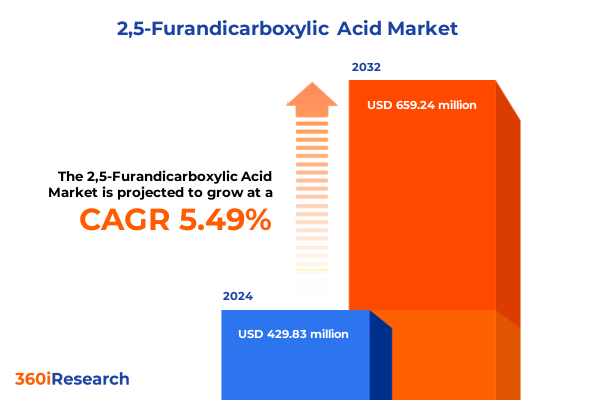

The 2,5-Furandicarboxylic Acid Market size was estimated at USD 451.88 million in 2025 and expected to reach USD 479.02 million in 2026, at a CAGR of 5.54% to reach USD 659.24 million by 2032.

Discover the Pivotal Role of Bio-Based 2,5-Furandicarboxylic Acid as a Cornerstone for Next-Generation Sustainable Materials Innovation

2,5-Furandicarboxylic Acid (FDCA) has emerged as a cornerstone in the quest for sustainable materials, offering a bio-based alternative to traditional petrochemical monomers. Derived from renewable resources such as fructose and other biomass feedstocks, FDCA represents a critical building block for the production of polyethylene furanoate (PEF), which rivals conventional polyethylene terephthalate (PET) in barrier performance and recyclability. As global supply chains increasingly prioritize carbon footprint reduction and circular economy principles, FDCA’s relevance continues to intensify.

The molecule’s furan ring structure endows it with superior barrier properties against oxygen and carbon dioxide, making it especially attractive for high-performance packaging applications. Beyond packaging, FDCA’s versatility extends to coatings, adhesives, sealants, pharmaceuticals, and polymer production, positioning it at the intersection of multiple growth vectors. In this context, the technology for producing FDCA has evolved rapidly, moving from emerging pilot plants to commercial-scale facilities. As stakeholders across the value chain align around sustainability targets, FDCA stands poised to reshape material science paradigms and decouple performance from petroleum dependence.

Unveiling the Major Shifts Transforming the 2,5-Furandicarboxylic Acid Landscape Amid Evolving Feedstocks and Policy Incentives

In recent years, the landscape surrounding FDCA production has been redefined by a confluence of technological breakthroughs and regulatory imperatives. On the technological front, advances in catalytic oxidation techniques have significantly improved conversion rates of hydroxymethylfurfural (HMF) to FDCA, lowering energy consumption and enhancing process yield. Concurrently, electrochemical processes have attracted investment as they promise solvent-free pathways with minimal byproducts, further strengthening FDCA’s green credentials.

Simultaneously, policy frameworks in key markets are shifting toward bio-based content mandates and carbon pricing mechanisms. Incentive schemes, such as tax credits for renewable monomer integration and grants for pilot-scale biorefineries, are accelerating project finance viability. These transformative shifts are creating a virtuous cycle: as more stakeholders commit to sustainable sourcing, economies of scale drive down production costs, which in turn encourages further adoption across the polymer and packaging industries. Ultimately, FDCA’s trajectory is being shaped by this dynamic interplay of technical innovation and supportive policy, underscoring its emergence as a foundational element in circular material ecosystems.

Analyzing the Far-Reaching Effects of 2025 United States Tariffs on 2,5-Furandicarboxylic Acid Supply Chains and Competitiveness

The introduction of new United States tariffs in 2025 has had a profound impact on the economics of FDCA and its precursors. With levies applied to imported hydroxymethylfurfural and certain intermediate chemicals, domestic producers have faced both challenge and opportunity. On one hand, higher input costs for import-reliant manufacturers have necessitated supply chain reengineering and closer partnerships with North American feedstock suppliers. On the other hand, tariff protection has enhanced the competitiveness of local FDCA production projects, incentivizing capital deployment in U.S. bioprocessing facilities.

