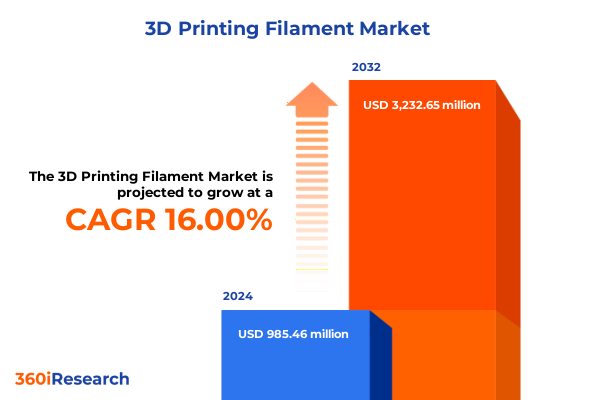

The 3D Printing Filament Market size was estimated at USD 1.13 billion in 2025 and expected to reach USD 1.30 billion in 2026, at a CAGR of 16.16% to reach USD 3.23 billion by 2032.

Setting the Stage for a Deep Dive into the Transformative Dynamics Driving the Modern 3D Printing Filament Industry

The 3D printing filament market has rapidly transcended its niche roots to become a vital component of additive manufacturing ecosystems worldwide. Fueled by ongoing advances in material science, digital fabrication platforms, and applications ranging from prototyping to end-use production, this arena demands a comprehensive understanding of both technological innovations and market drivers. As businesses and research institutions continue to adopt and integrate 3D printing solutions, the filament that serves as the raw feedstock has emerged as a strategic lever for performance, cost, and sustainability. Consequently, a detailed examination of this market’s foundational aspects is crucial for decision-makers seeking to harness its full potential.

In this executive summary, we embark on an exploration that begins with the core trends propelling the industry forward, traverses the complex landscape shaped by regulatory changes and tariffs, and delves into segmentation insights that reveal the nuanced interplay of material types, distribution channels, and end-use industries. Moreover, this document illuminates regional dynamics that underscore global growth patterns and competitive intensity. By synthesizing these elements, industry participants can identify areas of opportunity, anticipate emerging challenges, and craft strategies that align with the evolving demands of manufacturers, designers, and end users alike. Through this structured approach, we set the stage for informed decision-making and strategic alignment in a market defined by rapid innovation and dynamic supply chains.

Exploring How Cutting-Edge Materials Innovations and Digital Supply Chain Integration Are Reshaping the 3D Printing Filament Market

Innovation within the 3D printing filament space has accelerated at an unprecedented pace, forcing stakeholders to reimagine traditional manufacturing paradigms. Advanced polymer formulations are now engineered for enhanced mechanical strength, thermal resistance, and biocompatibility, enabling applications that were once restricted to industrial-grade materials. Furthermore, the emergence of composite filaments-infused with carbon fibers, metals, or ceramics-has expanded the scope of additive manufacturing into demanding sectors such as aerospace and medical devices, where material performance cannot be compromised.

Concurrently, the industry has witnessed a shift toward sustainability, with manufacturers prioritizing recycled and bio-based polymers to address environmental concerns. This movement has catalyzed investments in closed-loop recycling systems and material recovery technologies, establishing a more circular economy for filament production. Additionally, digital transformation has permeated every stage of the supply chain, from blockchain-enabled traceability of raw materials to AI-driven quality control during extrusion. These digital solutions not only enhance product consistency but also empower customers with granular insights into material provenance and performance characteristics.

Beyond material and digital innovations, the market has diversified in distribution methods. Online platforms have democratized access to specialty filaments, while traditional retail channels maintain a critical role in delivering standardized products to hobbyists and educational institutions. Together, these shifts indicate that the 3D printing filament landscape is no longer a monolithic commodity market but a dynamic ecosystem where customization, sustainability, and digital integration drive competitive advantage.

