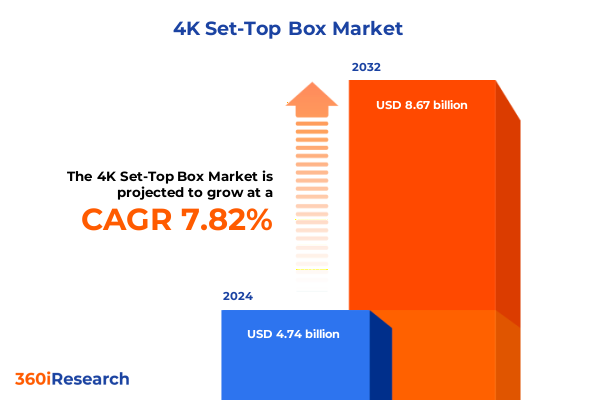

The 4K Set-Top Box Market size was estimated at USD 5.10 billion in 2025 and expected to reach USD 5.49 billion in 2026, at a CAGR of 7.85% to reach USD 8.67 billion by 2032.

Navigating the Emerging 4K Set-Top Box Ecosystem Where Ultra-High-Definition Entertainment Converges with Smart Connectivity for Consumers

The launch of ultra-high-definition set-top boxes represents a pivotal moment in the evolution of home entertainment, fusing cutting-edge video quality with intelligent connectivity to meet soaring consumer expectations. As audiences demand richer visuals and seamless access to diverse content libraries, manufacturers and service providers are compelled to reimagine hardware design, software architectures, and end-to-end user experiences. Against this backdrop, this executive summary distills critical insights on the technologies reshaping the 4K set-top box sector, regulatory and trade influences altering supply chains, and the nuanced segmentation patterns that define adoption dynamics across channels and end users.

By synthesizing the most current industry trends, the following analysis illuminates key innovations, strategic imperatives, and region-specific growth trajectories that will inform decision-making and investment prioritization. Stakeholders will find a comprehensive overview of how transformative shifts-from streaming platform integration to artificial intelligence-driven personalization-are driving differentiation. In addition, the scope and structure of the report underscore the interplay between tariff adjustments, competitive positioning, and consumer preferences. This document thus serves as a strategic compass for technology developers, operators, and investors aiming to capitalize on the promise of 4K set-top box solutions.

Transformative Technological Shifts Redefining the 4K Set-Top Box Market as Streaming, AI Integration, and Edge Computing Rapidly Surge

Over the past two years, unprecedented technological advances have catalyzed a fundamental transformation in the 4K set-top box landscape. Streaming platforms now demand native support for adaptive bitrate streaming and next-generation codecs, compelling device vendors to integrate hardware acceleration for HEVC, AV1, and beyond. Concurrently, the proliferation of voice assistants and AI-driven recommendation engines has shifted embedded software frameworks toward modular, cloud-interfaced architectures, unlocking new avenues for personalization and real-time analytics.

In parallel, the convergence of edge computing with content delivery networks has reduced latency and optimized bandwidth utilization, enabling smooth navigation through vast libraries of ultra-high-definition titles. This shift is augmented by the integration of 5G connectivity options in hybrid devices, which blend Ethernet and WiFi with cellular fallback to ensure uninterrupted streaming even in fluctuating network conditions. As hardware and software coalesce into unified ecosystems, partnerships between chip designers, operating system vendors, and content aggregators are shaping next-generation reference platforms that streamline development cycles and accelerate time-to-market.

Comprehensive Analysis of the Cumulative Effects of 2025 United States Tariffs on the 4K Set-Top Box Supply Chain and Pricing Dynamics

The implementation of new tariff measures in 2025 by the United States government has introduced a spectrum of cost variables impacting 4K set-top box manufacturers and their component suppliers. Heavy levies on semiconductor imports led to a discernible uptick in the average bill of materials for core processing units and memory modules. As a consequence, vendors have revisited bill-of-materials strategies, deciding whether to absorb incremental costs to retain competitive street pricing or pass them through to service providers and end customers.

Moreover, the tariffs prompted a geographic realignment of production footprints, with several OEMs and ODMs exploring partnerships in Southeast Asia and Mexico to mitigate duties and maintain lead times. This shift has had a compounding effect on logistics, raising freight costs and elongating delivery windows, while trade-compliant warehousing solutions gained prominence as a buffer against sudden policy changes. Nonetheless, forward-looking organizations are piloting direct sourcing from non-tariff jurisdictions and negotiating long-term supply agreements that include cost-containment clauses. Such strategies aim to stabilize pricing structures and preserve margin profiles despite ongoing regulatory uncertainties.

