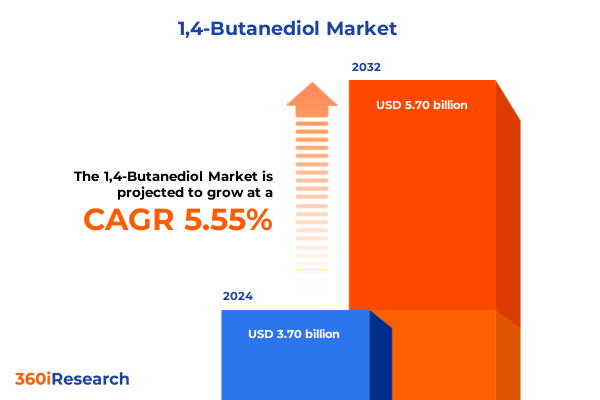

The 1,4-Butanediol Market size was estimated at USD 3.87 billion in 2025 and expected to reach USD 4.06 billion in 2026, at a CAGR of 5.67% to reach USD 5.70 billion by 2032.

Delving into the Fundamental Drivers and Core Applications Shaping the 1,4-Butanediol Industry Across Emerging and Established Manufacturing Markets and Environmental Considerations

The global 1,4-Butanediol landscape is anchored in its multifunctional chemistry, offering crucial building blocks for polymers, solvents, and specialty chemicals that underpin diverse industrial applications. With a molecular structure enabling conversion into gamma-butyrolactone and tetrahydrofuran, this diol serves as an essential intermediate in manufacturing polyurethanes, spandex fibers, and polybutylene terephthalate. Its versatility has driven continuous innovation in production techniques, catalysis, and downstream processes aimed at optimizing yields and minimizing environmental impact. As industries worldwide prioritize resource efficiency and performance, 1,4-Butanediol has emerged as a focal point for both petrochemical and bio-based pathways, reflecting its central role in material science and green chemistry applications.

Amidst shifting global trade dynamics and regulatory landscapes, market participants have intensified efforts to diversify feedstock sources and enhance process reliability. Technological advances in fermentation-based routes have revitalized interest in bio-derived 1,4-Butanediol, aligning with broader sustainability agendas and corporate climate commitments. Concurrently, established petrochemical producers continue to leverage large-scale chemical synthesis to meet demand for cost-competitive commodity grades. The intersection of these approaches underpins a complex competitive environment where innovation, feedstock access, and supply chain resilience define industry leadership and market trajectory.

Uncovering the Transformative Technological and Sustainability Shifts Propelling the 1,4-Butanediol Market Toward Innovation, Circular Production, and Advanced Supply Chain Integration

The 1,4-Butanediol market is experiencing transformative shifts driven by technological breakthroughs and sustainability imperatives. Notably, the advent of advanced microbial fermentation platforms has enabled scalable bio-based production that rivals traditional petrochemical processes in efficiency and cost. These innovations, exemplified by proprietary platforms converting renewable sugars into high-purity diol, are redefining supply chain paradigms and reducing carbon footprints. Additionally, the integration of process intensification techniques, such as continuous flow dehydration and dehydrogenation catalysts, has elevated throughput and selectivity, empowering producers to meet rising performance standards while adhering to stricter emissions regulations.

Beyond production, digital transformation is reshaping logistics, procurement, and customer engagement across the value chain. Real-time analytics, blockchain-anchored traceability, and predictive maintenance systems are improving operational resilience amid fluctuating feedstock costs and trade uncertainties. Moreover, stakeholder pressure for circular economy solutions has accelerated partnerships between chemical manufacturers and end-users to reclaim and recycle polymer waste streams, closing the loop on 1,4-Butanediol-derived materials. These cohesive shifts underline a market in flux, balancing cost, compliance, and sustainability drivers to chart a new course for growth and differentiation.

Analyzing the Cumulative Impact of U.S. Section 301 and Reciprocal Tariffs on 1,4-Butanediol Imports through 2025 and Their Effects on Supply and Pricing Dynamics

Since the initial Section 301 tariffs took effect in mid-2018, the United States has progressively imposed surcharges that cumulatively impact imports of 1,4-Butanediol originating from China and other covered markets. The first tranche, implemented July 6, 2018, introduced a 25 percent duty on over 800 HTS codes, including key polyalcohols and chemical intermediates. Subsequent tranches in August 2018 and September 2018 expanded coverage, ultimately subjecting more than 6,000 tariff lines to rates of up to 25 percent. These measures have remained largely intact through statutory reviews, with exclusion processes extended as recently as August 31, 2025, preserving elevated import costs for protected goods while marginally relieving certain downstream products.

