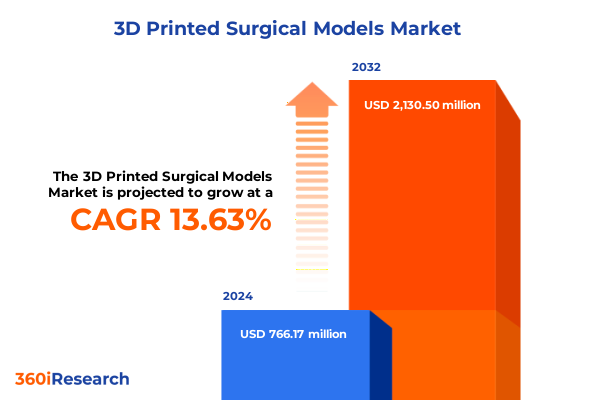

The 3D Printed Surgical Models Market size was estimated at USD 859.89 million in 2025 and expected to reach USD 971.27 million in 2026, at a CAGR of 13.83% to reach USD 2,130.50 million by 2032.

Unveiling the Revolutionary Role of 3D Printed Surgical Models in Transforming Preoperative Planning and Medical Training

3D printed surgical models have emerged as a critical bridge between medical imaging and the operating theater, offering clinicians an unprecedented tactile view of patient anatomy. These physical replicas, derived from CT and MRI scans, enable surgeons to rehearse complex procedures, refine surgical strategies, and anticipate potential challenges. The evolution from rudimentary anatomical prototypes to ultra-realistic, multi-material models underscores the rapid pace at which additive manufacturing has integrated into mainstream healthcare practice. As hospitals and clinics seek to enhance procedural accuracy and efficiency, the adoption of 3D printed surgical models has accelerated, carving out a pivotal role for this technology across preoperative planning and medical education.

The appeal of these models extends beyond surgical teams. Medical trainees benefit from lifelike practice scenarios that deepen anatomical understanding and procedural confidence without patient risk. Likewise, multidisciplinary teams leverage these models to foster collaborative decision-making, improving communication and reducing intraoperative surprises. The confluence of improved surgical outcomes, shortened procedure times, and heightened patient safety is driving widespread interest among healthcare administrators and policymakers. Consequently, these models are increasingly viewed not simply as training aids, but as essential components of patient-centric care pathways.

Industry data indicates that the global 3D printed surgical models market reached a valuation of USD 701.09 million in 2024 and is poised to expand further as healthcare providers prioritize personalized treatment solutions and invest in cutting-edge preoperative tools. With a growing geriatric demographic and rising demand for minimally invasive interventions, the landscape is ripe for continued integration of additive manufacturing platforms that deliver precision and repeatability in surgical preparation.

Emerging Technological Innovations Driving a Paradigm Shift in 3D Printed Surgical Model Applications Across Healthcare

Advancements in additive manufacturing have catalyzed profound shifts in how surgical models are conceived and utilized. Artificial intelligence is increasingly woven into the workflow, automating the segmentation of medical imaging data and accelerating model generation. AI-driven algorithms reduce manual intervention, enhancing both the speed and fidelity of anatomical replicas for preoperative planning. Meanwhile, hybrid models that marry 3D printing with augmented and virtual reality are redefining immersive surgical simulation. These integrated solutions allow surgeons to don headsets for an interactive exploration of patient-specific anatomy before transitioning seamlessly to physical replicas, thereby solidifying procedural strategies.

Simultaneously, the customization of surgical guides and instruments through 3D printing is unlocking new possibilities. Patient-specific guides tailored to individual anatomy ensure precise bone resections and implant placements, translating digital plans directly into the operating room. This confluence of technologies not only bolsters surgical accuracy but also fosters greater confidence among clinical teams. As these innovations gain traction, they collectively mark a paradigm shift in surgical preparation, transforming static planning into a dynamic, multi-sensory process that enhances both efficiency and outcomes.

Assessing the Comprehensive Effects of United States 2025 Trade Tariffs on the 3D Printed Surgical Model Ecosystem

The introduction of new U.S. tariffs in 2025 has reverberated across the healthcare supply chain, impacting the production costs of 3D printed surgical models. Tariffs on imported polymers, metals, and specialized resins have elevated raw material expenses by up to 30% for some additive manufacturing providers, compressing margins and prompting a reassessment of sourcing strategies. Concurrently, hospitals and clinics-already grappling with budgetary constraints-face higher acquisition costs for both in-house printing materials and externally procured anatomical models, intensifying pressure on healthcare providers to balance quality with fiscal prudence.

Despite these challenges, the tariff-driven environment has also spurred opportunities for reshoring and domestic manufacturing. Regions with established polymer and metal 3D printing capabilities are seeing renewed investment, as industry participants seek to mitigate exposure to international trade uncertainties. Furthermore, the intangible nature of digital blueprint transfers enables model production closer to point-of-care, bypassing traditional shipping channels and tariff barriers-a trend highlighted by the rise of in-hospital “point-of-care” printing centers that enhance supply chain resilience and ensure uninterrupted access to critical models.

