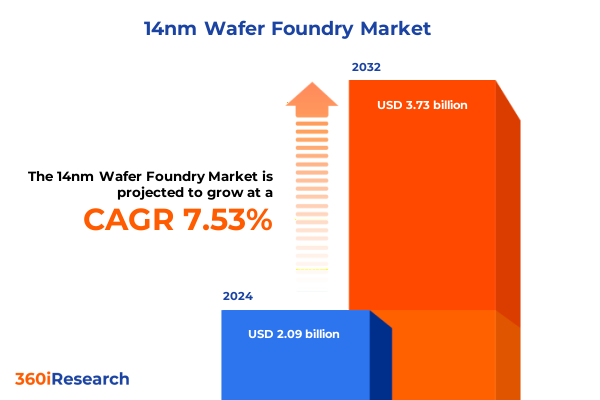

The 14nm Wafer Foundry Market size was estimated at USD 2.23 billion in 2025 and expected to reach USD 2.39 billion in 2026, at a CAGR of 7.60% to reach USD 3.73 billion by 2032.

Unveiling the Strategic Significance and Emerging Market Dynamics Shaping the Competitive 14nm Wafer Foundry Landscape in the Semiconductor Industry

The global semiconductor ecosystem continues to evolve at a breakneck pace, driven by relentless demand for more efficient, higher-performance, and power-optimized devices. Within this dynamic environment, the 14nm wafer foundry segment has emerged as a critical inflection point, balancing the maturity of planar transistor architectures with incremental improvements offered by FinFET designs. As device designers champion cost-effective process nodes for applications ranging from automotive safety systems to internet of things sensors, the relevance of 14nm capacity and expertise remains undiminished.

In parallel, market participants are navigating an increasingly complex value chain that spans from equipment suppliers and substrate vendors to design houses and end markets. Foundries operating at the 14nm node have refined their process technologies to deliver differentiated IP support, yield optimization, and multi-project wafer offerings. This amalgamation of technical prowess and service agility underscores the strategic significance of the 14nm tier, particularly in segments where performance per watt and cost per function drive purchasing decisions.

Against this backdrop, stakeholders require a clear understanding of the competitive landscape, regulatory headwinds, and shifting demand patterns. This report offers an executive-level orientation, distilling the foundational considerations that inform growth, resilience, and innovation across the 14nm wafer foundry space.

Identifying Disruptive Technological Advances and Strategic Alliances Transforming the Operational Landscape of 14nm Wafer Manufacturing Worldwide

The 14nm wafer foundry arena is undergoing transformative shifts propelled by the adoption of extreme ultraviolet lithography in adjacent nodes, prompting careful reevaluation of legacy planar process roadmaps. As next-generation nodes demand significant capital expenditure, many fabs are optimizing 14nm capacity to serve high-volume, cost-sensitive applications. This recalibration has spurred strategic alliances, enabling shared investment in yield ramp programs and collaborative IP ecosystems.

Concurrently, the consolidation of IDM and fabless partnerships is reshaping the supplier-customer dynamic. Integrated device manufacturers increasingly outsource peripheral product lines to foundries, while design-only firms leverage multi-source supply strategies to mitigate geopolitical volatility. The result is a more fluid, service-oriented model wherein tooling compatibility, chronic yield challenges, and co-development roadmaps take center stage.

Moreover, the relentless push into automotive, 5G, and sensor-intensive IoT markets has elevated requirements for functional safety, long-term supply guarantees, and quality certifications. Consequently, foundries at 14nm are expanding their reliability engineering practices and securing critical certifications. These combined factors signal a paradigm shift that elevates 14nm from a transitional node to a strategic production workhorse.

Examining the Pervasive Effects of Recent United States Tariffs on 14nm Wafer Foundry Supply Chains and Cost Structures in 2025

In 2025, newly enacted United States tariffs have introduced significant complexity into the 14nm wafer foundry value chain. Supply agreements spanning capital equipment, specialty gases, and photoresist materials now factor in elevated duties, driving a sector-wide reassessment of cost structures. Foundries and their upstream partners are implementing localized sourcing strategies to curb duty exposure, while some are redesigning logistics flows to exploit preferential trade agreements in allied markets.

The immediate impact has been a notable increase in landed cost per wafer, which end customers have absorbed through revised pricing arrangements. This has, in turn, prompted a wave of renegotiations around long-term supply contracts, with stakeholders seeking buffer provisions against further tariff escalations. Additionally, cross-border capacity sharing and dual-sourcing relationships have gained prominence as risk-mitigation tactics.

Looking ahead, the cumulative effects of the 2025 tariff regime may accelerate investment in onshore production facilities and spur policy advocacy to secure duty relief for critical semiconductor inputs. While these developments entail upfront capital commitments, they promise greater supply chain resilience and enhanced control over production schedules in an era of persistent trade friction.

