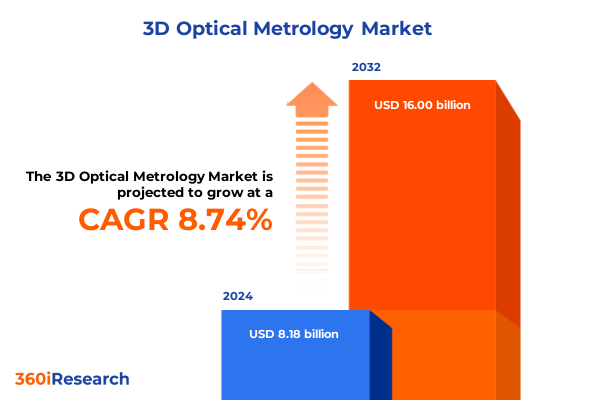

The 3D Optical Metrology Market size was estimated at USD 8.88 billion in 2025 and expected to reach USD 9.58 billion in 2026, at a CAGR of 8.76% to reach USD 16.00 billion by 2032.

Unveiling the Pivotal Role of Three-Dimensional Optical Metrology in Driving Precision, Efficiency, and Innovation Across Diverse Manufacturing Sectors

The rapid evolution of non-contact measurement technologies has propelled three-dimensional optical metrology from niche applications into a cornerstone of modern industrial processes. Increasingly, manufacturers across automotive, aerospace, and semiconductor sectors are leveraging laser triangulation, structured light, and interferometric techniques to ensure tighter tolerances and faster throughput than traditional tactile systems allow. Inline metrology solutions now integrate directly into production lines, delivering real-time data that feeds back into process control loops and drives continuous quality improvements; this approach has demonstrated significant efficiency gains in high‐precision environments such as microelectromechanical systems fabrication and advanced composite component inspection.

Beyond speed and automation, the precision offered by coherence scanning interferometry and white light interferometry has opened new frontiers in surface texture characterization. Standards like ISO 25178 now provide a unified framework for three-dimensional surface texture parameters, enabling consistent quality audits across global supply chains. In tandem, digital twin implementations powered by accurate 3D scans are becoming mainstream; leading OEMs construct virtual replicas of critical parts and manufacturing fixtures to validate fit, function, and performance before physical prototypes are produced.

As organizations prioritize Industry 4.0 initiatives, optical metrology’s role as a data-rich intelligence source has never been more critical. Its capability to capture millions of data points in seconds supports advanced analytics, machine learning algorithms, and predictive maintenance strategies. Consequently, stakeholders spanning R&D, production engineering, and quality assurance now regard 3D optical metrology not merely as a measurement tool but as an indispensable enabler of innovation and operational excellence.

Unraveling the Transformational Technological and Operational Shifts Reshaping the 3D Optical Metrology Industry’s Competitive Landscape

Over the past decade, the 3D optical metrology landscape has been reshaped by transformative technological advancements and shifting operational paradigms. Laser triangulation systems have matured to capture sub-millimeter accuracy at high scan rates, enabling handheld devices to rival traditional benchtop scanners in both speed and fidelity. Simultaneously, structured light solutions have achieved enhanced depth resolution, making them indispensable for complex geometries and freeform surface inspections in aerospace component manufacturing.

Another pivotal shift is the integration of artificial intelligence within metrology workflows. Machine learning algorithms now automate feature recognition, defect classification, and tolerance validation, significantly reducing the manual interpretation burden on operators. These AI-driven analytics are supported by cloud-based platforms that centralize data from disparate metrology assets, enabling cross-site benchmarking and remote expertise deployment. Consequently, manufacturers are experiencing accelerated time-to-insight and more consistent quality outcomes.

Finally, the convergence of optical metrology with digital twin environments and advanced simulation tools has created an end-to-end digital thread. Metrology data now informs virtual production planning, compensates for tool wear in real time, and optimizes CNC programming before physical runs. This synergy of measurement, simulation, and control has transformed quality assurance from a post-production checkpoint into an integral, proactive element of manufacturing design and execution.

Assessing the Cumulative Operational, Financial, and Strategic Impacts of Recent United States Tariff Measures on the 3D Optical Metrology Value Chain

In early 2025, the Office of the United States Trade Representative finalized significant increases under Section 301 of the Trade Act of 1974, imposing a 50 percent tariff on solar wafers and polysilicon and a 25 percent tariff on certain tungsten products, effective January 1, 2025. These adjustments form part of a broader effort to mitigate perceived risks in critical technology supply chains, but they also ripple through industries reliant on precision optics and semiconductor components.

Subsequently, in April 2025, the reciprocal tariff framework saw non-retaliating countries’ rates paused at 10 percent for ninety days, while China’s rate was clarified at 145 percent to include prior IEEPA duties. This exceptional rate drastically elevated the cost base for optical metrology hardware and scanning modules sourced from Chinese manufacturers, forcing many U.S. firms to re-evaluate supplier networks and consider nearshoring or domestic alternatives.

