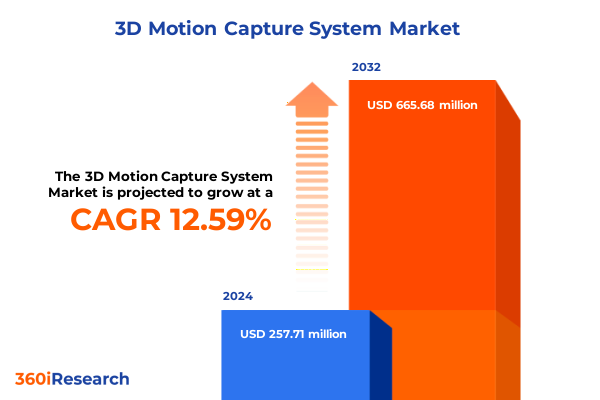

The 3D Motion Capture System Market size was estimated at USD 288.45 million in 2025 and expected to reach USD 323.47 million in 2026, at a CAGR of 12.68% to reach USD 665.68 million by 2032.

Understanding the transformative potential of advanced 3D motion capture methodologies in driving innovation across entertainment and healthcare industries

The evolution of three-dimensional motion capture technologies has transcended traditional boundaries, establishing itself as a critical enabler across multiple high-impact industries. Initially rooted in biomechanics and animation, modern systems now harness sophisticated arrays of cameras, sensors, and software algorithms to deliver unprecedented levels of precision. As the demand for immersive experiences and data-driven insights intensifies, the capabilities of motion capture have expanded from laboratory environments to real-time applications in entertainment, virtual production, and clinical diagnostics.

This introduction lays the foundation for understanding why motion capture systems have become a strategic asset. In entertainment, hyper-realistic character animation relies on seamless integration of capture data with visual effects pipelines. Meanwhile, healthcare providers utilize kinematic analysis to improve patient rehabilitation outcomes and advance research in neuromuscular disorders. Industrial innovators have likewise adopted these technologies to optimize assembly line operations and inform robotics programming. By illustrating this breadth of use cases, it becomes evident that 3D motion capture is not merely a niche technology but a transformative force shaping the future of product development and experiential design.

Exploring paradigm shifts reshaping the 3D motion capture ecosystem through convergence of AI-driven analytics and enhanced data precision capabilities

Recent years have witnessed a paradigm shift in how motion capture data is acquired, processed, and employed. Machine learning and artificial intelligence now underpin real-time skeletal tracking, enabling markerless systems to compete directly with conventional marker-based solutions in terms of accuracy. This convergence of AI-driven analytics with high-fidelity capture hardware accelerates decision making, allowing animators and clinicians to visualize movement patterns instantaneously.

Concurrently, cloud-based collaboration and edge computing have evolved to support distributed capture environments. Teams can now conduct large-scale, multi-site recordings and fuse data sets through secure, high-speed networks. Augmented reality overlays further enhance live capture sessions by providing in-situ feedback to performers and technicians. Together, these technological advancements are ushering in a new era of scalable, flexible capture workflows that minimize post-production cycles and democratize access to premium motion data.

Assessing cascading effects of recent United States tariff implementations on 3D motion capture system supply chains and component manufacturing costs

In 2025, a series of tariff adjustments by the United States government introduced additional duties on imported electronic components and precision hardware, directly impacting the production costs of motion capture equipment. Cameras, sensor arrays, and even calibration tools have seen increased import levies, leading manufacturers and integrators to reassess their sourcing strategies. As a result, original equipment manufacturers have begun exploring alternative supply chains, including nearshoring to regional partners to mitigate cost escalation.

These tariff-driven changes have also incentivized domestic investment in sensor design and camera manufacturing, with several independent firms announcing pilot production of key components. Service providers, facing elevated overheads for calibration kits and mounting equipment, have adjusted maintenance contracts and service fees accordingly. Ultimately, these cumulative impacts have prompted the industry to seek greater supply chain resilience, diversify vendor partnerships, and accelerate development of in-house component expertise to offset the uncertainty introduced by international trade policy.

Unveiling critical market segmentation insights that differentiate component, technological, capture method, and end user dynamics in motion capture systems

An in-depth examination of market segmentation reveals distinct opportunities and challenges across multiple dimensions. Component suppliers that specialize in high-precision cameras and sensor modules must navigate an ecosystem that demands seamless integration with advanced visualization software. Meanwhile, accessory manufacturers, from marker kits to calibration tools, must align their offerings with emerging standards in data fidelity and cross-platform compatibility. Installation and maintenance services are likewise adapting to comprehensive subscription and support models, reflecting a shift toward long-term customer engagement.

