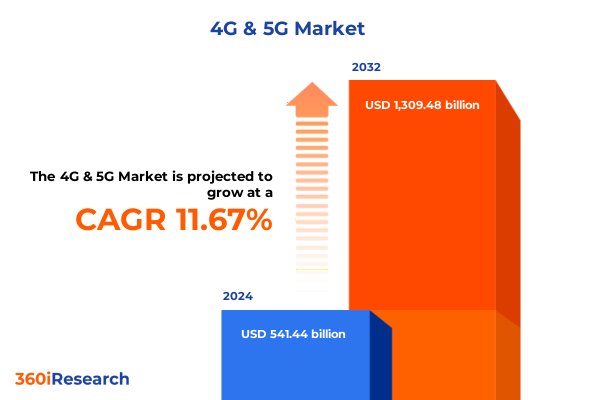

The 4G & 5G Market size was estimated at USD 602.03 billion in 2025 and expected to reach USD 670.00 billion in 2026, at a CAGR of 11.74% to reach USD 1,309.48 billion by 2032.

Introducing the Evolution of Mobile Connectivity: From Foundational 4G Infrastructure to Pioneering 5G-Age Innovations and Opportunities

The rapid evolution of mobile connectivity from fourth-generation (4G) networks to the forefront of fifth-generation (5G) deployments has reshaped the telecommunications landscape, unlocking unprecedented speeds, capacity, and functionality. 4G technology laid the groundwork for widespread mobile broadband use, enabling high-definition video streaming, real-time communications, and the rise of mobile applications that underpin today’s digital economy. In contrast, 5G introduces transformative capabilities such as ultra-low latency, massive machine-type communications, and network slicing, which support emerging use cases in industrial automation, immersive media, and smart city initiatives.

In parallel, spectrum allocation strategies have evolved to encompass low-band (<1 GHz) for wide area coverage, mid-band (1–6 GHz) for balanced performance, and high-band mmWave (>24 GHz) for ultra-high capacity, each playing a pivotal role in meeting diverse connectivity demands. Cloud-native architectures, including network function virtualization (NFV) and software-defined networking (SDN), have gained traction to enable more agile service delivery and cost-efficient scale. As the industry transitions to architectures such as Cloud Radio Access Network (C-RAN) and Multi‐access Edge Computing (MEC), operators are redefining how networks are designed, deployed, and monetized.

Against this backdrop, the convergence of hardware, software, and services across traditional operators, cloud hyperscalers, and emerging private network providers underscores a dynamic ecosystem. Hardware innovations in antennas, chipsets, and industrial IoT modules are complemented by advanced analytics platforms and orchestrated network management tools. Simultaneously, consulting and managed services deliver the expertise and operational support necessary to navigate the complexity of 4G continuity and 5G expansion. Understanding this multifaceted progression is critical for decision-makers seeking to capitalize on the next wave of mobile connectivity.

Identifying Critical Technological Transformations That Are Redefining the 4G to 5G Paradigm Across Connectivity, Virtualization, and Edge Intelligence

Across the mobile connectivity domain, several transformative shifts are redefining the 4G-to-5G paradigm, each driven by technological advances and evolving market expectations. First, the transition from monolithic, hardware-centric deployments toward virtualized, cloud-native infrastructures empowers operators to dynamically allocate resources and introduce new services at software speed. Innovations in network automation and orchestration reduce operational complexity, accelerate time-to-market, and optimize traffic management across heterogeneous access environments.

Meanwhile, the proliferation of multi-access edge computing is enabling real-time analytics and localized processing, which are essential for latency-sensitive applications such as autonomous vehicles and industrial control systems. This edge-enabled model complements centralized data centers, creating a distributed fabric that supports both broad coverage and hyper-local performance. Moreover, the adoption of network slicing allows service providers to carve distinct logical networks on a common physical infrastructure, delivering customized performance profiles for diverse verticals like healthcare, manufacturing, and public safety.

In the realm of spectrum, a strategic shift toward mid-band and high-band allocations is addressing burgeoning capacity requirements, while dynamic sharing frameworks for licensed and unlicensed bands are fostering more efficient utilization. As a result, ecosystem participants are increasingly partnering across traditional operator boundaries, software vendors, and cloud platforms to co-develop turnkey solutions. This collaborative momentum is laying the foundation for next-generation services that marry connectivity, compute, and analytics, delivering business models previously unattainable in the mobile arena.

