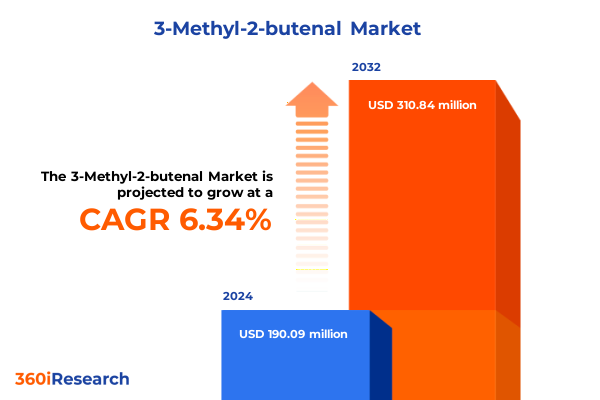

The 3-Methyl-2-butenal Market size was estimated at USD 199.54 million in 2025 and expected to reach USD 213.30 million in 2026, at a CAGR of 6.53% to reach USD 310.84 million by 2032.

Introducing 3-Methyl-2-Butenal as a Multi-Dimensional Aldehyde with Essential Reactive Properties and Diverse Industry Applications

3-Methyl-2-Butenal, an α,β-unsaturated aldehyde characterized by its conjugated double bond and aldehydic moiety, plays a pivotal role across multiple industry verticals. The compound’s molecular framework-featuring a four-carbon backbone with a methyl substituent-imparts a sharp, citrus-like aroma that delivers vibrancy in flavor and fragrance formulations. Its reactive aldehyde group enables further chemical modifications, positioning it as a key intermediate in synthetic pathways for more complex molecules.

Historically, 3-Methyl-2-Butenal has garnered attention for its utility in agrochemical production, where it serves as a building block for selective herbicide intermediates. Concurrently, its sensory profile underpins its widespread adoption in food flavoring agents, perfumes, and personal care products, where regulatory compliance demands consistent purity and stability. Within pharmaceutical applications, the compound’s versatility extends to active pharmaceutical ingredient manufacturing and drug formulation processes, underlining its cross-sectoral significance.

In recent years, innovation in catalytic methodologies and process intensification has enhanced the efficiency of 3-Methyl-2-Butenal synthesis. Advances in continuous flow processing and selective hydrogenation techniques have reduced byproducts and improved yield, underscoring the industry’s commitment to operational excellence. As global supply chains evolve and sustainability takes precedence, understanding the fundamental properties and application spectrum of 3-Methyl-2-Butenal becomes crucial for stakeholders aiming to capitalize on emerging opportunities.

Exploring the Convergence of Green Biotechnological Innovations and Consumer-Driven Regulatory Standards Reshaping 3-Methyl-2-Butenal Production

The landscape for 3-Methyl-2-Butenal has transformed markedly as sustainability initiatives have converged with technological breakthroughs. Biotechnological production platforms now leverage engineered microbial strains to convert renewable feedstocks into the target aldehyde, reducing carbon footprints and aligning with circular economy principles. This shift from petrochemical-derived routes to green bioprocessing underscores a broader commitment to environmental stewardship.

Alongside production innovations, evolving consumer preferences have fueled demand for naturally derived and clean label ingredients in food and personal care applications. Manufacturers are increasingly sourcing 3-Methyl-2-Butenal produced via fermentation to meet rigorous organic and natural certification standards. Meanwhile, digitalization of supply chain networks has enhanced traceability, enabling end-users to verify raw material provenance and quality parameters in real time.

Regulatory developments have also played a pivotal role, with tightened specifications for residual solvents and impurity profiles driving process refinement. Collaborative efforts between industry consortia and standards bodies have yielded updated guidelines that ensure safety without stifling innovation. Collectively, these transformative shifts are redefining how 3-Methyl-2-Butenal is produced, distributed, and integrated into value chains worldwide.

