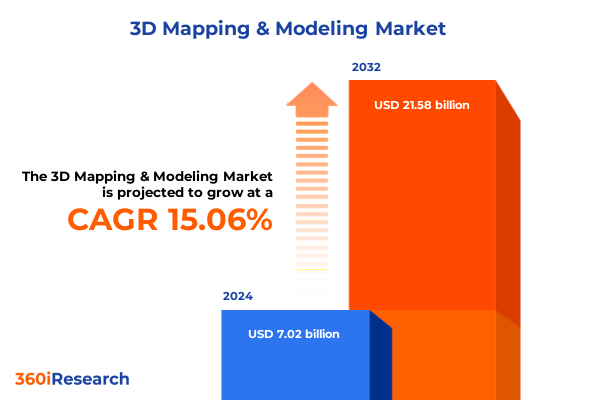

The 3D Mapping & Modeling Market size was estimated at USD 8.04 billion in 2025 and expected to reach USD 9.22 billion in 2026, at a CAGR of 15.14% to reach USD 21.58 billion by 2032.

Exploring the Evolution and Strategic Significance of Advanced Three-dimensional Mapping and Modeling in Modern Geospatial Applications

Three-dimensional mapping and modeling technologies have transformed the way organizations visualize, analyze, and interact with spatial data. By transcending traditional two-dimensional representations, these advanced geospatial methods enable dynamic simulations, precise measurements, and immersive experiences. With the convergence of high-resolution sensors, powerful processing algorithms, and accessible software platforms, stakeholders across industries can harness spatial intelligence to enhance decision-making, optimize workflows, and innovate products and services.

Over the past decade, continued advancements in sensor miniaturization and computational capacity have accelerated the adoption of laser scanning, lidar, photogrammetry, and simultaneous localization and mapping (SLAM) techniques. These four foundational technologies now underpin a broad spectrum of use cases, from infrastructure development and autonomous navigation to cultural heritage preservation and virtual environment creation. As integration with cloud computing, edge analytics, and artificial intelligence becomes more seamless, the three-dimensional mapping ecosystem is poised for sustained evolution. This introduction outlines the strategic relevance of these technologies and sets the stage for a comprehensive exploration of market transformations and actionable insights.

Understanding the Revolutionary Shifts Redefining Three-dimensional Mapping and Modeling Technologies across Industries and Use Cases

The three-dimensional mapping and modeling landscape is experiencing transformative inflection points that are reshaping capabilities and market dynamics. Sensor miniaturization is enabling the deployment of lightweight lidar and photogrammetry systems on unmanned aerial vehicles and handheld mobile platforms, unlocking new applications in disaster response and urban planning. Furthermore, breakthroughs in artificial intelligence and machine learning have automated complex point cloud processing tasks, reducing manual intervention and shortening project timelines.

Cloud-based infrastructures and edge computing have collectively enhanced the scalability and accessibility of spatial data workflows. Real-time data streaming combined with collaborative online environments empowers distributed teams to co-create and validate models concurrently. In parallel, advancements in SLAM algorithms-encompassing both lidar-based and visual slam methodologies-are improving localization accuracy and facilitating simultaneous mapping and navigation in GPS-denied environments. These converging shifts underscore a market environment defined by accelerated iteration cycles, interoperable platforms, and cross-industry collaboration.

Analyzing the Aggregate Effects of New United States Tariffs on Three-dimensional Mapping and Modeling Supply Chains and Technology Adoption

In 2025, new import tariffs imposed on critical components such as optical sensors, lidar modules, and high-resolution cameras have introduced a series of complex challenges and opportunities for the three-dimensional mapping and modeling industry. Supply chains have been compelled to re-evaluate sourcing strategies, leading some organizations to explore nearshore manufacturing and diversify vendor portfolios. These strategic moves aim to mitigate cost fluctuations while ensuring continuity of component availability for hardware integrators and service providers.

