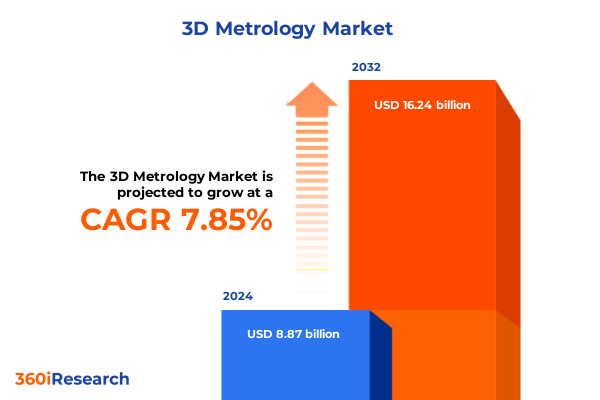

The 3D Metrology Market size was estimated at USD 11.32 billion in 2025 and expected to reach USD 12.17 billion in 2026, at a CAGR of 7.73% to reach USD 19.07 billion by 2032.

Exploring the Evolving Dynamics and Strategic Imperatives of the Global Advanced 3D Metrology Industry to Establish Context and Drive Comprehensive Understanding

The advanced 3D metrology landscape is defined by a convergence of precision engineering, digital transformation, and increasingly stringent quality control requirements across industries. Over the past decade, manufacturers and service providers have transitioned from manual inspection methods to integrated digital workflows that leverage point cloud processing, CAD comparison, and simulation capabilities. This evolution has been driven by the pursuit of tighter tolerances, accelerated time to market, and the imperative to harness data-driven insights for competitive differentiation. Simultaneously, the proliferation of portable arm systems and handheld scanners has democratized access to high-fidelity measurement tools, enabling applications that span research and development laboratories through to dynamic production environments.

As organizations navigate this shifting environment, they confront a spectrum of challenges-ranging from interoperability across hardware and software ecosystems to the growing complexity of multi-sensor coordinate measuring machines and structured light systems. Emerging demands for inline inspection and real-time feedback have placed a premium on speed and accuracy, while additive manufacturing and reverse engineering initiatives increasingly rely on non-contact 3D scanning and white light interferometry techniques to validate part geometry. In this context, the capacity to deliver actionable measurement reporting and robust data output formats-whether proprietary or industry-standard such as ASCII and STL-has become a critical differentiator for both equipment suppliers and software developers.

This report opens with an exploration of the foundational dynamics propelling the advanced 3D metrology sector, setting the stage with an overview of technology trajectories, regulatory influences, and the growing emphasis on quality assurance. By framing the industry’s strategic imperatives and the macroeconomic forces at play, readers will gain the necessary context to delve deeper into the subsequent analysis of transformative trends, tariff impacts, and segmentation-driven insights that underpin informed decision-making in this rapidly evolving domain.

Uncovering the Pivotal Technological and Market Transformations Reshaping the Future Trajectory of 3D Metrology and Quality Assurance Practices

Within the 3D metrology ecosystem, the pace of innovation has accelerated markedly as digital integration and intelligent automation become central to operational excellence. Smart factories are embedding measurement systems directly into production lines, facilitating Inline Inspection that captures and analyzes part geometries in real time. Concurrently, the convergence of CAD comparison tools with point cloud processing software has streamlined workflows, enabling rapid detection of deviations during Deformation Analysis and Quality Control processes. The result is a transition from reactive inspection to proactive quality management, reducing production disruptions and elevating overall equipment effectiveness.

Furthermore, a new generation of Multi-sensor Coordinate Measuring Machines (CMMs) is emerging, combining laser triangulation, contact scanning probes, and structured light modules into a unified platform. This modular approach addresses the constraints of traditional stationary CMMs, offering greater flexibility for automotive body-in-white inspections, aerospace component validation, and heavy machinery assembly alignment. At the same time, service models such as Pay Per Use and Equipment Lease are reshaping procurement strategies, allowing organizations to align capital expenditures with project cycles and manage variable demand without compromising on measurement capability.

Crucially, the rise of cloud-based analytics and AI-driven simulation modules is unlocking advanced capabilities in predictive maintenance and virtual testing. Measurement Reporting systems are now capable of generating prescriptive insights, recommending process adjustments to prevent drift before tolerance thresholds are exceeded. As these transformative shifts converge, stakeholders must recalibrate their investments and skill sets to fully harness the promise of an intelligent, data-centric metrology framework.

