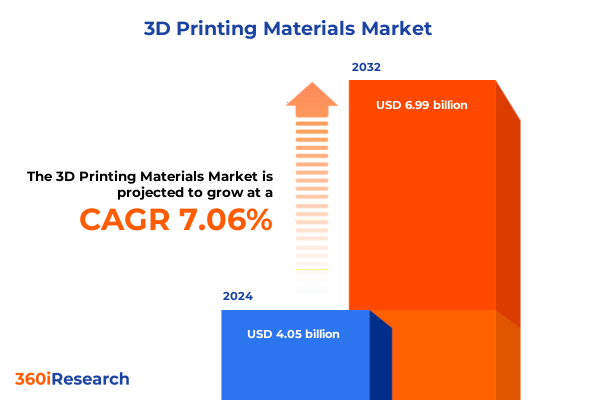

The 3D Printing Materials Market size was estimated at USD 4.32 billion in 2025 and expected to reach USD 4.62 billion in 2026, at a CAGR of 7.10% to reach USD 6.99 billion by 2032.

Exploring the Pillars of Innovation and Value in the Emerging Landscape of Three-Dimensional Printing Materials and Their Strategic Implications

The dynamic realm of three-dimensional printing materials has transcended its experimental origins to become an indispensable driver of innovation across industries. Recent advancements in polymer chemistry and metal alloys have not only expanded the palette of usable materials but also have reshaped the possibilities for engineering precision components. With manufacturers demanding ever-greater performance characteristics-ranging from enhanced thermal stability to improved biocompatibility-the materials landscape continues to evolve at an unprecedented pace.

In parallel, the convergence of digital design tools, automated production workflows, and additive manufacturing platforms has cemented materials science as a central enabler of competitive differentiation. Organizations are increasingly recognizing that material selection is not a mere procurement decision but a strategic lever that influences product lifecycle, cost efficiency, and end-user satisfaction. This paradigm shift underscores the need for a holistic understanding of material properties, supply chain considerations, and regulatory nuances.

As decision-makers navigate this complex landscape, synthesizing technical expertise with market intelligence becomes critical. This executive summary aims to distill core trends, assess the impact of recent policy adjustments, and surface actionable insights. By framing the current state of materials development alongside emerging challenges and opportunities, it sets the stage for informed strategic planning that ensures resilience and sustained growth in a rapidly transforming industry.

Unveiling the Key Technological Advancements and Paradigm Shifts Redefining the Three-Dimensional Printing Materials Space in 2025

The three-dimensional printing materials sector is undergoing transformative shifts driven by breakthroughs in composite formulations and next-generation photopolymers. Advanced composites, which blend ceramic reinforcements with thermoplastic matrices, now deliver unprecedented mechanical strength and thermal resistance. Concurrently, high-performance photopolymers that leverage UV-curable acrylic and epoxy chemistries are enabling finer resolution prints in medical device prototyping and dental applications.

Meanwhile, metals tailored for additive processes-particularly aluminum, stainless steel, and titanium-are redefining aerospace and automotive manufacturing by supporting weight reduction and design consolidation. Beyond composition, material form factors such as precision-engineered powders, filaments, and high-viscosity resins are optimizing deposition processes, enhancing surface finish, and reducing post-processing requirements. These material innovations coincide with the rise of sustainable feedstocks and recyclable formulations that address lifecycle considerations.

Moreover, the integration of artificial intelligence and machine learning into material development workflows is accelerating the discovery of novel polymer blends and alloy compositions. AI-driven predictive modeling reduces experimental cycles, while real-time process monitoring ensures consistent quality. Together, these transformative forces are reshaping the competitive playing field, compelling stakeholders to rethink traditional sourcing models, invest in agile R&D platforms, and foster cross-disciplinary collaborations.

Assessing the Comprehensive Effects of the 2025 United States Tariff Adjustments on the Accessibility and Economics of Three-Dimensional Printing Materials

In 2025, the United States introduced targeted tariffs on imported powders, filaments, and resins to bolster domestic production and address trade imbalances. These measures have reverberated across supply chains, compelling both material suppliers and end users to reevaluate sourcing strategies. Import dependencies for specialty aluminum and titanium powders, as well as high-purity photopolymer resins, have translated into recalibrated procurement approaches and intensified negotiations with domestic producers.

Consequently, stakeholders have accelerated investments in local manufacturing capabilities and strategic partnerships aimed at mitigating exposure to elevated import duties. Whereas imported stainless steel feedstocks once dominated specific aerospace components, incremental cost pressures are now driving a gradual pivot toward onshore alloy production facilities. Simultaneously, resin producers are exploring co-manufacturing arrangements with North American collaborators to circumvent tariff barriers and preserve competitive pricing.

These cumulative policy effects have also catalyzed a broader reassessment of inventory management and just-in-time delivery frameworks. Companies are expanding safety stock levels for critical materials while diversifying supplier portfolios to maintain continuity of operations. Ultimately, the 2025 tariff adjustments have underscored the importance of supply chain resilience and local ecosystem development as foundational elements of long-term strategic planning.