Evaluating the Strategic Realignments Triggered by 2025 United States Tariff Revisions on Specialty Aldehyde Import Dynamics

In 2025, the United States implemented targeted tariff adjustments on specialty chemical imports that have materially affected the 3-Methyl-2-Butenal trade ecosystem. Under revised Harmonized Tariff Schedule classifications, certain aldehydic intermediates sourced from key exporting regions incur higher duties, prompting downstream purchasers to reassess sourcing strategies and negotiate updated supply agreements.

These tariff elevations have increased landed costs for importers who historically relied on low-cost producers abroad. As a result, domestic manufacturers of 3-Methyl-2-Butenal and its precursors have experienced a competitive advantage, leading to a reconfiguration of global supply chains. Companies have responded by diversifying procurement from Europe, Middle East, and Asia-Pacific suppliers whose production costs align more favorably under the new duty structure.

Simultaneously, end-users have intensified efforts to secure multi-year contracts and invest in inventory buffering to mitigate volatility associated with import duties. The shifting tariff landscape underscores the importance of proactive trade compliance management and highlights opportunities for localized production footprint expansion. Ultimately, these 2025 tariff measures have accelerated strategic realignments across the specialty aldehyde sector, reshaping competitive dynamics and influencing long-term sourcing decisions.

Unlocking Multi-Vector Segmentation Insights that Illuminate 3-Methyl-2-Butenal Demand Patterns Across Application Pillars, Purity Levels, Channels, and Production Routes

Segmentation analysis of the 3-Methyl-2-Butenal ecosystem reveals distinctive demand drivers across multiple vectors. Considering application, the agrochemical domain leverages the compound for targeted herbicide and pesticide intermediate synthesis, whereas the fragrance and flavor segment integrates it into food flavoring systems, fine perfumes, and personal care formulations. In pharmaceutical settings, its reactivity facilitates both active pharmaceutical ingredient manufacturing and refined drug formulation pathways. Each downstream vertical imposes unique specifications, from thermal stability in agrochemicals to sensory consistency in perfumery.

Purity grade segmentation further delineates market dynamics. Analytical grade variants, characterized by stringent impurity thresholds, cater to laboratory research and high-precision formulation needs. Food grade derivatives adhere to rigorous safety standards for human consumption, underlining the importance of contaminant controls. Industrial grade material, while cost-effective, finds use in applications where trace impurities exert minimal impact on end-product performance.

Distribution channel considerations differentiate direct sales engagements, which service large end-users with customized technical support and volume commitments, from distributor networks that provide flexibility and regional reach, especially for small and medium-sized enterprises. Meanwhile, the production method axis distinguishes between biotechnological processes-emphasizing renewable feedstocks and reduced environmental impact-and conventional synthetic chemical routes, which benefit from established infrastructure and scale economies. This multifaceted segmentation framework guides strategic positioning and investment planning within the 3-Methyl-2-Butenal landscape.

This comprehensive research report categorizes the 3-Methyl-2-butenal market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Purity Grade

- Production Method

- Application

- Distribution Channel

Analyzing Regional Dynamics and Production-Consumption Profiles Driving 3-Methyl-2-Butenal Trends Across Americas, EMEA, and Asia-Pacific

Regional analysis underscores divergent strengths and challenges across geographies. In the Americas, robust agrochemical R&D centers and a mature fragrance industry support substantial demand for 3-Methyl-2-Butenal, with the United States leading in both consumption and process innovation. Tariff policies and regulatory frameworks continue to incentivize local production, nurturing domestic capacity expansion.

Europe, Middle East, and Africa feature a dense concentration of specialty chemicals manufacturers and stringent chemical safety regulations. The European Union’s REACH framework mandates comprehensive safety dossiers, which drive suppliers to refine impurity profiles and innovate greener synthesis routes. Meanwhile, emerging markets in the Middle East are investing in petrochemical integration to diversify product portfolios, and North African countries are leveraging favorable feedstock access for export-oriented production.

