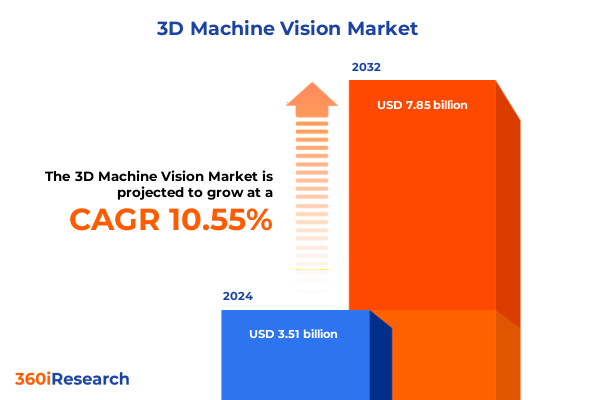

The 3D Machine Vision Market size was estimated at USD 3.86 billion in 2025 and expected to reach USD 4.26 billion in 2026, at a CAGR of 10.64% to reach USD 7.85 billion by 2032.

Groundbreaking Exploration of How 3D Machine Vision Is Redefining Precision, Enhancing Automation and Shaping the Future of Industrial Efficiency

Groundbreaking Exploration of How 3D Machine Vision Is Redefining Precision, Enhancing Automation and Shaping the Future of Industrial Efficiency

Three dimensional machine vision has emerged as a cornerstone of modern industrial automation by weaving depth perception into digital imagery to achieve unparalleled levels of precision. Unlike traditional two dimensional systems that rely solely on a flat representation of objects, 3D machine vision fuses spatial data with real time image analysis to deliver robust solutions for complex manufacturing environments. This convergence of optical engineering, sensor technology, and advanced algorithms has enabled decision makers to refine product quality, accelerate cycle times, and minimize waste at scale.

As global industries confront intensifying demands for accuracy and consistency, 3D machine vision systems have proven essential in unlocking new efficiencies across production lines. Their ability to measure volume, detect defects, and guide robotic operations has become integral for sectors ranging from automotive assembly to semiconductor fabrication. By offering a granular view of components and assemblies, these systems not only enhance process reliability but also empower engineering teams to iterate designs with greater confidence, driving a continuous improvement ethos within manufacturing settings.

Moreover, the integration of three dimensional vision with emerging computational paradigms such as edge computing and artificial intelligence is catalyzing a paradigm shift in how data is acquired, processed, and acted upon. Innovations in sensor miniaturization and real time neural network inference are enabling smaller footprints and lower latencies, allowing vision solutions to embed directly within robotics and mobile inspection platforms. This trend toward distributed intelligence underscores the transformative potential of 3D machine vision to redefine how industrial systems perceive, interpret, and respond to their surroundings.

Navigating Major Technological Transformations That Have Propelled 3D Machine Vision Beyond Traditional Imaging into Intelligent Spatial Analysis

Navigating Major Technological Transformations That Have Propelled 3D Machine Vision Beyond Traditional Imaging into Intelligent Spatial Analysis

Over the past decade, several breakthrough innovations have converged to elevate three dimensional machine vision from a niche research topic to a mission critical industrial tool. The advent of high speed, high resolution depth sensors has significantly broadened the scope of applications by delivering richer point cloud representations at faster frame rates. These improvements ushered in a new era of measurement accuracy, allowing systems to detect micron level deviations on complex geometries that were previously beyond the reach of standard two dimensional cameras.

In parallel, the infusion of deep learning methodologies within vision software has accelerated the development of adaptive inspection capabilities. Neural networks trained on volumetric datasets now excel at pattern recognition, anomaly detection, and predictive maintenance tasks, effectively reducing false positives and enabling dynamic calibration during production. Combined with structured light and time of flight techniques, these computational advances are redefining spatial analysis, enabling vision systems to discern subtle surface textures and irregularities that betray potential quality defects.

Furthermore, the proliferation of edge computing architectures has fostered a more resilient and scalable deployment model for machine vision. By decentralizing processing workloads and embedding intelligence closer to the point of measurement, organizations can achieve lower latency, enhanced data privacy, and reduced reliance on bandwidth intensive cloud connections. This shift not only bolsters real time responsiveness in safety critical settings but also streamlines system integration, empowering cross functional teams to orchestrate inspection and guidance workflows with unprecedented agility.