Examining the Aggregate Consequences of United States Tariff Policies in 2025 on Supply Chains, Costs, and Strategic Procurement in Mobile Networks

The imposition of new and expanded tariff measures by the United States in 2025 has introduced significant supply chain considerations for mobile network stakeholders. Tariffs targeting imported semiconductor components and network equipment have elevated input costs, prompting operators to reassess sourcing strategies and inventory management practices. In particular, higher duties on chipsets and antenna systems have increased procurement lead times and diminished margin visibility, compelling network builders to explore alternative or diversified supplier portfolios.

Furthermore, the cumulative effect of Section 301 and Section 232 tariffs has fueled a broader reevaluation of onshore versus offshore manufacturing choices. While reshoring critical production capabilities may mitigate future trade risk, it also requires substantial capital investment and process retooling. As a stopgap, many operators have accelerated partnerships with domestic foundries and contract manufacturers, leveraging government incentives and tax credits to offset incremental duties.

In addition, regional content requirements and import licensing adjustments have reshaped logistics planning, as carriers seek to balance compliance obligations with aggressive deployment timelines for 5G expansions. These evolving policy dynamics underscore the importance of proactive trade-policy monitoring and agile procurement frameworks, enabling network operators and equipment vendors to navigate the intricate interplay of cost pressures, regulatory complexity, and market demand.

Uncovering Deep Segment-Level Understandings from Components to Deployment Modes to Reveal Diverse Adoption Patterns in Mobile Network Infrastructure

A granular segmentation analysis reveals nuanced adoption patterns across components, technologies, spectrum bands, and deployment paradigms that collectively define market behavior. Within component segmentation, hardware remains the backbone, encompassing antennas, chipsets, and industrial IoT modules, the latter subdivided into communication and sensor modules. Complementing these physical assets, software platforms for analytics, monitoring, and orchestration deliver end-to-end visibility and policy control. Meanwhile, consulting and managed services, including maintenance and network operations, provide the specialized expertise to implement complex network architectures.

Network technology segmentation delineates the market between established 4G infrastructures and the accelerating footprint of 5G. Underpinning performance differentiation, spectrum band classification highlights the critical roles of low-band for widespread coverage, mid-band for capacity and balance, and mmWave for ultra-high throughput. Concurrently, network architecture segmentation captures the spectrum of deployment approaches, from cloud-optimized radio access networks to distributed nodes, edge compute platforms, virtualized functions, and software-defined control layers.

Further refining the landscape, deployment models distinguish between non-standalone and standalone implementations, while deployment type segmentation contrasts hybrid, private, and public network initiatives. Lastly, end-user insights trace demand trajectories across consumer, enterprise-spanning automotive, energy & utilities, healthcare, manufacturing, and retail-and government & public safety verticals. Together, these segment-level perspectives uncover the intersections of technology preference, spectrum strategy, and service delivery that drive differential growth across the mobile connectivity ecosystem.

This comprehensive research report categorizes the 4G & 5G market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Network Technology

- Spectrum Band

- Spectrum Ownership

- Network Architecture

- Deployment Type

- Deployment Mode

- End User

Evaluating Stakeholder Behavior and Infrastructure Developments Across the Americas Europe Middle East & Africa and Asia-Pacific Mobile Connectivity Markets

Regional market dynamics reflect the interplay between infrastructure maturity, regulatory environments, and stakeholder priorities across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, incumbent operators are advancing 5G deployments through spectrum auctions that emphasize mid-band and mmWave licenses, supported by substantial private sector investment in small-cell densification and public-private partnerships for smart city trials. Regulatory initiatives focused on network sharing and rural broadband grants have also accelerated coverage expansion.

Meanwhile, the Europe Middle East & Africa region exhibits considerable heterogeneity, with Western European markets prioritizing network virtualization and open-RAN trials, while Middle Eastern nations invest in greenfield 5G rollouts to drive digital transformation. In Africa, spectrum harmonization efforts and cost-effective deployment models are key enablers for extending connectivity to underserved areas.

