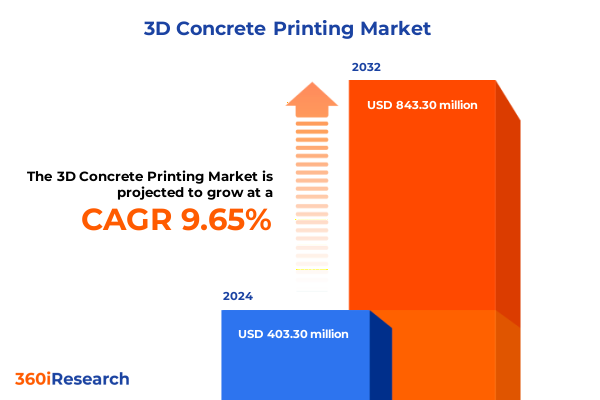

The 3D Concrete Printing Market size was estimated at USD 440.20 million in 2025 and expected to reach USD 483.53 million in 2026, at a CAGR of 9.73% to reach USD 843.30 million by 2032.

Driving Introduction Explaining How 3D Concrete Printing Is Revolutionizing Modern Construction Through Innovative Layered Manufacturing Techniques

The integration of three-dimensional concrete printing into the construction industry marks one of the most significant technological shifts of the past decade. By leveraging digital design tools and automated layering processes, this method promises to revolutionize how structures are conceived, engineered, and executed. From intricate architectural facades to rapid emergency shelter deployment, the potential use cases span an unprecedented range of applications, meeting both aesthetic and functional demands in a cost-effective manner.

Emerging platforms enable precise control over material deposition, reducing waste and accelerating build times. Reinforced fibers and admixtures tailored for 3D layering have enhanced the structural performance of printed elements, while real-time monitoring systems ensure consistency and safety throughout the printing cycle. Moreover, the capacity to translate complex digital models into tangible forms with minimal manual intervention has opened doors to novel design expressions and on-site adaptability.

As early adopters experiment with pilot projects around the globe, this executive summary offers a concise overview of key trends, market factors, and strategic considerations shaping the future of additive concrete manufacturing. By focusing on technological advancements, regulatory influences, and end-user dynamics, this document prepares decision-makers to capitalize on emerging opportunities and navigate challenges inherent in scaling this groundbreaking construction approach.

Unveiling the Transformative Shifts Redefining Construction Workflows Emphasizing Digitization Customization and Sustainability in 3D Concrete Printing

Traditional construction workflows are evolving dramatically under the influence of digital fabrication, ushering in transformative shifts across design, engineering, and execution phases. One of the most notable changes lies in the integration of parametric modeling tools that seamlessly translate complex geometries into executable printing instructions, thereby collapsing the gap between conceptualization and realization. This seamless transition has accelerated project timelines and enabled on-demand customization at scales once thought prohibitive.

Simultaneously, materials science breakthroughs have yielded concrete mixtures specifically formulated for extrusion-based systems, balancing pumpability with set-time control and mechanical resilience. These developments have broadened the spectrum of printable elements from simple wall segments to structurally robust beams and columns. As a result, stakeholders are embracing modular off-site construction augmented by in-field additive processes, merging the advantages of factory precision with on-site flexibility.

Environmental imperatives have further bolstered adoption, driving interest in low-carbon binder alternatives and recycled aggregate integration. At the same time, labor shortages and cost pressures have underscored the value of automation, prompting leading contractors to pilot hybrid workflows that combine robotic arms with rail-mounted gantries. Altogether, these converging forces are redefining construction as a digitally orchestrated, resource-efficient venture that leverages 3D printing to deliver superior performance and design freedom.

Dissecting the Cumulative Impact of United States Tariffs Implemented in 2025 on Materials Procurement and Equipment Sourcing in 3D Concrete Printing

In 2025, a series of heightened tariffs imposed by the United States on key imported materials and equipment have introduced new dynamics to the economics of concrete additive manufacturing. Components sourced from overseas, particularly high-precision extrusion nozzles and specialized polymer-based pumping systems, have seen cost escalations that ripple through supply chains. Project planners are recalibrating budgets to account for higher landed prices, prompting a pivot toward domestic suppliers and in-house fabrication capabilities.

Material tariffs have especially impacted advanced admixtures and binding agents that originate primarily in international chemical hubs. Consequently, research teams are intensifying efforts to formulate locally produced alternatives, focusing on fly ash–based geopolymers and slag derivatives that bypass import duties. Meanwhile, equipment manufacturers are exploring joint ventures with U.S.-based fabricators to establish new production lines, thereby mitigating tariff exposure while fostering technology transfer and local job creation.

Although short-term cost pressures have introduced challenges, these measures have also catalyzed innovation within domestic ecosystems. By fostering collaboration between material scientists, equipment designers, and construction contractors, the industry is charting a path toward more self-reliant supply networks. Ultimately, this strategic recalibration may yield a stronger, more resilient market capable of sustaining growth amidst shifting trade landscapes.