Asia-Pacific remains the largest manufacturing hub, where cost-effective feedstocks and burgeoning industrial infrastructure support high-volume output. China and India, in particular, are scaling capacity for both synthetic and biotechnological production methods, while Japan and South Korea focus on high-purity grades to serve advanced pharmaceutical and personal care sectors. This regional mosaic informs supply chain decisions and spotlights areas for targeted investment and collaboration across the 3-Methyl-2-Butenal value chain.

This comprehensive research report examines key regions that drive the evolution of the 3-Methyl-2-butenal market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders and Specialized Innovators Forging Strategic Partnerships and Technical Excellence in 3-Methyl-2-Butenal Production

The competitive arena for 3-Methyl-2-Butenal features established chemical conglomerates and specialized mid-tier producers. Large global players have invested in integrated production platforms, combining synthetic and biotechnological expertise to offer a spectrum of purity grades and customized intermediates. Their strategic alliances with academic institutions and technology providers have accelerated process optimization and novel catalytic solutions.

At the same time, agile specialty chemical firms differentiate through niche capabilities, such as precision odor profiling and small-batch manufacturing for high-end fragrance applications. Partnerships between these firms and research organizations enable rapid route-to-market for bespoke molecule development. Moreover, certain market participants are securing exclusive distribution agreements with regional distributors to enhance market penetration in underserved territories.

Collaborative ventures between agricultural chemical innovators and flavor and fragrance houses are further expanding the scope of 3-Methyl-2-Butenal usage. By co-developing new derivatives tailored to specific crop protection or sensory requirements, these alliances underscore the role of cross-sector synergies in driving next-generation product pipelines. Collectively, these strategic maneuvers shape a dynamic competitive landscape where differentiation hinges on technical prowess and partnership networks.

This comprehensive research report delivers an in-depth overview of the principal market players in the 3-Methyl-2-butenal market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BASF SE

- Bedoukian Research, Inc.

- Evonik Industries AG

- Firmenich International SA

- Givaudan SA

- International Flavors & Fragrances Inc.

- Jining Xinhe Chemical Co., Ltd.

- Kuraray Co., Ltd.

- Mane SA

- Sensient Technologies Corporation

- Solvay SA

- Symrise AG

- Takasago International Corporation

- Wanhua Chemical Group

- Zhejiang NHU Co., Ltd

Leveraging Sustainable Biotechnological Innovation and Supply Chain Diversification to Fortify Competitive Positioning in 3-Methyl-2-Butenal

Industry leaders should prioritize investment in sustainable biotechnological platforms to align with stringent environmental regulations and meet growing demand for naturally derived compounds. Building collaborative research initiatives with microbial engineering specialists can accelerate strain optimization and feedstock utilization, reducing production carbon intensity and enhancing cost competitiveness.

Supplier diversification remains critical to safeguarding against trade policy fluctuations and raw material shortages. Establishing multi-regional procurement arrangements and evaluating near-shoring options can mitigate exposure to tariff volatility and logistical disruptions, thereby stabilizing supply reliability. Additionally, companies should explore backward integration opportunities to secure critical intermediates and streamline value chains.

To differentiate premium offerings, stakeholders can develop advanced analytics capabilities for real-time monitoring of purity and impurity profiles, leveraging process analytical technology tools. These enhancements support compliance with evolving regulatory standards and provide demonstrable quality assurance to end-users. Furthermore, embracing digital platforms for end-to-end traceability fosters transparency and reinforces brand reputation among sustainability-focused customers.

Finally, continuous engagement with regulatory bodies and participation in industry consortia will ensure early awareness of policy shifts. By influencing guideline development and advocating for balanced safety standards, companies can maintain operational agility while shaping favorable market conditions for 3-Methyl-2-Butenal applications.

Detailing a Multi-Layered Research Framework Integrating Secondary Literature, Expert Interviews, and Rigorous Validation Protocols

Our research methodology combined exhaustive secondary data analysis with targeted primary interviews to deliver a robust perspective on the global 3-Methyl-2-Butenal landscape. Secondary sources included peer-reviewed journals, industry white papers, patent filings, and regulatory databases to map chemical properties, synthesis routes, and safety requirements.