Decoding Critical Segmentation Patterns Across Applications, End Use Industries, Technological Variants, Customer Profiles, and Wafer Diameters

Critical segmentation insights reveal that application-specific demand patterns drive capacity allocation decisions across the 14nm wafer foundry segment. High-performance signal processing modules, including digital signal processors and field-programmable gate arrays, command specialized process configurations, while power management ICs and microcontrollers benefit from proven yield stability on mature platforms. Meanwhile, RFICs and system-on-chip designs emphasize integration density and analog-digital co-optimization, influencing the selection of process variants.

End use industry considerations further refine this segmentation matrix. Aerospace and defense clients prioritize rigorous qualification cycles, whereas automotive customers focus on long-term availability and functional safety compliance. Computing and consumer electronics customers demand rapid turnaround and evolving IP libraries, while IoT and mobile device manufacturers value low power budgets and compact die footprints. Networking infrastructure providers require throughput-optimized solutions with robust thermal profiles.

At the technology level, the coexistence of FinFET and planar transistor options allows for differentiated cost-performance trade-offs. FinFET architectures deliver superior switching characteristics and leakage control, while planar processes offer economies of scale for less performance-sensitive components. Customer type segmentation distinguishes fabless design houses leveraging foundry services from integrated device manufacturers that retain core fabs in house. Finally, wafer diameter selection-between 200mm and 300mm substrates-reflects volume requirements, equipment availability, and target cost per die considerations.

This comprehensive research report categorizes the 14nm Wafer Foundry market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology Type

- Application

- End User

Exploring Diverse Regional Growth Trajectories and Ecosystem Evolutions in the Americas, EMEA, and Asia Pacific 14nm Wafer Foundry Markets

Geographic dynamics in the 14nm wafer foundry market illustrate a tripartite division of innovation ecosystems, each shaped by distinct policy incentives and industrial strengths. In the Americas, leading players have leveraged robust venture capital inflows and government-supported research initiatives to expand capacity and co-invest in pilot lines. This region has become a hotbed for advanced packaging collaborations, with foundries partnering with assembly-and-test specialists to deliver chiplet-based solutions.

Europe, the Middle East, and Africa present a more diversified terrain, where regional champions align with national semiconductor strategies to bolster local supply chains. Governments across this region are incentivizing technology sovereignty through targeted grants and preferential procurement policies. As a result, specialized 14nm fabs in this territory are focusing on niche segments such as automotive microcontrollers and industrial control ICs, while also forming cross-border consortia to underwrite capital-intensive upgrades.

Asia Pacific remains the epicenter of volume production, led by established contract manufacturers and emerging domestic players. These foundries benefit from integrated ecosystems encompassing equipment suppliers, materials vendors, and an extensive base of fabless customers. State-supported capacity expansions and collaborative R&D programs continue to reinforce the region’s dominance, with a particular emphasis on scaling EUV-linked process modules for future node transitions.

This comprehensive research report examines key regions that drive the evolution of the 14nm Wafer Foundry market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Moves, Capacity Expansion Plans, and Competitive Differentiators Among Leading Global 14nm Wafer Foundry Players

Leading foundry operators have distinguished themselves through a combination of capacity scaling, process innovation, and strategic customer partnerships. Market leaders committed to 14nm offerings have invested in advanced multi-patterning techniques to maximize yield and extend the node’s commercial lifespan. These investments underpin their ability to serve high-volume compute and memory applications at competitive cost structures.

At the same time, select challengers have cultivated differentiated service models by offering comprehensive IP portfolios and design enablement support, reducing time-to-market for emerging applications. Some providers have formed exclusive alliances with equipment vendors to co-develop EUV integrations on 14nm lines, anticipating spillover benefits for next-generation nodes. Others have negotiated toll-manufacturing agreements to optimize tool utilization and diversify revenue streams.

Furthermore, the competitive landscape features targeted expansions into specialty process segments-such as high-voltage and radiation-hardened offerings-enabling niche applications to source localized capacity. These moves underscore the importance of blending core node reliability with domain-specific enhancements in order to capture the full spectrum of demand across consumer, industrial, and defense markets.

This comprehensive research report delivers an in-depth overview of the principal market players in the 14nm Wafer Foundry market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Analog Devices, Inc.

- Applied Materials, Inc.

- ASML Holding N.V

- Elkem ASA

- GlobalFoundries Inc.

- Hua Hong Semiconductor Limited

- Infineon Technologies AG

- Intel Corporation

- KLA Corporation

- Macronix International Co., Ltd.

- MagnaChip Semiconductor Corporation

- MediaTek Inc.

- Micron Technology Inc.

- NVIDIA Corporation

- Qualcomm Incorporated

- Renesas Electronics Corporation

- ROHM Co., Ltd.

- Samsung Electronics Co., Ltd.

- Semiconductor Manufacturing International Corporation

- Shanghai Huali Microelectronics Corporation

- Siltronic AG

- SK hynix Inc.

- Soitec S.A.

- STMicroelectronics NV

- SUMCO Corporation

- SUSS MicroTec AG

- Taiwan Semiconductor Manufacturing Company Limited

- Tata Group

- Texas Instruments Incorporated

- Tower Semiconductor Ltd.

