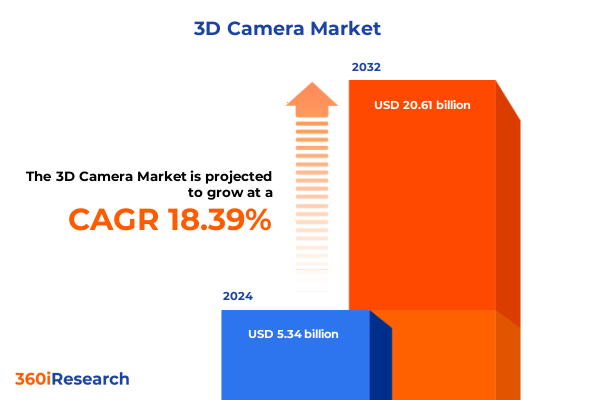

The 3D Camera Market size was estimated at USD 6.27 billion in 2025 and expected to reach USD 7.38 billion in 2026, at a CAGR of 18.52% to reach USD 20.61 billion by 2032.

Exploring the Evolution of 3D Camera Technology and Its Strategic Significance in Redefining Imaging Capabilities Across Industries

The rapid evolution of 3D camera technology has transformed the way industries capture and interpret visual data. What began as niche applications in industrial metrology has now expanded into a multitude of sectors, including healthcare diagnostics, autonomous vehicles, augmented reality experiences, and quality inspection systems. As technological capabilities advance, higher resolution depth sensing and faster processing speeds are unlocking new use cases and driving demand for more sophisticated imaging solutions. Moreover, the convergence of artificial intelligence algorithms with three-dimensional data acquisition is enabling real-time analytics and predictive insights, fundamentally reshaping traditional workflows.

In parallel, market dynamics have shifted significantly. Increasing investment in research and development by original equipment manufacturers, rising consumer interest in immersive technologies, and expanding industrial digitization initiatives are collectively fueling widespread adoption. Companies are exploring diverse 3D camera architectures-from time of flight sensors to structured light systems-to balance accuracy, speed, and cost requirements. This diversification has heightened competitive intensity, as established imaging firms and emerging startups vie for market share by differentiating on performance and integration ease.

Against this backdrop, understanding the strategic significance of 3D imaging becomes crucial for decision-makers. This summary synthesizes the core technological advances, regulatory influences, and competitive strategies defining today’s environment, equipping executives with the insights needed to navigate the evolving landscape and drive long-term growth.

Analyzing the Decisive Technological and Market-driven Shifts Reshaping the 3D Camera Landscape in Today’s Digital Era

The 3D camera industry is experiencing a period of transformative shifts driven by breakthroughs in sensor design, computational imaging, and data processing platforms. Advances in Complementary Metal-Oxide Semiconductor sensors have enhanced low-light performance and reduced power consumption, while improvements in Charge Coupled Device architectures continue to deliver unparalleled dynamic range for high-precision applications. Simultaneously, the emergence of hybrid sensor systems that integrate photogrammetry with structured light techniques is streamlining the capture of complex geometries and textures at both macro and micro scales, thereby expanding potential application domains.

Innovation in deployment models is also reshaping the competitive landscape. Fixed 3D vision systems, traditionally reserved for industrial manufacturing lines, are now complemented by mobile and handheld form factors capable of capturing depth data in unstructured environments. This shift has been accelerated by the proliferation of compact, mobile-optimized processors and standardized software development kits that simplify integration into existing digital ecosystems. As a result, businesses in sectors such as robotics, drones, and consumer electronics are quickly incorporating depth sensing capabilities to elevate automation workflows and deliver immersive user experiences.

In addition, new partnerships between camera manufacturers, software providers, and automation specialists are fostering end-to-end solutions. By aligning hardware design with advanced analytics and cloud-based processing, these alliances are enhancing scalability and unlocking novel business models. As the market matures, stakeholders who anticipate and respond to these transformative shifts will be best positioned to drive innovation and secure competitive differentiation.

