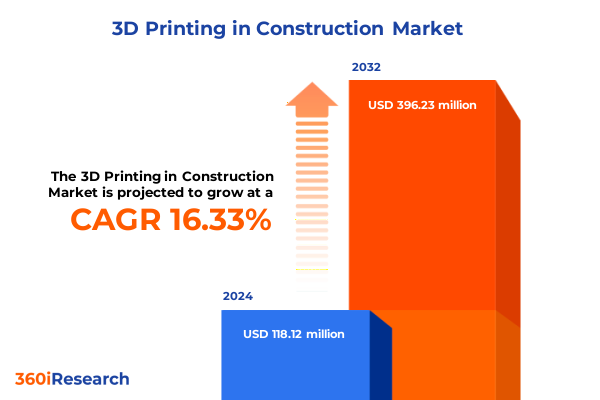

The 3D Printing in Construction Market size was estimated at USD 137.34 million in 2025 and expected to reach USD 161.06 million in 2026, at a CAGR of 16.34% to reach USD 396.23 million by 2032.

Embracing the Dawn of 3D Printing in Construction: How Additive Manufacturing Is Transforming Building Practices and Redining Structural Innovation

The advent of 3D printing in construction represents a paradigm shift, introducing additive manufacturing processes that transcend the limits of traditional building techniques. By layering cementitious materials with high precision, this approach enables complex geometries, reduces material wastage, and accelerates project timelines. Consequently, stakeholders across architecture, engineering, and construction are reevaluating workflows, embracing digital design-to-build platforms that seamlessly integrate architectural intent with on-site fabrication.

Emerging at the intersection of robotics, advanced material science, and digital modeling, 3D construction printing is redefining how structures are conceived and executed. Early adopters have demonstrated its potential through pilot projects ranging from residential prototypes to public infrastructure components. These pioneering efforts underscore the promise of cost efficiency, design flexibility, and sustainability. As investor interest intensifies and regulatory bodies adapt to accommodate these innovations, the industry stands on the brink of broader implementation. Through this executive summary, readers will gain a comprehensive understanding of the forces driving this transformation, the obstacles yet to overcome, and the strategic imperatives for successful deployment.

Unveiling the Groundbreaking Technological and Material Advances Shaping the Future of 3D Construction Printing Across the Globe

As the technology matures, dramatic breakthroughs in material formulations and printer capabilities have catapulted 3D construction printing from research labs into on-site deployments. Next-generation concrete mixes infused with recycled aggregates and supplementary cementitious materials have achieved strength and durability comparable to conventional mixes while significantly reducing carbon footprints. Simultaneously, modular gantry and robotic arm systems have scaled printing volumes, enabling the fabrication of multi-story elements and infrastructural components with unprecedented speed. According to recent industry reports, some 3D concrete printers now construct basic wall structures in under 24 hours, an accomplishment previously unthinkable in standard building trades (The Guardian) turn2news14.

In addition to material and hardware innovations, software advancements have streamlined the end-to-end workflow. Intelligent slicing algorithms translate complex architectural models into optimized toolpaths, balancing structural performance with print stability. Real-time monitoring and adaptive feedback loops ensure quality control throughout the build, mitigating defects and reducing the need for post-processing. By integrating environmental impact assessment modules, designers can evaluate life-cycle emissions and resource consumption before a single layer is deposited. This convergence of technology layers has ushered in a new era of design freedom, operational efficiency, and environmental stewardship, heralding transformative shifts in how the built environment is realized.

Assessing the Compounded Effects of Escalating United States Tariff Measures on 3D Printing Construction Cost Structures and Supply Chains in 2025

Tariff policies enacted in early 2025 have introduced significant cost pressures for firms relying on imported materials and machinery for 3D construction printing. Section 232 measures reinstated a 25% levy on steel and aluminum imports, while additional 10% baseline tariffs were applied to all foreign-sourced goods, layering duties as high as 35% on critical inputs like specialized alloys (JDSupra) turn0search1. Furthermore, reciprocal tariffs reaching 34% for select trading partners have exacerbated price volatility and supply chain disruption. This confluence of measures has impelled companies to reassess sourcing strategies, with some accelerating domestic partnerships to safeguard against escalating import costs (Washington Post) turn0news13.