Comprehensive Examination of the 2025 United States Tariff Policy and Its Far-Reaching Consequences on the 3D Machine Vision Ecosystem

Comprehensive Examination of the 2025 United States Tariff Policy and Its Far-Reaching Consequences on the 3D Machine Vision Ecosystem

The imposition of new tariffs in early 2025 on key optical and electronic components has reverberated throughout the entire three dimensional machine vision value chain, influencing everything from sourcing strategies to product roadmaps. Hardware manufacturers, facing elevated import duties on cameras, lighting modules, and specialized sensors, have reevaluated their supply networks to mitigate cost pressures. This necessity has prompted a wave of nearshoring initiatives, as well as collaborative arrangements with domestic semiconductor foundries to maintain price competitiveness and safeguard production continuity.

At the software end of the spectrum, the indirect effects of hardware tariff adjustments have driven renewed interest in algorithmic optimization and sensor fusion. Developers are intensifying efforts to extract greater informational value from fewer or lower cost optical modules, leveraging advanced deep learning frameworks to compensate for hardware constraints. This optimization-driven approach underscores a broader strategic shift, in which cross discipline innovation becomes paramount for sustaining performance benchmarks in the face of evolving trade policies.

Looking ahead, these tariff driven dynamics are expected to shape long term investment priorities within the industry. Capital allocation is increasingly favoring modular, adaptable architectures that can accommodate both domestic and import sourced components. As market participants continue to navigate this policy landscape, agility in procurement and a proactive stance toward regulatory changes will remain critical for preserving operational resilience and competitive differentiation.

In Depth Analysis of Component Technology Applications and Industry End User Trends Shaping the 3D Machine Vision Market Segmentation Dynamics

In Depth Analysis of Component Technology Applications and Industry End User Trends Shaping the 3D Machine Vision Market Segmentation Dynamics

The three dimensional machine vision market exhibits a bifurcation between hardware and software offerings, each driving distinct growth trajectories and innovation imperatives. On the hardware front, cameras and sensors form the backbone of any vision deployment, while advanced lighting and precision optics refine image quality under challenging conditions. High performance processors ensure that voluminous depth maps and point clouds are rendered and analyzed in real time, enabling responsive feedback loops for robotic actuators and inspection stations. Conversely, software platforms leverage deep learning frameworks and traditional image processing routines to translate raw sensor outputs into actionable insights, evolving rapidly to support adaptive calibration and predictive analytics.

Layering on top of component distinctions, the dominant technical modalities-laser triangulation, stereo vision, structured light, and time of flight-each present unique trade offs in terms of resolution, speed, and environmental robustness. Laser triangulation remains a go to for fine feature extraction and surface profiling, whereas structured light systems excel in volumetric measurement tasks where ambient interference is minimal. Stereo vision approaches provide cost effective depth perception by mimicking human binocular vision, and time of flight solutions deliver rapid scene capture in dynamic manufacturing contexts.

In real world deployments, these technological variants converge across a spectrum of applications such as precise identification of parts on conveyor lines, dimensional measurement of complex geometries, robotic position guidance in assembly cells, and rigorous quality assurance routines that detect microscopic defects. The aerospace and defense sectors rely heavily on high accuracy profiling for critical component validation, while the automotive and electronics industries demand high throughput inspection for both safety critical and consumer grade products. Food and beverage manufacturers increasingly deploy vision solutions for package integrity checks, and healthcare providers leverage three dimensional imaging for device assembly and pharmaceutical packaging. Meanwhile, the retail sector experiments with shelf scanning and automated checkout, showcasing the broad applicability of this technology across diverse end user industries.

This comprehensive research report categorizes the 3D Machine Vision market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Product Type

- Technology

- Application

- End-User Industry

Insightful Regional Perspectives Highlighting Growth Drivers and Adoption Trends Across the Americas, EMEA and Asia Pacific in 3D Machine Vision

Insightful Regional Perspectives Highlighting Growth Drivers and Adoption Trends Across the Americas, EMEA and Asia Pacific in 3D Machine Vision

Adoption patterns for three dimensional machine vision vary markedly by region, reflecting differences in industrial maturity, regulatory frameworks, and investment climates. In the Americas, well established manufacturing hubs in North America are leaning into automation upgrades to address labor constraints and maintain global competitiveness. The presence of leading technology vendors, coupled with supportive government incentives for advanced manufacturing initiatives, has solidified the region’s status as a test bed for cutting edge vision deployments in sectors like automotive assembly and semiconductor fabrication.

