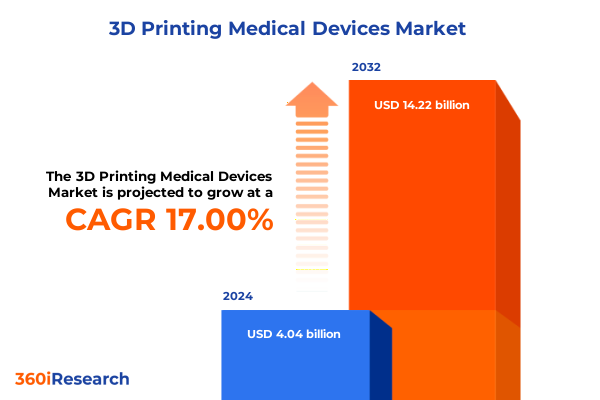

The 3D Printing Medical Devices Market size was estimated at USD 4.73 billion in 2025 and expected to reach USD 5.54 billion in 2026, at a CAGR of 16.99% to reach USD 14.22 billion by 2032.

Unveiling the Technological Evolution and Strategic Imperatives Driving the Rapid Integration of 3D Printing Within the Medical Device Sector

Over the past decade, three-dimensional printing has transitioned from a compelling prototyping tool to a fundamental enabler of personalization, precision, and efficiency in medical device manufacturing. From patient-specific implants to bespoke surgical guides, additive manufacturing has unlocked possibilities that were previously inconceivable with conventional production methods. Advances in material science have broadened the palette of biocompatible polymers and metals, while digital imaging and design software have matured to support intricate geometries and complex internal structures.

As healthcare providers and device OEMs strive to improve patient outcomes and manage cost pressures, the integration of 3D printing technologies has become a strategic imperative. This executive summary introduces the key forces propelling this transformation, including technological breakthroughs, evolving regulatory landscapes, granular market segmentation, regional dynamics, and the strategic maneuvers of leading suppliers. By synthesizing these elements, the report illuminates pathways to capitalize on emerging opportunities and navigate critical challenges facing the medical device community today.

Exploring the Convergence of Advanced Materials, Digital Workflows, and Regulatory Evolution That Is Redefining the 3D Printing Medical Device Landscape

In recent years, the landscape of 3D printing in medical devices has been reshaped by the convergence of advanced materials, sophisticated digital workflows, and proactive regulatory adaptations. Breakthroughs in metal and polymer formulations have enabled the production of implants and prosthetics that meet rigorous biocompatibility and mechanical performance criteria. Concurrently, the adoption of integrated software platforms has streamlined the transition from patient imaging data to printable design files, reducing lead times and minimizing the risk of human error.

Meanwhile, regulatory agencies have accelerated efforts to define clear guidelines for additive manufacturing, recognizing its potential to enhance quality, traceability, and customization. These shifts have fostered a more collaborative ecosystem in which device makers, technology providers, and clinical partners coalesce around standardized protocols, shared data frameworks, and joint validation initiatives. As a result, new applications-from on-demand surgical instruments to regenerative scaffolds-have moved more rapidly from concept to clinic, fundamentally redefining the boundaries of medical innovation.

Assessing the Cumulative Financial, Supply Chain, and Innovation Impacts of United States Tariffs on 3D Printing Medical Device Components in 2025

The introduction of new tariffs by the United States government in 2025 targeting imported metal powders and specialized polymer resins has created significant cost pressures across the additive manufacturing ecosystem. Manufacturers reliant on cost-competitive global suppliers have encountered rising input expenses, compelling many to reevaluate sourcing strategies and inventory models. In addition to immediate price increases, these measures have exacerbated lead-time volatility as logistics networks adjust to shifting trade flows.

In response, industry leaders have accelerated investments in domestic material production and established long-term agreements with strategic suppliers to hedge against further tariff escalations. While these efforts mitigate risk, they also raise the need for comprehensive supply chain visibility and resilience planning. Furthermore, the prospect of future regulatory modifications has spurred stronger collaboration between material scientists and design engineers to optimize formulations that balance performance with cost efficiency. As a result, the cumulative impact of tariffs in 2025 has driven a holistic reassessment of procurement, R&D priorities, and operational agility across the medical device printing sector.

Driving Future Success Through Strategic Investments and Collaborations: An Actionable Roadmap for Industry Leaders in 3D Printed Medical Device Manufacturing

Deep segmentation analysis uncovers the nuanced drivers of growth and innovation within the 3D printing medical device market. Application segmentation reveals robust expansion in dental aligners due to demand for discrete, patient-specific orthodontic solutions, alongside significant adoption of crowns, bridges, and denture fabrication technologies. In the implants space, orthopedic implants demonstrate steady uptake driven by aging populations, while craniofacial and dental implants benefit from enhanced imaging-to-print workflows. Prosthetics and orthotics technologies are evolving rapidly with improvements in material strength and comfort, and surgical instruments leverage additive manufacturing’s ability to deliver intricate, single-use tools on demand.

