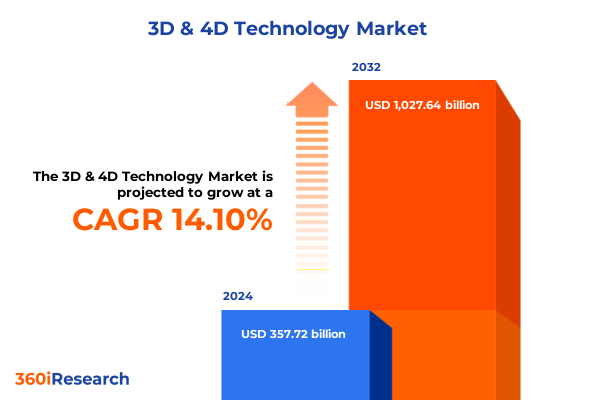

The 3D & 4D Technology Market size was estimated at USD 408.77 billion in 2025 and expected to reach USD 467.12 billion in 2026, at a CAGR of 15.15% to reach USD 1,097.64 billion by 2032.

Unveiling the Transformative Power of Advanced Additive Manufacturing through Cutting-Edge 3D and Adaptive 4D Technologies to Reshape Industry Landscapes

The landscape of manufacturing is undergoing a profound transformation driven by advancements in additive manufacturing. What began as a prototyping tool for rapid concept validation has evolved into a versatile production method capable of fabricating end-use parts with complex geometries and lightweight structures. Throughout the first quarter of 2025, shipments of entry-level 3D printers surged by 15% year-over-year, fueled by both rising demand for on-demand production and concerns over trade policy that accelerated adoption among small-to-medium enterprises.

Simultaneously, the emergence of four-dimensional printing-where materials respond to environmental stimuli such as heat, moisture, or magnetic fields-promises to expand the capabilities of additive manufacturing far beyond static structures. By integrating programmable materials like hydrogels and shape memory polymers, developers are exploring applications ranging from self-assembling aerospace components to biomedical devices that adapt to physiological conditions. Together, these innovations herald a new era in which manufacturing is defined not only by geometric freedom but also by dynamic functionality.

Charting the Evolution from Conventional Manufacturing to Intelligent Additive Processes Driving Customization, Efficiency, and Sustainable Growth

As digital innovation converges with traditional manufacturing, additive processes have rapidly matured to address critical challenges in speed, cost, and customization. Recent breakthroughs in powder bed fusion and directed energy deposition have enhanced precision and throughput, enabling metal components with micro-level detail and structural integrity previously achievable only through subtractive methods. At the same time, improvements in vat photopolymerization have increased resin diversity, opening new frontiers in biomedical and microfluidic device fabrication.

In parallel, the integration of artificial intelligence and digital twin technologies has streamlined design-to-production workflows. By simulating build outcomes and optimizing support structures virtually, manufacturers now reduce trial-and-error cycles, mitigate material waste, and accelerate time to market. These evolutions are complemented by pioneering research in four-dimensional printing, where shape memory polymers and hydrogel composites enable structures that can self-fold, self-heal, or change configuration on demand. This convergence of digital and material intelligence is catalyzing a shift from mass production to mass customization, fostering sustainable practices while accommodating ever-more complex product requirements.

Evaluating the Extensive Effects of Current US Trade Actions on Additive Manufacturing Supply Stability and Domestic Production Incentives

In January 2025, the Office of the United States Trade Representative finalized the latest round of Section 301 tariff increases on key imports from China, including elevated duties on solar wafers, polysilicon, and select steel and aluminum products. Meanwhile, in June 2025, tariffs on steel and aluminum were doubled to 50% under an executive proclamation aimed at bolstering domestic producers and national security interests. These measures have raised the cost of metal powders and consumables integral to additive manufacturing, compressing margins for service bureaus and prompting reevaluations of global supply chains.

At the same time, the broader atmosphere of trade uncertainty has underscored the strategic value of digital production. By transmitting design files electronically and printing critical parts on-site, companies can circumvent high import duties and mitigate logistical bottlenecks. This dynamic has accelerated reshoring initiatives and incentivized investments in U.S.-based materials research and manufacturing capacity. As adoption of additive processes expands, firms that harness digital blueprints and localize production are increasingly shielded from tariff-driven disruptions, reinforcing resilience in an increasingly volatile trade environment.