Analyzing the Far-Reaching Operational and Strategic Ripples from the 2025 United States Polymer Tariffs on Filament Production

In early 2025, the United States implemented a revised tariff structure targeting key polymer imports, including ABS, PLA precursors, and specialized engineering-grade resins. These measures, aimed at bolstering domestic manufacturing and protecting local suppliers, introduced import duties in the range of 7.5 to 15 percent on select feedstocks. As a result, filament producers faced increased input costs, which prompted a wave of strategic adjustments in sourcing and pricing strategies.

Many manufacturers responded by forging stronger partnerships with domestic suppliers of polymer pellets and investing in local extrusion facilities to mitigate import exposure. The pressing need to absorb or pass through higher costs spurred innovation in material formulations, as R&D teams sought to substitute affected polymers with alternatives that offered comparable performance at lower duty rates. Simultaneously, some global filament producers realigned their production footprints, shifting capacity closer to the U.S. market or leveraging free trade agreements in neighboring regions to optimize logistical efficiency.

These tariff-induced dynamics have also influenced end-user behavior. Price-sensitive industries, such as consumer electronics and education, have increased their adoption of entry-level filaments or explored bulk purchasing agreements to spread costs across larger volumes. Conversely, sectors with stringent performance requirements-like aerospace and healthcare-remain committed to premium materials, reflecting a willingness to prioritize technical specification over cost. Ultimately, the 2025 tariffs have catalyzed a recalibration of supplier relationships, material development roadmaps, and distribution strategies, reshaping the competitive landscape for 3D printing filament providers.

Uncovering How Material, Distribution, and End Use Dimensions Converge to Define Competitive Advantages in Filament Markets

Diving deeper into the market composition, material type plays a decisive role in defining performance and application scope. ABS continues to dominate where impact resistance and post-processing compatibility are critical, while PLA holds strong appeal for prototyping and educational settings due to its biodegradability and low melting temperature. Nylon and TPU have gained traction in flexible and functional prototyping scenarios, providing enhanced chemical resistance and elasticity, respectively. Meanwhile, PETG bridges the gap between PLA’s user-friendliness and ABS’s robustness, making it a versatile choice for both hobbyists and industrial users.

Distribution channels further nuance market dynamics. Online sales have surged, driven by the convenience of direct-to-consumer access and the proliferation of third-party marketplaces offering a vast selection of filament brands and formulations. Manufacturer websites have optimized digital storefronts with advanced search filters and subscription models, increasing customer retention and driving upsell opportunities. In parallel, retail channels maintain their importance for certain buyer segments. Mass merchants cater to entry-level users seeking affordability and immediate availability, whereas specialty stores position themselves as consultants, offering advice on technical specifications and material compatibility.

End-use industries also shape demand profiles. Aerospace applications require stringent certification protocols and specialized high-performance composites, whereas the automotive sector explores filament-based rapid tooling and in-cab interior prototypes. In consumer electronics, small-batch production of custom enclosures and device components accelerates innovation cycles. Educational institutions emphasize ease of use and safety, favoring PLA and PETG for classroom settings. Healthcare providers leverage biocompatible and sterilizable filaments for custom medical models and surgical guides. Across prototype and development activities, rapid iteration and material flexibility remain paramount, underscoring the value of a diversified filament portfolio.

This comprehensive research report categorizes the 3D Printing Filament market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Technology

- End Use Industry

- Application

- Distribution Channel

Examining Distinct Growth Drivers and Market Characteristics Across Americas, EMEA, and Asia-Pacific Regions

Geographic trends reveal distinct regional characteristics that guide strategic priorities. In the Americas, strong growth in North America is driven by robust R&D investments, a vibrant maker community, and supportive regulatory frameworks for additive manufacturing. Latin America, though smaller, shows emerging interest in localized production hubs to reduce dependency on imports and address supply chain disruptions.