Illuminating Segmentation Dynamics to Decode Market Preferences Across Material Composition, Form, Grade, Industry Verticals, and Application Domains

Examining material composition reveals that each category brings distinct performance profiles and market considerations to the additive ecosystem. Ceramic powders are prized for high-temperature applications, composites offer a balance of rigidity and weight savings, metals such as aluminum, stainless steel, and titanium are essential for load-bearing components, photopolymers including acrylic and epoxy enable precision detailing and rapid curing, while thermoplastics provide versatility across prototyping and end-use production contexts.

Turning to material form, filaments grant simplicity and cost-effectiveness for desktop printers, pellets support large-format extrusion systems, powders drive powder bed fusion techniques in both metal and polymer domains, and resins power stereolithography and digital light processing platforms with fine feature resolution. Material grade segmentation differentiates dental-grade formulations-characterized by biocompatibility and regulatory compliance-from industrial-grade variants engineered for structural performance and thermal endurance.

Industry vertical insights underscore how aerospace and defense applications demand certified alloys and resins with stringent traceability, automotive use cases prioritize cycle time reduction and surface finish, consumer goods manufacturing values aesthetics and tactile properties, educational institutions focus on safe, non-toxic materials, healthcare relies on specialized medical-grade polymers, and industrial sectors require abrasion-resistant and chemical-resistant formulations. Ultimately, application-driven segmentation highlights the nuanced requirements for aerospace components, dental restoratives, end-use parts in consumer electronics, medical devices, rapid prototyping iterations, and tooling fixtures supporting traditional manufacturing lines.

This comprehensive research report categorizes the 3D Printing Materials market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Composition

- Material Form

- Material Grade

- End Use Industry

- Application

Comparative Regional Perspectives and Strategic Growth Drivers Impacting Three-Dimensional Printing Materials Adoption Across Major Global Markets

Regional dissection of the three-dimensional printing materials landscape reveals divergent adoption trajectories shaped by local manufacturing capacities, regulatory environments, and investment climates. The Americas benefit from a robust network of advanced manufacturing hubs and government incentives aimed at onshoring critical supply chains, which accelerate the uptake of metal powders and industrial-grade polymers in aerospace and automotive clusters.

In the Europe, Middle East & Africa corridor, stringent regulatory frameworks and sustainability mandates have driven demand for recyclable thermoplastic filaments and eco-friendly composite formulations. Strong collaborations between research institutions and industrial consortia in this region continue to advance photopolymer innovations for medical and dental sectors, reinforcing its status as a key innovation nexus.

Asia-Pacific’s growth narrative is characterized by rapidly expanding manufacturing infrastructure and substantial capital allocation to additive printing technologies. Emerging economies are investing heavily in metal powder production and setting up dedicated facilities for photopolymer resin synthesis. Furthermore, cross-border partnerships and joint ventures are cultivating local expertise in advanced materials, thereby fostering a competitive environment that is fueling widespread commercial deployment.

This comprehensive research report examines key regions that drive the evolution of the 3D Printing Materials market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Market Participants Showcasing Innovation Leadership, Strategic Collaborations, and Competitive Positioning in Three-Dimensional Printing Materials

Across the competitive landscape, leading material suppliers demonstrate a blend of innovation prowess, strategic alliances, and extensive distribution networks. Some prominent players have diversified their portfolios through targeted acquisitions, securing advanced composite technologies and proprietary photopolymer resin formulations to strengthen their end-to-end value propositions. Others have forged collaborative development agreements with equipment manufacturers, embedding material expertise into hardware platforms to optimize performance.

Strategic partnerships with research universities and national laboratories have emerged as a critical lever, enabling companies to accelerate the commercialization of novel metal alloys and high-temperature polymers. Moreover, investments in digital platforms for material qualification and certification have differentiated these vendors by offering transparent data on mechanical properties, biocompatibility, and environmental impact.

Beyond technology, companies are expanding their global reach through regional production hubs and localized technical support teams. Such initiatives not only mitigate tariff risks but also deepen customer engagement through on-site training, application development services, and responsive supply chain integration. This multifaceted approach positions leading participants to capture a broader spectrum of use cases, from aerospace components to dental restoratives and beyond.

This comprehensive research report delivers an in-depth overview of the principal market players in the 3D Printing Materials market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3D Systems Corporation

- Carbon, Inc.

- Desktop Metal, Inc.

- EOS GmbH – Electro Optical Systems

- Formlabs, Inc.

- GE Additive (General Electric Company)

- HP Inc.

- Markforged, Inc.

- Materialise N.V.

- Nano Dimension Ltd.

- Protolabs, Inc.

- Renishaw plc

- SLM Solutions Group AG

- Stratasys Ltd.

