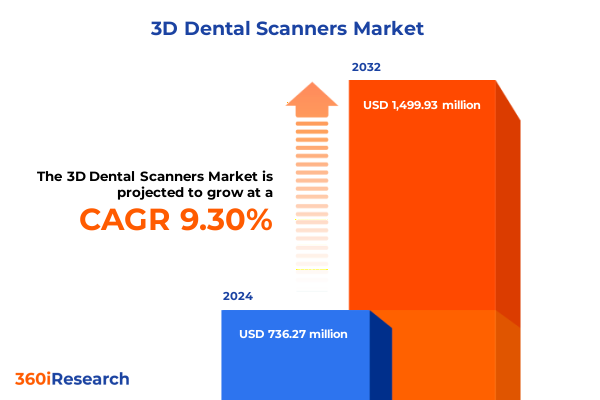

The 3D Dental Scanners Market size was estimated at USD 802.09 million in 2025 and expected to reach USD 874.68 million in 2026, at a CAGR of 9.35% to reach USD 1,499.93 million by 2032.

Immerse yourself in the dynamic world of 3D dental scanning as cutting-edge digital workflows revolutionize precision dentistry, elevate patient experiences, and drive clinical efficiency

The integration of three-dimensional scanning into dental practices marks a pivotal evolution in modern dentistry. As analog impressions give way to digital capture methods, clinicians and laboratories benefit from elevated diagnostic clarity, streamlined workflows, and enhanced patient experiences. By transitioning to digital imaging, practices are no longer constrained by the material inaccuracies and time delays associated with traditional impression techniques. Instead, real-time scanning enables instantaneous visualization of oral structures, facilitating more accurate prosthetic design and treatment planning.

In addition, the rise of intraoral and extraoral scanners has prompted a fundamental shift in collaboration between dental clinics, laboratories, and equipment manufacturers. Interdisciplinary coordination is now underpinned by shared digital models, enabling dental technicians to access precise three-dimensional datasets remotely. This synergy accelerates turnaround times for crowns, bridges, aligners, and other restorations, while also reducing the risk of human error. As a result, patient satisfaction rises in tandem with treatment predictability.

Given the rapid pace of technological innovation, it is imperative to understand how scanning modalities-whether confocal or structured light-impact diagnostic accuracy and clinical outcomes. With applications spanning endodontics, orthodontics, and guided implantology, the versatility of three-dimensional imaging continues to unlock new avenues for minimally invasive interventions. This section provides a foundational overview of the forces driving the adoption of digital scanning within the dental ecosystem, setting the stage for deeper analysis of transformative trends and market dynamics.

Experience how breakthroughs in sensor innovation and AI-enhanced software solutions are reshaping dental clinics and laboratories toward fully digital workflows

Over the past decade, the dental scanning landscape has witnessed transformative shifts driven by technological breakthroughs and changing stakeholder expectations. Advancements in sensor technology and computational power have enabled the development of lightweight, high-resolution intraoral scanners that capture oral topography with sub-millimeter accuracy. Early devices relied on single photogrammetry techniques but have since evolved to leverage structured light and multi-angle capture systems that minimize data stitching errors and improve surface fidelity.

Simultaneously, extraoral scanners-once confined to bulky benchtop devices-have become more compact and integrated with sophisticated software suites. These suites employ artificial intelligence algorithms to automate margin detection and streamline virtual articulation. Consequently, dental laboratories can produce crowns, bridges, and complex prostheses with a level of precision previously unattainable through manual wax-ups and stone casts. This leap in capability has realigned competitive positioning across the value chain, as labs invest in digital infrastructure to maintain relevance in an increasingly digital ecosystem.

Looking ahead, the convergence of intraoral scanning with augmented reality applications and machine-learning driven diagnostics hints at a future where chairside procedures are further optimized for speed and accuracy. Practitioners will be able to overlay live scan data with preoperative planning models, facilitating real-time adjustments and fostering more predictable treatment outcomes. Thus, the current era represents a critical inflection point wherein digital scanning technologies are not merely additive tools but fundamental enablers of a new clinical paradigm.

Investigate how new United States import tariffs in early 2025 are reshaping supply chains and incentivizing domestic manufacturing for dental scanner ecosystems

The imposition of new United States tariffs in early 2025 has introduced complex variables into the supply chain of three-dimensional dental scanners and related accessories. Components sourced from key manufacturing hubs abroad have seen cost upticks, prompting device makers to reassess their global procurement strategies. As a result, certain high-precision optical modules and electronic sensors have become subject to increased landed costs, leading to strategic price adjustments for end customers.