In the Europe, Middle East & Africa landscape, stringent environmental regulations have accelerated the adoption of recycled and bio-based filaments, while established automotive and aerospace clusters continue to demand high-performance materials. The Middle East’s strategic investments in advanced manufacturing and free zone incentives are fostering nascent filament extrusion facilities aimed at serving regional demand.

The Asia-Pacific region represents both scale and innovation. China’s rapid industrialization and government-backed initiatives have cultivated a dense ecosystem of filament manufacturers, often competing on price and volume. Australia and Southeast Asian markets, by contrast, emphasize customization and specialty formulations to address the needs of education and healthcare sectors. Across these geographies, proximity to raw material suppliers and logistical infrastructure remains a decisive factor in cost structures and delivery timelines.

This comprehensive research report examines key regions that drive the evolution of the 3D Printing Filament market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing How Vertical Integration, Strategic Alliances, and Digital Innovation Are Redefining Leadership in Filament Manufacturing

Leading filament producers have adopted divergent strategies to consolidate their market positions. Established chemical conglomerates leverage vertical integration, sourcing polymer feedstocks from their own refining operations and channeling them into proprietary extrusion lines. This approach enables strict quality control and cost containment while expediting new product introductions. Specialized material innovators, on the other hand, focus on niche formulations-such as high-performance composites or flame-retardant filaments-to differentiate their offerings and command premium pricing.

Strategic collaborations between hardware manufacturers and filament suppliers have proliferated, creating bundled solutions that guarantee optimal print performance and reduce troubleshooting for end users. Joint R&D ventures further enhance this synergy, enabling rapid iteration of material blends and print profiles tuned to emerging printer architectures. Moreover, select companies are investing in digital platforms that integrate filament ordering, inventory management, and usage analytics, fostering recurring revenue streams and deeper customer engagement.

On the competitive front, mid-sized players are capitalizing on agility, tailoring localized product portfolios and value-added services such as custom color matching or small-batch specialty runs. By contrast, global conglomerates emphasize scale economics and extensive distribution networks, reinforcing their reach in both traditional retail and e-commerce channels. This dynamic interplay between size, specialization, and digital enablement defines the competitive landscape and shapes future consolidation trajectories.

This comprehensive research report delivers an in-depth overview of the principal market players in the 3D Printing Filament market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3D HUBS B.V. by Protolabs

- 3D Systems, Inc.

- 3D4Makers B.V.

- Apium Additive Technologies GmbH

- Arkema S.A.

- BASF SE

- ColorFabb B.V

- Desktop Metal Inc.

- Dream Polymers

- DuPont de Nemours, Inc.

- Evonik Industries AG

- HATCHBOX 3D

- Henkel AG & Co. KGaA

- Hewlett-Packard Development Company, L.P.

- Intamsys Technology Co., Ltd.

- Koninklijke DSM N.V.

- Manlon Polymers

- Materialise NV

- N-Fil3D

- Shenzhen Esun Industrial Co., Ltd.

- Solvay SA

- Stratasys, Ltd.

- Ultimaker B.V.

- Victrex PLC

Strategic Playbook for Leadership Positioning Through Supply Chain Resilience, Sustainability, and Digital Engagement

To navigate the evolving terrain, industry leaders should prioritize supply chain diversification. Establishing alternative sourcing partnerships-including regional polymer suppliers and recycled material reclaimers-will mitigate exposure to tariff fluctuations and geopolitical disruptions. Concurrently, investing in modular extrusion capabilities can accelerate product customization and reduce time to market for new filament blends.

Material sustainability must move from a peripheral initiative to a core strategy. Companies are encouraged to allocate R&D resources toward bio-based and recycled polymer developments, while collaborating with recycling startups to close the loop on industrial scrap and end-of-life prints. Integrating sustainability metrics into product roadmaps will not only satisfy regulatory requirements but also resonate with environmentally conscious customers.

