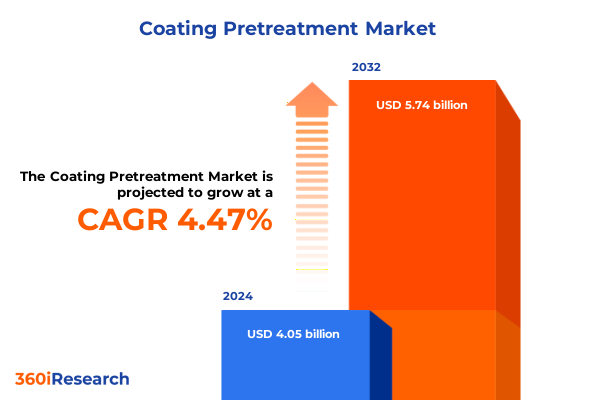

The Coating Pretreatment Market size was estimated at USD 4.21 billion in 2025 and expected to reach USD 4.38 billion in 2026, at a CAGR of 4.54% to reach USD 5.74 billion by 2032.

Unlocking the Role of Advanced Surface Preparation Techniques in Driving Quality and Compliance in Modern Coating Applications Across Industries

Coating pretreatment lies at the heart of every successful protective and decorative coating application, serving as the critical foundation that ensures adhesion, corrosion resistance, and durability. In an era marked by increasing demands for environmental compliance and enhanced performance, pretreatment processes have evolved beyond simple etching and cleaning operations to encompass a diverse array of advanced technologies. From chromate conversion treatments that deliver exceptional corrosion protection to chromate-free alternatives driven by regulatory imperatives, the selection of the optimal pretreatment chemistry is pivotal for meeting today’s quality and sustainability targets.

Moreover, the integration of automation and digital monitoring systems has revolutionized the manner in which pretreatment lines are managed, enabling real-time control of critical parameters such as pH, temperature, and chemical concentration. These innovations not only enhance process consistency and reduce waste but also empower manufacturers to adapt swiftly to new specifications and complex substrates. As a result, pretreatment has become a strategic lever for achieving operational excellence in industries ranging from automotive and aerospace to construction and electronics.

As we embark on an in-depth analysis of the coating pretreatment market, this introduction establishes the context for understanding the transformative forces reshaping the landscape. By examining key technological categories, regulatory drivers, and emerging performance requirements, readers will gain a comprehensive perspective on why pretreatment continues to be a cornerstone of modern coating applications.

Examining the Game-Changing Technological, Regulatory, and Sustainability Transformations Redefining Coating Pretreatment Practices Worldwide

Over the past decade, the coating pretreatment market has experienced a profound metamorphosis, propelled by converging technological, environmental, and regulatory trends. The shift toward sustainability has spurred the rapid adoption of non-chromate conversion and zirconium-based treatments, driven by stringent restrictions on hexavalent chromium and a global emphasis on safer chemical alternatives. Concurrently, digitalization has enabled pretreatment lines to leverage Industry 4.0 principles, with sensors and analytics providing unprecedented visibility into process performance and facilitating predictive maintenance.

In parallel, regulatory landscapes across North America, Europe, and Asia-Pacific have intensified requirements for wastewater discharge limits and volatile organic compound (VOC) emissions, prompting coating formulators to collaborate more closely with pretreatment suppliers in developing integrated, low-impact solutions. These partnerships have given rise to tailored chemistries that balance environmental compliance with the mechanical and aesthetic demands of end-use industries.

Furthermore, the emergence of bio-based and self-assembled monolayer (SAM) technologies is reshaping the market, offering novel pathways for surface activation and corrosion inhibition without traditional rinse-water usage. Driven by collaborative research between academic institutions and leading suppliers, these next-generation approaches herald a new era in which pretreatment transcends its traditional role to become an enabler of multifunctional coatings and circular economy strategies.