Analyzing the Cumulative Consequences of 2025 United States Trade Tariffs on Supply Chains Production Costs and Competitive Positioning in 3D Metrology

The imposition of new tariffs by United States authorities in 2025 has introduced a fresh set of variables into the 3D metrology value chain, impacting hardware sourcing, component costs, and competitive positioning. Suppliers reliant on imported optical profilers, photogrammetry modules, and phase shifting white light interferometry systems have experienced margin compression as duty rates range across essential measurement technologies. In response, manufacturers are recalibrating their supplier networks and exploring nearshore partnerships to mitigate exposure to elevated import costs.

These tariff-induced cost pressures have also reverberated through service-based segments, where equipment lease and pay-per-use contracts must now account for increased depreciation and financing expenses. Organizations that previously benefited from predictable lease rates are re-evaluating long-term engagements and exploring hybrid acquisition models that blend outright purchase of tactile CMMs with software-centric subscription licenses. This shift underscores a broader trend toward balancing capital allocation with operational flexibility in the face of regulatory volatility.

Despite short-term headwinds, the tariff landscape is catalyzing strategic innovation. Several leading players have accelerated development of domestically produced handheld scanners and portable arms, leveraging local manufacturing ecosystems to bypass duty barriers. At the same time, software providers are enhancing remote calibration and virtual commissioning features to ensure continuity of measurement services irrespective of hardware origin. As the market adapts, the underlying resilience of quality-focused industries-particularly aerospace & defense and automotive-continues to sustain demand for advanced 3D inspection solutions.

Discerning Critical Market Segmentation Patterns and Their Implications Across Product Types Components Measurement Techniques Data Outputs and End Users

A nuanced understanding of advanced 3D metrology requires a multi-dimensional segmentation framework that captures the interplay between technology, application, and end-user requirements. By examining market dynamics based on product type, we see that Laser & Probe systems co-exist with Mobile 3D Scanners, while Multi-sensor Coordinate Measuring Machines and Non-contact 3D Scanners serve complementary roles alongside Tactile Coordinate Measuring Machines to address diverse inspection scenarios. This product-driven segmentation reveals how form factor, measurement speed, and accuracy thresholds dictate solution selection across industries.

Segmenting by component unearths additional insights into ecosystem monetization. Hardware encompasses an array of subcategories from Handheld Scanners to Optical Profilers, Photogrammetry stations, Portable Arms, and Stationary CMM rigs. Parallel services range from Consulting Services and Equipment Lease to Equipment Purchase and Pay Per Use, demonstrating how providers are tailoring commercial models to match customer investment profiles. Software offerings are equally varied, spanning CAD Comparison, Measurement Reporting, Point Cloud Processing, and Simulation & Analysis modules, each unlocking distinct value within the inspection workflow.

Measurement technique further refines offering differentiation, with Contact Scanning and Laser Triangulation coexisting alongside Structured Light systems and White Light Interferometry, the latter subdivided into Coherence Scanning and Phase Shifting methodologies. When data output format is considered-ranging from ASCII and OBJ through PLY and STL to proprietary formats-the impact on interoperability and end-to-end traceability becomes clear. Finally, segmentation by end-user industry highlights the breadth of applications across Aerospace & Defense, Architecture & Construction, Automotive, Education & Research, Electronics & Semiconductor, Energy & Power, Healthcare & Medical Devices, and Heavy Machinery & Manufacturing, while application-focused categories such as Deformation Analysis, Inline Inspection, Quality Control, Research And Development, and Reverse Engineering illustrate how specific processes drive equipment and software selection. Together, these segmentation insights form a comprehensive lens through which stakeholders can align product strategies with market imperatives.

This comprehensive research report categorizes the 3D Metrology market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Measurement Type

- Installation Type

- Automation Level

- Application

- End User

Illuminating Regional Market Nuances and Anticipated Growth Drivers Across the Americas Europe Middle East Africa and the Asia Pacific in 3D Metrology

Geographic considerations play a central role in shaping investment decisions and competitive dynamics within the advanced 3D metrology space. In the Americas, robust demand is underpinned by the automotive and aerospace sectors, as well as by growing adoption within heavy machinery and manufacturing applications. The United States remains a hub for technological innovation, driven by both established original equipment manufacturers and a thriving services market that emphasizes rapid deployment of portable 3D scanners and inline inspection systems.