Technological segmentation further highlights divergent innovation paths. Inertial capture solutions are gaining traction for portable applications, leveraging accelerometers, gyroscopes, and magnetometers to provide real-time orientation data. Optical marker systems, in both active and passive configurations, remain the benchmark for studio environments where absolute tracking precision is paramount. In parallel, the contrast between marker-based and markerless methods illustrates a trade-off between setup complexity and operational flexibility.

End-user segmentation underscores the breadth of industry adoption. Academic and research institutions are exploring human behavior studies and neuroscience applications, while healthcare organizations deploy motion analysis for rehabilitation protocols. Industrial clients focus on assembly line optimization and robotics integration, and media and entertainment professionals require bespoke solutions for animation studios and gaming environments. Defense agencies also represent a niche but strategic segment, leveraging motion capture for training simulations and performance evaluation.

This comprehensive research report categorizes the 3D Motion Capture System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Components

- Technology

- Capture Method

- End User

Highlighting pivotal regional dynamics across Americas, Europe, Middle East & Africa, and Asia-Pacific that shape the evolution of 3D motion capture markets

Regional dynamics play a pivotal role in determining adoption rates and innovation trajectories. The Americas have cemented their leadership position, driven by robust research funding in North America and growing entertainment production hubs in Latin America. This region’s mature infrastructure supports extensive collaboration between universities, medical centers, and film studios, fostering an ecosystem that promotes rapid commercial deployment of capture technologies.

Meanwhile, Europe, the Middle East, and Africa exhibit diverse market drivers. European countries benefit from stringent medical device regulations, which uphold high standards for clinical applications of motion capture. Middle Eastern investment in sports science and entertainment production is opening new avenues for real‐time performance analysis. In Africa, academic research initiatives are gaining momentum, particularly within biomechanics and human behavioral studies, laying the groundwork for future growth.

In the Asia-Pacific region, rapid industrial automation and the gaming sector’s expansion have spurred significant demand. Leading Asian economies are incorporating motion capture into industrial robotics programming and virtual reality entertainment. Investments by local governments in advanced manufacturing and cross-border partnerships reflect a strategic commitment to establishing regional centers of excellence in motion analysis and immersive technologies.

This comprehensive research report examines key regions that drive the evolution of the 3D Motion Capture System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling leading innovators and dissecting competitive strategies that define the corporate landscape in the global 3D motion capture industry

A select group of technology providers has emerged as trailblazers in today’s competitive landscape. One leading specialist distinguishes itself through end-to-end integrated platforms, combining high-speed camera arrays with proprietary visualization software that accelerates production timelines. Another innovator has carved a niche in wearable inertial solutions, offering lightweight systems that empower field research and on-location capture without sacrificing accuracy.

Collaborations between hardware developers and cloud service operators have given rise to scalable capture-as-a-service offerings, enabling customers to access remote processing power and advanced analytics without deploying extensive on-site infrastructure. Key players are also pursuing strategic partnerships with academic institutions and defense contractors, co-developing custom capture suites tailored to rigorous performance requirements.

Additionally, targeted acquisitions have allowed major corporations to augment their portfolios with specialized software capabilities, such as machine learning-driven motion classification and predictive analytics for biomechanics. These strategic moves underscore the industry’s focus on expanding value propositions beyond hardware sales, positioning service contracts and software subscriptions as integral components of sustainable revenue models.

This comprehensive research report delivers an in-depth overview of the principal market players in the 3D Motion Capture System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A-Tech Instruments Ltd.

- Adobe Inc.

- Centroid 3D

- DARI Motion, Inc. by Scientific Analytics Inc.

- DEEPMOTION, INC. by Xiaomi Corporation

- Motion Analysis Inc.

- Movella Inc.

- NANSENSE Inc.

- Noitom Ltd.

- NOKOV Science & Technology Co., Ltd.

- Noraxon USA, Inc.

- Notch Interfaces Inc.

- PhaseSpace Inc.

- Planar Systems, Inc.

- Polhemus

- ProductionHUB, Inc.

- Prophysics AG

- PTI Phoenix Technologies Inc.

- Qualisys AB

- Reallusion Inc.

- Rokoko Studio

- Sony Electronics Inc.

- STT SYSTEMS

- Synertial

- Vicon Motion Systems Ltd

Delivering strategic, actionable recommendations for industry leaders to leverage emerging opportunities and navigate evolving challenges in motion capture

To thrive in this dynamic environment, industry leaders should prioritize the development of markerless capture solutions enhanced by artificial intelligence, reducing setup complexity and broadening potential application scenarios. Strengthening local manufacturing partnerships can mitigate exposure to tariff volatility and secure critical component availability. By offering bundled service agreements that integrate installation, calibration, and ongoing support, providers can foster long-term customer relationships while generating predictable revenue streams.