A mitigating development occurred in May 2025, when a U.S.-China trade accord restored reciprocal tariffs to 10 percent, while retaining Section 301 and IEEPA duties. Despite this relief, the cumulative impact of alternating tariff regimes has introduced volatility in procurement costs, lengthened lead times, and heightened compliance scrutiny. As a result, stakeholders now emphasize total cost of ownership analyses, dual-sourcing strategies, and deeper collaboration with customs experts to navigate evolving trade policies and sustain supply chain resilience.

Deep Dive into Product, Technology, Application, and Industry-Based Segmentation for Comprehensive Insights into 3D Optical Metrology Demand Dynamics

A nuanced examination of 3D optical metrology reveals demand dynamics that vary substantially by product type, encompassing hardware offerings such as handheld, inline, and stationary scanning systems, alongside services like consulting and maintenance & support, and software suites for both analysis and scanning workflows. Each segment addresses distinct customer requirements: handheld devices enable on-the-fly inspections in assembly cells, inline systems integrate into production lines for continuous feedback, while stationary platforms deliver the highest accuracy in controlled metrology cells. Consulting services guide adoption strategies, whereas maintenance ensures uptime and compliance, and software tools transform raw scan data into actionable insights for engineering teams.

Further differentiation arises from technology segmentation, where laser triangulation leads in speed and versatility, structured light offers superior depth resolution, time-of-flight supports long-range scanning, and white light interferometry excels in nanometer-scale surface profiling. Manufacturers select technologies according to part geometry, reflectivity, and required throughput, crafting bespoke measurement solutions that align with quality targets and cycle-time constraints.

Application segmentation spans dimensional measurement for verifying geometric tolerances, quality inspection for defect detection, reverse engineering for legacy parts digitization, and surface profiling for texture analysis. Similarly, end-use industry segmentation delineates aerospace & defense, automotive, electronics & semiconductors, energy & power, and healthcare sectors, each imposing unique accuracy thresholds, environmental controls, and regulatory standards. Understanding these intersecting segmentation layers is crucial for developing competitive offerings tailored to specific use cases and industry demands.

This comprehensive research report categorizes the 3D Optical Metrology market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Application

- End-Use Industry

Comparative Analysis of 3D Optical Metrology Adoption and Growth Drivers Across Americas, Europe Middle East & Africa, and Asia-Pacific Markets

Geographical insights into 3D optical metrology adoption highlight distinct regional characteristics that shape investment priorities and technology uptake. In the Americas, robust automotive and aerospace manufacturing clusters drive demand for high-accuracy inline and stationary scanning systems, while a growing network of additive manufacturing facilities seeks non-contact inspection capabilities to assure complex metal and composite parts. Local service providers emphasize turnkey solutions combining hardware, software, and maintenance contracts to support nearshore and reshoring efforts.

Across Europe, Middle East & Africa, legacy industrial powerhouses are complemented by emerging aerospace startups, resulting in a diverse metrology ecosystem. Here, regulatory focus on product safety and compliance fosters early adoption of white light interferometry and time-of-flight systems for surface and large-scale object inspections. Service bureaus and research institutes collaborate on standardization initiatives and deploy consulting frameworks to navigate data security and cross-border compliance requirements.

In the Asia-Pacific region, the rapid expansion of electronics & semiconductor fabrication sites has accelerated deployment of high-resolution optical metrology solutions for wafer inspection and micro-feature analysis. Meanwhile, energy & power equipment manufacturers are integrating handheld and inline scanners to manage quality in turbine blade production and solar cell manufacturing. Regional government incentives targeting Industry 4.0 and smart factory initiatives further stimulate investment in automated optical inspection systems.

This comprehensive research report examines key regions that drive the evolution of the 3D Optical Metrology market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Global Players and Innovative Challengers Shaping Competitive Dynamics in the 3D Optical Metrology Solutions Market

A competitive landscape in 3D optical metrology is shaped by multinational conglomerates with broad portfolios, as well as agile innovators specializing in niche capabilities. Hexagon AB and Carl Zeiss AG remain preeminent, offering end-to-end measurement ecosystems that integrate coordinate-measuring machines, non-contact scanners, and advanced metrology software. Their R&D investments and global service networks underpin leadership in high-precision and high-volume applications.

FARO Technologies, Inc. has distinguished itself through portable measurement solutions that combine laser trackers, handheld scanners, and AI-powered analytics for on-site inspections in construction, energy, and manufacturing domains. Similarly, Keyence Corporation’s streamlined hardware-software packages attract customers seeking rapid deployment with minimal customization, particularly in automotive and electronics assembly lines.

Complementing these leaders, a cohort of specialized vendors-such as Nikon Metrology NV, GOM GmbH, Creaform Inc., and Zygo Corporation-excel in targeted applications like reverse engineering, optical coherence tomography, and ultra-fine surface profiling. Their focus on modularity, open architecture, and interoperability with third-party CAD/CAM systems enables customers to tailor solutions to evolving production requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the 3D Optical Metrology market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AMETEK, Inc.

- Bruker Corporation

- Carl Zeiss AG

- Creaform, Inc.

- FARO Technologies, Inc.