Exploring Diverse Perspectives on Technology, Materials, Processes, Industries, and Applications That Drive Nuanced Additive Manufacturing Strategies

Market participants are scrutinizing technology type segmentation to align R&D efforts with emerging opportunities. Three-dimensional printing modalities like powder bed fusion and material jetting continue to dominate high-precision applications, while directed energy deposition and vat photopolymerization advance the fabrication of large-scale and high-performance components. Concurrently, four-dimensional printing platforms leverage shape memory polymers and hydrogels to create structures capable of post-build activation, setting the stage for adaptive systems in aerospace and biomedical fields.

Material type segmentation reveals that metals-including aluminum, stainless steel, and titanium-remain indispensable for structural components in aerospace and automotive industries, while composites such as carbon fiber reinforced polymers offer high strength-to-weight ratios for next-generation drones and sports equipment. Ceramics like alumina and silica are increasingly utilized in high-temperature and wear-resistant applications, and plastics-ranging from ABS to PLA-support cost-effective prototyping and small-batch production. This multi-material landscape fuels cross-sector innovation, as hybrid processes combine material properties to meet diverse performance criteria.

End-use industry segmentation underscores the pivotal role of additive manufacturing across aerospace tooling and parts, automotive prototyping and low-volume production, consumer fashion and jewelry, and biomedical devices spanning prosthetics and bioprinting. Each vertical leverages unique process advantages-from rapid prototyping in automotive design studios to localized production of specialized tooling in aerospace facilities-demonstrating how sector-specific requirements shape technology adoption.

Process segmentation further refines the ecosystem, breaking down additive methodologies into directed energy deposition, material extrusion, and powder bed fusion, among others, each with specialized sub-processes such as laser metal deposition and selective laser sintering. By understanding the nuanced capabilities and limitations of each method, manufacturers can optimize workflows for material compatibility, surface finish, and build rate.

Finally, application segmentation highlights the varied use cases for production, prototyping, research and development, and tooling. From mass customization of end-use parts to functional prototyping and iterative proof-of-concept builds, the additive manufacturing value chain supports innovation pipelines, drives rapid design verification, and enables lightweight, complex geometries that challenge traditional tooling paradigms.

This comprehensive research report categorizes the 3D & 4D Technology market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology Type

- Material Type

- Process

- End Use Industry

- Application

Uncovering Regional Dynamics Shaping Adoption and Innovation in Additive Manufacturing Across the Americas, EMEA, and Asia Pacific Markets

Across the Americas, strong support for reshoring and digital manufacturing has fueled investments in additive infrastructure, particularly in the United States, where advanced aerospace and medical device clusters lead the deployment of high-end metal and polymer 3D printing systems. Regulatory incentives and strategic partnerships between research universities and private sector innovators further accelerate the development of localized materials and processes tailored to domestic supply chains.

In Europe, Middle East, and Africa, stringent sustainability goals and circular economy initiatives are spurring the adoption of additive manufacturing to reduce material waste and decarbonize production. Aerospace hubs in Germany and France are integrating multi-laser powder bed fusion into mainstream production for critical engine components, while emerging markets in the Middle East explore additive technologies to support infrastructure projects and defense applications.

The Asia-Pacific region continues to drive scale through large-format polymer extrusion systems and cost-effective entry-level machines, with China and Japan investing heavily in materials innovation and automation. Government-backed initiatives in South Korea and Singapore emphasize 4D printing research, targeting adaptive materials for electronics and biomedical sectors. This diverse regional landscape reflects the interplay of policy frameworks, industry priorities, and R&D ecosystems shaping the global additive manufacturing trajectory.

This comprehensive research report examines key regions that drive the evolution of the 3D & 4D Technology market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Innovators and Strategic Partnerships Propelling Innovation and Competitive Differentiation in Additive Manufacturing Industry Ecosystems

Leading companies are differentiating through a combination of proprietary materials, software ecosystems, and end-to-end solutions. Stratasys and 3D Systems, as long-standing pioneers, continue to expand their portfolios with high-temperature polymers and advanced metal printers, while HP leverages its Multi Jet Fusion platform to deliver production-grade nylon parts at scale. Simultaneously, innovators like Carbon and Desktop Metal are driving material science breakthroughs in elastomers and metal composites, respectively, and forging partnerships with automotive and consumer brands to integrate additive processes into established manufacturing workflows.

On the metal additive front, EOS and Renishaw have strengthened their competitive positions by adding multi-laser capabilities and closed-loop process monitoring, enabling greater throughput and consistent quality for critical aerospace and medical components. Moreover, cross-industry collaborations-such as joint development agreements between software providers and hardware manufacturers-are enhancing workflow integration, data analytics, and secure digital file exchange, laying the groundwork for fully automated, networked factory environments.