Assessing the Comprehensive Effects of 2025 United States Tariffs on Supply Chains, Pricing Dynamics, and Competitive Positioning in 3D Cameras

The introduction of new trade measures by the United States in 2025 has had a pronounced impact on the global 3D camera supply chain, affecting component sourcing, pricing, and strategic partnerships. Tariffs imposed on key imaging components, such as specialized sensors and optical modules primarily manufactured in Asia, have increased landed costs for downstream assemblers. This has prompted original equipment manufacturers to reassess their supplier portfolios, exploring near-shoring options and investing in local manufacturing capabilities to mitigate tariff exposure.

As cost structures evolve, companies are also reconfiguring product roadmaps to preserve margins without sacrificing performance. Tier-one camera providers have initiated redesigns that substitute certain imported elements with domestically sourced alternatives, while maintaining tight tolerances critical for accuracy. At the same time, the higher input costs have accelerated consolidation among smaller suppliers, driving mergers and acquisitions aimed at achieving economies of scale and broader geographic reach.

Furthermore, the tariffs have influenced pricing strategies in end markets, where some vendors have absorbed increased costs to sustain competitive positioning, while others have pursued premium pricing models, emphasizing differentiated capabilities such as higher frame rates or enhanced depth accuracy. The resulting dynamic has elevated strategic complexity; companies must now balance supply chain resilience, cost management, and product differentiation to maintain market momentum and capitalize on emerging opportunities.

Uncovering Critical Product, Technology, and Application Segmentation Patterns Driving Adoption and Innovation in the 3D Camera Market

A nuanced analysis of market segments reveals distinct growth drivers and proprietary challenges across different product categories and use-case requirements. Photogrammetry systems, for example, have gained traction in contexts where high-resolution texture mapping is paramount, such as cultural heritage preservation and large-scale topographical surveys. Conversely, time of flight systems deliver rapid depth measurements for applications demanding real-time interaction, such as gesture recognition in consumer electronics and collision avoidance in autonomous robotics.

Delving deeper into sensing technology, Charge Coupled Device sensors continue to be favored in scenarios requiring exceptional image fidelity, whereas Complementary Metal-Oxide Semiconductor sensors are increasingly adopted for mobile and battery-sensitive deployments due to their efficiency and lower cost profile. Fixed installations dominate in manufacturing and warehouse automation, leveraging their consistent performance for quality inspection processes, while mobile deployments-integrated into drones, handheld scanners, or vehicles-are expanding in outdoor mapping, security patrols, and healthcare imaging.

The market’s applications further underscore the importance of targeted segmentation. Three-dimensional mapping and modeling have seen cross-industry adoption for urban planning, while security and surveillance systems leverage depth data to enhance threat detection accuracy. Virtual and augmented reality initiatives, propelled by media and entertainment enterprises, continue to demand high frame rates and accurate depth sensing, and industrial automation use cases rely on structured light and stereo vision systems for defect detection and process optimization. Within end-use industries, automotive manufacturers are integrating 3D cameras for driver assistance functions, healthcare providers deploy them for diagnostic imaging, and robotics developers embed them in autonomous platforms. Finally, distribution channels vary: specialist equipment dealers and systems integrators facilitate offline sales for complex installations, whereas online marketplaces offer faster procurement cycles for standardized modules.

This comprehensive research report categorizes the 3D Camera market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Image Sensing Technology

- Deployment

- Application

- End-Use Industry

- Distribution Channel

Evaluating Regional Dynamics and Growth Drivers Across the Americas, EMEA, and Asia-Pacific in the Expanding 3D Camera Sector

Regional dynamics within the 3D camera market are defined by differentiated investment trends, regulatory environments, and sector-specific demands. In the Americas, substantial research funding and robust venture capital interest are bolstering innovation hubs that specialize in advanced sensor development, fueling startups and established firms alike. North American manufacturers benefit from proximity to leading-edge automotive and aerospace clients, enabling rapid co-development cycles for autonomous navigation systems and precision inspection equipment.