In response, major original equipment manufacturers have pursued dual approaches: localizing critical assembly operations within North America and negotiating bulk procurement agreements to mitigate tariff impacts. These measures have, in turn, influenced the competitive dynamics between established global players and emerging domestic entrants. While price-sensitive segments, such as independent dental clinics and smaller laboratories, may experience temporary budgetary constraints, larger dental service organizations are leveraging economies of scale to absorb incremental expenses with minimal disruption to their capital investment plans.

Moreover, the tariff environment has accelerated investment in research and development aimed at reducing reliance on imported components. Companies are exploring alternative sensor suppliers and modular design architectures that facilitate component substitution without compromising scan accuracy. This strategic recalibration underscores an industry-wide shift toward resilience and supply chain agility, positioning stakeholders to adapt to evolving trade policies and maintain the forward momentum of digital dentistry adoption.

Uncover critical segmentation insights across product, end-user, technological, and clinical application dimensions to guide strategic technology deployment

Analyzing the market through multiple segmentation lenses reveals nuanced performance drivers that transcend simple product categorization. When examining device type, intraoral scanners have gained prominence in many practices due to their portability and direct chairside application, whereas extraoral scanners remain indispensable for laboratory workflows involving full-arch models and implant superstructures. In turn, end-user segmentation highlights that dental clinics-both chain and independent-capitalize on in-house scanning to enhance patient throughput, while dental laboratories, whether operating in-house or as third-party service providers, utilize extraoral scanning systems to meet increasingly stringent accuracy demands. Hospitals, which often integrate scanning platforms into oral surgery and maxillofacial departments, represent a specialized segment driven by interdisciplinary case complexity.

From a technology standpoint, confocal scanning systems, with their parallel and point confocal variants, continue to deliver exceptional soft-tissue detail, ideal for prosthodontic and periodontal applications. Meanwhile, laser triangulation devices maintain an edge in capturing reflective surfaces, although they may require supplementary post-processing. Structured light technologies, particularly those operating within blue and white light spectrums, have broadened application reach by minimizing patient discomfort and scan time. Photogrammetry solutions, although less prevalent in chairside scenarios, facilitate large-scale model digitization, proving valuable for full-arch restorative planning and orthodontic aligner fabrication.

Application segmentation underscores the diverse clinical use cases driving adoption: endodontic procedures benefit from high-resolution root canal visualizations, implantology workflows rely on both conventional and guided surgical protocols, and orthodontic treatments span bracket bonding to clear aligner workflows. Periodontics and prosthodontics further illustrate how tailored scanning modalities can optimize tissue health monitoring and precision prosthesis design. Collectively, these segmentation insights illuminate the interdependent factors influencing technology selection and inform targeted deployment across varied practice settings.

This comprehensive research report categorizes the 3D Dental Scanners market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Portability

- Technology

- Light Source

- Product Type

- Brightness of Optical Engine

- Application

- End User

Explore how regional dynamics across the Americas, Europe Middle East Africa, and Asia-Pacific shape dental scanner adoption and market expansion patterns

Regional analysis further elucidates the geographic drivers shaping the adoption of three-dimensional dental scanners. In the Americas, North America remains a powerhouse due to established digital dentistry infrastructure, favorable reimbursement environments, and high per capita investment in dental technology. Latin American markets are witnessing rising interest in digital solutions, spurred by expanding private dental practices and increasing awareness of minimally invasive procedures. These trends are balanced against infrastructure variances and import cost considerations that influence distributor channel strategies.

In the Europe, Middle East, and Africa region, Western Europe leads with robust regulatory frameworks and the presence of key device manufacturers. Adoption in emerging European markets is on the rise, fueled by government initiatives to digitalize healthcare and growing collaboration between dental schools and private practices. The Middle East exhibits strong growth potential, underpinned by substantial capital investment in high-end clinics. Conversely, African markets are characterized by a more gradual transition to digital scanning, often constrained by economic factors and priorities within broader healthcare systems.

The Asia-Pacific region represents a dynamic intersection of rapid urbanization and expanding dental tourism. In major markets such as China, Japan, and Australia, domestic manufacturers are actively innovating to capture market share, driving competitive pricing and technology localization. Southeast Asia and South Asia are increasingly marked by partnerships between local distributors and global technology leaders to introduce scanning solutions tailored for clinics of varying sizes. Across these geographies, factors such as regulatory harmonization, operator training programs, and digital literacy continue to influence adoption trajectories and long-term growth potential.