This comprehensive research report delivers an in-depth overview of the principal market players in the 3D & 4D Technology market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3D Systems, Inc.

- Desktop Metal, Inc.

- EOS GmbH

- GE HealthCare Technologies Inc.

- General Electric Company

- Google LLC

- HP Inc.

- LG Electronics Inc.

- Materialise NV

- Panasonic Holdings Corporation

- Renishaw plc

- Samsung Electronics Co., Ltd.

- SLM Solutions Group AG

- Sony Group Corporation

- Stratasys Ltd.

- The ExOne Company

Formulating Proactive Strategies to Enhance Supply Chain Agility, Technological Innovation, and Market Position in a Rapidly Evolving Additive Manufacturing Landscape

Industry leaders should prioritize investments in advanced material research to broaden the range of printable composites and smart polymers, thereby unlocking new functional applications in sectors such as healthcare and defense. Building strategic alliances with software developers will enhance design optimization and build simulation capabilities, reducing iteration cycles and ensuring first-time-right outcomes.

To reinforce supply chain resilience, companies must adopt a dual-source strategy, combining domestic production hubs with established international suppliers to balance cost, quality, and lead time considerations. Engaging proactively with policymakers and industry consortia can secure targeted incentives and favorable regulatory environments, while workforce development programs should focus on additive manufacturing accreditation and digital skills training to cultivate a talent pipeline aligned with emerging technology demands.

Outlining Rigorous Qualitative and Quantitative Approaches Ensuring Comprehensive and Objective Analysis of Additive Manufacturing Trends and Market Dynamics

This analysis draws upon a combination of primary and secondary research methodologies to ensure comprehensive coverage of market dynamics. Primary research involved in-depth interviews with industry executives, material scientists, and end-use customers across aerospace, automotive, healthcare, and consumer goods sectors. These conversations offered nuanced insights into technology adoption hurdles, material performance trade-offs, and emerging application requirements.

Secondary research encompassed a rigorous review of regulatory filings, academic journals, patent databases, and publicly available financial statements, enabling cross-validation of quantitative trends and qualitative observations. Data triangulation techniques were applied to reconcile multiple sources, while scenario planning exercises examined potential trade policy shifts and technology breakthrough timelines. Structured frameworks guided segmentation analysis, aligning process capabilities, material specifications, and end-use applications to map value chain intersections and identify white-space opportunities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our 3D & 4D Technology market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- 3D & 4D Technology Market, by Technology Type

- 3D & 4D Technology Market, by Material Type

- 3D & 4D Technology Market, by Process

- 3D & 4D Technology Market, by End Use Industry

- 3D & 4D Technology Market, by Application

- 3D & 4D Technology Market, by Region

- 3D & 4D Technology Market, by Group

- 3D & 4D Technology Market, by Country

- United States 3D & 4D Technology Market

- China 3D & 4D Technology Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3498 ]

Synthesizing Key Insights to Illuminate the Strategic Imperatives Guiding Future Investments and Innovations in Additive Manufacturing Technologies

Emerging from this synthesis is the recognition that additive manufacturing, enriched by four-dimensional capabilities, is no longer an experimental novelty but a strategic imperative for companies seeking agile, sustainable, and customized production models. The convergence of advanced materials, digital workflows, and adaptive processes positions this sector at the forefront of Industry 4.0 transformation, offering tangible outcomes in cost reduction, lead-time compression, and design freedom.

Looking ahead, market participants that excel will be those who integrate additive technologies within broader manufacturing ecosystems, leverage data-driven process controls, and foster collaborative innovation networks. By aligning strategic investments with targeted applications and regional priorities, organizations can capitalize on the next wave of additive manufacturing advancements and secure competitive advantages in a fast-evolving industrial landscape.

Connect with Our Associate Director of Sales and Marketing to Obtain the Definitive Additive Manufacturing and 4D Printing Market Research Report

I invite you to take the next step toward unlocking the full potential of additive manufacturing and emerging 4D technologies by securing the comprehensive market research report.

To explore tailored insights, competitive landscapes, and actionable strategies, reach out to Ketan Rohom (Associate Director, Sales & Marketing). His expertise will ensure you obtain a customized package that aligns with your strategic priorities and supports informed decision-making. Don’t miss the opportunity to gain a competitive edge-contact Ketan Rohom today to acquire the definitive guide for navigating the evolving world of 3D and 4D printing technologies.

- How big is the 3D & 4D Technology Market?

- What is the 3D & 4D Technology Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?