Complementing this, we conducted in-depth discussions with technical experts, procurement managers, and end-user formulators to capture real-world insights on application performance, quality challenges, and emerging demand patterns. These qualitative inputs were cross-referenced against quantitative process data to validate production cost structures and purity variance metrics.

To ensure accuracy and mitigate bias, a multi-layered validation protocol was employed. Progressive hypothesis testing through expert advisory panels confirmed trend relevance, while triangulation of disparate data sets substantiated key findings. All information underwent rigorous editorial review and compliance checks to align with global data integrity standards.

This structured approach guarantees that our analysis of 3-Methyl-2-Butenal is both comprehensive and actionable, offering stakeholders a reliable foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our 3-Methyl-2-butenal market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- 3-Methyl-2-butenal Market, by Purity Grade

- 3-Methyl-2-butenal Market, by Production Method

- 3-Methyl-2-butenal Market, by Application

- 3-Methyl-2-butenal Market, by Distribution Channel

- 3-Methyl-2-butenal Market, by Region

- 3-Methyl-2-butenal Market, by Group

- 3-Methyl-2-butenal Market, by Country

- United States 3-Methyl-2-butenal Market

- China 3-Methyl-2-butenal Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Concluding Perspectives Emphasizing Strategic Imperatives Driven by Sustainability, Regulatory Evolution, and Competitive Differentiation in 3-Methyl-2-Butenal

3-Methyl-2-Butenal stands at the intersection of innovation and tradition within the specialty chemicals arena. Sustainable production advances and shifting regulatory landscapes have driven a reorientation toward greener synthesis pathways, while consumer preferences amplify the value of naturally derived ingredients. At the same time, 2025 tariff shifts have underscored resilience through strategic sourcing and supply chain agility.

Segmentation analysis revealed that application-specific requirements-from selective herbicide intermediates to high-purity pharmaceutical grade materials-necessitate differentiated production and distribution models. Regional dynamics further highlight the interplay between cost-efficient manufacturing hubs in Asia-Pacific, stringent regulatory frameworks in EMEA, and innovation leadership in the Americas.

Competitive intensity is shaped by the dual presence of integrated chemical majors and nimble specialty producers, each leveraging partnerships and technological expertise to capture niche growth pockets. The synthesis of these elements outlines a trajectory characterized by heightened collaboration, sustainability orientation, and adaptive trade strategies.

Moving forward, stakeholders equipped with deep insights into production modalities, regulatory developments, and value chain segmentation will be best positioned to harness the evolving opportunities within the 3-Methyl-2-Butenal ecosystem.

Engage with Ketan Rohom to Secure Your 3-Methyl-2-Butenal Market Research Report and Unlock Strategically Tailored Chemical Industry Insights

To explore and acquire a comprehensive report on the global 3-Methyl-2-Butenal market, contact Ketan Rohom, Associate Director of Sales & Marketing. His expertise in aligning in-depth chemical industry insights with strategic business objectives ensures that clients receive tailored recommendations and actionable data to support decision-making. Engaging with Ketan enables prospective buyers to clarify specific research requirements, such as focus on purity grade analyses, supply chain risk assessments, or custom regional deep-dives, and to determine the most suitable package for their unique needs.

As a seasoned specialist in sales and marketing for chemical market intelligence, Ketan can provide detailed guidance on report structure, highlight the most critical sections relevant to stakeholder interests, and deliver flexible licensing options. Reach out directly to secure your copy of the 3-Methyl-2-Butenal market research report and gain the competitive edge necessary to drive innovation, optimize sourcing, and navigate evolving regulatory and trade environments with confidence. Let this strategic partnership accelerate your organization’s growth trajectory in the specialty aldehyde arena.

- How big is the 3-Methyl-2-butenal Market?

- What is the 3-Methyl-2-butenal Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?