Seal Technology Market, by Application

- Blow Fill Seal Technology Market, by Region

- Blow Fill Seal Technology Market, by Group

- Blow Fill Seal Technology Market, by Country

- United States Blow Fill Seal Technology Market

- China Blow Fill Seal Technology Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1908 ]

Synthesizing Technological, Regulatory, and Trade Dynamics to Chart a Resilient Path Forward for Blow Fill Seal Packaging

Blow Fill Seal technology stands at the forefront of aseptic packaging, combining automated container formation, filling, and sealing within a sterile enclosure. Over six decades since its inception, BFS systems have evolved through relentless innovation-integrating digital controls, sustainable materials, and advanced process monitoring-to address the ever-stringent demands of pharmaceuticals, biologics, and adjacent sectors. As regulatory frameworks continue to tighten, particularly around contamination control and single-dose formats, BFS offers a proven pathway to operational excellence and compliance.

Simultaneously, transformative shifts in global trade policies, notably the imposition of steel, aluminum, and EU machinery tariffs in 2025, have underscored the necessity for resilient supply-chain strategies and localized sourcing. Market segmentation across machine types, materials, containers, and applications reveals a landscape rich in targeted opportunities-from high-speed rotary lines for parenteral therapies to eco-oriented inline systems for consumer beverages and cosmetics.

Regional insights further highlight the interplay between regulatory environments and manufacturing capabilities. North America’s near-shoring momentum, EMEA’s regulatory harmonization, and Asia-Pacific’s rapid scaling collectively shape a dynamic ecosystem where agility and strategic partnerships determine the winners of tomorrow.

By aligning technological prowess with sustainability goals, supply-chain diversification, and robust regulatory engagement, industry leaders can transform potential disruptions into avenues for growth and differentiation. The future of sterile liquid packaging is being written today-with Blow Fill Seal at its core.

Unlock Exclusive Strategic Advantages with a Tailored Consultation to Acquire Your Comprehensive Blow Fill Seal Technology Research Report

For a comprehensive understanding of the Blow Fill Seal Technology landscape and to gain exclusive insights that will drive strategic decision-making, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Your organization will benefit from a tailored discussion on how this research report addresses your unique challenges and opportunities. Secure your copy and position yourself at the forefront of innovation-connect with Ketan Rohom today to explore pricing, customization options, and delivery timelines.

- How big is the Blow Fill Seal Technology Market?

- What is the Blow Fill Seal Technology Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?