Examining technology segmentation, stereolithography remains a mainstay for high-resolution polymer parts, while fused deposition modeling has gained traction for cost-effective prototype development. Selective laser sintering and binder jetting technologies provide scalable platforms for complex geometries, and direct metal laser sintering continues to drive advances in load-bearing metal implants. Electron beam melting, although less prevalent, is carving out a niche for large titanium structures.

Material segmentation highlights a shift toward metal alloys and ceramics for permanent implants, whereas plastics and composite materials dominate in temporary devices and prototyping. In the end user landscape, hospitals are expanding point-of-care printing capabilities for urgent surgical applications, dental clinics are establishing in-house labs for same-day prosthetic devices, contract manufacturers are scaling service bureaus to meet diverse OEM needs, and research institutes remain pivotal for exploratory bioprinting and regenerative medicine.

Finally, printer type segmentation shows rapid uptake of desktop systems among design and clinical teams for early-stage development, while industrial systems are indispensable for high-throughput, certified production workflows. Together, these segmentation insights form a cohesive framework to inform strategic investment, product portfolio planning, and partnership opportunities in the evolving 3D printing medical device domain.

This comprehensive research report categorizes the 3D Printing Medical Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Material

- Printer Type

- Application

- End User

Analyzing Growth Drivers and Strategic Opportunities Across the Americas, EMEA, and Asia-Pacific for Advancing 3D Printing in Medical Device Applications

Regional nuances are reshaping the trajectory of 3D printing medical devices globally. In the Americas, the United States leads with point-of-care manufacturing initiatives in major hospital networks and a favorable regulatory environment encouraging early adoption. Strong collaborations between device makers and leading academic medical centers have accelerated clinical validations and product launches, positioning the region at the forefront of personalized healthcare solutions.

Across Europe, the Middle East, and Africa, diverse healthcare systems and heterogeneous reimbursement models have created pockets of innovation hubs, particularly in Germany and the United Kingdom, where standardized regulatory frameworks underpin cross-border trade and clinical trials. Emerging markets in the Gulf region are investing heavily in healthcare infrastructure, creating new avenues for digital manufacturing and supply chain localization.

The Asia-Pacific region is experiencing the most rapid growth, fueled by government-led smart manufacturing initiatives, substantial R&D funding, and partnerships with local OEMs. China and Japan are particularly active in establishing domestic material production facilities and collaborative innovation centers. Australia and Singapore, with their robust healthcare ecosystems and emphasis on precision medicine, have become testbeds for advanced bioprinting and regenerative device applications. These varied regional dynamics underscore the need for tailored market entry strategies that align with local regulations, reimbursement pathways, and ecosystem capabilities.

This comprehensive research report examines key regions that drive the evolution of the 3D Printing Medical Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Strategies, Partnerships, and Innovation Pathways Adopted by Leading Manufacturers Shaping the 3D Printing Medical Device Industry Today

Leading participants are deploying a range of competitive strategies to secure their positions in the surging 3D printed medical device arena. Established equipment manufacturers are investing in collaborative partnerships with biomaterial suppliers to broaden their material portfolios and accelerate regulatory approvals. Meanwhile, pure-play materials companies are forging alliances with medical device OEMs to co-develop application-specific resin and metal formulations that meet stringent clinical requirements.

Simultaneously, technology-focused start-ups are challenging incumbents by offering cloud-enabled platforms and artificial intelligence–driven design tools that optimize part orientation, minimize support structures, and predict mechanical performance. Larger ecosystem players are responding with acquisitions of niche software developers and the expansion of service bureau offerings to provide end-to-end solutions from design validation to post-processing.

Moreover, cross-industry joint ventures are emerging, combining expertise from aerospace and automotive additive manufacturing to enhance production scalability and certification processes for high-volume medical components. These varied maneuvers illustrate a market in which collaboration and convergence are driving both incremental improvements and disruptive leaps, setting the stage for accelerated innovation in patient-focused devices.

This comprehensive research report delivers an in-depth overview of the principal market players in the 3D Printing Medical Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3D Systems Corporation

- Abbott Laboratories

- Anatomics Pty Ltd.

- Anisoprint SARL

- Apium Additive Technologies GmbH

- Arkema SA

- Biomedical Modeling Inc.

- Carbon, Inc.