Overall, while the cumulative impact of 2025 trade measures has introduced near-term cost headwinds, the impetus to localize production and embrace digital workflows positions the 3D printed surgical models sector for more secure, agile growth. Healthcare providers and manufacturers poised to invest in domestic capabilities and streamlined digital platforms will be best placed to navigate this evolving tariff landscape.

Decoding Market Segmentation to Uncover Critical Insights Across Technologies Materials Models Applications and End Users

A detailed examination of market segmentation reveals distinct dynamics across technology, material, model type, application and end user. The technology dimension encompasses binder jetting, fused deposition modeling, material jetting, powder bed fusion and stereolithography, each offering unique trade-offs in resolution, speed and material compatibility. Material preferences span ceramic, metal and polymer, reflecting varied demands for biocompatibility, mechanical strength and cost efficiency.

When considering model type, the market bifurcates into generic and patient-specific categories. Generic models serve educational, procedural demonstration and training objectives, providing consistent anatomical references for broad user groups. Patient-specific models extend into custom implant design, preoperative simulation and surgical planning, delivering bespoke solutions that mirror individual patient anatomy. Key clinical applications include cardiovascular, dentistry, neurology, orthopedics and urology, where precise anatomical understanding can directly influence surgical methodology and patient outcomes. Finally, the end user landscape comprises diagnostic centers, hospitals and research institutes, each leveraging these models to enhance diagnostic accuracy, procedural preparedness and academic exploration.

This comprehensive research report categorizes the 3D Printed Surgical Models market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Material

- Model Type

- Application

- End User

Spotlight on Regional Dynamics Highlighting Opportunities and Challenges in the Americas EMEA and Asia-Pacific Markets

Regional considerations significantly shape the trajectory of 3D printed surgical model adoption. In the Americas, North America leads with more than 35% of global revenue, driven by advanced healthcare infrastructure, favorable reimbursement frameworks and a mature ecosystem of additive manufacturing providers. Strong academic-industry collaborations and established point-of-care printing programs further bolster regional uptake. Europe, Middle East & Africa navigate a complex mosaic of regulatory requirements, including the EU Medical Device Regulation, which underscores quality and safety while also encouraging innovation in patient-specific model production. Established medical device clusters in Germany, the U.K. and France serve as hubs for additive manufacturing advancements, with local policymakers exploring tariff exemptions and incentive programs to support domestic supply chains.

Asia-Pacific represents a rapidly expanding frontier. Nations such as China and India are investing heavily in healthcare modernization, leading to unmet clinical needs and rising per capita healthcare spending. Technological partnerships between local hospitals and international 3D printing specialists are bridging expertise gaps, while economic growth fuels demand for cost-effective, patient-centered solutions. Together, these regional dynamics present diverse opportunities and challenges, underscoring the need for tailored go-to-market approaches for each geography.

This comprehensive research report examines key regions that drive the evolution of the 3D Printed Surgical Models market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Pioneers and Innovators Powering the Growth of 3D Printed Surgical Model Solutions Worldwide

Industry leadership is spearheaded by established 3D printing companies and specialized medical technology innovators. Stratasys has advanced anatomical modeling through partnerships that integrate high-resolution material jetting with software-driven segmentation, exemplified by its collaboration with Axial3D to streamline patient-specific model creation for orthopedic oncology procedures. 3D Systems distinguishes itself with its VSP surgical planning platform, which couples sophisticated DICOM-to-PRINT software and multi-material printers to deliver end-to-end patient-matched solutions across craniomaxillofacial and orthopedic specialties. Materialise further elevates the field with Mimics software and FDA-cleared clinical trials for bioresorbable tracheobronchial splints, showcasing the potential for 3D printed devices to inform both anatomical modeling and therapeutic innovations.

Beyond these global leaders, a cohort of emerging companies such as Formlabs, Lazarus 3D, Osteo3D, Onkos Surgical and WhiteClouds are pushing boundaries in materials development, cost reduction and niche application support. Their efforts to expand 3D printing capabilities to smaller hospitals and research institutes underscore the democratization of surgical modeling technologies, ensuring that advancements are accessible across a spectrum of clinical environments.

This comprehensive research report delivers an in-depth overview of the principal market players in the 3D Printed Surgical Models market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3D Systems Corporation

- Anatomiz3D Medtech Private Limited

- Aspect Biosystems Ltd

- Axial3D

- Carbon Inc

- Cellink

- Cyfuse Biomedical K.K.

