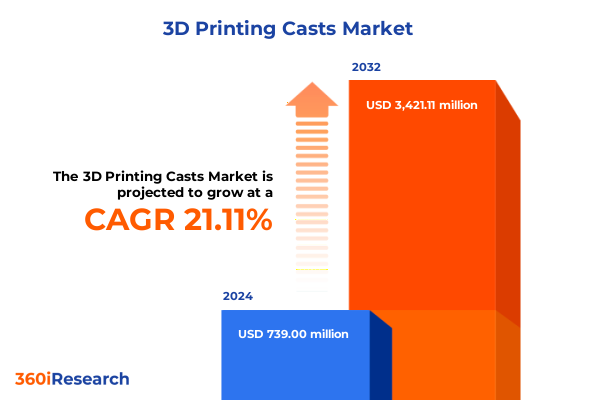

The 3D Printing Casts Market size was estimated at USD 888.57 million in 2025 and expected to reach USD 1,070.11 million in 2026, at a CAGR of 21.23% to reach USD 3,421.11 million by 2032.

Unveiling the Emergence of 3D Printed Casts Revolutionizing Personalized Orthopedic Care Through Unprecedented Precision, Enhanced Patient Comfort, and Technological Innovation Across Clinical Practice Settings

In recent years, three-dimensional printing technologies have emerged as a pivotal force in reshaping orthopedic care delivery by enabling the production of bespoke immobilization solutions. Gone are the days when standard plaster or fiberglass casts defined patient experience, as additive manufacturing now brings unprecedented levels of anatomical precision and ventilation to cast design. This shift aligns with broader trends toward personalized medicine, where therapies and devices are tailored to individual patient anatomy, lifestyle needs, and recovery objectives.

Consequently, stakeholders across the healthcare and manufacturing ecosystems are rethinking supply chains, clinical workflows, and patient engagement strategies. Surgeons and orthopedists are increasingly collaborating with engineers to optimize cast geometries that balance structural integrity with lightweight comfort. Simultaneously, materials scientists are advancing bio-compatible polymers to meet stringent sterility and mechanical performance requirements. Through transitional collaboration among clinicians, technologists, and regulators, the landscape for orthopedic immobilization is undergoing a rapid metamorphosis that extends well beyond traditional boundaries.

Exploring the Key Technological and Clinical Transformations Driving the Rapid Adoption of 3D Printing for Custom Orthopedic Casts Worldwide

Over the past decade, additive-manufacturing capabilities have advanced dramatically, particularly in fused deposition modeling, selective laser sintering, and stereolithography. These technological breakthroughs have translated into higher resolution geometries, faster production cycles, and broader material compatibility. As a result, what began as niche applications in research laboratories has now scaled to surgical centers and outpatient clinics, reflecting a wider industry embrace of digital workflows and on-demand manufacturing.

Parallel to technological progress, clinical acceptance has surged as evidence accrues around improved patient outcomes, including reduced skin irritation, enhanced mobility, and shorter recovery times. Healthcare institutions are integrating digital imaging with automated design algorithms, enabling rapid iteration and customization of cast structures. Moreover, investments in training for orthopedic specialists and biomedical engineers have fostered a new breed of cross-functional practitioners who streamline end-to-end processes from scanning to fitting. These convergent shifts are positioning 3D printed casts not merely as an innovation but as an operational necessity for next-generation orthopedic care.

Analyzing How 2025 United States Tariffs Are Reshaping Supply Chains, Material Costs, and Competitive Dynamics in the 3D Printed Casts Industry

In 2025, the imposition of updated United States tariffs on imported polymers and specialty filaments has introduced fresh cost dynamics for manufacturers of three-dimensional printed casts. Materials such as acrylonitrile butadiene styrene and thermoplastic polyurethane, traditionally sourced through global supply chains, have experienced price adjustments that ripple through production budgets. Consequently, domestic producers are evaluating nearshoring strategies and alternative sourcing partnerships to mitigate exposure to tariff-induced cost escalations.

Furthermore, the tariff environment has accelerated innovation in material science, as research institutions and private enterprises intensify efforts to develop locally produced biocompatible resins and recyclable filament options. Parallel supply chain initiatives are focusing on inventory buffering and multi-supplier frameworks to ensure consistent throughput despite potential import disruptions. As these adaptive strategies gain momentum, stakeholders are recalibrating pricing models, contractual agreements, and capital investment plans to sustain growth against a backdrop of evolving trade policies.