- United Microelectronics Corporation

- Vanguard International Semiconductor Corporation

- X-FAB Silicon Foundries SE

Actionable Strategic Imperatives for Industry Leaders to Enhance Resilience, Optimize Operations, and Capture Emerging Opportunities in 14nm Wafer Fabrication

Industry leaders should prioritize the diversification of their sourcing footprint by exploring alternative manufacturing corridors that align with evolving trade regulations. By strategically co-investing in regional satellite fabs, companies can mitigate tariff exposure while maintaining end-to-end process consistency. Simultaneously, forging deeper partnerships with equipment and materials suppliers will enable more agile responses to supply chain disruptions.

To capture emerging application segments, organizations must enrich their service offerings with design-for-manufacturability toolkits and industry-specific IP modules. This approach accelerates integration cycles for critical end markets such as automotive and 5G infrastructure. Moreover, an emphasis on yield optimization programs-leveraging advanced analytics and machine learning-will drive cost reductions and enhance process maturity on the 14nm platform.

Finally, stakeholder groups should invest in workforce development initiatives to ensure access to specialized talent capable of addressing the nuances of multi-patterning and advanced process control. By coupling human capital strategies with scaled digital twins of production lines, foundries can bolster operational resilience and unlock incremental productivity gains.

Outlining a Comprehensive Research Framework Combining Primary Insights, Secondary Data Sources, and Rigorous Validation for the 14nm Wafer Foundry Study

This analysis harnesses a mixed-method research framework designed to blend quantitative data with qualitative insights. Primary research involved structured interviews and in-depth discussions with executive-level decision-makers across foundry operators, design houses, and materials suppliers, providing direct visibility into capacity planning, technology roadmaps, and tariff mitigation strategies. These insights were supplemented by a broad survey of engineering teams to understand process challenges and yield improvement practices.

Secondary research leveraged a curated selection of industry whitepapers, patent filings, and publicly disclosed financial reports to establish benchmark metrics and historical trends. Trade association publications and government policy statements were reviewed to capture regulatory developments and incentive program details. The triangulation of these data sources enabled the construction of a robust segmentation model that reflects real-world decision criteria.

Analytical techniques included scenario planning to evaluate the potential evolution of trade dynamics, as well as sensitivity analyses comparing cost variances under different tariff regimes. Validation workshops with subject-matter experts were conducted to test key assumptions and ensure the rigor of findings. This comprehensive methodology ensures that conclusions rest on a solid evidentiary foundation and pragmatic stakeholder perspectives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our 14nm Wafer Foundry market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- 14nm Wafer Foundry Market, by Product Type

- 14nm Wafer Foundry Market, by Technology Type

- 14nm Wafer Foundry Market, by Application

- 14nm Wafer Foundry Market, by End User

- 14nm Wafer Foundry Market, by Region

- 14nm Wafer Foundry Market, by Group

- 14nm Wafer Foundry Market, by Country

- United States 14nm Wafer Foundry Market

- China 14nm Wafer Foundry Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Synthesizing Insights on Technological Trends, Tariff Impacts, Segmentation Nuances, and Regional Dynamics Driving the 14nm Wafer Foundry Sector

The convergence of mature process economics, evolving tariff regimes, and dynamic end-market requirements establishes a compelling narrative for the continued relevance of the 14nm wafer foundry segment. Technological shifts, from incremental FinFET enhancements to emerging packaging paradigms, catalyze new service offerings and strategic alliances that sustain node viability. At the same time, the 2025 United States tariffs have highlighted the importance of supply chain diversification and local sourcing initiatives.

Segment-level analysis underscores how distinct application needs-from signal processing ICs to integrated system-on-chip devices-shape process priorities and capacity planning. Regional insights affirm the complementary roles of the Americas, EMEA, and Asia Pacific in driving volume, innovation, and resilience across the value chain. Leading companies continue to differentiate through targeted expansions, co-development partnerships, and specialized IP enablement programs.

As the semiconductor landscape remains in flux, organizations that proactively align their operational, technical, and commercial strategies will be best positioned to leverage the inherent strengths of the 14nm node. This report offers the foundational insights necessary to navigate uncertainty, optimize resource allocation, and capitalize on the enduring demand for balanced cost-performance solutions.

Seize the Opportunity to Access In-Depth Analysis and Customized Market Intelligence on 14nm Wafer Foundry from our Associate Director of Sales

Ready to elevate your strategic decisions with exclusive insights and comprehensive market intelligence on the 14nm wafer foundry sector? Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to secure full access to the in-depth report. This tailored analysis arms stakeholders with the actionable data needed to navigate evolving tariff landscapes, leverage segmentation opportunities, and benchmark against leading foundry operators. Reach out to arrange a personalized briefing that aligns with your specific objectives and sets the stage for sustained competitive advantage in 14nm wafer fabrication.

- How big is the 14nm Wafer Foundry Market?

- What is the 14nm Wafer Foundry Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?