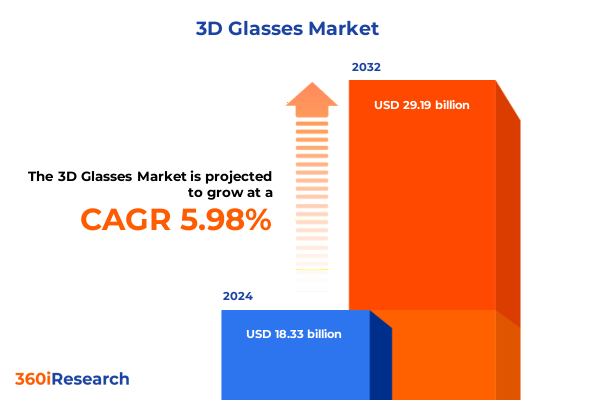

The 3D Glasses Market size was estimated at USD 19.45 billion in 2025 and expected to reach USD 20.65 billion in 2026, at a CAGR of 5.96% to reach USD 29.19 billion by 2032.

Exploring the Convergence of Technological Advancements and Consumer Expectations That Are Propelling Three Dimensional Wearable Display Solutions into Mainstream Adoption and Innovation

In an era defined by relentless technological innovation and shifting consumer expectations, three dimensional wearable displays have emerged as both a novelty and a utility across diverse sectors. From immersive entertainment experiences to precision-driven medical imaging, the trajectory of 3D glasses underscores a pivotal convergence of hardware sophistication and software ingenuity. Consumers are no longer satisfied with flat, two dimensional content; they demand a sense of presence that traditional screens cannot replicate. Simultaneously, businesses and institutions seek depth perception to enhance training simulations, remote collaboration, and diagnostic accuracy.

Against this backdrop, manufacturers and developers are navigating a complex ecosystem where technological paradigms-from active shutter mechanisms to auto stereoscopic lenses-must align with evolving user requirements. Rapid advances in display resolution, lightweight materials, and energy efficiency are enabling prototypes to transition into commercial products at an unprecedented pace. Meanwhile, strategic partnerships between component suppliers, software studios, and distribution platforms are reshaping supply chains and go-to-market strategies. This landscape demands an agile mindset, as stakeholder decisions today will dictate market leadership tomorrow.

This introduction provides a foundation for comprehending how the interplay between consumer demand, technological breakthroughs, and industry collaboration is charting the future of three dimensional glasses. Subsequent sections delve into transformative shifts, trade policy impacts, segmentation dynamics, regional patterns, corporate strategy, actionable guidance, and the research framework supporting these insights.

How Consumer Behavior Shifts and Technological Breakthroughs Are Redefining the Competitive Landscape of Three Dimensional Viewing Accessories

Over the past few years, the landscape of three dimensional eyewear has undergone a series of seismic shifts that redefine competitive benchmarks and user engagement models. Initially driven by enhancements in panel luminance and refresh rates, the industry has rapidly pivoted toward advanced polarization techniques and depth-sensing algorithms. For instance, passive polarized designs have gained popularity in large-scale venues due to their ergonomic simplicity, while active shutter systems are finding renewed purpose in niche simulation and training environments where precision and color accuracy are non-negotiable.

Concurrently, emerging auto stereoscopic displays are gradually eroding the traditional reliance on head-mounted devices, offering consumers glasses-free three dimensional experiences in public spaces such as retail showrooms and medical waiting areas. This shift is fueled by improvements in eye-tracking technology and content-adaptive rendering, which together overcome long-standing barriers of ghosting and viewing angles. As a result, the differentiation calculus for market participants has evolved: it is no longer sufficient to optimize a single performance attribute. Successful solutions now blend form factor innovation, software adaptability, and seamless integration with existing multimedia ecosystems.

Further reshaping the landscape are partnerships between consumer electronics brands and gaming studios, which are accelerating experiential content development cycles. New collaborations are enabling rapid deployment of exclusive titles optimized for specific 3D glass form factors, thus creating closed-loop value propositions that deepen customer loyalty. In summary, transformative shifts in display modalities, eyewear design, and content ecosystems are collectively redefining what it means to deliver a compelling three dimensional experience.

