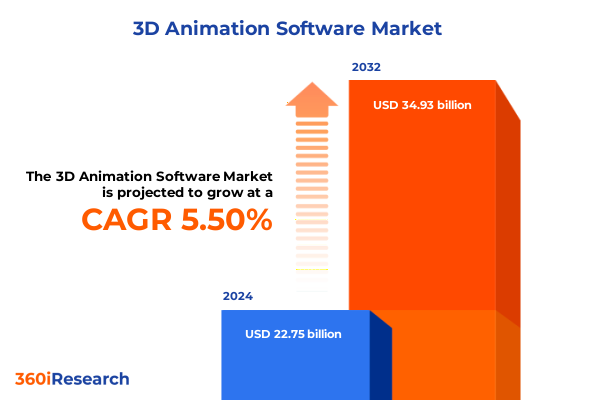

The 3D Animation Software Market size was estimated at USD 23.79 billion in 2025 and expected to reach USD 24.87 billion in 2026, at a CAGR of 5.63% to reach USD 34.93 billion by 2032.

Groundbreaking Evolution in 3D Animation Software Unveils New Creative Horizons through Enhanced Rendering, Simulation, and Collaborative Capabilities

The 3D animation software arena has emerged as a critical enabler of creative and technical workflows across a multitude of industries. Increasingly sophisticated rendering engines and simulation capabilities have expanded the scope of what is visually achievable, making three-dimensional imagery integral to fields ranging from entertainment to engineering. This landscape is defined by both robust incumbents continually refining their flagship solutions and newer entrants challenging norms with specialized, niche tools. As digital content consumption accelerates-driven by streaming, virtual experiences, and immersive learning-the demand for powerful and scalable animation software is driving unprecedented innovation.

Over the past several years, adoption barriers have diminished considerably. Companies that once reserved 3D animation for blockbuster film production are now leveraging these platforms to create compelling marketing assets and interactive educational modules. Simultaneously, improvements in hardware affordability and cloud-based delivery models have democratized access, enabling small and medium enterprises to participate alongside global studios. The acceleration of remote collaboration, propelled by modern workforce mobility, further amplifies the need for integrated software ecosystems. Together, these dynamics underscore a market at a pivotal juncture, poised for continued expansion as technology converges with creative ambition.

Pioneering Technological Convergence and Cloud-Driven Collaboration Propel the 3D Animation Software Landscape into a New Era of Real-Time Creativity

Recent years have witnessed a series of transformative shifts reshaping the contours of the 3D animation software market. The integration of artificial intelligence and machine learning has automated previously manual tasks, enabling real-time rigging, motion capture refinement, and predictive rendering optimizations. These advances not only accelerate production timelines but also empower artists to experiment more freely, pushing the boundaries of narrative and visual effects.

Moreover, cloud-native architectures have moved beyond proof-of-concept to become mainstream, offering on-demand scalability that aligns with fluctuating project requirements. The transition to hybrid and public cloud environments has facilitated seamless global collaboration, reducing latency and enabling geographically dispersed teams to co-create without compromising quality. As real-time engines originally developed for gaming continue to converge with traditional animation pipelines, the lines between interactive and linear media blur, opening avenues for immersive virtual and augmented reality experiences. These collective shifts underscore a market in constant flux, where agility and technological foresight determine leadership.

Assessing the Strategic Consequences of 2025 U.S. Tariff Adjustments on Hardware Investments and Software-as-a-Service Adoption in the 3D Animation Ecosystem

The imposition of new tariffs by the United States in early 2025 has introduced complexities that ripple through the 3D animation software ecosystem. While software itself is largely exempt from direct tariff duties, the broader impact manifests through increased hardware costs-particularly for high-performance workstations and graphics acceleration units sourced internationally. These elevating capital expenditures influence budgeting decisions, prompting firms to explore cloud-based render farms and subscription-based licensing models to mitigate upfront outlays.

Additionally, the tariffs have affected the supply chain for specialized peripherals, from motion-capture cameras to VR headsets, raising procurement lead times and escalating delivery costs. In response, many organizations are re-evaluating vendor agreements and diversifying supplier portfolios. The indirect consequence has been a strategic pivot toward software-as-a-service offerings that bundle hardware provisioning within comprehensive service contracts. This shift not only addresses tariff-induced pressures but also aligns with a broader industry trend favoring predictable operating expenses over discretionary capital investments.

