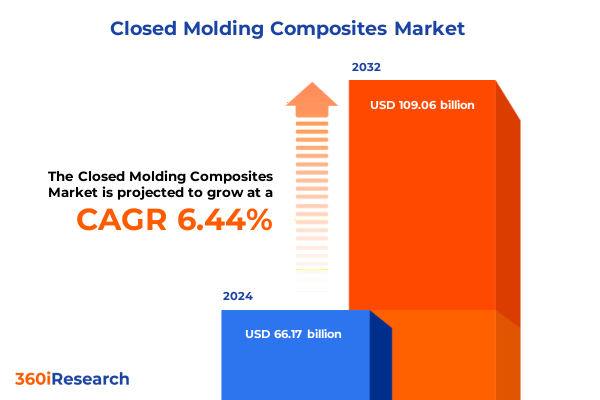

The Closed Molding Composites Market size was estimated at USD 70.07 billion in 2025 and expected to reach USD 74.22 billion in 2026, at a CAGR of 6.52% to reach USD 109.06 billion by 2032.

Exploring the Strategic Imperative of Closed Molding Composites in Driving Innovation Efficiency and Sustainability Across Diverse Industrial Applications

In today’s manufacturing landscape, closed molding composite technologies stand at the crossroads of innovation and sustainability, delivering high-performance materials with exceptional strength-to-weight ratios. These processes encapsulate techniques such as resin transfer molding, vacuum infusion, and sheet molding compound, which collectively offer tighter control over resin distribution and fiber alignment. As industries seek to reduce energy consumption and material waste, the closed molding approach emerges as a key enabler for greener production cycles and leaner operations.

Moreover, the adaptability of closed molding composites spans a broad scope of applications from structural components in aerospace assemblies to decorative enclosures in consumer electronics. This versatility relies on an intricate balance between fiber choices-including advanced carbon and aramid variants-and resin chemistries that range from thermosets for superior durability to thermoplastics for recyclability. Consequently, decision-makers are increasingly prioritizing these composite solutions to meet rigorous performance standards while also aligning with circular economy principles.

Transitioning from traditional open molding, manufacturers are capitalizing on automation, real-time monitoring, and predictive analytics to further elevate process efficiency and product consistency. This convergence of digital technologies with sophisticated material science underscores why closed molding composites have become the strategic imperative for companies looking to differentiate through innovation and resilience.

Unveiling the Pivotal Technological and Regulatory Shifts Transforming the Closed Molding Composites Landscape for Enhanced Market Competitiveness

The closed molding composites sector is undergoing a profound transformation driven by technological advancements, regulatory pressures, and evolving customer expectations. On the technological front, integrating Industry 4.0 principles such as robotics-assisted fiber placement and sensor-based cure monitoring has streamlined production cycles and reinforced quality control. Consequently, manufacturers are able to deliver complex geometries with minimal scrap rates, fortifying competitive positioning.

Concurrently, tightening environmental regulations-particularly concerning volatile organic compound (VOC) emissions and end-of-life recyclability-are steering research and development toward bio-based resins and natural fiber reinforcements. These shifts not only address sustainability mandates but also appeal to eco-conscious consumers demanding transparency and lifecycle accountability. As a result, natural fibers such as hemp and flax are gaining traction alongside traditional E glass and high-strength carbon fibers.

Furthermore, the acceleration of lightweight design priorities across the automotive, aerospace, and wind energy sectors has heightened demand for closed molding composites. This trend has prompted resin formulators to innovate hybrid chemistries that balance stiffness and impact resistance while enabling rapid cycle times. By adapting to these converging forces, industry participants are redefining the closed molding landscape and unlocking new pathways to growth and differentiation.

Assessing the Far-Reaching Consequences of 2025 United States Tariff Policies on the Closed Molding Composites Supply Chain and Cost Structures

Since the onset of the 2025 tariff adjustments, United States import duties on select composite fibers and preforms have reverberated throughout the supply chain, compelling stakeholders to recalibrate sourcing strategies. Notably, anti-dumping measures imposed on certain carbon fiber grades and aramid expansions have elevated landed costs, prompting many fabricators to explore domestic alternatives and diversify supplier portfolios. This recalibration has been especially pronounced in automotive body panels and wind turbine components, where thin margins intensify sensitivity to raw material price fluctuations.