Across Europe, the Middle East, and Africa, government-supported digitization programs and regulatory frameworks emphasizing data privacy and security are shaping adoption trajectories. The European Union’s initiatives to standardize digital twin implementations and bolster manufacturing resilience have created demand for photogrammetry and structured light solutions in smart factory deployments. Meanwhile, Middle Eastern infrastructure projects leverage 3D mapping for urban planning, and select African markets adopt low-cost time of flight systems for agricultural monitoring.

In the Asia-Pacific region, a convergence of manufacturing capacity, consumer electronics leadership, and cost-competitive production has established the area as both a key source of components and a major end market. High smartphone penetration and strong interest in immersive entertainment are driving demand for gesture recognition and virtual reality camera modules, while industrial manufacturing clusters in East Asia integrate stereo vision and structured light systems for automated quality control. Government initiatives in countries such as Japan and South Korea are further advancing research in quantum imaging and next-generation sensor materials, promising to accelerate future market evolution.

This comprehensive research report examines key regions that drive the evolution of the 3D Camera market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Strategic Collaborations Fueling Innovation, Market Expansion, and Competitive Advantage in the 3D Camera Domain

Leading companies in the 3D camera sector are emphasizing differentiated strategies to sustain innovation and market leadership. Industry stalwarts with deep vertical integration are focusing on end-to-end solutions, combining proprietary sensor fabrication with custom algorithms to deliver turnkey packages for enterprise clients. These players are leveraging long-standing relationships with automotive and industrial conglomerates to co-engineer applications that seamlessly integrate into existing automation platforms.

At the same time, nimble startups are carving out niches through specialized offerings-such as ultra-compact sensors tailored for wearable devices or AI-enabled depth analytics optimized for healthcare diagnostics. Strategic partnerships between hardware designers and software developers are common, as companies seek to embed advanced machine learning capabilities into camera systems to enable real-time defect detection, volumetric analysis, and predictive maintenance functionalities.

An additional competitive dynamic arises from open-source initiatives and developer communities that promote interoperability and accelerate innovation cycles. By participating in consortiums and standardization bodies, leading vendors influence emerging protocols and ensure compatibility with broader digital ecosystems. This collaborative approach not only reduces integration complexity for end users but also fosters a vibrant ecosystem of third-party innovators building complementary applications.

This comprehensive research report delivers an in-depth overview of the principal market players in the 3D Camera market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Basler AG

- Beike Realsee Technology (HK) Limited

- Canon, Inc.

- Cognex Corporation

- Eastman Kodak Company

- FARO Technologies, Inc.

- Fujifilm Holdings Corporation

- GoPro, Inc.

- Hangzhou Hikvision Digital Technology Co., Ltd.

- Hewlett Packard Enterprise Development LP

- Infineon Technologies AG

- Intel Corporation

- Leica Camera AG

- LG Electronics, Inc.

- Mantis Vision Ltd.

- Matterport Inc.

- Microsoft Corporation

- Nikon Corporation

- Olympus Corporation

- Panasonic Corporation

- Phase One A/S

- Samsung Electronics Co., Ltd.

- SICK AG

- Sony Corporation

- Structure Sensor

- Teledyne FLIR LLC

- Toshiba Corporation

- XYZprinting, Inc. by Nexa3D Inc.

- ZEISS Group

Delivering Strategic and Operational Recommendations to Empower Industry Leaders for Sustainable Growth and Competitive Differentiation in 3D Imaging

Organizations seeking to capitalize on the next wave of 3D imaging growth should consider a multifaceted strategic approach that addresses technology, partnerships, and organizational agility. First, investing in modular sensor architectures can enable rapid customization for vertical-specific requirements, accelerating time to market and improving cost efficiency. Aligning R&D priorities with target industry trends-such as robotic autonomy in manufacturing and immersive interfaces in consumer electronics-will ensure relevance as demand patterns evolve.

Second, forging strategic alliances across the value chain can mitigate supply chain vulnerabilities and foster co-innovation. Partnerships with component fabricators, software platform providers, and system integrators facilitate access to complementary capabilities and shared go-to-market channels. This ecosystem approach also strengthens resilience against geopolitical disruptions and tariff fluctuations by diversifying sourcing and distribution networks.