Deep-Dive into Component, Deployment, Software Type, Application, End-User Industry, and Organization Size Reveals Nuanced Adoption Patterns Across the 3D Animation Spectrum

Insight into market segmentation reveals critical variations in customer priorities and adoption patterns. Within the spectrum of component offerings, service-driven engagements are increasingly preferred by organizations seeking end-to-end support, while software licenses remain the nucleus of innovation for in-house studios. Deployment choices bifurcate between cloud solutions-where hybrid integrations and fully public or private clouds cater to differing compliance needs-and traditional on-premise installations that sustain deeply entrenched pipelines. The software typology further bifurcates into foundational modeling platforms, dedicated animation modules, high-fidelity rendering products, and simulation suites essential for physics-driven visualizations.

Across applications, advertising agencies harness 3D animation for captivating brand storytelling, educational institutions deploy interactive simulations to enhance learner engagement, and film and television studios rely on advanced rendering for blockbuster visual effects. The gaming sector continues to drive real-time engine enhancements, while virtual and augmented reality contexts demand seamless integration between animation assets and interactive frameworks. End-user industries range from architecture and engineering, where digital twin creation streamlines design reviews, to healthcare environments leveraging simulation for surgical training. Finally, organizational scale plays a pivotal role: large enterprises prioritize enterprise licensing agreements and centralized support, whereas small and medium firms gravitate toward modular subscriptions and scalable, pay-as-you-grow service models.

This comprehensive research report categorizes the 3D Animation Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Software Type

- End-User Industry

- Organization Size

- Application

- Deployment Mode

Unveiling Contrasting Drivers and Infrastructure Requirements Across Americas, Europe Middle East Africa, and Asia-Pacific That Shape Regional 3D Animation Software Strategies

Regional dynamics illuminate divergent drivers and adoption trajectories across the globe. In the Americas, North American studios spearhead investment in AI-assisted workflows, while Latin American production houses capitalize on cost-effective talent pools and cloud-based collaboration to serve global clients. The Europe, Middle East & Africa region exhibits a strong preference for on-premise solutions in markets with stringent data sovereignty regulations, even as multinational firms leverage private and hybrid clouds to balance control with scalability. Rapidly growing creative hubs in APAC-from South Korea’s gaming sector to India’s burgeoning visual effects studios-favor cloud-native, subscription-driven models that allow for nimble scaling in alignment with project pipelines.

Currency fluctuations and regional policy variations further shape procurement strategies. In the Americas, favorable leasing terms and government incentives for digital infrastructure support swift technology adoption. Conversely, regulatory frameworks in parts of EMEA necessitate robust data governance features, prompting vendors to embed advanced encryption and compliance modules. APAC’s focus on cost optimization stimulates demand for flexible consumption-based pricing, encouraging software providers to refine tiered offerings and localize support services. These regional nuances underscore the importance of a tailored go-to-market approach that accounts for infrastructure maturity, regulatory environments, and cultural preferences.

This comprehensive research report examines key regions that drive the evolution of the 3D Animation Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Alliances, Acquisitions, and Open-Source Initiatives Redefine Competitive Differentiation among Major and Emerging 3D Animation Software Providers

A competitive landscape defined by innovation and strategic partnerships characterizes the leading 3D animation software vendors. Market leaders continue to invest in AI-driven automation, while specialized challengers carve niches through advanced simulation fidelity or streamlined user experiences. Strategic alliances between software providers and cloud hyperscalers have become commonplace, enabling co-developed solutions that seamlessly integrate rendering engines with scalable compute resources. Additionally, partnerships with hardware manufacturers ensure optimized performance across GPU architectures, reinforcing vendor value propositions.

Emerging entrants are leveraging open-source frameworks to accelerate feature rollouts, while established brands bolster ecosystems through developer communities and plug-in marketplaces. Mergers and acquisitions have facilitated rapid capability expansion, as larger players absorb niche specialists to round out their portfolios. Across this tapestry of competition, differentiators hinge on ease of integration with existing pipelines, the depth of specialist support, and the strength of global partner networks. Long-term success will depend on the ability to anticipate and adapt to shifts in usage patterns, technology standards, and tariff landscapes.

This comprehensive research report delivers an in-depth overview of the principal market players in the 3D Animation Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adobe Inc.

- Autodesk, Inc.

- Blender Foundation

- Corel Corporation

- Dassault Systèmes SE

- Epic Games, Inc.

- Maxon Computer GmbH

- NewTek, Inc.

- Pixologic, Inc.

- PTC Inc.

- Reallusion Inc.