- Desktop Metal Inc

- EnvisionTEC GmbH

- EOS GmbH

- Formlabs Inc

- General Electric Company

- HP Inc

- Materialise NV

- Medacta International SA

- Medtronic plc

- Nikon SLM Solutions AG

- Organovo Holdings Inc

- Prodways Group

- Protolabs Inc

- Renishaw plc

- Stratasys Ltd

- Stryker Corporation

- Voxeljet AG

- Zimmer Biomet Holdings Inc

Strategic Imperatives and Practical Recommendations for Industry Leaders to Navigate the Evolving 3D Printed Surgical Models Market

To capitalize on the momentum of 3D printed surgical models, industry stakeholders should adopt a three-pronged strategy. First, investing in in-house digital imaging and point-of-care printing infrastructure will mitigate supply chain risks and enable rapid model generation, particularly critical under fluctuating tariff and trade conditions. Second, fostering collaborative partnerships between clinical teams, imaging specialists and biomedical engineers ensures seamless workflow integration from scan acquisition to model production, optimizing efficiency and clinical impact. Third, advocating for supportive regulatory frameworks-such as streamlined FDA pathways for diagnostic model production and targeted tariff exemptions for medical additive manufacturing materials-can unlock broader adoption and cost containment.

Additionally, continuous monitoring of material innovations and printer capabilities is essential. Organizations should conduct periodic technology audits to assess emerging multi-material platforms and AI-driven software updates, ensuring that their model portfolios reflect the latest advances in realism and biocompatibility. By aligning strategic investments with clinical driving forces and policy developments, industry leaders can secure a competitive edge, delivering safer, more effective patient care while driving sustainable growth in this dynamic market segment.

Detailed Explanation of Research Frameworks Techniques and Validation Processes Underpinning the 3D Printed Surgical Models Analysis

This comprehensive analysis of the 3D printed surgical models market is underpinned by a multi-layered research framework. The methodology commenced with rigorous desk research, encompassing peer-reviewed journals, regulatory filings, patent databases and industry white papers to identify core technological trends and regulatory milestones. Concurrently, primary interviews were conducted with key opinion leaders, surgeons, biomedical engineers and supply chain experts to validate emerging use cases and capture qualitative insights on adoption barriers and enablers.

Quantitative data was triangulated using public financial statements, trade association reports and hospital procurement records to ensure consistency and accuracy. Regional market assessments integrated import-export data and healthcare expenditure figures, while tariff impact analysis leveraged government announcements and trade policy documentation. Finally, iterative validation workshops with industry participants refined key findings, ensuring that the outcomes accurately reflect current market realities and provide actionable intelligence for decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our 3D Printed Surgical Models market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- 3D Printed Surgical Models Market, by Technology

- 3D Printed Surgical Models Market, by Material

- 3D Printed Surgical Models Market, by Model Type

- 3D Printed Surgical Models Market, by Application

- 3D Printed Surgical Models Market, by End User

- 3D Printed Surgical Models Market, by Region

- 3D Printed Surgical Models Market, by Group

- 3D Printed Surgical Models Market, by Country

- United States 3D Printed Surgical Models Market

- China 3D Printed Surgical Models Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing Key Findings and Looking Ahead to the Future Impact of 3D Printed Surgical Models in Healthcare Delivery

In summary, 3D printed surgical models represent a transformative nexus of digital imaging and additive manufacturing, reshaping preoperative planning, medical education and patient engagement. Technological breakthroughs-such as AI-driven segmentation and hybrid AR/VR workflows-are amplifying the precision and utility of these models, while regulatory and tariff landscapes catalyze innovation in domestic production and supply chain resilience. Segmentation insights reveal diverse applications across technologies, materials, model types, clinical specialties and end users, each with distinct growth trajectories. Geography-specific dynamics highlight the strategic importance of tailored market entry and expansion strategies in the Americas, EMEA and Asia-Pacific regions. Leading companies like Stratasys, 3D Systems and Materialise, alongside agile challengers, are driving market evolution, underscoring the critical need for targeted investments in infrastructure, partnerships and policy advocacy.

As stakeholders navigate this rapidly evolving field, continued collaboration across clinical, technological and regulatory domains will be essential. By aligning strategic imperatives with emerging industry trends and localized market conditions, healthcare providers, manufacturers and policymakers can harness the full potential of 3D printed surgical models to enhance patient outcomes, reduce procedural risk and shape the future of precision medicine.

Contact Ketan Rohom to Gain Exclusive Access and Purchase the Definitive 3D Printed Surgical Models Market Research Report Today

Ready to delve deeper into the strategic opportunities and detailed data underpinning this transformative 3D printed surgical models market assessment, connect with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to secure your copy of the comprehensive research report. Gain unparalleled insights that empower your organization to lead in this dynamic field with confidence and precision by reaching out today to purchase this definitive industry guide.

- How big is the 3D Printed Surgical Models Market?

- What is the 3D Printed Surgical Models Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?