Further compounding these measures, the introduction of a new reciprocal tariff regime in April 2025 established a baseline 10 percent tariff on all imports and elevated Chinese-origin chemical imports to a 34 percent duty. By aligning retaliatory rates with sectors deemed to maintain trade barriers against U.S. exports, policymakers have intensified cost pressures on 1,4-Butanediol sourced from affected regions. Together, these frameworks have reshaped sourcing strategies, incentivizing domestic manufacturing expansions and alternate supply chain routes to mitigate escalating landed costs and preserve margin resilience.

Revealing Key Segmentation Insights Driving Demand for 1,4-Butanediol across Application Pathways, End-Use Industries, Production Types, Processes, and Distribution Models

A nuanced understanding of market segmentation reveals diverse demand drivers and competitive landscapes for 1,4-Butanediol. Application-wise, the market bifurcates into gamma-butyrolactone, valued for its solvent attributes and polymer precursor role, and tetrahydrofuran, critical for elastic fiber synthesis and specialty polymer production. This dichotomy reflects downstream consumption patterns that range from hydrophobic coatings to high-performance spandex manufacturing, underlining the strategic importance of tailored product grades and consistent quality standards.

When examining industry verticals, automotive applications leverage 1,4-Butanediol-derived polyurethanes for seating foams, electrical insulation, and lightweight components, whereas coatings technology exploits its solvent properties to achieve rapid drying and adhesion performance. The pharmaceutical sector employs the diol as a reaction medium and intermediate for drug synthesis, while polymers such as polyester polyols, spandex, and thermoplastic polyurethane underscore the chemical’s versatility. Differentiating along petrochemical and bio-based types further highlights evolving feedstock preferences, as sustainability concerns drive growth in biogenic production. Production pathways span high-yield chemical synthesis and emerging fermentation processes, each with inherent cost structures and environmental footprints. Finally, direct sales models cater to large industrial accounts requiring technical support and custom formulations, while distributor networks extend reach into niche segments and regional markets, ensuring broad market coverage.

This comprehensive research report categorizes the 1,4-Butanediol market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Production Process

- Distribution Channel

- Application

- End-Use Industry

Distilling Key Regional Insights Highlighting Differentiated Drivers and Opportunities for the 1,4-Butanediol Market in the Americas, EMEA, and Asia-Pacific Regions

Regional dynamics for 1,4-Butanediol reflect localized industrial ecosystems and supply chain configurations. In the Americas, the market is buoyed by robust automotive manufacturing clusters in the U.S. and Mexico, alongside significant pharmaceutical production hubs in North America. Investments in bio-based chemical plants, particularly in the U.S. Gulf Coast, have been spurred by state and federal incentives aimed at reducing greenhouse gas emissions and enhancing domestic supply security, reinforcing the region’s leadership in sustainable chemical synthesis.

Europe, the Middle East, and Africa collectively illustrate a dual narrative of advanced manufacturing and emerging market expansion. Western Europe’s stringent environmental regulations and circular economy mandates have accelerated adoption of bio-derived 1,4-Butanediol, while Central and Eastern European automotive and electronics sectors continue to consume significant volumes of petrochemical grades. In the Asia-Pacific region, rapid industrialization in China, India, and Southeast Asia drives demand for both conventional and specialty diol grades. Competitive feedstock sourcing, expanding port infrastructure, and government-backed chemical corridor projects underscore the region’s strategic importance and capacity growth ambitions.

This comprehensive research report examines key regions that drive the evolution of the 1,4-Butanediol market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Innovating in Petrochemical Production and Bio-Based Technologies within the Global 1,4-Butanediol Market Landscape

Leading global producers of 1,4-Butanediol include legacy petrochemical giants and specialized chemical manufacturers with expansive production capacities and integrated downstream operations. BASF SE maintains a prominent position, leveraging multi-feedstock facilities and proprietary dehydration catalysts to supply bulk volumes for polyurethane and PBT applications. LyondellBasell and Evonik Industries further diversify supply via technology licensing and strategic joint ventures, optimizing cost structures through economies of scale and regional production footprints.

Concurrently, innovators in the bio-based segment are redefining market opportunities through fermentation technology and circular economy integration. Genomatica’s GHOST® platform has enabled commercial-scale sugar-to-BDO conversion in partnership with major chemical players, while Novamont’s Mater-Biotech biorefinery exemplifies Europe’s circular model for waste-to-chemical production. Emerging alliances, such as the Cargill-HELM Qira joint venture, underscore the trend toward collaborative capacity expansion and feedstock diversification, positioning these entities as catalysts for sustainable industry transformation.

This comprehensive research report delivers an in-depth overview of the principal market players in the 1,4-Butanediol market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ascend Performance Materials LLC

- Ashland Inc.

- BASF SE

- Chang Chun Group

- China Petrochemical Corporation

- Dairen Chemical Corporation

- DuPont de Nemours, Inc.

- Evonik Industries AG

- Genomatica, Inc.

- Grupa Azoty S.A.

- Henan Kaixiang Fine Chemical Co., Ltd.