Evaluating the Far Reaching Consequences of Recent United States Trade Measures on Innovative Three Dimensional Eyewear Supply Chains and Cost Structures

In early 2025, the United States implemented a new wave of tariffs targeting key components used in three dimensional glasses, including specialized liquid crystal panels, micro-LED matrices, and precision injection-molded frames. These levies, which range up to 15 percent on imported display modules and up to 10 percent on optical lenses, have precipitated a cascade of cost adjustments across the supply chain. Suppliers based in East Asia, accustomed to high-volume export markets, are recalibrating production volumes and exploring near‐shoring opportunities to mitigate the impact of additional import duties.

As a result of these trade measures, assembly facilities within the United States are facing higher input costs, prompting original equipment manufacturers to reassess sourcing strategies. Several industry players have announced the relocation of subassembly operations to Mexico and other lower‐tariff jurisdictions, thereby reducing the effective duty burden and preserving competitive unit economics. However, this reorientation has also led to logistical complexities and extended lead times, creating pressure on inventory planning and just‐in‐time manufacturing models.

Moreover, the tariff environment has catalyzed innovation in materials science and device architecture, as component developers seek alternative substrate materials and modular optical assemblies that fall outside the tariff scope. While such efforts require considerable R&D investment, they hold the promise of unlocking new higher-margin product tiers. In parallel, end-users are beginning to experience price adjustments, as premium three dimensional glasses carry a modest surcharge to offset the elevated manufacturing expenses. Overall, the cumulative impact of United States tariffs in 2025 is driving a strategic realignment of global supply chains, an accelerated push toward component diversification, and a renewed emphasis on long‐term value engineering.

Unearthing Deep Dive Perspectives Across Technology Modalities Product Configurations Applications and Distribution Pathways in Three Dimensional Glasses Market

A nuanced understanding of the three dimensional glasses market requires an appreciation of how technology, application, product, distribution, and end-user segments intertwine. Within the technology spectrum, active shutter designs command significant attention for their precise synchronization with high-refresh-rate displays, while passive polarized options are prized for broad compatibility and energy efficiency. Auto stereoscopic systems, though still emerging, are carving out a presence in public installations where glasses-free interaction is paramount. Transitioning to applications, consumer electronics continue to dominate adoption, yet gaming and entertainment ecosystems are rapidly outpacing traditional segments by delivering exclusive titles and high-fidelity content. Industrial and aerospace customers, in contrast, value ruggedized form factors and extended lifespan, whereas medical imaging specialists prioritize optical clarity and ergonomic adjustability for diagnostic procedures.

When examining product typologies, dedicated head-mounted glasses offer the most immersive experience at the expense of portability, whereas mobile 3D units strike a balance of convenience and performance for on-the-go consumption. Universal clip-on glasses present a cost-effective retrofit solution, enhancing existing screens without requiring full device replacement. Distribution channels also differ markedly: OEM supply agreements facilitate design-to-production partnerships, offline retail engages end users through experiential showrooms, and online retail leverages e-commerce efficiencies for rapid fulfillment. Finally, end users bifurcate into commercial buyers-prioritizing bulk procurement, service agreements, and long-term technical support-and residential customers, whose purchasing decisions are influenced by ease of use, aesthetic integration, and content availability. Taken together, these segmentation lenses reveal a multifaceted market where product developers must navigate interdependent decision criteria to optimize reach and profitability.

This comprehensive research report categorizes the 3D Glasses market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Technology

- Application

- End User

- Distribution Channel

Profiling Regional Dynamics and Adoption Patterns Spanning the Americas Europe Middle East Africa and Asia Pacific for Advanced Three Dimension Glasses

Regional dynamics in the three dimensional glasses industry reflect a tapestry of consumer preferences, regulatory landscapes, and infrastructure maturity. In the Americas, early adopters in North America drive demand for premium form factors, particularly among gaming communities and enterprise simulation providers. Supportive intellectual property frameworks and proximity to leading software studios foster rapid integration of new eyewear technologies into mainstream applications. Meanwhile, Latin American markets exhibit a preference for cost-effective passive polarized solutions, as consumers and small businesses prioritize affordability and durability over cutting-edge performance.