The Europe, Middle East & Africa region exhibits a diverse spectrum of demand drivers. Western European markets prioritize precision engineering in sectors such as medical devices and electronics, while Eastern European manufacturers are increasingly integrating structured light and laser triangulation technologies to upgrade legacy production lines. Meanwhile, the Middle East’s energy and power industries are deploying white light interferometry solutions for pipeline and turbine component analysis, and North African heavy machinery assemblers are leveraging CMM-based quality control to meet global export standards.

Asia-Pacific continues to register strong growth, led by China’s investment in domestic production of optical profilers and portable arms that cater to both local demand and export markets. Japan remains at the forefront of multi-sensor CMM innovation, and South Korea’s semiconductor and electronics conglomerates are partnering with software vendors to enhance point cloud processing workflows. Across the region, emerging markets in Southeast Asia are adopting handheld scanner solutions to address infrastructure projects, creating a fertile landscape for providers that can balance cost competitiveness with measurement accuracy.

This comprehensive research report examines key regions that drive the evolution of the 3D Metrology market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Strategic Collaborations That Are Driving Innovation and Competitive Advantage in the 3D Metrology Ecosystem

The competitive arena for advanced 3D metrology is defined by a mix of entrenched global leaders and agile innovators. Key hardware manufacturers are investing heavily in research and development to introduce multi-sensor platforms that combine tactile probes, laser modules, and structured light capabilities into unified systems. Long-standing CMM developers are extending their offerings through partnerships with software specialists, enabling seamless integration of digital twin and simulation tools alongside traditional inspection workflows.

Software vendors are equally active, evolving from standalone point cloud processing solutions to comprehensive measurement reporting suites that leverage cloud-based analytics and predictive modeling. In parallel, a growing segment of service-oriented enterprises is expanding consulting and lease-based models, targeting companies that require on-demand access to metrology expertise without committing to full ownership. This blend of product innovation and flexible business models underscores the competitive imperative to deliver both technical excellence and customer-centric solutions.

Collaborations across the ecosystem have emerged as a defining trend, with partnerships forged between hardware OEMs, software developers, and systems integrators. Joint initiatives aimed at developing open interfaces and standardized data output formats are gaining traction, as stakeholders recognize the strategic value of interoperability. At the same time, leading players are forming alliances to co-develop specialized measurement techniques, pooling resources to tackle complex applications in sectors such as aerospace turbine engine inspection and semiconductor wafer metrology.

This comprehensive research report delivers an in-depth overview of the principal market players in the 3D Metrology market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3D Systems, Inc.

- Advantest Corporation

- Alicona Imaging GmbH

- Amiga Engineering Pty Ltd.

- Applied Materials, Inc.

- Artec Europe, S.a.r.l.

- Automated Precision, Inc.

- Baker Hughes Company

- Bruker Corporation

- Carl Zeiss AG

- Faro Technologies, Inc. by AMETEK, Inc.

- GelSight, Inc.

- Heliotis AG

- Hexagon AB

- Hi-Tech Metrology Pty Ltd.

- HS&S Machine Tools and Metrology Inc.

- IKUSTEC VISION SYSTEMS LAB, SLL

- InnovMetric Software Inc.

- Intertek Group PLC

- JENOPTIK AG

- KEYENCE CORPORATION

- KLA Corporation

- Metrologic Group SAS by Sandvik AB

- Nikon Corporation

- Novacam Technologies Inc.

- Polyrix Inc.

- ReGenerateNZ Ltd.

- Renishaw PLC

- Rigaku Corporation

- SENSOFAR TECH, S.L.

- SGS SA

- Shining 3D Tech Co., Ltd.

- Trimble Inc.

- TRIMOS SA

- Veris Ltd.

- WENZEL Group GmbH & Co. KG

Formulating Strategic and Operational Recommendations to Empower Industry Leaders to Navigate Disruption Scale Capabilities and Capture Market Opportunities

To thrive in the evolving 3D metrology landscape, industry leaders must adopt strategies that balance technological investment, operational agility, and customer engagement. First, organizations should prioritize the deployment of flexible, modular measurement platforms capable of accommodating a range of sensors and probes. By doing so, they can address diverse inspection requirements from inline quality control to reverse engineering without fragmented infrastructure.

Second, diversifying the supply chain through partnerships with nearshore component manufacturers and regional service providers can mitigate the impact of trade uncertainties and tariff fluctuations. Establishing local calibration and repair centers will reduce downtime and ensure uninterrupted support for time-sensitive projects. Third, integrating advanced analytics, simulation, and AI-driven anomaly detection into measurement reporting frameworks will empower proactive decision-making and unlock predictive maintenance capabilities, enhancing overall equipment effectiveness.

