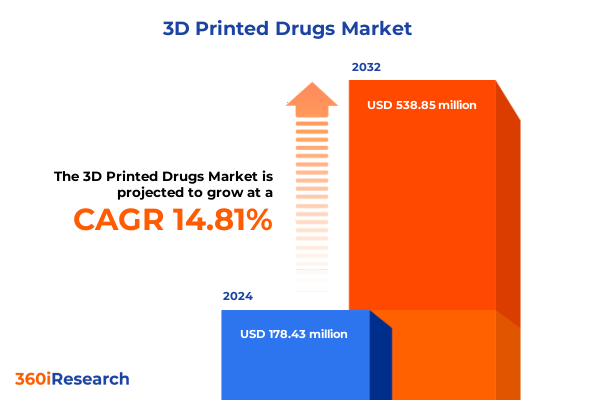

The 3D Printed Drugs Market size was estimated at USD 202.89 million in 2025 and expected to reach USD 231.28 million in 2026, at a CAGR of 14.97% to reach USD 538.85 million by 2032.

Exploring the Emergence of 3D Printed Pharmaceuticals and Their Potential to Redefine Personalized Medicine and Supply Chain Innovation

The advent of three-dimensional printing in pharmaceuticals represents one of the most disruptive technological leaps in modern drug manufacturing. By enabling precise layer-by-layer deposition of active pharmaceutical ingredients, these methods allow for highly customizable dosage forms, from complex geometries to personalized release profiles. In this context, the convergence of digital design, advanced materials science, and regulatory adaptation is rapidly accelerating the transition from traditional batch processes to on-demand production models.

As the industry embraces digital transformation, stakeholders across the value chain-R&D centers, contract research organizations, and manufacturing facilities-are exploring the potential of 3D printed drugs to address longstanding challenges such as drug shortages, patient compliance, and complex drug combinations. Concurrently, regulatory bodies are establishing guidelines to ensure scalable quality control and patient safety, signaling an imminent shift toward commercially viable applications. This section introduces the fundamental concepts underpinning 3D printed pharmaceuticals and sets the stage for understanding how these innovations are reshaping the drug development and delivery paradigms.

Unveiling the Key Technological, Regulatory, and Collaborative Paradigm Shifts Driving the Commercialization of 3D Printed Medicines

Over the past few years, transformative shifts have catalyzed the evolution of 3D printed drugs from laboratory curiosity to industrial reality. Initially confined to proof-of-concept studies, these technologies have begun to penetrate mainstream development pipelines, driven by advances in materials compatibility, printer accuracy, and throughput capabilities. Furthermore, the integration of real-time process analytics and closed-loop manufacturing systems has significantly enhanced reproducibility and compliance, bridging the gap between experimental methods and robust commercial production.

Equally important, the regulatory environment has adapted to accommodate these novel manufacturing pathways. Guidance documents issued by leading agencies now address critical topics such as excipient variability, layer adhesion, and dose uniformity, fostering a clearer roadmap for product approval. Meanwhile, strategic collaborations among pharmaceutical companies, technology providers, and academic institutions have accelerated knowledge exchange, enabling faster iteration of formulation designs. As a result, the therapeutic landscape is witnessing the emergence of print-enabled fixed-dose combinations, complex geometries for targeted drug release, and on-site production capabilities poised to transform hospital pharmacies and remote clinics.

Analyzing the Ripple Effects of 2025 United States Tariffs on Active Ingredients and Polymer Resins Within the 3D Printing Pharmaceutical Supply Chain

Since January 2025, the enactment of targeted U.S. tariffs on imported active pharmaceutical ingredients and specialized polymer resins has introduced a new layer of complexity in the manufacturing cost structure. Materials sourced from traditional suppliers in Asia faced incremental duties, prompting companies to reassess procurement strategies and supply chain resilience. Consequently, many developers have pursued domestic polymer production partnerships and alternative resin chemistries to mitigate duty impacts, while logistics teams have reconfigured freight routes to optimize landed costs.

This tariff landscape has also accelerated regionalization efforts among contract manufacturers and research institutions, as reshoring initiatives received renewed attention. Stakeholders invested in evaluating local API synthesis capabilities and exploring vertically integrated models to ensure material availability. In parallel, companies leveraged dual-sourcing frameworks and long-term supplier agreements to stabilize prices and secure consistent access to critical components. Over time, these adaptations have not only offset tariff burdens but also laid the foundation for a more agile and geographically diversified supply chain that aligns with evolving trade policies.