- GOM GmbH

- Hexagon AB

- Intertek Group plc

- Jenoptik AG

- Keyence Corporation

- KLA Corporation

- Leica Geosystems AG

- Metrologic Group SAS

- Mitutoyo Corporation

- Nikon Corporation

- Perceptron, Inc.

- Renishaw plc

- Scantech Co., Ltd.

- WENZEL Group GmbH

- Zygo Corporation

Actionable Strategies and Best Practices for Industry Leaders to Navigate Challenges and Capitalize on Opportunities in 3D Optical Metrology

Industry leaders should pursue a multipronged approach to capitalize on emerging opportunities in 3D optical metrology. First, diversifying supplier networks to include both established OEMs and innovative providers mitigates exposure to tariff volatility and ensures access to cutting-edge technologies. Cultivating strategic partnerships with regional integrators and service bureaus enables rapid market entry and localized support.

Second, prioritizing integration of AI-driven analytics within metrology software can streamline inspection workflows and enhance predictive maintenance capabilities. By embedding machine learning algorithms that classify defects and detect process deviations, organizations can reduce manual analysis time and respond proactively to quality issues. Investing in cloud-native platforms also fosters cross-facility data sharing and continuous improvement cycles.

Third, aligning service offerings with customer needs-such as calibration programs, on-site training, and outcome-based maintenance contracts-strengthens value propositions and drives recurring revenue streams. Developing modular hardware architectures and open-API software ecosystems allows for scalable expansions and customization, catering to evolving tolerance requirements and production volumes.

Finally, engaging in standardization initiatives and collaborating with regulatory bodies ensures compliance with emerging norms while shaping industry benchmarks. Contributing to international working groups and publishing best practices not only enhances brand credibility but also fosters trust with quality-sensitive end-use industries.

Detailed Explanation of Research Methods, Data Sources, and Analytical Frameworks Underpinning the 3D Optical Metrology Market Study

This study employs a robust research methodology combining primary and secondary data collection to ensure comprehensive coverage of the 3D optical metrology market. Primary research included in-depth interviews with senior executives, technical directors, and end-user procurement officers across key industries. These qualitative insights were complemented by surveys of on-the-ground metrology specialists, capturing evolving requirements for accuracy, throughput, and software integration.

Secondary research encompassed an extensive review of industry publications, white papers, technical standards, and patent filings. Data triangulation techniques were used to reconcile discrepancies between different data sources and validate key trends. Proprietary databases tracking technology adoption rates, equipment deployment metrics, and service contract volumes were also leveraged to enhance the empirical foundation of our analysis.

Quantitative data were analyzed using statistical modeling and scenario analysis, exploring sensitivity to variables such as tariff fluctuations, regional incentives, and industry digitalization initiatives. The research framework included rigorous peer review by subject matter experts from academia and industrial metrology associations to ensure methodological integrity and relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our 3D Optical Metrology market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- 3D Optical Metrology Market, by Product Type

- 3D Optical Metrology Market, by Technology

- 3D Optical Metrology Market, by Application

- 3D Optical Metrology Market, by End-Use Industry

- 3D Optical Metrology Market, by Region

- 3D Optical Metrology Market, by Group

- 3D Optical Metrology Market, by Country

- United States 3D Optical Metrology Market

- China 3D Optical Metrology Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Synthesizing Key Findings and Strategic Insights to Guide Stakeholder Decision-Making in the 3D Optical Metrology Ecosystem

The insights presented herein underscore the pivotal role of 3D optical metrology in enabling precision, efficiency, and innovation across critical manufacturing verticals. Technological breakthroughs-ranging from handheld scanning to AI-powered analytics-have broadened the application spectrum, while evolving trade policies and regional dynamics continue to shape strategic decisions.

Segmentation analysis reveals that success hinges on aligning product portfolios with customer needs across hardware, services, and software domains, and tailoring solutions to specific technologies, applications, and industry requirements. Regional perspectives highlight diverse adoption drivers, from reshoring initiatives in the Americas to Industry 4.0 incentives in the Asia-Pacific and stringent quality standards in Europe, Middle East & Africa.

Leading companies leverage global footprints, R&D investments, and service capabilities to maintain competitive advantage, but the rise of specialized challengers underscores the value of agility and focused innovation. Actionable recommendations emphasize supplier diversification, AI integration, service differentiation, and active participation in standardization efforts as pathways to sustainable growth.

Collectively, these findings equip stakeholders-from OEM engineering teams to service bureau managers and executive decision-makers-with the strategic intelligence needed to navigate the complex, evolving 3D optical metrology landscape and capitalize on emerging opportunities.

Secure Your Comprehensive 3D Optical Metrology Market Analysis Report by Connecting with Ketan Rohom, Associate Director of Sales & Marketing

To access the full depth of analysis, detailed data tables, and strategic guidance featured in this 3D Optical Metrology market report, reach out to Ketan Rohom, Associate Director, Sales & Marketing. Ketan will guide you through customizable options tailored to your organization’s needs, ensuring you receive the critical intelligence to stay ahead in precision measurement and quality control. Engage now to secure your copy and empower your decision-making with actionable insights that drive competitive advantage in an evolving global landscape.

- How big is the 3D Optical Metrology Market?

- What is the 3D Optical Metrology Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?