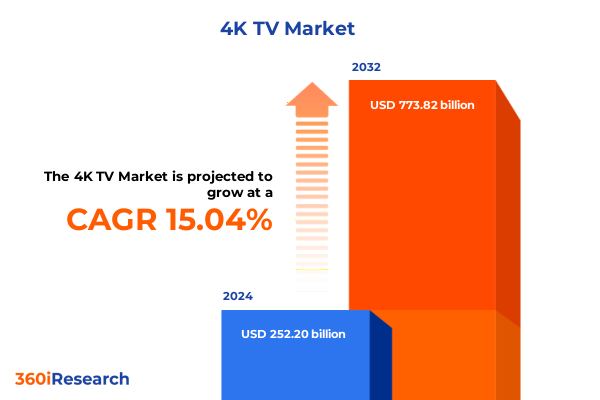

The 4K TV Market size was estimated at USD 289.05 billion in 2025 and expected to reach USD 331.29 billion in 2026, at a CAGR of 15.10% to reach USD 773.82 billion by 2032.

Setting the Stage for the Next Generation of Ultrahigh Definition Television as Consumers Demand Smarter, Larger, and More Immersive Viewing Experiences

The global ultrahigh-definition television landscape has reached an inflection point as technological breakthroughs and evolving consumer expectations converge to create unprecedented opportunities. Over the past few years, the ubiquity of high-speed broadband, the proliferation of streaming platforms, and the mainstream adoption of next-generation gaming consoles have collectively accelerated the shift to 4K resolution. Consumers are no longer content with incremental improvements; they demand truly immersive experiences characterized by razor-sharp clarity, vibrant color reproduction, and seamless motion handling.

Against this dynamic backdrop, manufacturers and content providers are collaborating more closely than ever to deliver end-to-end solutions. Panel innovators are refining manufacturing techniques to enable thinner, lighter displays without compromising on brightness or contrast. Simultaneously, chipset developers are integrating advanced image processing algorithms that leverage artificial intelligence to optimize picture quality on a scene-by-scene basis. As a result, 4K sets today not only render stunning visuals but also adapt in real time to ambient conditions and content types, ensuring viewers enjoy the best possible experience in any environment.

Looking ahead, the industry’s success will hinge on its ability to balance innovation with accessibility. While premium features such as AI-driven upscaling, high dynamic range formats, and variable refresh rates continue to distinguish flagship models, expanding the reach of these technologies into mid-tier and entry-level segments will be critical. Strategic partnerships between OEMs, component suppliers, and software developers will define the next phase of growth, positioning 4K television as the de facto standard for both home entertainment and commercial deployments.

Uncovering the Technological and Market Catalysts Driving Rapid Evolution in Picture Quality, Connectivity, and Consumer Engagement across the 4K TV Ecosystem

Over the past year, the 4K television market has experienced a series of transformative shifts driven by breakthroughs in display architecture and consumer electronics integration. One of the most notable developments is the rise of Mini-LED backlighting in LCD panels, which offers significant improvements in local dimming precision and peak brightness, bringing performance closer to that of OLED alternatives while maintaining high efficiency. This innovation has enabled manufacturers to deliver enhanced contrast ratios and deeper blacks without the risk of burn-in, making Mini-LED an increasingly viable option for premium models.

Parallel to backlighting enhancements, television operating systems have evolved into sophisticated multimedia hubs. Leading brands are embedding AI-based content optimization engines that automatically tweak picture and sound settings based on viewing habits, ambient lighting, and scene characteristics, all in real time. Voice and gesture control integrations have also matured, allowing viewers to interact with their 4K screens more intuitively and access streaming services, gaming menus, and smart home controls with minimal friction. These advancements are redefining the role of the television as the central node in consumer technology ecosystems.