Diving Into Multifaceted Market Segmentation of 3D Printed Casts by Technology, Material Innovation, Custom Customization Models, Clinical Applications, and End User Profiles

When evaluating the three-dimensional printed cast market through the lens of additive-manufacturing technologies, fused deposition modeling stands out for its accessibility and cost-effectiveness, delivering rapid prototyping capabilities. Selective laser sintering introduces high-strength structures suited to load-bearing applications, while stereolithography offers ultra-fine surface finishes, making it ideal for complex anatomical regions. This technological diversity underpins tailored strategies by clinical providers and original equipment manufacturers, who align device specifications with patient requirements and production throughput goals.

Material selection further refines product performance, as acrylonitrile butadiene styrene balances rigidity with impact resistance, whereas polylactic acid provides biodegradable alternatives aligned with sustainability mandates. Thermoplastic polyurethane, known for its elasticity and skin friendliness, caters especially well to pediatric and geriatric cases. Coupled with customization models that range from fully personalized geometries to semi-custom templates, these materials empower practitioners to navigate trade-offs between turnaround time and patient-specific design fidelity. Moreover, clinical applications extend across the treatment of bone fractures-whether arm and wrist, finger and toe, or leg and ankle-while also addressing chronic orthopedic conditions and post-surgical immobilization needs. Finally, diverse end users, including ambulatory surgical centers, hospitals and clinics, and specialized orthopedic centers, drive distinct adoption patterns influenced by procedural volume, capital budgets, and operational priorities.

This comprehensive research report categorizes the 3D Printing Casts market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Material

- Customization Type

- Application

- End User

Unpacking Regional Market Dynamics Shaping the Demand for 3D Printed Casts Across the Americas, EMEA, and Asia-Pacific Healthcare Landscapes

Geographically, the Americas have emerged as a bastion for rapid adoption of three-dimensional printed casts, led by pioneering clinical trials in the United States and Canada. The concentration of advanced manufacturing hubs and favorable reimbursement frameworks have fostered a competitive environment where both startups and established medical device companies accelerate product launches. North American healthcare providers leverage integrated imaging systems and in-house printing facilities to shorten patient wait times and achieve cost efficiencies across surgical and outpatient settings.

In contrast, the Europe, Middle East, and Africa region is characterized by a mosaic of regulatory landscapes and varied healthcare infrastructures. Western European nations, benefiting from centralized approval processes and robust R&D funding, continue to pilot novel cast designs aimed at therapeutic outcomes and patient engagement metrics. Meanwhile, emerging markets in the Middle East and Africa exhibit growing interest in sustainable, locally produced casting solutions, prompting early collaborations between global technology providers and regional medical institutions. Asia-Pacific presents another dynamic tableau, where populous nations are balancing cost sensitivities with ambitious investment in digital healthcare. Rapidly expanding hospital networks in China, Japan, and India are integrating additive manufacturing into orthopedic protocols, with an emphasis on scalable production and telemedicine-enabled design consultations. Across each region, government incentives, reimbursement policies, and infrastructure readiness synergistically influence the trajectory of market expansion.

This comprehensive research report examines key regions that drive the evolution of the 3D Printing Casts market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Movements and Innovations from Leading Companies Advancing 3D Printed Cast Solutions Through Partnerships, Research, and Manufacturing Excellence

The competitive arena of three-dimensional printed casts features a blend of legacy additive-manufacturing firms and specialized medical technology startups. Industry veterans such as Stratasys and 3D Systems continue to enhance their platforms with medical-grade materials and software suites tailored to orthopedic workflows. These companies leverage long-standing relationships with healthcare providers to pilot integrated solutions that encompass hardware, design tools, and post-processing services.

Simultaneously, pioneering firms like Materialise and EOS are deepening their focus on regulatory compliance and certification, collaborating with clinical researchers to validate performance through peer-reviewed studies. Emerging contenders such as Formlabs and EnvisionTEC are capitalizing on modular printing systems and user-friendly interfaces to lower adoption barriers among small to midsized clinics. Partnerships between medical device OEMs and technology providers are becoming increasingly common, as stakeholders recognize the value in combining domain expertise, manufacturing scale, and go-to-market channels. This collaborative model is setting the stage for accelerated product development, streamlined supply chains, and expanded service networks in the orthopedic casting ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the 3D Printing Casts market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ActivArmor, Inc.

- All3DP GmbH

- Aniwaa Pte. Ltd.

- Dimension Ortho

- EOS GmbH

- Formlabs Inc.

- Gero3D Ltd

- Instalimb Inc

- Materialise NV

- MedFab3D

- Stratasys, Ltd

- TriMed Group

- Xkelet S.L.

