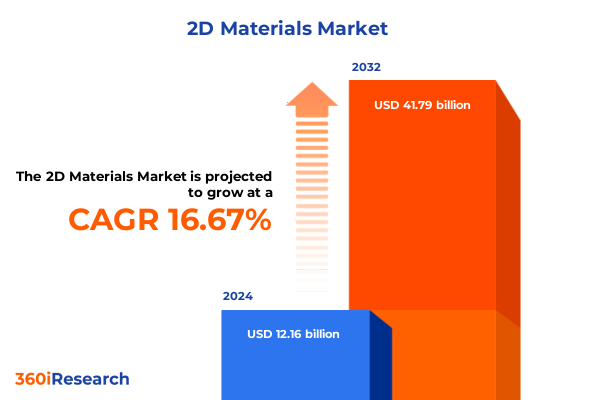

The 2D Materials Market size was estimated at USD 14.18 billion in 2025 and expected to reach USD 16.53 billion in 2026, at a CAGR of 16.69% to reach USD 41.79 billion by 2032.

Setting the Stage for Next-Generation Innovation in Two-Dimensional Materials Revolutionizing Multiple Industries and Applications

Two-dimensional materials have captured global attention as enablers of groundbreaking performance in electronics, energy storage, and advanced coatings. Beyond the singular promise of atomically thin layers, the collective portfolio from graphene to black phosphorus and a suite of transition metal dichalcogenides is redefining material science across industries. Continuous improvements in synthesis and characterization are closing the gap between laboratory breakthroughs and industrial applications, cultivating new value chains and heightening strategic importance for stakeholders worldwide.

As intensive R&D efforts parallel emerging commercialization pathways, decision-makers are compelled to grasp the technological levers shaping the field. The interplay of unique electrical, mechanical, and thermal properties across distinct material families underscores the necessity of a structured overview. By tracing the evolution from foundational discoveries to current pilot deployments, this synopsis lays the groundwork for informed dialogue on investment, collaboration, and next-generation product development.

Navigating Paradigm Shifts in the Two-Dimensional Materials Landscape Driven by Technological Breakthroughs and Evolving Supply Chain Dynamics

The two-dimensional materials ecosystem is in the throes of transformative shifts as advanced fabrication methods converge with expanding application horizons. Chemical vapor deposition and liquid phase exfoliation have matured substantially, enabling higher throughput of uniform graphene films and discrete nanoplatelets alike. Concurrently, a surge in flexible electronics demonstrations and prototype photodetectors signals a pivotal moment where academic curiosity transitions into commercial feasibility.

Supply chain dynamics are also undergoing material reconfiguration. Strategic partnerships between device manufacturers and raw material suppliers are reshaping traditional sourcing models, while geopolitical considerations are prompting diversification away from single-country dependencies. Intellectual property landscapes have become increasingly congested, prompting alliances that expedite time-to-market through shared platforms for scalable processing. These shifts underscore a clear trajectory: the industry is crystallizing around robust production pipelines and application-specific integration strategies that will govern competitive positioning in the years ahead.

Assessing the 2025 United States Tariff Policies Reshaping Supply Strategies and Cost Dynamics for Two-Dimensional Materials

The introduction of incremental tariff measures in 2025 targeting imports of critical two-dimensional materials has added a complex layer to the supply equation. Stakeholders across the value chain have recalibrated procurement strategies, seeking domestic sourcing alternatives or localized manufacturing arrangements to mitigate cost volatility. Research institutions and early-stage manufacturers have accelerated pilot lines in North America to avoid margin erosion, while larger enterprises leverage vertical integration to cushion pricing impacts.

In response, suppliers have reevaluated global allocation plans, prioritizing high-value applications in energy storage and semiconductors where margin resilience is strongest. The ripple effects extend through downstream sectors, influencing lead times and prompting renewed interest in license-based transfers of proprietary growth techniques. This tariff-driven realignment is reshaping competitive dynamics, placing a premium on supply agility and reinforcing the strategic imperative of diversified partner networks.