This duality has led to strategic realignments across the value chain. Some polymer producers have accelerated qualification of locally sourced FDCA to mitigate volatility, while others have explored backward integration into biomass conversion and catalytic oxidation platforms. In parallel, end-users are recalibrating their procurement strategies, blending imports with domestic volumes to optimize total cost of ownership. As a result, the cumulative effect of these tariff measures extends beyond cost adjustments, catalyzing broader shifts in investment, capacity planning, and collaborative R&D efforts throughout the U.S. FDCA ecosystem.

Gaining Deep Insights from Segmentation Criteria to Understand Diverse Pathways and Markets for 2,5-Furandicarboxylic Acid Applications

Diving into the production methodologies, three primary pathways are shaping the FDCA market. Biomass conversion routes leverage sugar-rich feedstocks like fructose and inulin, harnessing enzymatic or chemical hydrolysis to generate HMF intermediates before oxidation. Catalytic oxidation processes, by contrast, employ metal oxide catalysts under controlled temperature and pressure to yield high-purity FDCA with fewer downstream purification steps. Meanwhile, electrochemical processes are attracting attention for their ambient-temperature requirements and potential water-based electrolytes, offering a lower environmental footprint compared to traditional chemical methods.

Purity thresholds represent another critical axis of differentiation. Grades below ninety-eight percent are often utilized for applications where minor impurities do not compromise performance, such as certain adhesives and sealants. Conversely, grades exceeding ninety-eight percent are essential for high-value applications in coatings, pharmaceuticals, and polymer production, where even trace contaminants can affect polymerization kinetics and end-product stability. Application domains themselves further stratify the market. Packaging producers prioritize barrier properties and recyclability, whereas pharmaceutical developers emphasize regulatory compliance and bio-compatibility. Polymer production entities assess both monomer consistency and scalability.

Finally, sales channels shape market outreach and customer engagement. Offline retail continues to serve specialized industrial purchasers requiring hands-on technical support and bulk shipments, while online platforms provide streamlined ordering, digital data sheets, and logistical transparency for fast-moving accounts. Together, these segmentation lenses reveal a nuanced market matrix in which process innovation, purity optimization, application demands, and channel dynamics coalesce to define competitive positioning.

This comprehensive research report categorizes the 2,5-Furandicarboxylic Acid market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Production Process

- Purity

- Application

- Sales Channel

Exploring Regional Dynamics Shaping the Evolution of the 2,5-Furandicarboxylic Acid Market Across the Americas, EMEA, and Asia-Pacific

Across the Americas, the FDCA market is anchored by strong policy support for bio-based materials and significant R&D concentrations in the United States and Brazil. Stakeholders benefit from well-established sugarcane and corn biomass infrastructures, which provide reliable feedstock pipelines. In Canada, federal incentives for green chemistry have spurred pilot projects aimed at converting forestry residues into HMF, broadening the feedstock base beyond conventional starches.

In Europe, Middle East, and Africa, regulatory frameworks such as the European Green Deal and REACH compliance foster a rigorous environment for adoption of sustainable monomers. The European Union’s Circular Economy Action Plan places FDCA in a strategic position, as polymer manufacturers seek to reduce reliance on fossil resources. Meanwhile, emerging economies within EMEA are exploring joint ventures and technology licensing to access FDCA production know-how, leveraging lower labor costs and proximity to key end-market clusters.

In Asia-Pacific, rapid industrialization and escalating environmental regulations in China, India, and Japan are driving demand for advanced bio-based polymers. China’s five-year plan for carbon peaking has led to direct subsidies for biorefinery infrastructure, while Japan’s sustainability roadmap incentivizes corporate commitments to closed-loop materials. India’s biochemical innovation centers are also piloting decentralized production models near agricultural hubs, highlighting the region’s potential to become a leading exporter of both FDCA and its derivative polymers.