- SideFX Software Inc.

- Smith Micro Software, Inc.

- The Foundry Visionmongers Ltd.

- Unity Technologies, Inc.

Actionable Blueprint for Market Leaders to Drive Platform Interoperability, Cloud Adoption, and AI-Driven Innovation while Mitigating Hardware Cost Pressures

Industry leaders should act decisively to align offerings with evolving customer needs. Prioritizing modular architectures that enable seamless interoperability between modeling, animation, and rendering modules will foster stickiness within diverse workflows. Leaders must also enhance cloud-native deployments by offering transparent pricing models that accommodate predictable budgeting and encourage incremental adoption. To address the operational impacts of increased hardware costs, bundling service credits for cloud-based render time and hardware-as-a-service options can deliver immediate relief to clients managing capital constraints.

Investment in AI and automation should focus on user-centric enhancements that reduce manual workloads while preserving creative flexibility. Cultivating robust developer ecosystems through comprehensive APIs and SDKs will accelerate third-party innovation, further entrenching platforms within enterprise pipelines. Geographically, vendors must tailor regional strategies by embedding compliance modules for sensitive markets and offering localized support structures. Finally, proactive engagement with policy makers and industry consortia can help shape tariff dialogues and standards development, ensuring that the sector’s collective voice informs future regulatory frameworks.

Methodical Blending of Primary Executive Interviews, Quantitative Deployment Metrics, and Secondary Industry Publications Ensures Robust and Validated Market Insights

This report’s findings are grounded in a rigorous research methodology combining primary and secondary data sources. Primary insights were gathered through in-depth interviews with C-level executives, product managers, and technical architects representing end-user organizations, software vendors, and service providers. These qualitative perspectives were complemented by quantitative data obtained from proprietary databases detailing software deployment trends, license utilization, and cloud consumption metrics.

Secondary research involved a comprehensive review of industry publications, peer-reviewed journals, and conference proceedings to contextualize technological advancements. Trade association reports and regulatory filings provided clarity on tariff implementations and compliance requirements. Data triangulation ensured validity by cross-verifying insights across multiple sources and reconciling discrepancies through follow-up inquiries. The resulting synthesis offers a holistic, evidence-based view of the 3D animation software market’s current state and forward trajectory.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our 3D Animation Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- 3D Animation Software Market, by Component

- 3D Animation Software Market, by Software Type

- 3D Animation Software Market, by End-User Industry

- 3D Animation Software Market, by Organization Size

- 3D Animation Software Market, by Application

- 3D Animation Software Market, by Deployment Mode

- 3D Animation Software Market, by Region

- 3D Animation Software Market, by Group

- 3D Animation Software Market, by Country

- United States 3D Animation Software Market

- China 3D Animation Software Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Summarizing the Interplay of Innovative Technologies, Economic Pressures, and Regional Nuances that Will Define Future Leadership in 3D Animation Software

In summary, the 3D animation software market stands at a crossroads defined by rapid technological evolution, shifting economic landscapes, and region-specific adoption dynamics. The convergence of AI, cloud-native architectures, and real-time engines is creating unprecedented creative possibilities while simultaneously challenging traditional production paradigms. Tariff-induced hardware cost pressures have accelerated the transition toward service-oriented delivery models, underscoring the strategic importance of flexible pricing and bundled offerings.

Segmentation and regional analyses reveal nuanced customer priorities that demand tailored solutions, while the competitive environment underscores the necessity for continual innovation and strategic partnerships. By embracing modular platforms, transparent consumption models, and proactive policy engagement, industry stakeholders can navigate headwinds and capitalize on growth opportunities. Ultimately, success in this rapidly transforming market will hinge on a balance of technological foresight, operational agility, and deep customer empathy.

Empower Your Strategic Decision Making by Engaging with Ketan Rohom to Acquire the Definitive 3D Animation Software Market Research Report and Gain a Competitive Edge

To secure a detailed and actionable roadmap for navigating the evolving 3D animation software market, contact Ketan Rohom at Associate Director, Sales & Marketing for a tailored consultation. Leverage his expertise to gain immediate insights into strategic positioning, competitive differentiation, and growth acceleration. Investing in this comprehensive research report will equip your organization with the intelligence required to capitalize on emerging trends, mitigate tariff impacts, and drive innovation across applications. Reach out today to transform your market understanding into measurable business results and maintain leadership in a rapidly shifting landscape.

- How big is the 3D Animation Software Market?

- What is the 3D Animation Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?