Assessing the Compound Effects of 2025 United States Trade Tariffs on Coating Pretreatment Supply Chains, Material Costs, and Competitive Dynamics

In 2025, United States trade policy continues to exert significant influence on coating pretreatment supply chains and material costs. Tariffs imposed under prior Section 301 measures have led to notable increases in the price of specialty chemicals, with industry sources estimating cost hikes ranging from eight to fifteen percent on intermediates crucial to conversion and phosphate treatments. These additional expenses stem from direct tariff pass-through as well as elevated freight and insurance premiums, which collectively compress margins for contract manufacturers and toll processors until pricing adjustments can be implemented or negotiated with downstream customers.

Moreover, the chemical sector has experienced sharp increases in key raw material expenses, with freight costs for certain feedstocks rising by as much as 170 to 228 percent. Underlying chemical prices-particularly for monoethylene glycol and ethanol used in phosphate processes-have surged by 33 to 37 percent, further amplifying operational overhead for pretreatment line operators. In the coatings segment, tariff-related cost increases are often passed downstream, prompting manufacturers to either absorb margin erosion or transfer price impacts to end users in automotive, construction, and general industrial markets.

Simultaneously, U.S. exporters of pretreatment chemistries face heightened compliance costs tied to evolving customs classification and documentation requirements. These factors have driven some firms to explore alternate sourcing strategies, including reshoring production and establishing joint ventures in tariff-neutral regions. Collectively, these adaptations underscore the imperative for strategic supply chain resilience and highlight the enduring ripple effects of trade policy on coating pretreatment economics.

Unveiling Critical Pretreatment Market Segmentation Insights That Illuminate the Roles of Technology, Substrate, and End-Use Industry in Coating Performance

The pretreatment market can be deconstructed through multiple lenses that each reveal critical drivers of adoption and performance. Technologies such as chromate conversion treatments, non-chromate conversion processes, passivation, phosphating, and zirconium treatments occupy distinct niches based on factors like corrosion resistance, cost, and environmental compliance. Within these categories, further subdivisions-hexavalent versus trivalent chromate, phosphorosilicate conversion and silanization in non-chromate options, and iron, manganese, and zinc phosphating-address specialized requirements, from automotive body panels to machinery components.

Substrate materials represent another axis of segmentation. Aluminum and its alloys-both cast and wrought-present unique surface chemistries that necessitate tailored pretreatment chemistries, while galvanized steel and various forms of iron and steel require phosphate or passivation treatments to achieve target adhesion and durability. Each material category imposes specific process controls and chemical concentrations to ensure consistent results, underscoring the importance of comprehensive technical support.

End-use industries further refine pretreatment selection. Industries such as appliances, automotive, construction, electronics, and general industrial each impose varied performance benchmarks. The automotive sector, for example, spans both OEM and aftermarket applications with stringent cyclical corrosion tests, whereas general industrial customers focus on equipment and machinery where operational uptime and long-term substrate integrity are paramount. Understanding the cumulative impact of these intersecting segmentation criteria is essential for developing robust pretreatment strategies and delivering tailored solutions that meet precise end-use demands.

This comprehensive research report categorizes the Coating Pretreatment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Pretreatment Technology

- Substrate Material

- End Use Industry

Deciphering How Regional Dynamics in the Americas, Europe Middle East Africa, and Asia Pacific Shape Strategic Priorities for Coating Pretreatment Innovations

Regional dynamics exert a profound influence on coating pretreatment strategies, reflecting the interplay of regulatory frameworks, manufacturing capabilities, and end-market demands. In the Americas, a robust automotive and aerospace base has driven demand for high-performance chromate conversion and phosphating lines, supported by investments in local chemical manufacturing to reduce dependency on long‐haul imports. Meanwhile, stringent environmental regulations in Canada and the United States continue to nudge formulators toward trivalent and chrome-free technologies to minimize hexavalent chromium usage.