Key Segmentation Insights Revealing Strategic Perspectives Across Technology Type Application End Users Material Types Printer Types and Service Models

Based on technology type, the market is characterized by an evolving balance between contour crafting systems that deliver expansive coverage through rail-mounted and robotic-arm configurations and extrusion platforms that offer versatile deposition via pump and screw mechanisms. Powder bonding techniques centered on binder jetting have emerged as complementary processes, enabling the production of intricate structural elements with minimal post-processing. Together, these modalities define the technological spectrum, with each approach calibrated to meet specific project demands.

Moving into applications, architectural printing continues to flourish, particularly in the creation of bespoke decorative elements and façade panels. Commercial deployments have gained traction in office fit-outs and retail environments seeking streamlined timelines and design differentiation. Infrastructure initiatives are leveraging printed components for bridges, roads, and tunnels, while residential projects increasingly feature both multi-family complexes and single-family prototypes. Restoration efforts targeting historical landmarks and structural repair have also benefited from the precision layering capabilities inherent in additive processes.

End-user profiles reveal distinct adoption drivers across architects and design firms, general and specialty contractors, federal and municipal agencies, and developers in commercial and residential sectors. Consulting practices and design studios are at the forefront of conceptual innovation, while large contractors focus on operational efficiencies. Government bodies are facilitating pilot programs, and real estate developers are monitoring performance metrics to inform investment decisions.

Material choices encompass traditional concrete variants such as fiber-reinforced, high-performance, and ready-mix formulations alongside emerging geopolymers derived from fly ash and slag. Cement-sand and polymer-modified mortars are also integral for finishing and bonding printed components. Printer typologies range from stationary gantry systems to mobile portal and truck-mounted units, with robotic arms offering four-axis and six-axis flexibility. Lastly, service models span direct sales, long- and short-term rental, and comprehensive service contracts emphasizing maintenance and operator training.

This comprehensive research report categorizes the 3D Concrete Printing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology Type

- Material Type

- Printer Type

- Service Model

- Application

- End-User

In-depth Regional Insights Highlighting Market Dynamics and Adoption Patterns Across Americas Europe Middle East Africa and Asia Pacific

In the Americas, the additive construction landscape is marked by strong academic-industry partnerships and robust venture capital funding. Early adopter states have sponsored demonstration projects, showcasing printed pedestrian bridges and modular housing units. Regulatory frameworks are maturing, with building codes gradually integrating additive standards. This favorable environment is driving an uptick in pilot programs, fostering a concentration of research hubs in North America while encouraging startups to refine specialized printer architectures and bespoke material blends.

Across Europe, the Middle East, and Africa, government agencies have assumed a proactive stance in supporting sustainable construction through subsidies and policy incentives. European nations are at the vanguard of low-carbon innovation, piloting geopolymer solutions and recycled aggregate integration. In the Middle East, large-scale infrastructure projects have embraced robotic-arm printing for complex façade installations, while African nations are exploring portable systems to address urgent housing needs. This regional mosaic underscores the versatility of 3D concrete printing, adapting to diverse climatic, regulatory, and socioeconomic contexts.

Asia-Pacific exhibits the fastest uptake, spurred by high population density and urgent infrastructure requirements. China’s industrial-scale facilities lead in volume production of modular building blocks, while Australia’s research institutions emphasize earthquake-resistant design. Japan and South Korea are integrating smart sensors into printing platforms for real-time quality assurance, and Southeast Asian markets are prioritizing low-cost housing applications. Together, these factors converge to position the region as a bellwether for commercial scalability and cross-border technology transfer.

This comprehensive research report examines key regions that drive the evolution of the 3D Concrete Printing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Key Companies Shaping the 3D Concrete Printing Ecosystem Through Strategic Partnerships Innovation and Market Differentiation

Several pioneering companies are at the forefront of advancing 3D concrete printing capabilities. Equipment manufacturers continue to refine extrusion nozzles and multi-axis robotic arms to enhance precision and throughput, while material specialists focus on bespoke mixtures that balance printability with structural performance. Strategic partnerships between technology providers and construction firms have accelerated practical deployments, establishing reference projects that validate long-term durability and regulatory compliance.

In parallel, software developers are delivering integrated platforms that consolidate design, simulation, and machine control into unified workflows. These digital ecosystems enable real-time process optimization, predictive maintenance, and seamless integration with building information modeling systems. Some leading firms have even introduced subscription-based models that bundle printer hardware, software access, and continuous upgrades, blurring the lines between capital investment and serviced offering.

Meanwhile, service-oriented enterprises have emerged to address on-site operational challenges, offering turnkey solutions that include installation, commissioning, training, and maintenance. By covering the full project lifecycle, these companies are lowering barriers to entry for general contractors and smaller developers. Collectively, this diverse corporate landscape is driving cost efficiencies, elevating technical standards, and broadening the user base of additive concrete manufacturing.

This comprehensive research report delivers an in-depth overview of the principal market players in the 3D Concrete Printing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Apis Cor LLC

- Branch Technology Inc.

- Cazza Construction LLC

- COBOD International A/S

- Contour Crafting Corporation

- CyBe Construction BV

- D-Shape Srl

- ICON, Inc.