- Huntsman Corporation

- Invista S.à r.l.

- Jiangsu Hailun Petrochemical Co., Ltd.

- LANXESS AG

- LyondellBasell Industries N.V.

- Markor Chemicals Group Co., Ltd.

- Mitsubishi Chemical Holdings Corporation

- Novamont S.p.A.

- Saudi International Petrochemical Company

- Shanxi Sanwei Group Co., Ltd.

- Solvay S.A.

- The Dow Chemical Company

- Xinjiang Tianye Group Co., Ltd.

Delivering Actionable Strategic Recommendations for Industry Leaders to Navigate Tariff Pressures, Embrace Sustainable Production, and Enhance Market Resilience

To navigate evolving tariff regimes and cost pressures, industry leaders should prioritize diversification of feedstock sourcing, integrating both petrochemical and bio-based supplies to balance risk and sustainability goals. Strengthening partnerships with logistics providers and exploring nearshoring opportunities can mitigate tariff impacts and enhance supply chain agility. Additionally, investing in process development-such as continuous flow dehydration and advanced catalyst systems-can improve energy efficiency and reduce per-unit manufacturing costs, bolstering competitiveness in price-sensitive markets.

Further, engaging in cross-industry collaborations to develop circular end-of-life solutions will drive differentiation and compliance with tightening environmental regulations. Stakeholders should leverage data analytics and digital twins to optimize production parameters, forecast maintenance needs, and refine demand planning. Finally, proactive engagement with policymakers to shape sustainable trade and environmental policies can provide early insight into regulatory shifts, enabling companies to adapt strategies and capitalize on emerging incentives. Such an integrated approach will position organizations to thrive amid supply chain complexity and evolving market demands.

Outlining a Robust Research Methodology Leveraging Primary Interviews, Rigorous Data Triangulation, and Proprietary Analytical Models for Comprehensive Market Insights

This analysis is grounded in a rigorous hybrid research framework that integrates both primary and secondary intelligence. Primary insights were gathered through in-depth interviews with C-suite executives, technical directors, and procurement specialists across leading chemical manufacturers and end-use industries. These qualitative perspectives were supplemented by structured surveys to quantify operational priorities and procurement criteria for 1,4-Butanediol applications.

Secondary research leveraged authoritative public sources, including regulatory filings, trade commission reports, peer-reviewed scientific literature, and credible news outlets, to contextualize macroeconomic factors and tariff developments. Proprietary demand modeling and scenario analysis frameworks were applied to triangulate data points, validate trends, and stress-test assumptions. Quality control measures, such as cross-validation between data sets and peer reviews, ensure the highest levels of accuracy and reliability in the final deliverables.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our 1,4-Butanediol market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- 1,4-Butanediol Market, by Type

- 1,4-Butanediol Market, by Production Process

- 1,4-Butanediol Market, by Distribution Channel

- 1,4-Butanediol Market, by Application

- 1,4-Butanediol Market, by End-Use Industry

- 1,4-Butanediol Market, by Region

- 1,4-Butanediol Market, by Group

- 1,4-Butanediol Market, by Country

- United States 1,4-Butanediol Market

- China 1,4-Butanediol Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Synthesizing Critical Market Themes to Conclude How Tariffs, Sustainability Trends, and Technological Advances Will Shape the Future of the 1,4-Butanediol Industry

In conclusion, the 1,4-Butanediol industry stands at a crossroads of regulatory complexity, technological innovation, and sustainability transitions. Persistent Section 301 and reciprocal tariffs have reshaped global sourcing patterns, driving investment in domestic and alternate production capacities. Meanwhile, the shift toward bio-based and circular production models underscores industry commitment to environmental stewardship without compromising performance.

Segmentation analyses reveal distinct value propositions across applications, end-use industries, and regions, highlighting opportunities for targeted product strategies and operational efficiencies. Leading companies are leveraging integrated approaches, from cutting-edge fermentation technologies to advanced catalyst development, to secure competitive advantage. As market dynamics continue to evolve, stakeholders who adopt proactive supply chain diversification, invest in process excellence, and align with regulatory and sustainability trends will be best positioned to capture growth and long-term value in the 1,4-Butanediol market.

Engage with Ketan Rohom at 360iResearch to Unlock Comprehensive 1,4-Butanediol Market Intelligence and Propel Strategic Decision-Making with Our Premium Report

To acquire the full 1,4-Butanediol market research report and access in-depth analysis, proprietary data, and strategic insights, please reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. His expertise in guiding industry leaders through complex market intelligence can ensure your organization stays ahead of evolving dynamics and competitive pressures. Engage with him to secure bespoke consulting options, tailored data sets, and premium deliverables designed to support high-impact decisions and drive sustainable growth in the 1,4-Butanediol sector.

- How big is the 1,4-Butanediol Market?

- What is the 1,4-Butanediol Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?