Tariff-driven cost pressures have also prompted a renewed focus on software-centric business models, encouraging enterprises to emphasize subscription-based offerings and pay-per-use pricing mechanisms over traditional licensing agreements. As a result, many software vendors are enhancing cloud-based platforms to deliver scalable analytics, secure data storage, and modular feature sets that offset hardware price increases. At the same time, research and development teams are prioritizing sensor fusion and algorithmic optimization to extract greater value from existing hardware, thereby counterbalancing the financial impact of import duties.

Despite initial concerns about increased capital expenditures, these regulatory changes have spurred innovation across the ecosystem. Organizations are accelerating collaborations with regional manufacturing partners, investing in end-to-end service models that integrate hardware leasing with software subscriptions, and expanding training programs to maximize return on existing equipment. Consequently, the landscape is evolving toward more resilient supply chains and diversified revenue streams, laying the groundwork for sustainable growth in a higher-tariff environment.

Uncovering Critical Segmentation Drivers Shaping Three-dimensional Mapping and Modeling Markets across Technologies Applications and Industries

The three-dimensional mapping and modeling market is delineated by several core segmentation strategies that illuminate distinct growth vectors. Within the technology framework, laser scanning remains pivotal, subdivided into both mobile and terrestrial solutions, while lidar spans airborne, mobile, and terrestrial implementations. Photogrammetry techniques are further classified into close range, drone, and satellite methodologies, each delivering unique resolution and coverage trade-offs. Concurrently, simultaneous localization and mapping (SLAM) technologies bifurcate into lidar-based slam and visual slam approaches, catering to scenarios requiring real-time spatial awareness.

On the application front, cultural heritage preservation and site excavation define archaeology initiatives, whereas disaster management leverages earthquake simulation and flood monitoring to bolster resilience. Navigation and autonomous systems incorporate autonomous cars, drones and unmanned aerial vehicles, and robotics use cases. Urban planning benefits from infrastructure development and smart city frameworks, while the virtual reality segment addresses both gaming and simulation and training environments.

End users span the automotive and transportation sector, construction and engineering, government and defense agencies, media and entertainment, mining and geology enterprises, and the oil and gas industry. Deployment modes encompass cloud-based services that facilitate scalability alongside on-premises installations offering enhanced data sovereignty. Pricing strategies range from perpetual licensing to flexible pay-per-use and subscription models. Additionally, vertical industries such as environmental monitoring, real estate, transportation and logistics, and utilities present specialized requirements and adoption patterns that drive tailored solution development.

This comprehensive research report categorizes the 3D Mapping & Modeling market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Pricing Model

- Application

- End User

- Deployment Mode

- Vertical Industry

Revealing Distinct Regional Dynamics Influencing Adoption and Development of Three-dimensional Mapping and Modeling in Global Markets

Regional examination of the three-dimensional mapping and modeling sector reveals divergent adoption patterns and regulatory frameworks. In the Americas, robust research and development infrastructure combined with significant government funding for smart infrastructure initiatives has established North America as a technology leader. The presence of major aerospace and automotive OEMs fosters partnerships with specialized integrators, accelerating rollout of advanced lidar scanning and photogrammetry applications across commercial and defense domains.

Within Europe, Middle East and Africa, regulatory harmonization efforts, including cross-border data standards and safety directives, have elevated demand for interoperable solutions. European municipalities prioritize urban planning models that integrate environmental monitoring with smart city platforms, while the Middle East is channeling substantial capital into large-scale infrastructure and digital twin projects. In Africa, emerging markets are leveraging mobile laser scanning and drone photogrammetry to address resource mapping and disaster preparedness amid limited legacy mapping databases.

Asia-Pacific is witnessing accelerated deployment of three-dimensional mapping and modeling solutions driven by infrastructure modernization in China and India, widespread adoption of autonomous vehicle trials in Japan and South Korea, and ASEAN nations exploring cloud-based applications for agricultural monitoring. These regional disparities underscore the importance of localized go-to-market strategies and regulatory compliance pathways tailored to distinct economic and technological landscapes.