This comprehensive research report examines key regions that drive the evolution of the 2,5-Furandicarboxylic Acid market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators Driving Competitive Advantages in the 2,5-Furandicarboxylic Acid Industry Through Pioneering Technologies

The competitive landscape of FDCA is anchored by a handful of visionary companies that have pioneered production platforms and secured strategic partnerships. Avantium remains a frontrunner with its catalytic technology and established PEF demonstration plants, enabling it to supply both pilot volumes and commercial samples. DuPont has leveraged its polymer expertise to co-develop FDCA-based resins for high-performance packaging, integrating these materials into existing value streams and tapping into its global distribution network.

Corbion distinguishes itself through joint ventures targeting large-scale biomass conversion, combining its fermentation know-how with partner access to agricultural feedstocks. Origin Materials has advanced electrochemical oxidation research, securing patents and forming alliances with specialty chemical firms to accelerate scale-up. In parallel, emerging players like Futerro are capturing niche applications by tailoring FDCA purity grades for pharmaceutical intermediates, while regional consortia in Asia-Pacific explore localized production clusters aimed at reducing logistics costs.

Collectively, these companies underscore a pattern of technology licensing, joint ventures, and offtake agreements. While first-mover advantages remain significant, newcomers are leveraging modular plant designs and digital process controls to challenge incumbents. As a result, competitive differentiation is increasingly driven by intellectual property portfolios, feedstock integration strategies, and agility in responding to end-user specifications.

This comprehensive research report delivers an in-depth overview of the principal market players in the 2,5-Furandicarboxylic Acid market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AstaTech Inc.

- AVA Biochem AG

- Avantium N.V.

- BASF SE

- Biosynth Ltd

- Carbone Scientific CO.,LTD

- Chemsky (shanghai) International Co., Ltd.

- Corbion NV

- Eastman Chemical Company

- Merck KGaA

- MOLBASE

- Novamont S.p.A. by Versalis

- Sarchem Laboratories Inc.

- Spectrum Laboratory Products, Inc.

- Thermo Fisher Scientific Inc.

- Tokyo Chemical Industry Co., Ltd

- VIVAN Life Sciences Pvt. Limited

Crafting Strategic Roadmaps with Actionable Recommendations to Propel Growth and Resilience in the 2,5-Furandicarboxylic Acid Sector

Industry leaders seeking to harness the full potential of FDCA should prioritize targeted investments in advanced oxidation catalysts that can deliver high conversion efficiencies under mild conditions. By aligning R&D roadmaps with emerging electrochemical process developments, organizations can reduce both capital expense and environmental impact. In parallel, refining purification systems to achieve consistently high purity grades above ninety-eight percent will unlock access to premium applications in pharmaceuticals and specialty coatings.

Strategic collaborations between biorefiners, catalyst manufacturers, and polymer producers can mitigate risk and accelerate commercial rollout. Establishing joint ventures or offtake agreements with feedstock suppliers ensures reliability of biomass inputs, while co-investments in modular plant configurations enable rapid capacity adjustments. To navigate the implications of 2025 tariff regimes, leaders should adopt a dual-sourcing approach that blends domestic and imported intermediates, thereby optimizing cost structures and ensuring supply continuity.

Finally, channel strategies must evolve in tandem with customer needs. Enhancing digital ordering platforms for online retail enables real-time data sharing and streamlined logistics, while bolstering technical support capabilities in offline channels reinforces customer confidence for large-scale orders. By integrating these actionable recommendations into a cohesive strategy, industry leaders can fortify their market position and drive sustainable growth in the FDCA ecosystem.