- EOS GmbH

- Evonik Industries AG

- Formlabs Inc.

- GE HealthCare Technologies Inc.

- Henkel AG & Co. KGaA

- Johnson & Johnson Services, Inc.

- Materialise NV

- Organovo Holdings Inc.

- Prodways Group

- Proto Labs, Inc.

- RapidMade Inc.

- Renishaw PLC

- Restor3d, Inc.

- Siemens AG

- SLM Solutions Group AG

- Smith & Nephew PLC

- Solvay S.A.

- Stratasys Ltd.

- Stryker Corporation

- Thermo Fisher Scientific Inc.

- Zimmer Biomet Holdings, Inc.

- Zortrax S.A.

Driving Future Success Through Strategic Investments and Collaborations: An Actionable Roadmap for Industry Leaders in 3D Printed Medical Device Manufacturing

Industry leaders can capitalize on rising momentum by focusing on three core imperatives. First, strategic investments in advanced material research will yield a competitive edge, enabling the co-creation of application-specific alloys and polymers optimized for performance, biocompatibility, and regulatory compliance. Second, building robust point-of-care manufacturing networks within healthcare systems will shorten product development cycles and enhance clinical responsiveness, strengthening relationships with key end users.

Third, forging deeper partnerships with regulatory bodies and standards organizations can streamline approval pathways, reducing time to market and mitigating compliance risks. In parallel, integrating digital thread architectures that connect design, production, and quality management systems will improve traceability and support data-driven decisions. By prioritizing these initiatives, industry stakeholders will not only navigate emerging tariff landscapes and supply chain uncertainties but also position themselves to lead transformative advancements in patient-centric care.

Elucidating the Comprehensive Research Methodology Employing Primary Engagements, Secondary Analysis, and Validation Techniques for Robust Market Intelligence

The insights presented in this report derive from a rigorous mixed-method research framework. Primary research engagements included in-depth interviews with C-level executives, R&D directors, and clinical specialists across medical device OEMs, material suppliers, and healthcare institutions. These conversations were complemented by surveys of laboratory managers and hospital procurement teams to capture real-world adoption trends and operational challenges.

Secondary research encompassed a comprehensive review of publicly available literature, patent filings, regulatory guidance documents, and white papers from leading industry consortia. Quantitative data points were triangulated through cross-referencing trade publications, scientific conference proceedings, and investor presentations. To ensure analytical robustness, findings were validated through iterative discussions with an advisory panel of domain experts, covering technology feasibility, supply chain dynamics, and evolving policy frameworks.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our 3D Printing Medical Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- 3D Printing Medical Devices Market, by Technology

- 3D Printing Medical Devices Market, by Material

- 3D Printing Medical Devices Market, by Printer Type

- 3D Printing Medical Devices Market, by Application

- 3D Printing Medical Devices Market, by End User

- 3D Printing Medical Devices Market, by Region

- 3D Printing Medical Devices Market, by Group

- 3D Printing Medical Devices Market, by Country

- United States 3D Printing Medical Devices Market

- China 3D Printing Medical Devices Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing Key Insights and Strategic Implications to Chart a Forward-Looking Perspective on the Evolution of 3D Printing in Medical Device Manufacturing

This executive summary has synthesized the pivotal forces shaping the 3D printing medical device sector-from breakthrough materials and digital workflows to the ripple effects of new tariffs and granular segmentation dynamics. Regional perspectives highlight divergent growth pathways and underscore the necessity of tailored strategies to harness local opportunities. Corporate profiles reveal a landscape defined by collaboration, convergence, and competitive differentiation.

As additive manufacturing continues to gain clinical validation and regulatory clarity, stakeholders across the value chain must adopt a proactive posture, leveraging data-driven insights to inform investment, innovation, and partnership decisions. By aligning strategic priorities with the evolving technological, regulatory, and market landscapes, organizations can unlock new frontiers in personalized care, operational resilience, and sustainable growth. The time to act is now, as the industry stands on the cusp of a new era in medical device manufacturing.

Engage with Ketan Rohom to Secure Your Comprehensive Report and Gain Unparalleled Strategic Insights into the 3D Printing Medical Device Market

For organizations seeking a decisive edge in a rapidly evolving market, partnering with Ketan Rohom ensures direct access to unparalleled expertise and tailored insights. As Associate Director of Sales & Marketing, Ketan stands ready to guide you through the complexities of 3D printing in medical device manufacturing, helping you align strategic objectives with market realities. Reach out today to secure the comprehensive report and embark on a pathway to innovation, enhanced competitiveness, and sustainable growth in this transformative industry

- How big is the 3D Printing Medical Devices Market?

- What is the 3D Printing Medical Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?