Across Europe, Middle East & Africa, the regulatory environment varies widely, shaping both hardware certification pathways and content localization requirements. Western European nations, buoyed by strong retail networks, embrace a mix of dedicated head-mounted devices and mobile 3D units, while Eastern European and Middle Eastern markets show growing interest in versatile universal clip-on solutions. In African markets, pilot deployments of 3D glasses in medical imaging and educational technologies underscore the potential for leapfrog innovation. Turning to Asia-Pacific, the region stands at the forefront of manufacturing prowess and consumer electronics adoption. East Asian countries leverage robust domestic supply chains to introduce advanced active shutter glasses with proprietary enhancements, whereas South-East Asia demonstrates surging uptake in gaming and entertainment applications. Emerging economies such as India balance cost considerations with a burgeoning interest in AR/VR hybrids that extend three dimensional capabilities into augmented realities. Collectively, these regional insights underscore the necessity of tailored go-to-market strategies that align with local ecosystem characteristics.

This comprehensive research report examines key regions that drive the evolution of the 3D Glasses market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Leading Innovators and Market Shapers Driving Advancements and Strategic Collaborations within the Three Dimensional Wearable Display Industry

A cadre of established electronics giants and agile newcomers are propelling the three dimensional wearable display sector forward through a combination of R&D investment, strategic alliances, and targeted product rollouts. Industry stalwarts renowned for display manufacturing have leveraged their deep expertise to introduce advanced polarization filters and light-modulation techniques, thereby raising the performance baseline for competitors. Conversely, specialized startups are carving niches in areas such as low-latency eye tracking and ultra-lightweight composite materials, securing partnerships with content creators to co-develop immersive experiences.

Strategic collaborations have also become a hallmark of competitive differentiation. For example, leading chipset providers have entered into co-development agreements with eyewear innovators to fine-tune graphics processing units for three dimensional rendering, ensuring seamless integration with virtual production pipelines. Simultaneously, software platforms specializing in volumetric video capture are integrating directly with hardware manufacturers to deliver end-to-end solutions, from content capture to distribution. These multifaceted alliances not only accelerate time-to-market but also foster ecosystem lock-in by bundling hardware and software into cohesive offerings. As a result, the balance of power within the industry is shifting toward entities that can orchestrate complex value chains, combining optics, electronics, and interactive media under a unified strategic vision.

This comprehensive research report delivers an in-depth overview of the principal market players in the 3D Glasses market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3D Glass Solutions

- AMERICAN PAPER OPTICS

- Corning Incorporated

- Dolby Laboratories, Inc.

- DOMO Gadgets Pvt. Ltd.

- eDimensional Inc.

- Epson America, Inc.

- HCBL CINEMA 3D SYSTEMS

- infitec GmbH

- Lenovo

- LG Electronics

- Lightspeed Design, Inc.

- NVIDIA Corporation

- Optoma Europe Limited

- Panasonic Corporation

- Quantum3D, Inc.

- RealD Inc.

- Samsung Electronics Co., Ltd.

- SCHOTT AG

- Shenzhen HONY Optical Co.,Ltd

- Siemens AG

- SONY Corporation

- VOLFONI IBERIA SL

- VR Lens Lab

- Vuzix (Europe) Limited

Strategic Imperatives for Stakeholders to Harness Emerging Opportunities Mitigate Risks and Drive Growth in the Three Dimensional Eyewear Ecosystem

To capitalize on emerging opportunities and navigate a landscape disrupted by trade policy shifts and rapid technological change, industry leaders should prioritize a set of strategic imperatives. First, diversifying component sourcing through multi-tier supplier ecosystems can mitigate tariff exposure and reduce lead-time risks, while also unlocking access to alternative material innovations. Second, investing in modular optical platforms that accommodate both active and passive polarization techniques will enable product portfolios to address diverse application requirements without necessitating ground-up redesigns.