Revealing Critical Insights Across 3D Printing Methodologies, Dosage Forms, Release Mechanisms, Therapeutic Targets, and End-User Adoption Patterns

Examining the market through the lens of 3D printing technologies reveals that fused deposition modeling leads adoption, largely due to its versatility in handling a wide range of thermoplastic excipients. Within this approach, nozzle-based systems deliver high-resolution constructs suitable for specialized dosage forms, whereas pellet-based platforms cater to high-throughput production. Inkjet printing complements these capabilities by enabling precise microdroplet placement, making it ideal for low-dose and multi-layered applications. Selective laser sintering brings unique advantages in producing intricate geometries without support structures, and stereolithography stands out for high-fidelity prototypes and rapid formulation screening.

When considering dosage forms, tablets represent the most extensively explored application, largely for their ease of manufacturing and patient familiarity, while capsules and nanoparticles are gaining traction for targeted delivery and enhanced bioavailability. The selection among controlled, delayed, or immediate release profiles allows formulators to tailor pharmacokinetics to clinical needs, improving therapeutic outcomes and patient adherence. In therapeutic areas, cardiovascular and oncology indications dominate current pipelines, reflecting high unmet needs and willingness to invest in innovative modalities. Dental and neurology segments are also emerging as attractive niches, driven by specialized device integration and localized delivery demands. Finally, end users span contract research organizations that accelerate early-stage development, hospitals and clinics piloting point-of-care production, pharmaceutical companies integrating print-enabled product lines, and research institutes advancing foundational science.

This comprehensive research report categorizes the 3D Printed Drugs market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- 3D Printing Technology

- Dosage Form

- Drug Release

- Therapeutic Area

- End User

Comparative Regional Developments and Strategic Ecosystem Investments Shaping the Adoption of 3D Printed Drug Technologies Worldwide

In the Americas, robust R&D infrastructure and supportive regulatory frameworks have positioned the United States and Canada at the forefront of clinical translation for 3D printed pharmaceuticals. Initiatives to modernize compounding standards and invest in advanced manufacturing facilities underscore regional leadership. Furthermore, Latin American markets are beginning to explore point-of-care applications to address local supply constraints, laying the groundwork for broader adoption.

Across Europe, the Middle East, and Africa, regulatory harmonization efforts by the European Medicines Agency and individual member states have been pivotal. Countries such as Germany, Switzerland, and the United Kingdom have launched pilot programs for in-hospital printing centers, while emerging EMEA markets are leveraging technology partnerships to build foundational capabilities. In parallel, Middle Eastern nations are investing in regional centers of excellence to reduce reliance on imports and enhance healthcare sovereignty.

The Asia-Pacific region exhibits a dual trajectory: established markets like Japan and Australia are advancing toward commercial product approvals, supported by clear guidelines on print validation, whereas high-growth markets in Southeast Asia and India are rapidly scaling pilot initiatives. Local equipment manufacturers and formulation experts are collaborating to create lower-cost printer models and regionally optimized drug libraries, fueling a more inclusive ecosystem for digital pharmaceutical production.

This comprehensive research report examines key regions that drive the evolution of the 3D Printed Drugs market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Mapping Competitive Strategies and Collaborative Partnerships Demonstrating Technological Leadership and Market Differentiation in 3D Printed Pharmaceuticals

Several industry leaders are carving distinct pathways to capture value in the 3D printed drugs domain. Companies with established pharmaceutical expertise are leveraging proprietary polymer formulations and process analytics to achieve high-precision dosing and accelerated regulatory clearance. Meanwhile, technology-native entrants are focusing on hardware innovations - such as multi-material printheads and integrated quality monitoring - to broaden application scope across complex dose forms.

Strategic partnerships between specialty API manufacturers and software providers have emerged as a key trend, enabling end-to-end solutions from formulation design to production execution. Moreover, collaborations with clinical research networks are facilitating real-world validation of print-enabled therapies, strengthening the case for reimbursement and formulary inclusion. In addition, forward-looking players are exploring adjacent opportunities in bioprinting and continuous manufacturing, positioning themselves to extend plasticity beyond small-molecule drugs into biologics and combination products.

Differentiation is increasingly achieved through intellectual property portfolios that cover novel excipient compositions, multi-step printing processes, and in-line quality control sensors. As competitive landscapes evolve, the ability to integrate digital twins and machine learning-driven process optimization will become a defining factor for leadership in this rapidly maturing sector.

This comprehensive research report delivers an in-depth overview of the principal market players in the 3D Printed Drugs market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3D Bioprinting Solutions Ltd

- 3D Systems, Inc.

- Anatomics Pty Ltd.

- Aprecia Pharmaceuticals, LLC

- Curify Ltd

- Cyfuse Biomedical K.K.

- FabRx Ltd.

- GlaxoSmithKline Plc

- Laxxon Medical Corp.

- MB Therapeutics

- Merck KGaA

- Proto Labs Inc.

- Renishaw PLC

- Siemens AG

- Triastek, Inc.