Uncovering Rigorous Research Methodologies Underpinning Comprehensive Analysis of the 2,5-Furandicarboxylic Acid Market Landscape

The foundation of this analysis is a robust research framework combining primary and secondary intelligence. Primary research involved in-depth interviews with executives, process engineers, and R&D leaders across biorefinery operators, catalyst developers, polymer manufacturers, and end-users. These conversations yielded nuanced perspectives on technology readiness levels, purification challenges, and tariff impacts. Complementing this, secondary research encompassed a systematic review of peer-reviewed journals, patent filings, regulatory and policy publications, and industry white papers.

To ensure comprehensive coverage, data triangulation techniques were employed, correlating trade flow statistics, energy consumption metrics, and price trend analyses. Segmentation matrices based on production process, purity criteria, application domains, and sales channel dynamics were constructed to map competitive intensity and identify white-space opportunities. Regional insights were derived from policy documents, incentive program announcements, and case studies highlighting pilot-scale deployments in key geographies. Through continuous validation with market participants, the methodology ensured high confidence in the findings and strategic recommendations presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our 2,5-Furandicarboxylic Acid market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- 2,5-Furandicarboxylic Acid Market, by Production Process

- 2,5-Furandicarboxylic Acid Market, by Purity

- 2,5-Furandicarboxylic Acid Market, by Application

- 2,5-Furandicarboxylic Acid Market, by Sales Channel

- 2,5-Furandicarboxylic Acid Market, by Region

- 2,5-Furandicarboxylic Acid Market, by Group

- 2,5-Furandicarboxylic Acid Market, by Country

- United States 2,5-Furandicarboxylic Acid Market

- China 2,5-Furandicarboxylic Acid Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Concluding Perspectives Highlighting the Strategic Importance and Future Potential of 2,5-Furandicarboxylic Acid in Sustainable Material Science

The journey of FDCA from laboratory curiosity to commercial reality exemplifies the evolution of sustainable material science. As catalytic oxidation technologies matured and policy environments aligned with circular economy principles, FDCA secured its place as a bio-based alternative capable of displacing petrochemical monomers. The interplay of supply chain shifts, regional policy incentives, and competitive innovation has crystallized into a dynamic ecosystem where agility and collaboration are paramount.

Looking forward, the strategic importance of FDCA will only intensify as brand owners and regulators demand higher bio-based content and stricter lifecycle assessments. Market participants who embrace advanced production techniques, forge strategic partnerships, and tailor purity grades to specific applications will capture disproportionate value. Moreover, navigating tariff landscapes with diversified sourcing strategies and localized production investments will further strengthen resilience.

In conclusion, FDCA represents a transformative milestone in the pursuit of high-performance, sustainable polymers. By integrating the insights and recommendations detailed in this report, stakeholders can catalyze new value chains that deliver both environmental and commercial benefits, solidifying FDCA’s role as a keystone monomer in next-generation material systems.

Seize the Opportunity to Secure Comprehensive Insights on the 2,5-Furandicarboxylic Acid Market with Expert Guidance from Ketan Rohom

Elevate your strategic decision-making by securing the definitive market research report on 2,5-Furandicarboxylic Acid, guided by the expert insight of Ketan Rohom, Associate Director of Sales & Marketing. This comprehensive analysis offers in-depth perspectives on evolving production processes, purity benchmarks, application opportunities, sales channels, and regional dynamics. Armed with this knowledge, you can navigate the complexities of 2025 United States tariffs, capitalize on transformative shifts in green polymer landscapes, and benchmark against leading industry innovators.

Don’t miss the chance to gain a competitive edge in the rapidly advancing FDCA market. Reach out directly to Ketan Rohom to discuss tailored research packages, exclusive data sets, and strategic consulting options designed to accelerate your growth trajectory. Your pathway to sustainable innovation begins here-contact Ketan Rohom today to secure your copy of the most authoritative study on 2,5-Furandicarboxylic Acid.

- How big is the 2,5-Furandicarboxylic Acid Market?

- What is the 2,5-Furandicarboxylic Acid Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?