This comprehensive research report examines key regions that drive the evolution of the 3D Mapping & Modeling market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Pioneering Organizations Driving Innovation and Strategic Collaborations in the Three-dimensional Mapping and Modeling Ecosystem

Leading organizations in the three-dimensional mapping and modeling arena are distinguished by their integration of cutting-edge sensor technologies, robust software platforms, and strategic ecosystem partnerships. One notable technology provider has solidified its market leadership through a combination of terrestrial laser scanning hardware and cloud-native processing solutions. Another competitor has expanded its footprint by acquiring specialized photogrammetry software developers and embedding AI-driven point cloud analytics within its core offering.

Several differentiated players are driving innovation through alliances with autonomous vehicle manufacturers and robotics firms, enabling real-world validation of SLAM and lidar systems. Collaborative partnerships between hardware manufacturers and digital twin platforms are facilitating the creation of comprehensive infrastructure models for urban planning and utilities management. Furthermore, cloud services providers are forging strategic relationships with mapping vendors to deliver seamless data ingestion, high-performance computing, and integrated GIS capabilities.

Competitive dynamics also reflect ongoing investment in research centers, patent filings for novel scanning algorithms, and expansion into adjacent verticals, such as media production for virtual reality content. Organizations that effectively balance hardware development with software innovation, while nurturing an agile partnership ecosystem, are best positioned to capture emerging opportunities and shape the next phase of market growth.

This comprehensive research report delivers an in-depth overview of the principal market players in the 3D Mapping & Modeling market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adobe Inc.

- Airbus SE

- Aries Marine and Engineering Service

- Autodesk, Inc.

- Bentley Systems, Incorporated

- Chicago Projection Mapping

- Concept3D, Inc.

- CyberCity 3D, Inc.

- Dassault Systèmes S.E.

- Environmental Systems Research Institute, Inc.

- Golden Software, LLC

- Hexagon AB

- Information Transformation Services

- Intertek Group PLC

- Jensen Consulting Limited

- Lumen and Forge, LLC

- LuxCarta

- Mapbox, Inc.

- MAPSystems

- Matterport, Inc.

- Maxon Computer GmbH

- Mitsubishi Electric Corporation

- NavVis GmbH

- Nebulem Manufacturing Limited

- TomTom International B.V.

- Topcon Positioning Systems, Inc.

- Trimble Inc.

Formulating Strategic Imperatives and Actionable Guidance to Empower Industry Leaders in Expanding Three-dimensional Mapping Capabilities

Industry leaders seeking to capitalize on the evolving three-dimensional mapping landscape should prioritize modular sensor integration strategies that allow for rapid adaptation to emerging hardware innovations. By adopting open APIs and standardized data schemas, organizations can ensure interoperability across diverse platforms and reduce integration complexity. In addition, investing in edge computing capabilities will enable real-time processing of spatial data, lowering latency and enhancing field operations for applications such as autonomous navigation and disaster response.

Strategic partnerships with cloud service providers offer the opportunity to develop hybrid deployment models that align with client requirements for scalability, security, and regulatory compliance. Leaders should also explore collaborative research initiatives with academic institutions and consortia to advance algorithmic optimization, especially in domains like SLAM and AI-enhanced photogrammetry. Moreover, establishing in-house training programs for data scientists and geospatial engineers will cultivate specialized expertise critical to differentiating service offerings.

Finally, executives are encouraged to evaluate pay-per-use and subscription pricing frameworks to lower entry barriers for new customers while generating predictable revenue streams. By continuously iterating on customer feedback loops and usage analytics, organizations can refine their product roadmaps and deliver incremental feature enhancements aligned with market demand.