Across Europe, Middle East, and Africa, regulatory drivers such as REACH and region-specific VOC limits have accelerated the rollout of non-chromate conversion and low‐temperature phosphating chemistries. Industry-leading suppliers in Western Europe have responded with innovative systems designed for minimal effluent treatment requirements, while emerging markets in the Middle East and Africa are beginning to adopt these advanced chemistries to meet infrastructure and energy sector demands.

In Asia-Pacific, rapid industrialization in China, India, South Korea, and Southeast Asia has spurred dynamic growth in pretreatment installations. The region’s emphasis on high-volume automotive production and burgeoning electronics manufacturing has created strong demand for automated pretreatment lines capable of rapid throughput. Suppliers are capitalizing on this momentum by establishing regional research centers and production facilities to deliver localized support and customized chemistries that align with both performance expectations and evolving regulatory mandates.

This comprehensive research report examines key regions that drive the evolution of the Coating Pretreatment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Exploring Competitive Strategies and Technological Leadership of Key Players Steering the Future of Coating Pretreatment Markets Globally

Leading players in the coating pretreatment market are leveraging strategic investments and portfolio realignments to fortify their competitive positions. PPG’s announcement of a $380 million investment for a state-of-the-art aerospace coatings and sealants facility in Shelby, North Carolina, underscores a commitment to advanced manufacturing and supply chain integration. The new facility will enhance capacity for critical pretreatment chemistries used in aerospace applications, while digital process controls promise improved yield and reduced waste. Concurrently, PPG has undertaken a strategic divestiture of its U.S. and Canadian architectural-coatings business for $550 million, aiming to streamline operations and reallocate capital toward higher-margin specialty segments. This divestiture, coupled with a cost reduction program affecting 1,800 roles, is projected to yield annualized pretax savings of $175 million, bolstering investment capacity in pretreatment research and development.

Similarly, AkzoNobel has reshaped its global footprint by divesting its decorative paint unit in India for $1.6 billion and shifting focus toward performance coatings in Asia. This transaction enables the company to concentrate on core B2B pretreatment and protective markets, supported by the retained intellectual property of the Dulux brand and a royalty-based model in select territories. As performance coatings contributed over 60 percent of the company’s adjusted core earnings in 2024, AkzoNobel’s strategic pivot reflects an emphasis on high-value pretreatment chemistries and regional partnerships designed to drive sustainable growth.

These examples illustrate how market leaders are aligning capital expenditure, divestiture, and M&A activity to reinforce technological leadership in conversion coatings, phosphate treatments, and chrome-free alternatives, thus setting the stage for continued innovation and differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Coating Pretreatment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Akzo Nobel N.V.

- Altech Anodizing & Coatings Inc.

- Atotech Deutschland GmbH

- Axalta Coating Systems Ltd.

- BASF SE

- Chemetall GmbH

- Coral Chemical Company

- DuBois Chemicals, Inc.

- DuPont de Nemours, Inc.

- Element Solutions Inc.

- Henkel AG & Co. KGaA

- Hubbard‑Hall Inc.

- Jotun A/S

- MKS Instruments, Inc.

- Nihon Parkerizing Co., Ltd.

- NIPSEA International Limited

- PPG Industries, Inc.

- Quaker Houghton Corporation

- RPM International, Inc.

- The Dow Chemical Company

- Troy Chemical Industries, Inc.

- Vanchem Performance Chemicals Inc.

- Westchem Technologies Inc.

Implementing Actionable Recommendations to Enhance Operational Efficiency, Sustainability, and Competitive Resilience in the Coating Pretreatment Industry

Industry leaders must adopt a multi-pronged approach to maintain competitiveness in the rapidly evolving pretreatment market. First, prioritizing digital transformation by integrating process analytics and automation platforms will enable real-time quality control, predictive maintenance, and enhanced resource efficiency. This approach not only reduces operational costs but also accelerates time to compliance in response to tightening environmental regulations.