In Asia-Pacific, dense urban environments in East Asia continue to push the envelope on mmWave commercialization and ultra-broadband applications, whereas South and Southeast Asian markets balance affordability with performance, often leveraging low-band spectrum and hybrid public-private network models. Across all regions, ecosystem collaboration among operators, technology vendors, and system integrators shapes the pace and character of mobile network evolution.

This comprehensive research report examines key regions that drive the evolution of the 4G & 5G market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Participants Demonstrating Innovation Strategic Partnerships and Competitive Differentiation in the Mobile Connectivity Ecosystem

Leading participants in the mobile connectivity ecosystem are distinguishing themselves through targeted innovation, strategic alliances, and expanded service portfolios. Key infrastructure vendors are launching multi-layer antenna systems optimized for mid-band and mmWave frequencies, while chipset manufacturers are unveiling new system-on-chip solutions that integrate power efficiency with support for network slicing. Cloud providers are deepening their involvement by offering turnkey edge computing platforms tailored for telco workloads, and software firms are enhancing orchestration suites with AI-driven analytics for predictive maintenance and capacity forecasting.

In parallel, consulting and managed service companies are forging partnerships with both operators and hyperscalers to deliver comprehensive deployment and operational support, bundling network design, testing, and optimization services under unified service level agreements. Additionally, private network integrators are aligning with vertical specialists to deliver industry-specific use cases, such as automated logistics in manufacturing and remote patient monitoring in healthcare. These collaborative strategies reinforce the competitive positioning of ecosystem leaders and accelerate the introduction of differentiated 5G-enabled solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the 4G & 5G market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alpha Wireless Ltd.

- Alpha Wireless Ltd.

- Amphenol Antenna Solutions

- Analog Devices, Inc.

- Anritsu Corporation

- Ansys, Inc.

- Broadcom Inc.

- C&T RF Antennas Inc

- Cisco Systems, Inc.

- Comba Telecom Systems Holdings Limited

- CommScope

- Digi International Inc.

- Ericsson AB

- Evercom Communication

- Faststream Technologies

- Fujitsu Limited

- Huawei Technologies Co., Ltd.

- Huber+Suhner AG

- Infineon Technologies AG

- Inseego Corp.

- Intel Corporation

- Kathrein SE

- Keysight Technologies, Inc.

- Marvell Technology, Inc

- Mavenir, Inc.

- MediaTek Inc.

- Mitsubishi Electric Corporation

- NEC Corporation

- NETGEAR, Inc.

- Nokia Corporation

- NXP Semiconductors N.V.

- PC-Tel, Inc.

- Qorvo, Inc.

- Qualcomm Technologies Inc.

- Samsung Electronics Co., Ltd.

- Sierra Wireless, Inc.

- Skyworks Solutions, Inc.

- STMicroelectronics International N.V.

- TE Connectivity Ltd.

- Texas Instruments, Inc.

- UNISOC(Shanghai)Technologies Co., Ltd. by Tsinghua Unigroup Co., Ltd.

- ZTE Corporation

Delivering Actionable Strategies to Navigate Regulatory Challenges Technology Adoption and Partnership Models for Mobile Network Advancement

Industry leaders must move beyond incremental upgrades and embrace holistic strategies that encompass regulatory engagement, technology standardization, and partnership ecosystems. To navigate complex trade policies and tariff volatility, organizations should establish dedicated policy monitoring units and cultivate relationships with governmental agencies to anticipate and influence regulatory shifts. In parallel, adopting open interfaces and interoperable architectures will mitigate vendor lock-in and lower barriers for multi-vendor deployments. This approach facilitates seamless network slicing, supports non-standalone to standalone migrations, and fosters a thriving supply chain.

From a technology standpoint, investing in edge computing and advanced analytics platforms is paramount for capturing new revenue streams in enterprise and public safety verticals. Industry players should co-innovate with system integrators and cloud hyperscalers to develop modular, use-case-driven solutions that combine connectivity, compute, and application logic. Moreover, service providers can differentiate through managed offerings that include AI-powered performance assurance and remote network orchestration, catering to customers that require end-to-end SLAs without in-house expertise.

Finally, forging cross-industry alliances-with automotive OEMs, utility companies, and healthcare providers-will cultivate high-value use cases and accelerate deployment. By participating in testbeds and standards bodies, companies can shape the future of network interfaces, security frameworks, and next-generation service models. These actionable strategies enable organizations to turn emerging technologies into sustainable competitive advantage.