Action-Oriented Strategic Recommendations to Propel Stakeholder Success and Sustainable Growth in the Competitive Three-Dimensional Printing Materials Industry

Industry leaders seeking to capitalize on evolving demand should prioritize the development of advanced composite materials that combine lightweight characteristics with enhanced thermal and mechanical properties. Simultaneously, establishing co-manufacturing partnerships within key regions can help mitigate policy-induced cost pressures and improve supply chain resilience. Providers should also invest in modular digital platforms that integrate material qualification data to support rapid application development and regulatory compliance.

Furthermore, diversifying material portfolios to include both dental-grade resin systems and industrial-grade high-performance polymers can unlock new end-use sectors and reinforce cross-industry relevance. Aligning materials roadmaps with additive equipment manufacturers through early-stage collaboration will create optimized hardware-material ecosystems, delivering differentiated value to end users.

Finally, actionable steps include building sustainability frameworks centered on recyclable materials and lifecycle management, while enhancing technical support services to accelerate customer adoption. By coordinating research initiatives with academic and government institutions, organizations can access emerging technologies and co-develop next-generation alloys and polymer blends. Executing these strategies will position stakeholders to lead market transitions and secure enduring competitive advantages.

Transparent Research Procedures and Data Collection Framework Validating the Credibility and Depth of Insights in the Three-Dimensional Printing Materials Analysis

This analysis draws upon a dual-phased research approach combining primary interviews with senior executives, engineers, and procurement specialists, alongside extensive secondary research from reputable industry publications, patent filings, and public company disclosures. The primary phase included structured discussions to validate material performance criteria, supply chain challenges, and regional growth drivers.

Complementing these insights, secondary data collection involved triangulating information from trade association reports, government trade databases, and technical whitepapers to ensure comprehensive coverage of material compositions, form factors, grading standards, and end-use applications. Analytical frameworks such as SWOT analysis and Porter's Five Forces were employed to assess competitive dynamics and identify strategic inflection points.

Data integrity was further reinforced through expert panel reviews, where independent academics and industry consultants scrutinized key findings and methodology. Quality control procedures included cross-verification of tariff details with official government publications and consultation with in-country market specialists. This rigorous methodological foundation underpins the credibility of the insights presented in this executive summary.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our 3D Printing Materials market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- 3D Printing Materials Market, by Material Composition

- 3D Printing Materials Market, by Material Form

- 3D Printing Materials Market, by Material Grade

- 3D Printing Materials Market, by End Use Industry

- 3D Printing Materials Market, by Application

- 3D Printing Materials Market, by Region

- 3D Printing Materials Market, by Group

- 3D Printing Materials Market, by Country

- United States 3D Printing Materials Market

- China 3D Printing Materials Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesis of Critical Findings and Strategic Reflections Framing the Future Trajectory of Three-Dimensional Printing Materials Development

The synthesis of this research underscores a multifaceted materials landscape defined by rapid technological evolution, shifting policy environments, and diversified application requirements. Material composition advancements-spanning ceramics, composite matrices, metal alloys, photopolymers, and thermoplastics-continue to expand the horizons of additive manufacturing. Concurrently, policy measures such as the 2025 tariff adjustments have reaffirmed the importance of resilient supply chains and local manufacturing capabilities.

Segmentation analysis reveals that nuanced material forms, grade specifications, and targeted applications demand tailored solutions, compelling suppliers to adopt agile development models. Regional insights further highlight distinct growth trajectories shaped by regulatory frameworks and investment priorities, from the Americas’ focus on onshoring to EMEA’s sustainability mandates and Asia-Pacific’s manufacturing scale-up.

In sum, stakeholders that integrate material innovation with strategic partnerships, digital qualification platforms, and sustainability initiatives will be best positioned to lead the next wave of three-dimensional printing applications. The collective findings chart a path for informed decision-making and strategic investment, laying the groundwork for sustained value creation in this dynamic industry.

Engage with Associate Director for Exclusive Access to In-Depth Three-Dimensional Printing Materials Research Insights and Customized Strategic Guidance

To explore tailored implications for your organization and secure strategic foresight, reach out directly to Ketan Rohom, whose stewardship in sales and marketing has empowered leading stakeholders to harness critical insights. A conversation with Ketan will provide personalized guidance on aligning material selections with evolving industry demands, navigating policy landscapes, and tapping into emerging growth corridors.

By engaging in this dialogue, you will obtain priority access to proprietary research findings, exclusive data deep dives, and recommendation frameworks curated to your operational needs. Ketan’s expertise ensures that you can translate complex market intelligence into actionable plans, whether refining your supply chain resilience, accelerating product innovation, or expanding your footprint across high-potential regions.

Connect with Ketan Rohom for a comprehensive walkthrough of the full report, and discover how tailored strategies can drive your competitive differentiation. Secure your advantage now and transform research into measurable business outcomes by partnering with a proven leader committed to your success.

- How big is the 3D Printing Materials Market?

- What is the 3D Printing Materials Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?