Compounding these financial burdens, ongoing litigation surrounding tariff authority has injected uncertainty into procurement planning. Plaintiffs challenge the administration’s broad interpretation of emergency powers under the IEEPA, arguing that the sweeping levies lack statutory authorization (V.O.S. Selections v. Trump) turn0news14. A looming appellate hearing could redefine the legal framework for future tariff impositions, directly influencing the cost structure of 3D printing operations. Despite potential relief through judicial review, manufacturers and service bureaus face immediate margin compression and project delays as they navigate a fracturing global trade landscape.

Decoding Market Dimensions Through Multi-Level Segmentation Across Materials, Technologies, Software, Components and Applications in 3D Construction Printing

The 3D printing in construction market unfolds across distinct material categories, each offering unique performance attributes and application potential. Concrete mixtures such as self-healing concrete leverage encapsulated healing agents for autonomous crack repair, while ultra-high performance concrete delivers tensile strengths that rival traditional steel reinforcement. In parallel, metal-based solutions incorporate steel alloys optimized for structural load-bearing and sustainable composites that integrate recycled feedstocks, expanding possibilities for durable façade elements and modular beams. Polymers complete the spectrum; thermoplastics enable rapid prototyping of non-load-bearing fixtures, whereas thermosetting polymers impart heat resistance for specialized formwork applications.

Technological modalities further segment the landscape into extrusion and powder binding approaches. Contour crafting and layer-based extrusion systems excel at depositing continuous filaments of cementitious slurries, facilitating robust shell construction. Meanwhile, binder jetting and selective laser sintering unlock fine-detail components and repair parts production through precise particle consolidation in metal or polymer powders. Underpinning these physical processes is a triad of software capabilities-control software coordinates print paths and ensures precision, design software empowers architects with parametric modeling tools for bespoke geometries, and simulation software validates environmental impact and structural performance before deployment.

Component segmentation delineates printed outputs into roofs and floors, supporting columns and beams, and walls and façades. Flooring systems range from interlocking floor panels to monolithic slabs, while roofing structures exploit lightweight trusses printed on-demand. Reinforced beams and supportive columns can be fabricated with integrated conduit pathways for mechanical systems, enhancing installation efficiency. Three-dimensional printed wall panels merge insulation and structural functions, and pre-cast walls printed off-site accelerate the erection phase with plug-and-play simplicity. Across end-use applications, the technology adapts to diverse project scales: office complexes and retail constructs leverage rapid façade printing, factories and power utilities integrate printed support structures, infrastructure undertakings apply printed bridge components, and residential builds benefit from fully printed load-bearing shells.

This comprehensive research report categorizes the 3D Printing in Construction market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Software Type

- Component Type

- Technology Type

- End-Use Application

Navigating Region-Specific Dynamics and Growth Drivers Shaping the Adoption of 3D Printing Technologies Across the Americas, EMEA, and Asia-Pacific

Regional dynamics shape the pace and nature of 3D printing adoption in construction across the Americas, EMEA, and Asia-Pacific, driven by policy environments, infrastructure demands, and investment priorities. In North America, public-private partnerships and regulatory sandboxes have catalyzed pilot programs in both the United States and Canada. High labor costs and pressing affordable housing needs have propelled stakeholder collaboration to lower barriers and validate performance through demonstration projects in Texas and Florida. This market’s maturity is underscored by the presence of leading OEMs and service bureaus investing in localized manufacturing networks.

Conversely, Europe, the Middle East, and Africa region exhibits a heterogeneous landscape. Northern and Western Europe benefit from robust R&D funding and progressive sustainability mandates that prioritize low-carbon building strategies. Meanwhile, the Middle East has embraced 3D printing in high-profile hospitality and social housing initiatives, leveraging ample land resources to test large-scale printers. In Africa, constrained budgets have steered attention towards cost-effective concrete printing solutions capable of addressing critical housing shortages, often supported by international development grants and NGO partnerships.