Deep Insights into 4K Set-Top Box Market Segmentation Uncovering Application, Distribution, End User, and Connectivity Drivers Shaping Adoption Trends

Market segmentation reveals how distinct application scenarios shape design priorities and performance requirements for 4K set-top boxes. Devices tailored for traditional Cable TV networks emphasize robust tuner integration and conditional access modules, while IPTV-focused units prioritize middleware compatibility and multicast streaming efficiency. Meanwhile, OTT streaming devices hinge on seamless interoperability with subscription video-on-demand services and ad-supported platforms alike, and satellite-oriented boxes require advanced demodulation and error-correction capabilities.

Understanding distribution pathways also offers valuable perspective into go-to-market strategies and customer outreach. Direct sales channels facilitate bespoke deployments for service providers that seek white-label solutions, whereas offline retail remains important for reaching mass-market consumers in big-box electronics stores. At the same time, online retail has surged as a cost-effective avenue for consumer acquisition, and specialized operator channels continue to drive bundled promotions that lock in long-term service agreements.

The segmentation further extends to end-user categories, underscoring divergent needs between commercial and residential deployments. In commercial settings, such as hospitality and corporate environments, stability and centralized device management are paramount. Conversely, residential adoption focuses on user interfaces, voice control integration, and ease of network setup. Lastly, connectivity options-ranging from stable wired Ethernet to flexible WiFi-play a critical role in aligning device form factors with installation environments, balancing performance, convenience, and cost constraints.

This comprehensive research report categorizes the 4K Set-Top Box market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Connectivity

- End User

- Distribution Channel

Strategic Regional Insights Spotlighting Growth Patterns and Key Drivers for 4K Set-Top Box Adoption across the Americas, EMEA, and Asia-Pacific

Regional dynamics in the 4K set-top box market exhibit significant variation in maturity, regulatory frameworks, and consumer behavior across the globe. In the Americas, high broadband penetration and the prevalence of streaming-first households accelerate the adoption of ultra-high-definition set-top devices. North American service providers leverage bundled content packages and exclusive channel offerings to incentivize equipment upgrades, while Latin American markets show strong growth potential driven by expanding fixed-line infrastructure and increasing disposable income.

In the Europe, Middle East & Africa region, regulatory mandates around broadcasting standards and local content quotas shape supplier strategies. Western European operators integrate advanced DRM capabilities to comply with rights management requirements, whereas Middle Eastern pay-TV platforms differentiate through multi-lingual UI customizations. In Africa, the affordability of satellite-focused boxes remains a gateway to premium movie and sports content, despite lower average ARPUs.

Asia-Pacific stands out as a high-growth frontier, fueled by government-led digital inclusion initiatives and a proliferation of regional streaming services. Countries such as India and China emphasize cost-sensitive hardware designs, leading vendors to optimize for high-volume, low-margin models. Meanwhile, markets in Australia and Japan demand cutting-edge feature sets-like hybrid broadcast-broadband TV support and home automation integration-reflecting advanced consumer expectations and robust network backbones.

This comprehensive research report examines key regions that drive the evolution of the 4K Set-Top Box market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Competitive Dynamics in the 4K Set-Top Box Arena Illuminating Strategic Partnerships, R&D, and Market Positioning Influences

Leading technology providers are jockeying to establish their flagship 4K set-top box offerings as de facto platforms for both operators and end users. Semiconductor companies continue to innovate on multi-core SoCs that deliver hardware-accelerated decoding for multiple codecs concurrently, enabling service providers to future-proof their video delivery pipelines. At the same time, OEMs with strong relationships in the pay-TV operator segment differentiate by bundling advanced DRM, cloud DVR client support, and integrated voice assistants.

Content distribution partners are also entering the device economics by co-branding hardware with exclusive content rights or value-add services. This trend is evident in collaborations between leading streaming platforms and device makers, resulting in customized user interfaces and priority content indexing. Furthermore, strategic alliances between chip vendors and software startups have spawned reference designs that expedite time-to-market, allowing smaller manufacturers to compete aggressively on price without sacrificing feature sets.

Competition is intensifying in adjacent smart home ecosystems, prompting set-top box vendors to integrate with home automation hubs and IoT frameworks. The convergence of living-room entertainment and smart-home control surfaces in devices that incorporate Zigbee radios, Bluetooth connectivity, and support for automation platforms. As a result, established household appliance manufacturers and new entrants alike are redefining the purpose of the set-top box as a centralized node within the connected home.

This comprehensive research report delivers an in-depth overview of the principal market players in the 4K Set-Top Box market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ARRIS International plc

- Cisco Systems, Inc.

- Commscope Technologies LLC

- EchoStar Corporation

- Echostar Technologies Corporation

- Hisense Co., Ltd.