Detailing a Robust and Transparent Research Methodology Underpinning Comprehensive Three-dimensional Mapping and Modeling Market Insights

The research methodology underpinning this analysis combines rigorous primary and secondary research phases designed to provide comprehensive and transparent market insights. Primary data was collected through in-depth interviews with industry stakeholders, including hardware manufacturers, software providers, technology integrators, and end users across multiple verticals. These interviews were supplemented by expert workshops and Delphi panel sessions that validated emerging trends and competitive strategies.

Secondary research comprised systematic review of industry publications, technical journals, regulatory documents, and patent databases. Information from trade associations and public filings was triangulated to ensure accuracy and contextual relevance. The market segmentation framework was developed through an iterative process, aligning technological categories and application domains with real-world deployment scenarios.

Qualitative analysis techniques, including SWOT and PESTEL assessments, were applied to interpret macroeconomic factors, regulatory shifts, and competitive dynamics. Data integrity was ensured through cross-verification with multiple sources and continuous liaison with domain experts. Finally, research findings were peer-reviewed and subjected to senior editorial scrutiny to uphold the highest standards of clarity, consistency, and methodological rigor.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our 3D Mapping & Modeling market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- 3D Mapping & Modeling Market, by Technology

- 3D Mapping & Modeling Market, by Pricing Model

- 3D Mapping & Modeling Market, by Application

- 3D Mapping & Modeling Market, by End User

- 3D Mapping & Modeling Market, by Deployment Mode

- 3D Mapping & Modeling Market, by Vertical Industry

- 3D Mapping & Modeling Market, by Region

- 3D Mapping & Modeling Market, by Group

- 3D Mapping & Modeling Market, by Country

- United States 3D Mapping & Modeling Market

- China 3D Mapping & Modeling Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2544 ]

Synthesizing Key Takeaways and Strategic Implications to Illuminate the Future Trajectory of Three-dimensional Mapping and Modeling Technologies

The convergence of advanced sensor technologies, computational breakthroughs, and interconnected ecosystems has established three-dimensional mapping and modeling as indispensable tools for modern enterprises. As organizations navigate complex regulatory environments and supply chain uncertainties, strategic emphasis on software-driven solutions and flexible deployment models will be instrumental in sustaining competitive advantage. Moreover, the sector’s continued alignment with emerging domains such as autonomous systems, virtual reality, and digital twins underscores its role as a catalyst for broader digital transformation initiatives.

Regional nuances, from North America’s R&D prowess to Asia-Pacific’s infrastructure expansion and EMEA’s regulatory harmonization, highlight the need for localized strategies that leverage specific market strengths. Leading companies that successfully integrate hardware innovation with cloud-native architectures and cultivate cross-industry partnerships are positioned to define the next wave of growth. Furthermore, adherence to modular pricing frameworks and open data standards will facilitate adoption among diverse end users and applications.

In summation, the three-dimensional mapping landscape is characterized by dynamic shifts that demand proactive adaptation and collaboration. With a clear understanding of segmentation drivers, regional dynamics, and regulatory influences, stakeholders can formulate informed strategies that harness the full potential of spatial intelligence.

Engage with Ketan Rohom to Access In-depth Three-dimensional Mapping Market Research Report and Drive Strategic Growth with Tailored Insights

To explore deeper into the evolving realm of three-dimensional mapping and modeling and secure comprehensive market intelligence, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Engaging with Ketan will grant you tailored strategic perspectives that align with your organization’s unique objectives. Through a personalized consultation, you can uncover actionable insights, leverage expert guidance on emerging technologies, and gain prioritization frameworks essential for driving innovation.

By purchasing the full market research report, you will benefit from in-depth analyses of technology trends, application use cases, regional dynamics, and competitive landscapes. Ketan Rohom will guide you through report highlights, demonstrate how these insights can fortify your strategic road map, and facilitate a seamless acquisition process. Take advantage of this opportunity to partner with an expert and empower your decision-making with authoritative data and forward-looking recommendations.

- How big is the 3D Mapping & Modeling Market?

- What is the 3D Mapping & Modeling Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?