- Yissum

Guiding Strategic Investments in Flexible Platforms, Collaborative Ecosystems, and Data-Driven Process Optimization to Accelerate 3D Printed Drug Commercialization

To capitalize on emerging opportunities in 3D printed drugs, organizations should prioritize the development of modular manufacturing platforms that can seamlessly transition between R&D, pilot, and large-scale production. By investing in flexible process technologies, companies can accommodate evolving product portfolios and rapidly adapt to shifting patient and regulatory requirements. Building cross-functional teams that integrate formulation scientists, print technologists, and regulatory experts will further accelerate time-to-market and ensure cohesive compliance strategies.

Furthermore, establishing strategic alliances with raw material suppliers and academic institutions can secure access to innovative excipients and novel bioinks, creating a continuous pipeline of platform enhancements. Leveraging data analytics and digital twins will enable real-time process monitoring and predictive maintenance, reducing downtime and enhancing batch consistency. Lastly, engaging with patient advocacy groups and reimbursement stakeholders early in development can smooth the path toward market acceptance, demonstrating both clinical value and cost-effectiveness to payers and healthcare providers.

Outlining the Rigorous Multi-Source Research Framework That Underpins Our Comprehensive Insights Into 3D Printed Drug Development and Commercialization

This analysis integrates both primary and secondary research methodologies to ensure robust and unbiased insights. Primary research comprised in-depth interviews with operational leaders at pharmaceutical manufacturers, technology providers, regulatory consultants, and end users, capturing firsthand perspectives on the challenges and opportunities inherent to print-enabled drug production. Secondary research involved extensive review of regulatory guidelines, peer-reviewed journals, patent filings, and publicly available case studies to triangulate findings and validate emerging trends.

Quantitative data were supplemented by thematic analysis of operational benchmarks and supply chain metrics, enabling a nuanced understanding of cost drivers and time-to-market factors. Where possible, real-world implementation studies and pilot program outcomes were scrutinized to assess scalability and clinical viability. Throughout the research process, findings were subjected to rigorous quality assurance protocols, including cross-verification by subject matter experts and methodological peer review, to ensure the credibility and reliability of all conclusions presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our 3D Printed Drugs market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- 3D Printed Drugs Market, by 3D Printing Technology

- 3D Printed Drugs Market, by Dosage Form

- 3D Printed Drugs Market, by Drug Release

- 3D Printed Drugs Market, by Therapeutic Area

- 3D Printed Drugs Market, by End User

- 3D Printed Drugs Market, by Region

- 3D Printed Drugs Market, by Group

- 3D Printed Drugs Market, by Country

- United States 3D Printed Drugs Market

- China 3D Printed Drugs Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Synthesizing Technological Advancements, Regulatory Adaptations, and Market Dynamics to Unveil the Future Trajectory of 3D Printed Therapeutics

The maturation of 3D printed pharmaceuticals marks a paradigm shift in how drugs are formulated, manufactured, and delivered. Through converging technological advances-encompassing versatile print platforms, sophisticated excipient chemistries, and integrated quality analytics-the industry is poised to overcome persistent challenges in personalization, supply chain resilience, and complex dose combination therapies. Regulatory evolution and tariff-driven supply chain reconfiguration have further refined the ecosystem, reinforcing the need for agile, regionally diversified manufacturing strategies.

Key segmentation insights demonstrate the nuanced interplay between technology choice, dosage form, release mechanism, therapeutic area, and end-user requirements, underscoring the importance of targeted product development and strategic partnerships. Regional analyses reveal differentiated adoption paths, with established markets leading commercialization efforts and emerging regions rapidly building out foundational capabilities. Competitive landscapes continue to evolve, with IP protections, platform flexibility, and digital integration emerging as critical differentiators.

Looking ahead, industry leaders who embrace collaborative innovation, data-driven process optimization, and patient-centric value propositions will be best positioned to translate the promise of 3D printed drugs into widespread clinical and commercial success. This report provides the actionable intelligence necessary to navigate this transformative landscape and capitalize on the next wave of pharmaceutical innovation.

Engage with Our Associate Director to Gain Exclusive Access to the Detailed 3D Printed Drugs Market Report That Fuels Strategic Decision Making

If you are ready to unlock the strategic insights and competitive advantages that advanced analysis of the evolving 3D printed drugs market can offer, connect directly with Ketan Rohom, Associate Director of Sales & Marketing. He can customize a comprehensive briefing tailored to your organization’s priorities, guiding you through key findings on technological advances, regulatory shifts, and competitive positioning. Ketan’s expertise will ensure you receive targeted recommendations-whether you aim to accelerate R&D, optimize supply chains, or expand into emerging therapeutic segments. Reach out today to secure immediate access to the full market research report, empowering your leadership team with the actionable data and in-depth perspectives required to drive innovation and growth in the rapidly transforming pharmaceutical landscape

- How big is the 3D Printed Drugs Market?

- What is the 3D Printed Drugs Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?