Moreover, the cumulative impact of tariffs has accelerated domestic capacity expansions, as North American producers seek to mitigate dependency on offshore manufacturers. This trend is supported by incentive programs aimed at bolstering local production of advanced fibers and high-performance resins. Consequently, the regional supply chain is witnessing a renaissance of collaborative ventures between fiber innovators and closed molding equipment vendors, fostering vertically integrated platforms.

Nevertheless, tariff-driven cost pressures have introduced complexities in contract negotiations and long-term procurement agreements. Fabricators are now negotiating more dynamic pricing mechanisms tied to published indices and duty pass-through clauses. Despite these challenges, the industry’s collective response has underscored its resilience, leveraging regulatory shifts as catalysts for supply chain optimization and technological investment.

Unlocking Critical Market Segmentation Perspectives to Illuminate Fiber Resin Process Application and End Use Industry Dynamics in Closed Molding Composites

Diving into the fiber dimension reveals that carbon fiber continues to command attention for its unparalleled stiffness and lightweight attributes, with PAN-based precursors leading innovation in aerospace structures while pitch-based variants are carving niches in high-temperature applications. Meanwhile, aramid fibers-exemplified by Kevlar’s ballistic performance and Nomex’s thermal resilience-remain indispensable in defense and industrial safety solutions. Glass fibers such as E-glass provide a cost-effective backbone for pipes and tanks, while S-glass is gaining ground where superior tensile strength is nonnegotiable. In parallel, natural reinforcements like flax and hemp are emerging as eco-friendly substitutes for noncritical components, offering competitive mechanical profiles and reduced carbon footprints.

Turning to resin technologies, thermosets continue to dominate when it comes to structural integrity, with epoxy resins prized for bond strength, polyester varieties balancing cost-performance ratios, and vinyl ester systems delivering chemical resistance. Contrastingly, thermoplastics such as nylon, PEEK, polyethylene, and polypropylene are unlocking recyclability pathways and enabling rapid processing cycles, particularly in high-volume electrical enclosures and consumer goods applications. This bifurcation underscores a broader industry pivot toward closed-loop systems where end-of-life recovery is as critical as initial performance.

Examining process modalities, bulk molding compound and sheet molding compound maintain strong footholds in automotive and construction due to their scalability, whereas injection molding and compression molding are accelerating throughput in electronics housings and decorative panels. More advanced methods like resin transfer molding and vacuum infusion are becoming indispensable for large-scale structural components, offering low void contents and high fiber volume fractions. Light RTM blends these attributes with cycle efficiencies suited for mid-tier production runs, further diversifying the methodological toolkit available to composite fabricators.

In application sectors, structural components in aerospace and defense are setting the pace for material innovation, while body panels in automotive continue to push the envelope for lightweight, crash-worthy designs. Decorative items are leveraging aesthetic freedom afforded by closed molding, enriching consumer goods with complex textures and colors. Housing and enclosures benefit from the moisture resistance and electrical insulation of select composites, and pipes and tanks depend on corrosion-resistant chemistries to handle aggressive fluids.

Finally, in terms of end use industry, aerospace & defense persist as early adopters with stringent certification protocols, automotive champions prioritize fuel economy and performance, and construction stakeholders value durability and design flexibility. Consumer goods players emphasize tactile quality and recyclability, whereas electrical & electronics firms prize dielectric properties and flame retardance. The marine sector is drawn to saltwater resilience and weight reduction, and wind energy capitalizes on the exceptional fatigue life of tailored fiber composites. This layered segmentation narrative underscores why targeted material and process decisions are paramount for capturing specific industry advantages.