Shifting focus to Europe, the Middle East and Africa, the convergence of stringent quality standards in automotive and defense with robust investment in Industry 4.0 programs has stimulated demand for high precision inspection systems. European OEMs are partnering with local robotics integrators to create turnkey solutions that integrate three dimensional vision into existing production infrastructures. In parallel, emerging markets in the Middle East are exploring vision guided robotics for aerospace maintenance and pipeline inspection, demonstrating the geographical breadth of application scenarios.

In the Asia Pacific region, government led initiatives aimed at digitizing supply chains and strengthening domestic technology capabilities have propelled significant uptake of machine vision. Electronics manufacturing giants in East Asia are deploying sophisticated three dimensional inspection systems to support miniaturized component production, while Southeast Asian countries are ramping up investments in smart factory frameworks. Collectively, these regional dynamics underscore a global mosaic of adoption, where each geography applies three dimensional machine vision in ways that align with its unique industrial strengths and strategic priorities.

This comprehensive research report examines key regions that drive the evolution of the 3D Machine Vision market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Competitive Landscape Evaluation Emphasizing Innovative Leadership and Partnership Trends Among Prominent 3D Machine Vision Providers

Strategic Competitive Landscape Evaluation Emphasizing Innovative Leadership and Partnership Trends Among Prominent 3D Machine Vision Providers

The competitive arena of three dimensional machine vision is characterized by the coexistence of established hardware manufacturers and agile software innovators, each vying to capture critical points of differentiation. Legacy electronics firms have leveraged decades of sensor and optics expertise to introduce camera platforms with unparalleled resolution and low light performance, while specialist software vendors rapidly iterate on deep learning models to unlock new inspection capabilities. Strategic collaborations between these camps are increasingly common, enabling the bundling of turnkey systems that marry best in class hardware with intuitive analytics modules.

Amid this environment, mid size technology outfits are forging partnerships with academic research centers and robotics integrators to fast track prototyping of customized solutions. By integrating proprietary sensor fusion algorithms with off the shelf cameras, these entrants have carved out niche positions in sectors such as pharmaceutical packaging and precision agriculture. Meanwhile, global conglomerates continue to strengthen their market positions through targeted acquisitions of complementary software startups and regional system integrators, broadening their solution portfolios and expanding distribution networks.

This dynamic interplay has led to accelerated innovation cycles, with incumbents investing heavily in research and development to maintain technological leadership. Cross industry alliances focusing on interoperability standards are also emerging, aimed at reducing integration complexity and fostering a more open ecosystem. As competition intensifies, the ability to deliver holistic solutions-combining hardware, software and integration services-will differentiate leading players and determine long term market share.

This comprehensive research report delivers an in-depth overview of the principal market players in the 3D Machine Vision market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3D Infotech, Inc.

- Amtek Instruments Pvt Ltd

- Balluff GmbH

- Basler AG

- Canon,Inc

- Cognex Corporation

- Dassault Systèmes SE

- EPIC Systems Group LLC

- Hermary Opto Electronics Inc.

- Industrial Vision Systems

- Intel Corporation

- Inuitive Ltd.

- ISRA VISION GmbH

- Keyence Corporation

- Luminar Sdn. Bhd.

- Luxolis

- Mech-Mind Robotics Technologies Co., Ltd.

- MVTec Software Gmbh

- National Instruments Corporation

- OMNIVISION Technologies, Inc.

- Omron Corporation

- Optotune Switzerland AG

- Pleora Technologies Inc.

- Qualitas Technologies

- Sick AG

- Sony Group Corporation

- Stemmer Imaging AG

- Teledyne Technologies Incorporated

- TKH Group NV

- Zebra Technologies Corporation

Proactive Strategic Guidance for Industry Stakeholders to Capitalize on Emerging Opportunities and Navigate the 3D Machine Vision Market Evolution

Proactive Strategic Guidance for Industry Stakeholders to Capitalize on Emerging Opportunities and Navigate the 3D Machine Vision Market Evolution

To harness the full potential of three dimensional machine vision, industry leaders must prioritize investments in adaptive software and flexible hardware architectures that can evolve alongside emerging use cases. Focusing on integration of deep learning models at the edge will empower organizations to conduct real time analytics directly within production cells, thereby reducing latency and network dependencies. Simultaneously, diversifying supplier bases and establishing modular component ecosystems will mitigate the impact of changing trade policies and supply chain disruptions, ensuring stable access to critical optical and electronic parts.