Moreover, organizations should forge cross-sector partnerships between hardware engineers and content developers to co-create proprietary three dimensional experiences that drive customer loyalty. Integrating immersive applications into existing software ecosystems-such as enterprise collaboration tools or gaming subscription services-can further extend market reach. Additionally, brands must cultivate localized go-to-market strategies by establishing regional test beds and pilot programs, thereby tailoring product iterations to specific regulatory and consumer contexts. Finally, committing to iterative user research and ergonomic testing will ensure that future 3D glasses offerings balance performance gains with wearer comfort, a critical factor for sustained adoption across both commercial and residential segments.

Outlining Rigorous Research Framework Data Collection Protocols and Analytical Approaches Underpinning Comprehensive Three Dimensional Glasses Market Analysis

The insights presented in this executive summary derive from a multi-step research methodology designed to capture both breadth and depth across the three dimensional glasses value chain. Initially, a structured literature review of patent filings, academic publications, and industry white papers established an overview of technological trajectories and innovation hotspots. This secondary research was complemented by primary interviews with key decision-makers representing component manufacturers, software developers, and end-user organizations, enabling validation of market developments and emerging pain points.

Quantitative data collection encompassed a proprietary supplier database that tracks design wins, production capacities, and partnership announcements. Analytical frameworks applied include SWOT analysis to assess competitive positioning, Porter’s Five Forces to evaluate ecosystem pressures, and cross-impact mapping to identify areas of convergence between hardware and content domains. Regional market profiling utilized a combination of trade data evaluation and localized field surveys to discern regulatory influences and consumer sentiment. Finally, triangulation techniques were employed to reconcile disparate data sources and ensure robustness of conclusions. This rigorous approach underpins the strategic recommendations and sector insights articulated throughout this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our 3D Glasses market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- 3D Glasses Market, by Product

- 3D Glasses Market, by Technology

- 3D Glasses Market, by Application

- 3D Glasses Market, by End User

- 3D Glasses Market, by Distribution Channel

- 3D Glasses Market, by Region

- 3D Glasses Market, by Group

- 3D Glasses Market, by Country

- United States 3D Glasses Market

- China 3D Glasses Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Summarizing Core Findings and Strategic Considerations to Navigate the Complexities of the Three Dimensional Glasses Landscape and Capitalize on Future Disruptions

In synthesizing the technological, regulatory, and competitive factors shaping the three dimensional glasses landscape, it becomes clear that the market is entering a new phase of maturation. Advancements in polarization technology, depth rendering algorithms, and ergonomic design are converging to deliver products that meet both performance expectations and user comfort criteria. At the same time, trade policy dynamics have highlighted the importance of supply chain resilience and strategic sourcing, prompting stakeholders to reevaluate operational footprints and partnership models.

Segmentation analysis reveals that no single product type or distribution channel holds a monopoly on growth; rather, success will hinge on the ability to orchestrate hybrid portfolios that cater to distinct use cases. Regional insights further underscore the need for contextual strategies, with North America, Europe, Middle East & Africa, and Asia-Pacific each exhibiting unique adoption drivers. Leading companies capable of integrating optical engineering, electronic miniaturization, and content ecosystem development stand to capture disproportionate value, provided they maintain agility in the face of evolving consumer demands and policy landscapes.

Ultimately, the path forward demands a delicate balance between innovation speed and operational discipline. Organizations that proactively invest in cross-functional partnerships, modular design frameworks, and localized market testing will be best positioned to harness the full potential of three dimensional wearable displays. As the boundary between virtual and physical realities continues to blur, those who translate these insights into decisive action will chart the course for the industry’s next wave of growth.

Connect with an Associate Director to Secure the Definitive Comprehensive Three Dimensional Glasses Market Research Report and Outpace Competitors

To position your organization at the forefront of three dimensional eyewear innovation and secure a comprehensive repository of strategic intelligence, reach out to Ketan Rohom, Associate Director of Sales & Marketing, to obtain the full market research report tailored to your unique business objectives and accelerate your competitive advantage

- How big is the 3D Glasses Market?

- What is the 3D Glasses Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?