Second, forging strategic partnerships with raw material suppliers and end-use manufacturers can unlock co-innovation opportunities for next-generation pretreatment chemistries. Collaborative ventures between chemical developers and OEMs allow for joint development of bio-based inhibitors, smart conversion layers, and low-temperature processes that align with circular economy principles.

Lastly, mitigating trade policy risks through diversified sourcing and regional production footprints will prove essential for supply chain resilience. Companies should evaluate near-shoring options, form joint ventures in tariff-neutral zones, and negotiate long-term supply agreements with built-in price adjustment mechanisms. By taking these preemptive actions, industry leaders can safeguard margins, reduce lead-time volatility, and ensure uninterrupted access to critical pretreatment chemicals.

Detailing a Rigorous Research Methodology Underpinning the Analysis of Market Dynamics, Technological Trends, and Regulatory Impacts in Coating Pretreatment

This analysis is grounded in a rigorous, multi-stage research methodology designed to ensure accuracy and comprehensiveness. Primary research involved structured interviews with senior executives, technical experts, and procurement professionals across leading pretreatment chemical suppliers, end-use manufacturers, and regulatory bodies. Insights gleaned from these dialogues were corroborated through secondary sources, including industry publications, trade association reports, and patent filings.

Quantitative data collection encompassed detailed vendor databases and customs records to map material flows, tariff classifications, and pricing trends. Data triangulation techniques were employed to validate findings, while scenario analysis assessed the implications of evolving trade policies and regulatory frameworks on pretreatment process economics.

Finally, expert workshops and peer reviews provided additional validation, ensuring that the research outputs reflect the latest technological advances and strategic developments. This systematic approach underpins the reliability of the insights presented, offering stakeholders a transparent and robust foundation for informed decision-making in coating pretreatment.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Coating Pretreatment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Coating Pretreatment Market, by Pretreatment Technology

- Coating Pretreatment Market, by Substrate Material

- Coating Pretreatment Market, by End Use Industry

- Coating Pretreatment Market, by Region

- Coating Pretreatment Market, by Group

- Coating Pretreatment Market, by Country

- United States Coating Pretreatment Market

- China Coating Pretreatment Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1749 ]

Concluding Insights Highlighting the Imperative for Innovation, Sustainability, and Strategic Agility in the Evolving Coating Pretreatment Market Landscape

The coating pretreatment landscape stands at a pivotal juncture, where the confluence of technological advancement, regulatory change, and global supply chain pressures demands proactive adaptation. Innovation in non-chromate and zirconium treatments, coupled with digital process monitoring, offers a pathway to enhanced performance and environmental compliance. At the same time, shifting tariff regimes underscore the necessity for resilient sourcing strategies and diversified production footprints.

Looking forward, market participants that embrace sustainable chemistries, invest in automation, and cultivate strategic alliances will be best positioned to capture new growth opportunities across automotive, aerospace, and industrial sectors. Furthermore, ongoing dialogue with regulatory authorities and industry consortia will facilitate the timely adoption of next-generation technologies that balance performance with ecological responsibility.

In conclusion, the imperative for actionable insights and agile strategies has never been greater. As coating pretreatment evolves to meet the exacting demands of modern manufacturing, stakeholders must leverage data-driven analysis, collaborative innovation, and robust risk mitigation measures to secure a competitive advantage in this dynamic market.

Drive Business Growth with Expert Insights on Coating Pretreatment by Connecting with Ketan Rohom and Securing Your Comprehensive Market Research Report Today

Elevate your strategic planning and operational decision-making in the coating pretreatment space by securing the definitive market research report today. With comprehensive analysis of technological trends, regulatory impacts, and competitive dynamics, this report equips you with the insights necessary to stay ahead of evolving industry challenges. Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to access detailed market segmentation, in-depth regional intelligence, and expert recommendations tailored to your business needs. Don’t miss the opportunity to transform data into actionable strategies-connect with Ketan Rohom now to accelerate your growth and drive long-term success with authoritative research.

- How big is the Coating Pretreatment Market?

- What is the Coating Pretreatment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?