Detailing Rigorous Research Methodology Integrating Diverse Primary and Secondary Data Sources for Robust Mobile Technology Insights

This research draws on a comprehensive methodology that integrates both secondary and primary data collection to ensure robust and balanced findings. The secondary phase involved an extensive review of publicly available sources, including regulatory filings, industry white papers, vendor technical briefs, and academic publications, to establish foundational knowledge of network architectures, spectrum policies, and emerging technology roadmaps. Concurrently, proprietary trade-policy databases and customs analytics were analyzed to quantify the impact of tariffs on component sourcing and supply chain configurations.

The primary research component comprised structured interviews with more than 50 senior executives across operators, equipment vendors, cloud providers, system integrators, and enterprise end users. These conversations provided real-world perspectives on deployment strategies, procurement priorities, and service monetization models. Interview findings were triangulated against market data and deployment case studies to validate insights and identify consistent themes across regions and verticals.

Following data aggregation, qualitative and quantitative analyses were conducted to map segment-level dynamics, assess technology adoption curves, and elucidate regional differentiators. Analytical frameworks such as SWOT and Porter’s Five Forces were adapted to the telecom context, enriching the narrative with strategic implications. The resulting research deliverable provides a transparent, verifiable, and actionable view of the 4G and 5G mobile connectivity landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our 4G & 5G market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- 4G & 5G Market, by Component

- 4G & 5G Market, by Network Technology

- 4G & 5G Market, by Spectrum Band

- 4G & 5G Market, by Spectrum Ownership

- 4G & 5G Market, by Network Architecture

- 4G & 5G Market, by Deployment Type

- 4G & 5G Market, by Deployment Mode

- 4G & 5G Market, by End User

- 4G & 5G Market, by Region

- 4G & 5G Market, by Group

- 4G & 5G Market, by Country

- United States 4G & 5G Market

- China 4G & 5G Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 2385 ]

Drawing Together Key Findings to Illuminate Future Pathways Investment Priorities and Strategic Imperatives in the Mobile Connectivity Domain

Synthesis of the research reveals that the convergence of advanced spectrum strategies, cloud-native architectures, and edge-enabled services is redefining mobile connectivity ecosystems and unlocking new value propositions. The shift from 4G to 5G accelerates the need for dynamic resource allocation, requiring operators to adopt virtualization and open-RAN frameworks to remain competitive. Meanwhile, evolving tariff landscapes underscore the importance of flexible sourcing models and domestic manufacturing partnerships to safeguard network deployments against trade uncertainties.

Segment-level analysis highlights that enterprises in healthcare, manufacturing, and energy are rapidly embracing private and hybrid network configurations for mission-critical applications, while consumer and public safety stakeholders prioritize coverage and reliability in licensed low-band deployments. Regional comparisons show that the Americas leads in mmWave commercialization, Europe Middle East & Africa pushes virtualization and open architectures, and Asia-Pacific balances affordability with high-performance urban rollouts.

Looking ahead, industry participants must align regulatory advocacy, technology standardization, and ecosystem collaboration to capitalize on emerging use cases-from autonomous mobility to immersive XR experiences. By embracing proactive procurement strategies, investing in edge compute capabilities, and fostering cross-industry alliances, organizations can translate the research insights into differentiated offerings and sustainable growth in the mobile connectivity domain.

Encouraging Direct Engagement with Associate Director Ketan Rohom to Secure Comprehensive 4G and 5G Mobile Network Research Insights for Strategic Planning

To explore how these comprehensive insights can empower your strategic initiatives and accelerate your competitive differentiation in the rapidly evolving 4G and 5G mobile connectivity space, we invite you to connect directly with Ketan Rohom, Associate Director of Sales & Marketing. His deep industry expertise and consultative approach will help you tailor the findings to your organization’s unique objectives and challenges, ensuring maximal return on your research investment. Engage now to secure the detailed market data, in-depth analyses, and actionable frameworks that will underpin your network deployment, partnership negotiations, and technology roadmaps. Reach out today to turn data-driven intelligence into decisive action and propel your mobile connectivity strategy forward.

- How big is the 4G & 5G Market?

- What is the 4G & 5G Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?