Proposing Actionable Strategies for Industry Leaders to Capitalize on 3D Printed Cast Opportunities Through Collaboration, Innovation, and Regulatory Navigation

Industry leaders seeking to harness the potential of three-dimensional printed casts should prioritize strategic partnerships that bridge clinical expertise and manufacturing capabilities. By aligning with material developers and regulatory consultants early in product design, organizations can expedite approval processes while ensuring patient safety. Moreover, investing in modular printing infrastructure and cloud-based design platforms will enable rapid scaling of operations and flexibility in accommodating diverse clinical use cases.

In parallel, organizations must cultivate robust supply chain resilience by diversifying polymer sources and engaging in long-term procurement agreements to mitigate tariff-related cost volatility. On the clinical front, tailored training programs for orthopedic staff and biomedical engineers are essential to drive consistent adoption and capture workflow efficiencies. Finally, deploying data-driven feedback loops across patient outcomes, device performance, and production metrics will inform iterative improvements, positioning companies to lead in an increasingly competitive marketplace.

Outlining the Comprehensive Research Methodology Utilized to Assess Market Dynamics, Validate Insights, and Ensure Analytical Rigor for 3D Printed Cast Studies

The foundation of this analysis rests on a comprehensive, multi-tiered research methodology integrating both primary and secondary sources. Primary research included in-depth interviews with orthopedic surgeons, biomedical engineers, and supply chain managers across North America, Europe, and Asia-Pacific. These conversations provided nuanced perspectives on clinical requirements, operational challenges, and future innovation pathways.

Secondary research encompassed an exhaustive review of peer-reviewed journals, regulatory documents, patent filings, and corporate white papers to triangulate data on material properties, technology performance, and market dynamics. Quantitative insights were buttressed by usage statistics from additive-manufacturing consortia and healthcare analytics platforms. To ensure analytical rigor, all findings underwent iterative validation through expert panels and cross-referencing with public financial disclosures from leading technology providers. This robust framework underpins the reliability of the insights and strategic recommendations presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our 3D Printing Casts market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- 3D Printing Casts Market, by Technology

- 3D Printing Casts Market, by Material

- 3D Printing Casts Market, by Customization Type

- 3D Printing Casts Market, by Application

- 3D Printing Casts Market, by End User

- 3D Printing Casts Market, by Region

- 3D Printing Casts Market, by Group

- 3D Printing Casts Market, by Country

- United States 3D Printing Casts Market

- China 3D Printing Casts Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Summarizing the Evolution, Market Drivers, and Future Potential of 3D Printed Casts in Transforming Orthopedic Treatment Pathways Globally

The confluence of additive-manufacturing advancements, clinical adoption, and evolving trade policies has propelled three-dimensional printed casts from conceptual experiments to mainstream orthopedic solutions. Across geographies and clinical settings, the technology’s promise of personalized fit, improved patient comfort, and streamlined workflows is coming to fruition. Material innovations and modular printing architectures continue to expand the range of applications, from routine fracture management to complex post-surgical immobilization.

Looking ahead, the interplay of regulatory harmonization, cost optimization strategies, and collaborative R&D will determine the pace at which 3D printed casts redefine standard care protocols. Stakeholders who embrace a holistic approach-melding technological acumen with clinical insights and supply chain agility-will be best positioned to capture emerging opportunities. Ultimately, the evolution of three-dimensional printed cast solutions signals a broader shift toward precision healthcare, where additive manufacturing serves as a catalyst for enhanced patient outcomes and operational excellence.

Connecting with Ketan Rohom to Secure Comprehensive Insights on 3D Printed Cast Innovation, Market Trends, and Strategic Opportunities Through a Detailed Report

If you are poised to unlock unparalleled insights and competitive advantages in the rapidly evolving realm of three-dimensional printed orthopedic casts, you are invited to engage directly with Ketan Rohom, Associate Director of Sales & Marketing. With extensive experience guiding healthcare organizations and manufacturing enterprises toward strategic implementation of additive-manufacturing solutions, Ketan offers tailored advice to align emerging opportunities with your unique business objectives. By reaching out, you will gain access not only to an in-depth market research report but also to ongoing support in interpreting findings, benchmarking performance, and identifying collaboration prospects across the value chain.

Take the next step in transforming patient care and operational efficiency by contacting Ketan Rohom today. Secure your copy of the comprehensive report and set your organization on a path to lead the field of 3D printed casts. Ketan and his team are ready to discuss customized engagement options, licensing arrangements, and executive briefings designed to integrate the latest intelligence into your strategic planning process.

- How big is the 3D Printing Casts Market?

- What is the 3D Printing Casts Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?