This comprehensive research report categorizes the Closed Molding Composites market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Fiber Type

- Resin Type

- Process Type

- Application

- End Use Industry

Analyzing Regional Dynamics Shaping Closed Molding Composites Adoption and Growth Trajectories Across the Americas Europe Middle East and Asia-Pacific

Across the Americas, robust automotive and wind energy demand has positioned North America as a hotbed for closed molding composites investment, particularly in regions benefiting from reshoring incentives and renewable energy mandates. The presence of advanced manufacturing hubs in the United States and Canada further reinforces the region’s appeal, facilitating close collaboration between OEMs and material suppliers to drive next-generation composite solutions.

In Europe, stringent environmental directives and aerospace commitments have galvanized growth in closed molding adoption, with Germany and France leading projects that integrate lightweighting imperatives into high-speed rail and aerospace platforms. The Middle East is witnessing experimental deployments for infrastructure projects that favor corrosion-resistant pipe systems, while select African markets are exploring cost-effective fiber options to modernize construction and transportation networks.

Meanwhile, Asia-Pacific stands out for its rapid industrialization and burgeoning automotive manufacturing in nations such as China, Japan, and Korea. The region’s electronics sector continues to spur demand for injection-molded composite housings, and wind energy expansion in coastal markets is driving investment in large-scale vacuum infusion facilities. Regional clusters in Southeast Asia are increasingly positioning themselves as strategic export bases, combining competitive labor costs with rising technical capabilities in composite engineering.

This comprehensive research report examines key regions that drive the evolution of the Closed Molding Composites market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Strategic Initiatives and Competitive Positions of Leading Closed Molding Composites Providers Driving Innovation Collaboration and Market Expansion

Leading providers within the closed molding composites landscape are executing multifaceted strategies to solidify market positions. Established fiber manufacturers are partnering with resin formulators to co-develop hybrid material systems that address both mechanical performance and environmental metrics. Some resin suppliers have expanded their portfolios through the acquisition of biopolymer startups, signaling a shift toward more sustainable supply chains.

Equipment vendors are integrating smart factory solutions directly into their machinery, offering in-line cure monitoring and predictive maintenance modules that enhance uptime and part consistency. These collaborations between hardware and materials specialists underscore an ecosystem-wide push toward end-to-end composite solutions. Additionally, service bureaus are broadening their capabilities beyond prototyping, offering low-volume series production with turnkey engineering support to accelerate time-to-market for emerging applications.

Innovation hubs established through joint ventures between OEMs and material science institutions are nurturing next-generation fiber architectures and resin chemistries. Such alliances are yielding groundbreaking developments in nanoreinforcements and self-healing matrix systems, which promise to extend component life cycles and reduce maintenance overhead. By orchestrating these diverse initiatives, leading companies are shaping a cohesive narrative of value creation across the closed molding composites value chain.

This comprehensive research report delivers an in-depth overview of the principal market players in the Closed Molding Composites market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AOC, LLC

- BASF SE

- Exel Composites Plc

- Gurit Holding AG

- Hexcel Corporation

- Huntsman Corporation

- Magnum Venus Products, Inc.

- Mitsubishi Chemical Corporation

- Owens Corning

- SGL Carbon SE

- Solvay SA

- Teijin Limited

- Toray Industries, Inc.

Empowering Industry Leaders with Actionable Strategies to Capitalize on Emerging Opportunities and Mitigate Risks in Closed Molding Composite Technologies

To capitalize on prevailing trends, industry leaders should prioritize the integration of sustainable fiber alternatives and recyclable resin systems, leveraging partnerships with bio-based material innovators. Concurrently, investing in automation and digital twins will enhance throughput and quality consistency, enabling rapid scaling of complex geometries without sacrificing precision. Supply chain resilience can be further fortified by diversifying fiber sources across multiple geographies and negotiating dynamic procurement contracts that accommodate tariff-related volatility.

In parallel, developing co-engineering frameworks with OEMs is essential for aligning material specifications with end-use performance targets. This collaborative approach accelerates design iterations and fosters deeper customer engagement. Additionally, embedding real-time analytics into manufacturing lines will unlock predictive maintenance insights, mitigating downtime risks and reducing overall production costs.