Another essential recommendation is to foster cross functional collaboration between data scientists, mechanical engineers, and operations teams to co develop custom vision workflows tailored to enterprise specific challenges. This collaborative framework will drive continuous refinement of inspection parameters and calibration routines, leading to incremental performance gains and higher yields. Organizations should also explore shared innovation initiatives with end user partners, leveraging pilot programs to validate novel applications in fields such as additive manufacturing and collaborative robotics.

Finally, leadership must cultivate a culture of data governance and cybersecurity best practices to safeguard sensitive production metrics and intellectual property. As three dimensional point cloud data becomes more valuable for predictive maintenance and digital twin modeling, robust encryption, access controls and audit mechanisms will be critical for maintaining trust across partner ecosystems. By implementing these strategic imperatives, stakeholders can position themselves at the forefront of the industry’s next wave of growth.

Comprehensive and Rigorous Research Framework Combining Primary Insights and Secondary Data to Ensure Reliability in 3D Machine Vision Market Analysis

Comprehensive and Rigorous Research Framework Combining Primary Insights and Secondary Data to Ensure Reliability in 3D Machine Vision Market Analysis

This study employs a multifaceted research design that begins with in depth interviews of subject matter experts across camera manufacturing, software development, and systems integration. Primary qualitative insights were gathered through consultations with senior engineering leads, operations managers, and end user decision makers to capture real world deployment challenges and strategic imperatives. These expert perspectives were then corroborated with extensive secondary research drawn from peer reviewed journals, industry white papers, public filings, and leading technology trade publications to construct a holistic view of the market landscape.

Quantitative data was triangulated using a combination of company reported sales volumes, patent filing trends, and procurement records sourced from publicly listed manufacturers and integrators. Rigorous validation processes involved cross referencing multiple data points and conducting follow up interviews to resolve discrepancies. Additionally, scenario analysis was applied to evaluate the sensitivity of market dynamics under varying policy and technology adoption trajectories. This methodology fostered a robust and defensible analytical foundation, ensuring that the insights and recommendations presented herein reflect both empirical rigor and strategic relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our 3D Machine Vision market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- 3D Machine Vision Market, by Component

- 3D Machine Vision Market, by Product Type

- 3D Machine Vision Market, by Technology

- 3D Machine Vision Market, by Application

- 3D Machine Vision Market, by End-User Industry

- 3D Machine Vision Market, by Region

- 3D Machine Vision Market, by Group

- 3D Machine Vision Market, by Country

- United States 3D Machine Vision Market

- China 3D Machine Vision Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Concluding Synthesis Emphasizing the Strategic Importance and Future Trajectory of 3D Machine Vision in Advancing Industrial Automation

Concluding Synthesis Emphasizing the Strategic Importance and Future Trajectory of 3D Machine Vision in Advancing Industrial Automation

In summary, three dimensional machine vision stands at the nexus of technological innovation and operational excellence, offering organizations the tools to unlock unprecedented levels of precision and efficiency. From the integration of advanced depth sensing modalities to the implementation of edge based artificial intelligence, the evolution of this field continues to disrupt conventional inspection and guidance workflows. As trade policies shift and regional investment patterns evolve, market participants who exhibit agility in procurement and a willingness to embrace cross discipline collaboration will be best positioned to thrive.

Looking forward, the confluence of machine vision data with broader industrial IoT ecosystems and digital twin frameworks foreshadows a new era of intelligent manufacturing. Organizations that proactively adapt their architectures to accommodate distributed processing and real time analytics will realize the greatest strategic gains. By aligning executive vision with technical execution and fostering an ecosystem of partnership, stakeholders can capitalize on the transformative potential of three dimensional machine vision to drive sustained competitive advantage in an increasingly automated world.

Unlock Comprehensive 3D Machine Vision Insights and Engage Ketan Rohom for a Tailored Brief to Propel Your Strategic Decisions

Engaging with the intricacies of three dimensional machine vision can transform strategic decision making and operational outcomes, paving the way for sustained competitive advantage. Ketan Rohom, Associate Director, Sales & Marketing, invites industry stakeholders to take the next step by securing a comprehensive market research report that offers unparalleled depth and clarity. By discussing your specific requirements with Ketan, you can access tailored insights, one-on-one consultations, and customized data extracts designed to address your organization’s unique challenges. This tailored engagement ensures that your executives and technical teams receive actionable intelligence that aligns with your strategic goals and accelerates innovation. Reach out to Ketan Rohom today to explore the full breadth of findings and recommendations encapsulated in this in-depth analysis, and position your enterprise at the vanguard of 3D machine vision adoption and excellence

- How big is the 3D Machine Vision Market?

- What is the 3D Machine Vision Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?