Finally, the growing convergence between ultra-high-definition displays and next-generation gaming platforms has accelerated demand for TVs supporting HDMI 2.1 standards, which enable 4K at up to 120Hz, variable refresh rates, and auto low-latency modes. Gamers are increasingly prioritizing screens that can handle fast-paced graphics without compromise, and manufacturers are responding with models that offer sub-10-millisecond input lag and advanced motion interpolation features. This synergy between gaming and home entertainment is reshaping purchase decisions, driving interest in larger screen sizes and higher refresh rate capabilities.

Assessing the Far-Reaching Consequences of 2025 Tariff Policy Changes on Cost Structures, Sourcing Strategies, and Competitive Dynamics within the United States 4K TV Market

In early 2025, the United States implemented a new set of tariffs targeting imports of flat panel displays, including televisions assembled in China, as part of a broader initiative to address trade imbalances and protect domestic manufacturing. A study commissioned by the Consumer Technology Association and the National Retail Federation highlights that these measures are likely to increase costs throughout the supply chain, placing additional pressure on margin structures. As import duties rise, manufacturers and retailers will face difficult choices regarding cost absorption, price adjustments, or strategic realignment of sourcing.

To mitigate the impact of import levies, many television brands are exploring alternative manufacturing hubs. Mexico has emerged as a leading beneficiary due to existing trade agreements and established infrastructure supporting panel assembly and final testing. Shifting production closer to the U.S. market offers the dual benefits of tariff avoidance and reduced logistics complexity, though it requires upfront investment in localized capacity. Simultaneously, a smaller cohort of companies is evaluating facility expansions in the United States itself, signaling a potential resurgence of nearshoring trends that dominated previous decades.

However, not all manufacturers possess the scale or supply chain flexibility to execute rapid relocations. As a result, those constrained by legacy sourcing agreements may pass elevated costs to end consumers, leading to higher retail prices and potential softening in upgrade cycles, particularly during seasonal promotional windows. Industry observers warn that the full impact of these tariffs may not be felt until the second half of 2025, when reciprocal measures and adjustments in production footprints converge to reshape shipment patterns and pricing strategies across all product tiers.

Delving into the Nuances of Panel Technologies, Screen Dimensions, Display Formats, and End User Preferences Shaping the Diverse Fabric of the 4K Television Marketplace

The diversity of panel technologies has never been greater, encompassing traditional LED-LCD implementations that use direct-lit, edge-lit, or full-array backlight designs, alongside more advanced offerings such as Mini-LED, OLED, and QLED. While legacy edge-lit models remain prevalent in entry-level price bands, full-array backlighting is becoming increasingly common in mid-tier ranges for its superior contrast control. At the same time, Mini-LED panels are closing the performance gap with emissive displays by delivering localized dimming zones at a more accessible price point, and demand for OLED screens continues to expand among discerning buyers who prioritize perfect black levels and wide viewing angles.

Screen dimensions play a pivotal role in consumer decision-making. Mid-range formats between 43 and 55 inches remain the mainstay for living rooms and family spaces, while the premium segment increasingly gravitates toward 55-to-65-inch models for a balanced combination of immersion and affordability. Models larger than 65 inches are gaining ground in high-end installations and dedicated home theater setups, and smaller-than-43-inch sets are finding renewed utility in secondary rooms, guest quarters, and specialized commercial applications where compact footprints are essential.

Display curvature also shapes purchase patterns. Despite a resurgence of interest in flat-panel designs driven by multi-viewer ergonomics, curved screens retain a niche following among gaming enthusiasts and boutique installations seeking a sense of wraparound immersion. Meanwhile, end-user segmentation underscores the distinct requirements across residential and commercial deployments: home environments prioritize aesthetic integration and smart home functionality, whereas commercial buyers-spanning corporate, education, hospitality, and retail sectors-value reliability, extended operating lifecycles, and tailored content management solutions.