Finally, fostering an organizational culture that rewards experimentation and cross-functional innovation will stimulate the development of breakthrough composite architectures. By balancing short-term operational efficiencies with long-term R&D investments, industry leaders can secure sustainable competitive advantages and lead the evolution of closed molding composite technologies.

Detailing a Rigorous Multistage Research Methodology Combining Primary Engagement Secondary Analysis and Data Triangulation for Credible Insights

This research is grounded in a comprehensive multistage methodology that begins with exhaustive secondary analysis of industry publications, technical journals, and patent filings to establish a foundational understanding of market dynamics. Building upon this baseline, targeted primary interviews were conducted with composite engineers, procurement managers, and sustainability experts across key geographies to capture diverse perspectives and validate emerging trends.

Subsequently, quantitative data points were triangulated through cross-referencing publicly available trade statistics, regulatory filings, and corporate disclosures to ensure accuracy and coherence. Advanced data analytics techniques were employed to identify correlation patterns between tariff developments and supply chain adjustments, as well as to map regional adoption rates against policy incentives.

Throughout the process, rigorous peer reviews and industry advisory consultations were implemented to refine assumptions and contextualize findings. This layered approach guarantees that insights are not only robust and credible but also aligned with the real-world complexities faced by closed molding composite stakeholders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Closed Molding Composites market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Closed Molding Composites Market, by Fiber Type

- Closed Molding Composites Market, by Resin Type

- Closed Molding Composites Market, by Process Type

- Closed Molding Composites Market, by Application

- Closed Molding Composites Market, by End Use Industry

- Closed Molding Composites Market, by Region

- Closed Molding Composites Market, by Group

- Closed Molding Composites Market, by Country

- United States Closed Molding Composites Market

- China Closed Molding Composites Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Synthesizing Core Insights and Strategic Imperatives to Conclude the Executive Overview of Closed Molding Composites Market Needs and Opportunities

In conclusion, the closed molding composites arena is entering a pivotal phase characterized by heightened technological integration, evolving sustainability benchmarks, and intricate regulatory landscapes. The strategic convergence of advanced fibers, innovative resin chemistries, and process automation is redefining performance expectations across automotive, aerospace, wind energy, and beyond. Meanwhile, the ripple effects of 2025 tariff policies have catalyzed domestic production initiatives and underscored the importance of agile supply chain architectures.

Segmentation insights reveal that fiber selection, resin type, processing technique, target application, and end use industry each present unique opportunities and challenges. Regional dynamics further illustrate that global adoption is uneven yet accelerating, driven by policy incentives and sector-specific growth imperatives. Leading companies are responding through collaborative platforms, sustainable material development, and smart equipment offerings, shaping a market landscape ripe for innovation.

As decision-makers navigate this multifaceted environment, embracing data-driven strategies and fostering cross-industry partnerships will be crucial. The insights presented herein serve as a strategic compass, illuminating pathways to operational excellence and sustainable growth within the closed molding composites domain.

Seize the Opportunity to Secure Comprehensive Closed Molding Composites Market Intelligence by Connecting with Ketan Rohom Associate Director Sales Marketing

To obtain the full-depth closed molding composites market report, reach out to Ketan Rohom, Associate Director, Sales & Marketing, who will guide you through the tailored options that best suit your strategic needs. Engaging directly with the report’s custodian guarantees you access to the latest datasets, proprietary analysis, and expert commentary designed to accelerate your decision-making process.

By connecting with Ketan, you align your organization with an essential resource that decodes complex supply chain dynamics, regulatory shifts, and material innovations. Seize the chance to leverage comprehensive intelligence that empowers your team to stay ahead of industry disruptions and capitalize on emergent opportunities. Contact Ketan today to transform insights into impact and position your enterprise at the forefront of the closed molding composites revolution.

- How big is the Closed Molding Composites Market?

- What is the Closed Molding Composites Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?