Deriving Actionable Insights from Deep Segmentation of Material Classes, Applications, and Industry-Specific Use Cases

Granular segmentation reveals distinct trajectories across material classes, with black phosphorus carving niche roles in optoelectronics due to its thickness-dependent band gap and high charge mobility, while graphene maintains dominance in transparent conductive films and protective coatings. Within transition metal dichalcogenides, molybdenum disulfide excels in transistor architectures through its sizable direct band gap, and tungsten disulfide finds growing use as a solid lubricant additive. In composites, hexagonal boron nitride yields thermal management benefits that complement its chemical inertness for protective layers.

Application segmentation further frames market maturation: protective coatings and structural composites capitalize on two-dimensional dispersions for enhanced mechanical strength, while flexible electronics, photodetectors, and transparent conductive films exploit material tunability at the atomic scale. Energy storage divisions balance battery electrode modifications with emerging supercapacitor platforms that leverage high surface area, and sensor development harnesses the selective surface chemistries of biosensors and gas sensors for unprecedented sensitivity. End-user industries-including aerospace and defense, automotive, and semiconductor manufacturing-are aligning their roadmaps to these differentiated material-application intersections.

This comprehensive research report categorizes the 2D Materials market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Manufacturing Technology

- Form

- Application

- End User Industry

Unlocking Regional Variations in Innovation Capacity and Commercialization Pathways for Two-Dimensional Materials Across Key Global Markets

Regional dynamics shape adoption pathways in distinct ways. In the Americas, robust venture capital activity and dense innovation clusters accelerate pilot programs for two-dimensional materials in flexible electronics and advanced sensing solutions. Collaborations between national labs and industry players underscore an ecosystem that prizes early commercialization and strategic independence in supply. In contrast, Europe, the Middle East, and Africa concentrate efforts on joint research consortiums, leveraging cross-border grants to advance sustainable production techniques and circular economy approaches, particularly within thermal management and protective coatings sectors.

The Asia-Pacific region continues to command scale advantages through expansive manufacturing capacities, underpinned by government incentives in China, South Korea, and Japan. Here, lithium-ion battery enhancements and high-volume transparent conductive films for display technologies are prioritized, with localized supply chains optimizing cost-performance ratios. As each region charts its own strategic course, global players must tailor entry and scaling strategies to regional policy frameworks, industrial ecosystems, and funding landscapes for maximum impact.

This comprehensive research report examines key regions that drive the evolution of the 2D Materials market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating the Strategic Maneuvers of Key Players Blending Advanced Fabrication with Application-Driven Collaborations

Competitive intensity in the two-dimensional materials arena centers on firms that integrate material science expertise with scalable production capabilities. Established players are reinforcing core competencies in chemical vapor deposition and epitaxial growth, pursuing incremental yield improvements and defect reduction to drive down per-unit costs. Simultaneously, agile startups are advancing liquid phase exfoliation techniques with novel solvent systems and continuous-flow processes to enable low-temperature, high-purity dispersions suited to coatings and composite matrices.

Strategic alliances between material suppliers and end-user OEMs are proliferating as a pathway to co-development of application-specific formulations. Licensing models for patented synthesis approaches complement in-house capacity expansions, enabling rapid geographic footprint growth. Core differentiators now encompass process modularity, quality assurance metrics, and the ability to deliver application-ready material forms-dispersions, films, flakes, or powders-tailored to customers across aerospace, automotive, and semiconductor segments.

This comprehensive research report delivers an in-depth overview of the principal market players in the 2D Materials market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 2D Carbon Graphene Material Co., Ltd.

- 2D LLC

- 2D Materials Pte Ltd.

- ACS Material, LLC

- American Elements

- Applied Nanolayers

- AVANZARE INNOVACION TECNOLOGICA S.L.

- BASF SE

- BeDimensional

- Beijing Beike 2D Materials Co., Ltd.

- HORIBA EU Group companies

- HORIBA, Ltd.

- HQ Graphene

- HYGRANER SRL

- Kriya Materials B.V.

- Layer One – Advanced Materials

- NanoXplore Inc.

- Nitronix Nanotechnology Corporation

- Ossila Ltd

- PlanarTECH LLC

- SixCarbon Technology (Shenzhen)

- Smart-elements GmbH

- The Henry Royce Institute

- Thomas Swan & Co. Ltd.