This comprehensive research report examines key regions that drive the evolution of the 3D Dental Scanners market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyze the competitive terrain where global leaders, specialized innovators, and regional entrants vie to deliver seamless digital scanning ecosystems

The competitive landscape of three-dimensional dental scanners is populated by a diverse array of companies ranging from established global leaders to agile regional innovators. Leading manufacturers have concentrated on expanding their product portfolios through continuous firmware updates, software integration, and strategic partnerships with dental laboratories and software providers. These alliances have enabled seamless interoperability between scanning devices and laboratory information management systems, enhancing digital case workflow efficiency. As a result, key players are able to offer comprehensive ecosystems that extend beyond hardware, encompassing cloud-based collaboration platforms and advanced analytics tools.

Meanwhile, a number of mid-sized companies are leveraging focused R&D efforts to differentiate their offerings through proprietary scanning algorithms and ergonomic device designs that prioritize clinician comfort. These specialized entrants often capitalize on niche segments, such as high-speed orthodontic scanning or tissue-friendly imaging modalities for periodontal diagnostics. Simultaneously, smaller regional providers are gaining traction by customizing service models to meet local regulatory, training, and pricing requirements, reinforcing their competitive positioning in specific geographic pockets.

Through both organic innovation and strategic acquisitions, the industry’s top firms continue to fortify their market leadership. Recent collaborations between scanner manufacturers and restorative solution providers underscore a trend toward vertical integration, aligning digital impression capture with downstream processing and manufacturing workflows. This consolidation not only streamlines the end-to-end ecosystem but also creates high barriers to entry, compelling emerging companies to pursue niche differentiation or geographic specialization to sustain competitive advantage.

This comprehensive research report delivers an in-depth overview of the principal market players in the 3D Dental Scanners market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- 3Shape A/S

- Align Technology, Inc.

- Aniwaa Pte. Ltd.

- Asahi Roentgen Co., Ltd.

- BIOTECH Dental SAS

- Capvis AG

- Carestream Health Inc

- Condor Technologies NV

- Danaher Corporation

- Densys Ltd.

- Dental Wings Inc.

- Dentaurum GmbH & Co. KG

- Dentsply Sirona Inc.

- Hexagon AB

- imes-icore GmbH

- J. Morita Corporation

- KaVo Dental Technologies, LLC

- Kivi Technologies

- Kulzer GmbH

- Maestro 3D by by AGE Solutions S.r.l.

- MEDIT corp

- Midmark Corporation

- Owandy Radiology

- Planmeca OY

- Runyes Medical Instrument Co., Ltd.

- Shining 3D Tech Co., Ltd.

- Straumann Holding AG

- Vatech Co., Ltd.

Embrace modular innovation, strategic alliances, and supply chain resilience to accelerate adoption and differentiate in a competitive scanning landscape

To navigate the complexities and seize the burgeoning opportunities of the three-dimensional dental scanning market, industry leaders must adopt a multifaceted strategy. First, investing in modular, software-upgradable platforms will ensure product longevity and adaptability as scanning algorithms and regulatory expectations evolve. By prioritizing firmware overhauls that enhance accuracy and user-interface simplicity, companies can sustain customer loyalty and reduce total cost of ownership for end users.

Furthermore, forging deeper alliances with dental laboratories and clinical education institutions will facilitate broader technology adoption. Through shared training programs and co-development initiatives, stakeholders can cultivate digital proficiency among practitioners, accelerating the shift from analog to digital workflows. In parallel, proactive engagement with regulatory bodies will help shape standards for scan data interoperability and patient privacy, thereby bolstering user confidence.

On the supply chain front, diversifying component sourcing and expanding regional assembly centers will mitigate risks associated with trade policy fluctuations. Establishing strategic buffer inventories for critical optical modules and electronics can cushion the impact of future tariff adjustments. Lastly, harnessing data analytics from connected platforms can unlock actionable insights into scanner utilization patterns and clinical outcomes, laying the groundwork for personalized maintenance services and value-added service models.

Understand the robust multi-stage research approach combining primary interviews, secondary intelligence, and advanced analytical techniques for validated insights

This research follows a rigorous multi-stage methodology that integrates both primary and secondary data sources to ensure comprehensive and reliable insights. Initially, an extensive literature review of peer-reviewed journals, industry white papers, and regulatory publications was conducted to establish a foundational understanding of scanning technologies and clinical applications. Concurrently, trade association reports and patent filings were analyzed to map innovation trajectories and intellectual property trends.