In Asia-Pacific, rapid urbanization and infrastructure expansion provide fertile ground for 3D construction printing innovation. China’s government-led stimulus for construction automation has fostered local champions who advance large-format printing for multi-story residential blocks. Australia and South Korea have integrated 3D printing into government housing programs, incentivizing low-emission construction practices. Across the region, the blend of strong state support, competitive manufacturing ecosystems, and acute housing demand underscores a fast-evolving innovation footprint.

This comprehensive research report examines key regions that drive the evolution of the 3D Printing in Construction market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborators Driving Accelerated Adoption and Industry Transformation in 3D Construction Printing

Industry pioneers and emerging challengers alike are shaping the competitive landscape of 3D printing in construction through differentiated technology portfolios and strategic partnerships. ICON has garnered attention for its Vulcan printer, capable of producing residential units in under 24 hours, and its collaborations with humanitarian organizations to deliver affordable housing solutions on multiple continents (BuildingRadar) turn1search1. European-based COBOD International has solidified its position by partnering with established contractors to retrofit existing facilities with modular 3D printing capabilities, extending its footprint into wind turbine components and infrastructure elements (CCE Online News) turn1search0.

Apis Cor and WinSun exemplify vertically integrated models that control material development and on-site printing execution. Apis Cor’s compact mobile printers have demonstrated the feasibility of rapid on-site construction in extreme climates, from arid deserts to urban infill sites, while WinSun’s pioneering use of recycled concrete aggregates achieved significant waste reductions and cost savings in residential village projects (Time) turn2news13. Complementing these global leaders, innovative entrants such as SQ4D and XtreeE focus on region-specific applications-SQ4D securing occupancy certifications in the United States for fully printed homes, and XtreeE delivering bespoke architectural elements for marine and public art installations in Europe (Manufactur3D) turn1search4. Collectively, these companies underscore a vibrant ecosystem where technology differentiation, application focus, and sustainability credentials drive competitive advantage.

This comprehensive research report delivers an in-depth overview of the principal market players in the 3D Printing in Construction market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acciona S.A.

- AI Build Ltd.

- Alquist 3D

- Apis Cor

- BATIPRINT 3D

- Branch Technology, Inc.

- COBOD International A/S

- CONCR3DE

- Contour Crafting Corporation

- CyBe Construction B.V.

- Evolution Construction System, S.L.

- FRAMECAD

- ICON Technology, Inc.

- Imprimere AG

- Mighty Buildings, Inc.

- MudBots 3D Concrete Printing, LLC

- MX3D BV

- MYK LATICRETE India Pvt. Ltd.

- Samsung E&A Co., Ltd.

- Sika AG

- SQ4D Inc.

- Tvasta Manufacturing Solutions Private Limited

- WASP S.r.l.

- XtreeE

- Yingchuang Building Technique (Shanghai)Co., Ltd.

Strategic Imperatives and Actionable Roadmaps to Empower Industry Leaders in Harnessing 3D Printing for Competitive Advantage and Sustainable Growth

To capitalize on the momentum of 3D printing in construction, industry leaders should initiate strategic pilots that align with organizational risk profiles and resource availability. By collaborating with technology providers on proof-of-concept projects, companies can accrue experiential insights, refine workflows, and validate cost and time savings within controlled environments. Moreover, forging alliances with academic institutions and standard bodies will enable proactive influence on emerging regulations and certification protocols, ensuring that printed components meet or exceed safety and performance criteria.

In parallel, stakeholders should realign supply chains to prioritize flexibility and resilience. This involves diversifying raw material sources, establishing domestic extrusion or powder binding suppliers, and investing in digital traceability systems to monitor material provenance and compliance. Furthermore, embedding sustainability metrics within project evaluation frameworks will support corporate ESG objectives, enhancing brand reputation and unlocking green financing opportunities.

Finally, executive teams must cultivate a culture of continuous innovation by upskilling the workforce in digital competencies and additive manufacturing principles. Structured training programs, cross-functional project rotations, and knowledge-sharing platforms will accelerate organizational readiness, enabling seamless integration of 3D printing capabilities into existing project pipelines. By adopting these actionable recommendations, industry players can harness additive manufacturing’s full potential, driving operational excellence, competitive differentiation, and long-term value creation.