- Huawei Technologies Co., Ltd.

- Humax Co., Ltd.

- Infomir LLC

- Kaon Media Co., Ltd.

- LRIPL Limited

- MyBox Technologies Private Limited

- Netgem S.A.

- Panasonic Holdings Corporation

- Roku, Inc.

- Sagemcom SAS

- Samsung Electronics Co., Ltd.

- Sharp Corporation

- Skyworth Digital Holding Co., Ltd.

- TCL Technology Group Corporation

- Technicolor S.A.

- TP Vision Europe B.V.

- Viasat, Inc.

- Xiaomi Corporation

- ZTE Corporation

Actionable Strategic Recommendations for Industry Leaders to Capitalize on 4K Set-Top Box Opportunities, Enhance Differentiation, and Drive Sustainable Growth

Industry leaders should prioritize the development of modular hardware architectures that accommodate rapid codec evolution and emerging AI capabilities. By decoupling core processing modules from user interface layers, companies can accelerate feature upgrades and respond nimbly to shifting content delivery protocols. Equally important is the expansion of strategic partnerships with cloud service providers to integrate scalable transcoding and machine-learning engines, enabling adaptive streaming and personalized recommendations without overburdening on-device resources.

A differentiated go-to-market approach involves balancing online retail efforts with operator collaborations to capture both direct-to-consumer and subscription-driven revenue streams. Tailored pricing models, such as bundled software-as-a-service offerings or ad-supported tiering, can unlock new monetization pathways while enhancing stickiness. In tandem, establishing multi-year component supply agreements can hedge against tariff volatility and secure preferential access to next-generation chipsets.

Finally, embedding smart-home integration as a core value proposition will resonate with the growing segment of consumers seeking unified ecosystem experiences. By aligning set-top box firmware with leading IoT protocols and voice assistant platforms, vendors can transform their devices into versatile command centers-driving incremental upsell opportunities for security, lighting, and energy management add-ons.

Robust Research Methodology Leveraging Primary and Secondary Data Sources to Ensure Comprehensive and Reliable Insights into the 4K Set-Top Box Market

This research employs a hybrid methodology that combines in-depth primary interviews, comprehensive secondary source analysis, and robust data triangulation to deliver actionable intelligence. Primary insights were gathered through structured discussions with senior executives at chipset manufacturers, device OEMs, pay-TV operators, and streaming platform architects. These conversations yielded granular perspectives on product roadmaps, pricing strategies, and integration challenges.

Secondary data sources encompass publicly available regulatory filings, patent databases, technology white papers, and industry conference proceedings. Quantitative data were validated through cross-referencing multiple vendor disclosures and market trend analyses. In addition, expert workshops were convened to stress-test assumptions, refine segmentation frameworks, and validate regional growth projections. This multi-layered approach ensures that the findings presented are both comprehensive and resilient against rapidly shifting market conditions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our 4K Set-Top Box market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- 4K Set-Top Box Market, by Type

- 4K Set-Top Box Market, by Connectivity

- 4K Set-Top Box Market, by End User

- 4K Set-Top Box Market, by Distribution Channel

- 4K Set-Top Box Market, by Region

- 4K Set-Top Box Market, by Group

- 4K Set-Top Box Market, by Country

- United States 4K Set-Top Box Market

- China 4K Set-Top Box Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Concluding Perspectives on the 4K Set-Top Box Industry Transformation and Its Implications for Technology Providers, Operators, and Consumer Experiences

In sum, the 4K set-top box market stands at the nexus of technological innovation, evolving consumer habits, and regulatory flux. The interplay of advanced streaming standards, AI-driven personalization, and tariff-induced supply chain realignment has forged a landscape replete with both challenges and unparalleled growth avenues. Segmentation by application type, distribution channel, end user, and connectivity underscores the importance of targeted strategies, while regional variances highlight where investment and partnership models will yield the greatest returns.

As device capabilities converge toward multifunctional smart-home hubs, the competitive battleground will extend beyond pure video performance to encompass ecosystem integration, user experience design, and sustainable cost management. For stakeholders ready to embrace these dynamics, the pathway to market leadership is guided by nimble hardware architectures, resilient supply chain frameworks, and a relentless focus on end-user value creation.

Connect with Ketan Rohom to Secure In-Depth Market Intelligence and Unlock Strategic Prowess in the 4K Set-Top Box Domain

Unlock a deeper understanding of the ultra-high-definition set-top box market by connecting with Ketan Rohom, Associate Director of Sales & Marketing, to explore tailored insights and secure your competitive advantage today

- How big is the 4K Set-Top Box Market?

- What is the 4K Set-Top Box Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?