The primary research phase involved structured interviews and surveys with key stakeholders, including dental practitioners, laboratory technicians, equipment distributors, and device manufacturers. These engagements provided qualitative perspectives on technology adoption drivers, pain points in existing workflows, and expectations for future developments. Quantitative data was collected through targeted questionnaires focused on purchase criteria, utilization rates, and regional deployment patterns.

Subsequently, the gathered data underwent triangulation with secondary sources such as government trade statistics, tariff records, and publicly available financial disclosures of leading companies. Advanced analytical techniques, including cross-segmentation analysis and scenario planning, were employed to identify critical market dynamics across product types, end users, technologies, and applications. The research findings were then validated through iterative expert reviews to ensure accuracy, relevance, and strategic applicability.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our 3D Dental Scanners market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- 3D Dental Scanners Market, by Component

- 3D Dental Scanners Market, by Portability

- 3D Dental Scanners Market, by Technology

- 3D Dental Scanners Market, by Light Source

- 3D Dental Scanners Market, by Product Type

- 3D Dental Scanners Market, by Brightness of Optical Engine

- 3D Dental Scanners Market, by Application

- 3D Dental Scanners Market, by End User

- 3D Dental Scanners Market, by Region

- 3D Dental Scanners Market, by Group

- 3D Dental Scanners Market, by Country

- United States 3D Dental Scanners Market

- China 3D Dental Scanners Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 2703 ]

Synthesize how technological evolution, regulatory dynamics, and competitive forces converge to define the future of digital dentistry

In conclusion, three-dimensional dental scanning stands at the forefront of a paradigm shift in dentistry, reshaping the continuum of clinical diagnosis, laboratory fabrication, and patient engagement. The convergence of advanced imaging modalities with artificial intelligence and cloud-based collaboration platforms underscores a future where digital workflows are not mere enhancements but foundational to superior clinical outcomes.

The implications of recent United States tariffs have catalyzed supply chain reconfiguration and accelerated domestic manufacturing initiatives, highlighting the industry’s adaptability in the face of trade policy shifts. Moreover, nuanced segmentation insights reveal diverse adoption patterns driven by device type, end-user environment, technological architecture, and clinical application. Regional analyses further contextualize these trends within distinct regulatory, economic, and cultural landscapes across the Americas, EMEA, and Asia-Pacific.

Armed with an understanding of the competitive dynamics among global leaders, specialized innovators, and regional entrants, decision-makers are positioned to forge strategic partnerships, optimize procurement strategies, and invest in modular, future-proof platforms. As the market continues to evolve, stakeholders who proactively align their R&D, supply chain, and go-to-market initiatives with emerging demands will secure lasting competitive advantage.

Connect with Ketan Rohom for exclusive personalized insights and secure your comprehensive three-dimensional dental scanning market report today

To gain comprehensive insights and empower your strategic decisions in the evolving landscape of three-dimensional dental scanning, we invite you to engage directly with Ketan Rohom, Associate Director of Sales & Marketing. Ketan Rohom’s expertise in articulating the detailed nuances of scanning technologies, regulatory dynamics, and competitive positioning offers an unparalleled opportunity to unlock tailored solutions suitable for your organization’s unique requirements.

By reaching out for a personalized consultation, you will benefit from exclusive access to in-depth discussions on adoption strategies, implementation roadmaps, and best-practice case studies that align with the specific challenges and objectives you face. This one-on-one engagement allows for real-time dialogue, enabling deeper understanding of how extraoral and intraoral scanning modalities can integrate into your existing workflows and future innovations.

Furthermore, Ketan Rohom can guide you through the full scope of this extensive research report, highlighting critical intelligence areas-from transformative technology shifts to the nuanced effects of the latest United States tariff policies. Whether your priority lies in refining operator training, optimizing clinical throughput, or exploring novel application fields such as guided implantology and clear aligner workflows, this conversation will set the stage for actionable outcomes.

Contact Ketan Rohom today to request a sample chapter, discuss custom data insights, or schedule an executive briefing. Take this decisive step to harness the power of cutting-edge 3D dental scanning research and drive your organization toward enhanced clinical precision, patient satisfaction, and sustainable growth.

- How big is the 3D Dental Scanners Market?

- What is the 3D Dental Scanners Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?