- Ultrananotech Private Limited

- Versarien PLC

Implementing Dynamic Sourcing and Co-Innovation Strategies to Secure Leadership in Two-Dimensional Materials Applications

Industry leaders must prioritize flexibility in sourcing by establishing dual-track supplier networks that combine domestic production pilots with vetted international partners. Investing in modular manufacturing platforms that accommodate chemical vapor deposition, liquid phase exfoliation, and mechanical exfoliation techniques will enable rapid reallocation of capacity in response to tariff shifts or supply bottlenecks. At the same time, embedding co-innovation frameworks with end-user customers will unlock demand signals early, ensuring that material properties align precisely with performance requirements in flexible electronics, energy storage, and sensing.

Furthermore, executives should cultivate open innovation channels with academic institutions to access breakthroughs in two-dimensional heterostructures and composite integration. Building cross-functional teams that integrate market intelligence, supply chain analytics, and R&D roadmapping will facilitate a holistic response to evolving application landscapes. By aligning capital investments with prioritized use cases-such as photodetectors for advanced imaging or supercapacitors for high-power density energy solutions-organizations can position themselves at the forefront of commercialization curves.

Leveraging a Rigorous Multi-Source Research Framework That Integrates Expert Interviews, Facility Assessments, and Peer-Reviewed Data

This analysis draws on a robust research methodology combining extensive primary interviews with industry executives, material scientists, and process engineers. Secondary data sources include peer-reviewed journals, patent databases, and corporate white papers, which were meticulously cross-referenced to ensure factual integrity. Production technology assessments incorporated site visits to fabrication facilities, while application-specific insights emerged from structured consultations with end-user product development teams.

Quantitative performance metrics for each fabrication approach were validated through third-party test reports and laboratory benchmarks. Regional ecosystem evaluations leveraged institutional publications and policy documents, ensuring a comprehensive view of funding mechanisms, regulatory frameworks, and public-private partnership models. This triangulated approach underpins the credibility of conclusions and recommendations, providing stakeholders with a transparent basis for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our 2D Materials market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- 2D Materials Market, by Material Type

- 2D Materials Market, by Manufacturing Technology

- 2D Materials Market, by Form

- 2D Materials Market, by Application

- 2D Materials Market, by End User Industry

- 2D Materials Market, by Region

- 2D Materials Market, by Group

- 2D Materials Market, by Country

- United States 2D Materials Market

- China 2D Materials Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2862 ]

Concluding Insights on the Intersection of Fabrication Innovation, Strategic Sourcing, and Collaborative Ecosystems Driving the Future of Two-Dimensional Materials

The convergence of advanced fabrication technologies, evolving supply strategies, and targeted application development underscores a pivotal moment for two-dimensional materials. As tariff regimes recalibrate global flows and regional priorities shape distinct commercialization blueprints, stakeholders must navigate a landscape characterized by both rapid innovation cycles and structural shifts. Those who master the nexus of material properties, scalable processes, and market-centric collaborations will define the competitive frontier in electronics, energy storage, and protective solutions.

Looking ahead, sustained investment in heterostructure engineering and in-line quality control will unlock the next wave of performance breakthroughs. Cross-industry alliances will be essential for driving down integration barriers and accelerating time-to-market. By aligning strategic initiatives with actionable insights from segmentation and regional analysis, industry participants can secure differentiated positions and contribute to the broader maturation of two-dimensional materials.

Take decisive action today by connecting with Ketan Rohom to unlock unparalleled two-dimensional materials market intelligence

Elevate your strategic initiatives today by partnering with Associate Director of Sales & Marketing, Ketan Rohom, to secure the comprehensive market research report and gain a decisive edge in two-dimensional materials. This exclusive dossier delivers in-depth analysis, rich insights, and practical recommendations curated to accelerate innovation, optimize sourcing strategies, and guide investment decisions across material types and applications. Engage directly with Ketan to tailor report deployment to your organization’s objectives, unlock proprietary data on segmentation nuances, regional dynamics, and competitive landscapes, and ensure your teams have the actionable intelligence necessary to thrive. Reach out promptly to integrate this essential resource into your planning cycle and lead the next phase of growth in the 2D materials ecosystem

- How big is the 2D Materials Market?

- What is the 2D Materials Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?