Comprehensive Research Approach Combining Primary Insights, Secondary Data and Rigorous Validation to Map the 3D Construction Printing Ecosystem

Our research framework employed a hybrid methodology, commencing with extensive secondary research across peer-reviewed journals, trade publications, and regulatory filings to map technological advancements, tariff policies, and regional adoption patterns. Primary interviews with C-suite executives, project managers, and material scientists provided qualitative insights into deployment challenges, strategic priorities, and success metrics. To validate findings, we triangulated data points through multiple sources, including patent databases, government tenders, and equipment supplier disclosures.

Quantitative analysis encompassed a rigorous assessment of adoption rates across segments and geographies, leveraging project databases and public infrastructure records. Scenario modeling evaluated the impact of tariff fluctuations under alternate policy trajectories, while sensitivity analyses tested the robustness of cost-saving assumptions under varied material compositions and print speeds. Finally, peer reviews by industry experts and academic advisors ensured methodological rigor and impartiality. This comprehensive approach underpins the credibility of our insights and recommendations, offering stakeholders a dependable foundation for strategic planning and investment decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our 3D Printing in Construction market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- 3D Printing in Construction Market, by Material Type

- 3D Printing in Construction Market, by Software Type

- 3D Printing in Construction Market, by Component Type

- 3D Printing in Construction Market, by Technology Type

- 3D Printing in Construction Market, by End-Use Application

- 3D Printing in Construction Market, by Region

- 3D Printing in Construction Market, by Group

- 3D Printing in Construction Market, by Country

- United States 3D Printing in Construction Market

- China 3D Printing in Construction Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2544 ]

Synthesizing Key Insights on Technology Disruption, Market Dynamics and Strategic Pathways to Conclude the 3D Printing Construction Narrative

In conclusion, 3D printing in construction is no longer a nascent concept but an accelerating force reshaping design, supply chains, and project delivery models. Technological strides in material science, hardware scalability, and software intelligence have converged to unlock new possibilities in structural innovation, sustainability, and cost optimization. However, the evolving tariff landscape and regulatory uncertainties underscore the importance of adaptive strategies and robust risk management.

Segmentation analysis reveals that end-to-end value creation-from advanced cementitious mixtures to specialized software and diversified components-will continue to drive competitive differentiation. Regional insights highlight varied adoption trajectories, where policy frameworks and infrastructure demands catalyze localized innovation ecosystems. Leading companies demonstrate that partnerships, integrated business models, and focused R&D investments are critical to capturing first-mover advantages.

Ultimately, the successful integration of 3D printing into mainstream construction hinges on collaborative ecosystems that bridge technology providers, regulators, financiers, and end users. By embracing rigorous pilot validations, supply chain realignment, and workforce transformation, stakeholders can mitigate barriers and capitalize on the transformative potential of additive manufacturing. As the sector evolves, those who proactively adapt and innovate will define the next frontier of resilient, efficient, and sustainable built environments.

Secure Your Competitive Edge in 3D Printing Construction by Connecting with Ketan Rohom for In-Depth Market Intelligence and Strategic Guidance

To secure unparalleled insights and strategic advantage in the rapidly evolving world of 3D printing in construction, reach out directly to Ketan Rohom, the Associate Director of Sales & Marketing. Ketan’s in-depth expertise and deep understanding of market dynamics will enable you to unlock tailored solutions and actionable intelligence designed to drive your organization’s growth and innovation. By engaging with Ketan, you gain access to comprehensive data analysis, exclusive industry benchmarks, and personalized guidance that will empower you to make informed decisions and stay ahead of emerging trends. Whether you are exploring new material technologies, evaluating regional opportunities, or assessing the impact of policy shifts, a conversation with Ketan will provide the clarity and confidence necessary to navigate complex challenges. Connect today to request your full market research report and transform your strategic vision into tangible results.

- How big is the 3D Printing in Construction Market?

- What is the 3D Printing in Construction Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?