Finally, nurturing internal competencies in data analytics and software development will be critical. Integrating depth data with AI-driven analytics platforms unlocks new service offerings, such as predictive maintenance dashboards and interactive visualization tools. By establishing cross-functional teams that blend hardware expertise with software engineering talent, organizations can deliver differentiated solutions that resonate with end users and create sustainable competitive advantage.

Detailing the Robust Research Framework, Data Collection Practices, and Analytical Techniques Underpinning the Comprehensive 3D Camera Market Study

The research methodology underpinning this market analysis combines primary and secondary research techniques to ensure robustness and credibility. Primary data was gathered through in-depth interviews with key stakeholders, including hardware executives, system integrators, and end-user decision-makers across automotive, healthcare, and industrial automation sectors. These insights provided firsthand perspectives on adoption drivers, technology preferences, and unmet needs.

Secondary research involved a comprehensive review of technical publications, patent filings, regulatory documents, and public company disclosures to map technology trajectories and competitive developments. Market intelligence was further enriched by analyzing trade data, tariff schedules, and supply chain reports, elucidating the impact of 2025 United States trade measures on component flows and cost structures. Rigorous triangulation of qualitative insights and quantitative data points ensured alignment and reduced bias.

Analytical techniques employed include segmentation analysis to identify growth pockets across product types, sensing technologies, deployment models, applications, end-use industries, and distribution channels. Regional assessments leveraged macroeconomic indicators and industry-specific investment trends, while competitive benchmarking evaluated product portfolios, strategic alliances, and innovation pipelines. This structured methodology provides a transparent framework for interpreting market dynamics and supports informed decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our 3D Camera market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- 3D Camera Market, by Product Type

- 3D Camera Market, by Image Sensing Technology

- 3D Camera Market, by Deployment

- 3D Camera Market, by Application

- 3D Camera Market, by End-Use Industry

- 3D Camera Market, by Distribution Channel

- 3D Camera Market, by Region

- 3D Camera Market, by Group

- 3D Camera Market, by Country

- United States 3D Camera Market

- China 3D Camera Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Synthesizing Core Insights and Strategic Takeaways to Guide Decision-makers in Navigating the Future Trajectory of 3D Camera Technology

This executive summary has distilled the fundamental drivers, trends, and strategic considerations shaping the 3D camera market. From the convergence of advanced sensor technologies and computational imaging to the ramifications of newly enacted trade policies, the landscape is characterized by rapid innovation and evolving competitive dynamics. Segmentation insights highlight the diverse requirements across product architectures and application domains, while regional analysis underscores the importance of tailored strategies to address market-specific opportunities.

Leading companies are leveraging integrated solutions, partnerships, and open-source initiatives to differentiate their offerings and expand global reach. To thrive in this environment, organizations must adopt nimble R&D frameworks, forge collaborative alliances, and strengthen capabilities in depth data analytics. By aligning strategic priorities with emergent technological and regulatory shifts, industry participants can unlock new growth avenues and cement their positions as market leaders.

As the 3D imaging ecosystem continues to mature, decision-makers equipped with a nuanced understanding of these insights will be best positioned to anticipate disruption, innovate effectively, and deliver compelling value propositions. The insights presented herein serve as a guide for charting a successful course in the dynamic and promising realm of three-dimensional camera technology.

Engaging with Ketan Rohom to Acquire In-depth 3D Camera Market Analysis and Unlock Strategic Opportunities for Your Organization’s Success

If you’re ready to strengthen your strategic positioning and capitalize on emerging opportunities in the 3D camera market, reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan can guide you through the comprehensive research findings, tailor insights to your unique business needs, and facilitate acquisition of the full market report. Engaging with Ketan will ensure you receive timely, data-driven guidance to optimize investment decisions, refine product roadmaps, and achieve sustained competitive advantage. Contact Ketan today to unlock the detailed analysis, expert recommendations, and actionable intelligence that will propel your organization’s growth in the rapidly evolving 3D imaging landscape

- How big is the 3D Camera Market?

- What is the 3D Camera Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?