Embracing digital platforms for filament procurement and analytics will unlock new avenues for customer engagement. By offering subscription models, automated reordering, and real-time usage data, firms can foster loyalty and derive actionable insights to refine product offerings. Partnerships with printer OEMs and software providers will further enhance these digital ecosystems, ensuring seamless user experiences.

Finally, aligning pricing strategies with end-use requirements will be essential. Tiered pricing models that reflect material performance and certification levels can capture value from high-end industrial applications while maintaining accessibility for entry-level buyers. Regularly benchmarking competitor prices and monitoring raw material indices will empower agile adjustments and preserve margins under shifting cost structures.

Detailing a Robust Multi-Method Research Framework Combining Expert Interviews Surveys and Secondary Analysis for Market Clarity

This analysis is founded on a rigorous multi-method research approach combining primary and secondary data. Expert interviews with material scientists, supply chain executives, and additive manufacturing specialists provided firsthand insights into emerging trends and strategic imperatives. These qualitative perspectives were complemented by a targeted survey of end-users across aerospace, healthcare, automotive, and education sectors to gauge material preferences, procurement challenges, and investment priorities.

Secondary research encompassed an exhaustive review of industry whitepapers, regulatory filings, patent databases, and digital platform analytics to map competitive landscapes and technological advancements. Trade association publications and government reports were examined for tariff schedules, environmental regulations, and incentive programs affecting filament production and usage.

Data triangulation was employed to validate findings, cross-referencing interview narratives with survey results and secondary source statistics. This methodology ensured a robust analytical framework, providing both breadth and depth in capturing the complex dynamics of the 3D printing filament market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our 3D Printing Filament market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- 3D Printing Filament Market, by Material Type

- 3D Printing Filament Market, by Technology

- 3D Printing Filament Market, by End Use Industry

- 3D Printing Filament Market, by Application

- 3D Printing Filament Market, by Distribution Channel

- 3D Printing Filament Market, by Region

- 3D Printing Filament Market, by Group

- 3D Printing Filament Market, by Country

- United States 3D Printing Filament Market

- China 3D Printing Filament Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesizing Market Forces Material Innovations and Regional Dynamics to Chart the Future Trajectory of Filament Demand

The 3D printing filament market stands at a pivotal juncture defined by innovation, regulatory shifts, and evolving end-use requirements. Material advancements and sustainability imperatives are reshaping product portfolios, while digital supply chain tools and strategic partnerships are forging new pathways to customer engagement. Concurrently, policy changes such as the 2025 U.S. tariffs have underlined the importance of supply chain agility and localized production strategies.

Segmentation insights highlight the nuanced demands across material types, distribution channels, and industry verticals, revealing opportunities for differentiation and targeted growth. Regional analyses further accentuate the diversity of market dynamics, underscoring the need for tailored approaches in the Americas, EMEA, and Asia-Pacific markets. Leading companies that harness vertical integration, digital innovation, and sustainability will be best positioned to outpace competitors and capture emerging market segments.

As the industry continues to mature, ongoing investment in R&D, strategic collaborations, and digital transformation will be paramount. This analysis provides a comprehensive foundation for stakeholders to align their strategies, mitigate risks, and seize the opportunities presented by this dynamic and rapidly evolving market.

Unlock Exclusive Market Intelligence and Drive Strategic Growth in the 3D Printing Filament Sector with Expert Guidance from Ketan Rohom

To secure unparalleled strategic guidance and gain a competitive edge in the rapidly evolving 3D printing filament industry, connect with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to obtain the comprehensive market research report tailored to your business needs. Explore in-depth analyses, expert recommendations, and actionable forecasts that will empower your organization to navigate tariff challenges, capitalize on material innovations, and optimize distribution channels. Reach out today to unlock the insights that will drive your next phase of growth and leadership in the filament market.

- How big is the 3D Printing Filament Market?

- What is the 3D Printing Filament Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?