This comprehensive research report categorizes the 4K TV market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Panel Type

- Screen Size

- Screen Type

- End User

Exploring Regional Variations in Adoption, Distribution Channels, and Both Emerging and Established Market Drivers across the Americas, EMEA, and Asia-Pacific Territories

Geographic markets exhibit distinct characteristics that influence both demand trajectories and distribution strategies. In the Americas, the United States stands as a mature landscape with high penetration rates, driven by a combination of streaming service proliferation, gaming console cycles, and television replacement patterns. Retail channels in North America are increasingly hybrid, blending online-exclusive launches with experiential showroom formats that allow consumers to compare picture quality under controlled lighting conditions. Meanwhile, Canada presents a more conservative upgrade cadence, with buyers placing a premium on energy efficiency and service partnerships.

Turning to Europe, the Middle East, and Africa, the EMEA region exhibits a patchwork of adoption rates. Western Europe has embraced 4K as the de facto standard, with consumers habitually seeking OLED and QLED technologies for flagship purchases, bolstered by stringent energy regulations. The Middle East is witnessing robust growth in luxury residential and hospitality projects where ultra-large screen formats and weatherproof outdoor displays are in demand. In parts of Africa, constraints in broadband infrastructure slow widespread uptake of streaming-optimized features, although gradual improvements in connectivity and the proliferation of affordable 4K devices signal upside potential.

Asia-Pacific remains both the world’s largest production hub and one of its fastest-growing consumer markets. China and South Korea lead in manufacturing scale and innovation, often pioneering new panel technologies and form factors. In contrast, markets such as India and Southeast Asia display a bifurcated landscape: price-sensitive consumers drive demand for value-oriented LED-LCD sets, while an emerging affluent class shows enthusiastic adoption of premium OLED, Mini-LED, and smart-enabled models. This regional diversity necessitates tailored go-to-market approaches that balance local preferences with global technology roadmaps.

This comprehensive research report examines key regions that drive the evolution of the 4K TV market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Manufacturers and Innovative New Entrants Redefining Competitive Advantage through Advanced Display Technologies, Strategic Partnerships, and Brand Differentiation

The competitive landscape is dominated by a core group of global manufacturers renowned for their technological leadership and brand equity. Samsung Electronics has continued to extend its Neo QLED portfolio, integrating quantum dot technologies with localized dimming to push brightness and color accuracy to new heights. Strategic partnerships with chipset designers and content platforms have strengthened its ecosystem play, ensuring seamless interoperability with smart home devices. LG Electronics remains the foremost champion of OLED, with its organic emissive panels offering unparalleled contrast and viewing angles. Recent rollouts have emphasized improved lifespan characteristics and higher refresh rate support to address both consumer and commercial gaming segments.

Sony has reinforced its position in the premium sector through its proprietary cognitive processing engine, which utilizes machine learning to analyze and enhance each frame in real time. The company’s focus on sound integration, including upward-firing speakers and support for immersive audio codecs, differentiates its offerings in home theater applications. Chinese brands such as TCL and Hisense are leveraging aggressive pricing strategies and deep partnerships with Mini-LED backlight suppliers to rapidly capture market share in North America and EMEA. These companies emphasize value-oriented feature sets-combining high refresh rate support, outdoor-friendly brightness levels, and integrated Roku or Android TV platforms-to appeal to budget-conscious consumers without sacrificing core performance.

Emerging contenders, including Vizio and smaller LCD specialists, continue to carve niches by optimizing cost structures and enhancing local service networks. Collectively, this constellation of incumbents and challengers is driving continuous innovation, compelling each player to refine product portfolios and invest in next-generation display technologies to sustain competitive differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the 4K TV market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Apple Inc.

- Changhong Electric Co., Ltd.

- Haier Group Corporation

- Haier Inc.

- Hisense Group Co., Ltd.

- Koninklijke Philips N.V.

- Konka Group Co., Ltd.

- LG Electronics Inc.

- Panasonic Holdings Corporation

- Samsung Electronics Co., Ltd.

- Seiki Digital

- Sharp Corporation

- Skyworth Digital Holdings Co., Ltd.

- Sony Corporation

- TCL Technology Group Corporation

- Vizio Inc.