In addition, companies should expand their service portfolios by introducing hybrid commercial models that blend consulting, equipment lease, and pay-per-use structures. This customer-centric approach aligns investment with usage patterns and fosters long-term partnerships. Investing in workforce development and certification programs will also be critical, as the complexity of multi-sensor CMMs and white light interferometry systems demands specialized skills. Finally, engaging in collaborative standardization efforts will support interoperability and foster broader adoption of open data formats, reinforcing market leadership and driving sustainable growth.

Detailing the Rigorous Research Framework and Analytical Approaches Employed to Deliver Accurate and Insightful Findings in the 3D Metrology Analysis

The research underpinning this analysis leverages a blended methodology that combines extensive secondary research with targeted primary interviews. Initial desk-based investigations involved a comprehensive review of academic journals, industry white papers, and patent filings to map technology trajectories and identify emerging measurement techniques. This was supplemented by an examination of company reports, publicly available earnings calls, and regulatory filings to profile competitive strategies and tariff impacts.

Primary research included structured interviews with C-level executives, metrology engineers, and procurement specialists across key end-user industries. These conversations provided firsthand insights into procurement rationales, service preferences, and evolving quality assurance protocols. To validate quantitative data, we employed triangulation techniques, cross-referencing survey results with industry association statistics and customs import-export records.

Analytical approaches encompassed thematic analysis for qualitative inputs and trend extrapolation models for interpreting the cumulative impact of regulatory changes. The segmentation framework was rigorously tested through multivariate clustering, ensuring each dimension-from product type through application-accurately reflects market heterogeneity. Throughout the process, stringent data quality protocols were maintained, with outlier detection and consistency checks reinforcing the credibility of the findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our 3D Metrology market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- 3D Metrology Market, by Offering

- 3D Metrology Market, by Measurement Type

- 3D Metrology Market, by Installation Type

- 3D Metrology Market, by Automation Level

- 3D Metrology Market, by Application

- 3D Metrology Market, by End User

- 3D Metrology Market, by Region

- 3D Metrology Market, by Group

- 3D Metrology Market, by Country

- United States 3D Metrology Market

- China 3D Metrology Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Synthesizing Key Findings and Strategic Implications to Provide a Cohesive Perspective on the Future Outlook of the 3D Metrology Market

This executive summary has synthesized the core drivers shaping the advanced 3D metrology sector, from foundational technology innovations to regulatory pressures and regional market dynamics. In elucidating transformative shifts-such as smart factory integration and AI-enabled inspection workflows-we have spotlighted the strategic imperatives for aligning product portfolios with emerging end-user requirements. The analysis of 2025 tariff effects underscores the importance of supply chain agility and domestic manufacturing capacity in maintaining cost efficiency and competitive resilience.

Segmentation insights provide a granular view of how diverse product types, measurement techniques, and application areas intersect with commercial models and data output preferences. Regional perspectives highlight the unique growth trajectories across the Americas, Europe Middle East & Africa, and Asia-Pacific, emphasizing the need for tailored market entry and expansion strategies. Competitive profiling and collaboration trends reveal the ongoing convergence of hardware, software, and services, pointing to the value of interoperability and ecosystem partnerships.

Ultimately, this summary distills actionable recommendations for industry leaders to navigate disruption, optimize resource allocation, and accelerate innovation. By leveraging a robust research methodology and a multi-faceted segmentation framework, stakeholders are equipped with the insights necessary to anticipate market shifts and capitalize on emerging opportunities in the evolving 3D metrology domain.

Engage Directly with Ketan Rohom to Secure Comprehensive Market Intelligence Insights and Propel Decision Making with a Tailored Strategic Research Partnership

To access the full breadth of analysis and obtain customized strategic guidance tailored to your specific organizational needs, we invite you to reach out directly to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Partnering with Ketan ensures that you gain priority access to the comprehensive market research report, including executive briefings and dedicated support for interpreting the findings in line with your growth objectives. Whether you are seeking to refine your product road map, optimize your supply chain, or explore emerging growth corridors, Ketan will work collaboratively with you to structure a tailored engagement model and deliver the insights that matter most. Act now to transform data into decisive action and secure your competitive position in the rapidly evolving domain of 3D metrology.

- How big is the 3D Metrology Market?

- What is the 3D Metrology Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?