- Sika AG

- XtreeE SAS

- Yingchuang Building Technique (Shanghai) Co., Ltd.

Crafting Actionable Recommendations to Empower Industry Leaders to Drive Adoption Scale Operations and Foster Sustainable Growth in 3D Concrete Printing

Industry leaders should prioritize investment in research and development to tailor material formulations and printing parameters for diverse climatic and structural applications. By collaborating with academic institutions and specialized laboratories, organizations can accelerate the introduction of low-carbon binders and high-performance admixtures, thereby strengthening their competitive positioning and regulatory alignment.

Concurrently, diversifying supply chains to incorporate domestic component fabrication will mitigate exposure to international tariffs and logistical disruptions. Establishing joint ventures with local partners for nozzle and pump production can secure critical equipment availability while supporting regional economic development.

To foster greater adoption, technology providers and contractors should co-develop training academies focused on upskilling site personnel in digital workflow management and printer operation. These initiatives will reduce operator error, enhance safety protocols, and streamline project timelines.

Finally, engaging proactively with standardization bodies and municipal regulators will shape conducive policy frameworks. By participating in pilot programs and sharing empirical performance data, stakeholders can influence building code revisions and accreditation criteria, unlocking broader acceptance and ensuring sustainable growth.

Comprehensive Research Methodology Detailing Data Collection Validation and Analytical Techniques Underpinning the 3D Concrete Printing Market Study

The research underpinning this analysis followed a multi-tiered approach to ensure rigor and credibility. Initially, a series of in-depth discussions were conducted with material scientists, equipment engineers, and construction managers to capture firsthand insights on emerging applications and technical barriers. These primary dialogues were supplemented by structured interviews with regulatory experts and end-user organizations across North America, Europe, and Asia-Pacific.

Secondary data sources included peer-reviewed journals, patent filings, and open-source technical repositories, providing a comprehensive perspective on material formulations, printer architectures, and lifecycle assessments. Additionally, industry white papers and conference proceedings were reviewed to identify nascent trends and standardization efforts.

Quantitative data points were triangulated against multiple benchmarks to validate consistency and reduce bias. Proprietary databases tracking equipment deployments and contract awards were utilized to corroborate market activity. Throughout the process, findings were subjected to iterative expert validation workshops, facilitating consensus on key themes and ensuring that conclusions reflect a holistic understanding of the evolving 3D concrete printing landscape.

This methodological framework delivers a balanced synthesis of qualitative insights and quantitative evidence, equipping decision-makers with both strategic context and operational detail.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our 3D Concrete Printing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- 3D Concrete Printing Market, by Technology Type

- 3D Concrete Printing Market, by Material Type

- 3D Concrete Printing Market, by Printer Type

- 3D Concrete Printing Market, by Service Model

- 3D Concrete Printing Market, by Application

- 3D Concrete Printing Market, by End-User

- 3D Concrete Printing Market, by Region

- 3D Concrete Printing Market, by Group

- 3D Concrete Printing Market, by Country

- United States 3D Concrete Printing Market

- China 3D Concrete Printing Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 4134 ]

Concluding Reflections Emphasizing Core Findings and Future Trajectories Foreseen for 3D Concrete Printing in the Global Construction Landscape

The exploration of 3D concrete printing reveals a market in dynamic evolution, marked by rapid technological innovation and shifting economic drivers. Key transformative shifts, from digital modeling integration to sustainable material development, underscore the sector’s capacity to redefine construction norms. At the same time, external forces such as tariffs and regulatory changes continue to shape strategic priorities, prompting stakeholders to recalibrate supply chains and collaborative frameworks.

Segmentation analyses highlight the diversity of technology types and applications, encompassing everything from rail-mounted contour crafting to binder-jet powder bonding and from decorative architectural elements to critical infrastructure components. Regional variations further illustrate how local policies, funding models, and labor dynamics influence adoption trajectories, with Asia-Pacific emerging as a bellwether for scale deployment and the Americas and EMEA each demonstrating distinct competitive advantages.

Corporate activity, including strategic partnerships, software integration, and full-service offerings, points to a maturing ecosystem that balances hardware innovation with operational support. Looking forward, actionable recommendations around R&D investment, supply-chain localization, workforce upskilling, and regulatory engagement will be pivotal in driving sustainable growth. Collectively, these insights paint a comprehensive picture of an industry poised to transform modern construction through additive concrete technologies.

Exclusive Opportunity to Connect with Ketan Rohom to Access the Complete Market Research Report on 3D Concrete Printing Innovations

If you’re ready to explore the full breadth of insights and data driving innovation in 3D concrete printing, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan’s expertise in advanced construction technologies makes him the ideal guide to help you navigate the nuances of this rapidly evolving market. By engaging with Ketan, you can secure immediate access to the comprehensive report that unpacks technology roadmaps, regulatory considerations, and strategic playbooks tailored for your organization. Seize this opportunity to position your team at the forefront of additive construction by obtaining the actionable intelligence needed to accelerate your projects and investments.

- How big is the 3D Concrete Printing Market?

- What is the 3D Concrete Printing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?