Leaders are also advised to invest in seamless interoperability between capture hardware and data visualization tools, creating unified workflows that accelerate time-to-insight. Establishing alliances with cloud platform providers will enable real-time collaboration and data sharing, a capability increasingly demanded by distributed production teams. Further, companies should explore cross-sector partnerships-particularly with healthcare and defense organizations-to validate solutions in mission-critical settings and unlock adjacent markets.

Finally, a concerted focus on end-user training and certification programs will ensure that new adopters achieve maximum value from their motion capture investments, reducing barriers to entry and enhancing overall customer satisfaction. By implementing these strategic initiatives, organizations will be well-positioned to capitalize on the rapid evolution of 3D motion capture technologies.

Outlining a comprehensive mixed research methodology integrating primary expertise and secondary data sources to ensure validity and credibility of insights

This research employs a rigorous mixed-methodology framework to ensure reliability and depth of insights. The secondary phase involved exhaustive analysis of technical whitepapers, peer-reviewed journals, regulatory filings, and industry publications to identify prevailing trends, technology roadmaps, and policy developments. Public filings from key players provided additional clarity on strategic priorities and investment patterns.

Complementing the secondary research, the primary phase consisted of structured interviews with executives, technical leads, and end users across entertainment, healthcare, industrial, academic, and defense segments. These conversations yielded qualitative perspectives on operational workflows, purchase criteria, and unmet needs. To validate these findings, a triangulation process compared qualitative data against empirical evidence, ensuring that divergent viewpoints were reconciled and that insights reflected the broader market context.

Throughout the study, data integrity was maintained through systematic coding, peer reviews, and cross-functional stakeholder validation. Statistical checks and methodological audits confirmed that conclusions are both robust and actionable. This meticulous approach guarantees that the research delivers a comprehensive, fact-based understanding of the 3D motion capture ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our 3D Motion Capture System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- 3D Motion Capture System Market, by Components

- 3D Motion Capture System Market, by Technology

- 3D Motion Capture System Market, by Capture Method

- 3D Motion Capture System Market, by End User

- 3D Motion Capture System Market, by Region

- 3D Motion Capture System Market, by Group

- 3D Motion Capture System Market, by Country

- United States 3D Motion Capture System Market

- China 3D Motion Capture System Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2226 ]

Synthesizing executive summary findings to underscore strategic imperatives and illuminate future trajectories for 3D motion capture adoption and growth

The insights presented in this executive summary underscore the expansive influence of 3D motion capture systems across diverse industries. Technological advancements, from AI-powered markerless tracking to cloud-enabled collaboration, are redefining traditional workflows and enabling new use cases in entertainment, healthcare, industrial automation, and defense. The ripple effects of recent tariff adjustments underscore the importance of supply chain agility and local manufacturing strategies.

Segmentation analysis highlights nuanced opportunities, whether in specialized hardware components, services, or software platforms. Regional perspectives reveal distinctive growth drivers-from research funding in the Americas to regulatory standards in Europe, and rapid industrialization in Asia-Pacific. Key market participants have responded by forging strategic partnerships, pursuing targeted acquisitions, and expanding service portfolios to include analytics and subscription models.

By synthesizing these findings, we identify clear strategic imperatives: embrace flexible capture methods, cultivate resilient supply chains, and pursue value-added services that deepen customer engagement. Companies that align their strategies with these imperatives will be uniquely positioned to harness the full potential of next-generation motion capture technologies and drive sustainable growth in a rapidly evolving ecosystem.

Engage directly with Ketan Rohom to secure comprehensive market intelligence and catalyze strategic decision making in 3D motion capture solutions purchasing

To explore how leading organizations can leverage unparalleled insights into technology adoption, cost considerations, and competitive dynamics, we invite you to engage directly with Ketan Rohom, Associate Director of Sales & Marketing. Through a tailored consultation, you will gain access to an exclusive overview of our comprehensive 3D motion capture market research report, enabling you to align strategic initiatives with emerging trends and overcome operational challenges.

Our expert team, under Ketan’s guidance, will walk you through the research methodology, validate how tariff shifts may affect your supply chain, and illustrate segmentation opportunities across end-user verticals. Participants in this conversation will receive complimentary high-level findings and a customized proposal that outlines how deeper data-driven intelligence can accelerate product innovation, enhance service offerings, and optimize go-to-market strategies.

Reach out to secure your place in this one-on-one briefing session and acquire the actionable insights necessary to drive sustainable growth. Equip your leadership with the foresight and intelligence derived from the latest empirical research, ensuring your organization remains at the forefront of the rapidly evolving 3D motion capture landscape.

- How big is the 3D Motion Capture System Market?

- What is the 3D Motion Capture System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?