- Xiaomi Corporation

Outlining Strategic Imperatives and Targeted Initiatives to Capitalize on Emerging Consumer Demands, Operational Efficiencies, and Technological Breakthroughs in 4K Television

To thrive in the rapidly evolving 4K television landscape, industry leaders must adopt a multifaceted approach that balances technological innovation with operational resilience. First, accelerating investments in Mini-LED and OLED R&D will ensure leadership in both mass-market and high-end segments. By advancing manufacturing efficiencies and reducing yield challenges, companies can unlock new price-performance thresholds and address consumer demand for superior picture quality without prohibitive cost premiums.

Equally critical is the diversification of global supply chains to mitigate geopolitical and tariff-related risks. Expanding production capacity in Mexico or establishing localized assembly lines within the United States can provide tariff relief while reducing lead times. This strategic shift should be complemented by collaborative partnerships with panel suppliers and logistics providers to optimize inventory management and maintain responsiveness to shifting consumer demand patterns.

Moreover, embedding AI-driven features and enhanced gaming capabilities will continue to serve as key differentiators. Companies should forge alliances with leading gaming console manufacturers and content streaming platforms to co-develop optimized viewing profiles, variable refresh rate protocols, and low-latency modes. Finally, adopting sustainable design practices-using recycled materials, improving energy efficiency, and minimizing packaging waste-will resonate with environmentally conscious consumers and comply with emerging regulatory frameworks in key regions.

Detailing the Rigorous Multi-Source Research Framework Combining Expert Insights, Primary Interviews, and Industry Data to Ensure Unbiased and Comprehensive Analysis

This analysis is grounded in a rigorous research framework that integrates primary, secondary, and qualitative methodologies to deliver a holistic perspective on the 4K television market. Primary insights were obtained through interviews with senior executives at panel manufacturers, chipset developers, and leading television brands, providing firsthand accounts of innovation roadmaps, production strategies, and go-to-market approaches. Complementary discussions with supply chain experts, regional distributors, and key enterprise buyers in corporate, education, hospitality, and retail segments offered nuanced views into demand drivers and end-user requirements.

Secondary data collection encompassed an extensive review of industry publications, trade association reports, and proprietary data repositories, ensuring alignment with the latest technology trends and policy developments, including tariff adjustments and trade regulations. Quantitative datasets from shipment trackers and financial disclosures were triangulated to validate directional trends across product tiers, geographies, and channel performance. All findings underwent a multi-tiered review process, combining editorial scrutiny and expert validation to guarantee accuracy, relevance, and impartiality.

This robust methodology ensures that the insights presented herein are both evidence-based and actionable, equipping decision-makers with the depth of understanding required to navigate complexities, anticipate market shifts, and capitalize on emerging opportunities in the ultrahigh-definition television ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our 4K TV market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- 4K TV Market, by Panel Type

- 4K TV Market, by Screen Size

- 4K TV Market, by Screen Type

- 4K TV Market, by End User

- 4K TV Market, by Region

- 4K TV Market, by Group

- 4K TV Market, by Country

- United States 4K TV Market

- China 4K TV Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Synthesizing Key Findings and Strategic Insights to Illuminate the Path Forward for Stakeholders Navigating an Intensely Competitive and Rapidly Evolving 4K TV Market

As the 4K television market enters its next phase of maturity, stakeholders must navigate a confluence of technological advancements, regulatory dynamics, and evolving consumer expectations. The rise of Mini-LED and ongoing enhancements in OLED and QLED technologies promise to further elevate visual performance, while AI-driven features and gaming-centric capabilities will continue to shape product differentiation. Simultaneously, geopolitical considerations and tariff policies underscore the importance of adaptable supply chains and nearshoring strategies.

Regional distinctions-from the mature marketplaces of North America and Western Europe to the diverse growth trajectories in Asia-Pacific-highlight the necessity of bespoke approaches that align with local preferences, regulatory frameworks, and distribution ecosystems. Leading manufacturers and agile challengers alike must foster strategic partnerships and leverage data-driven insights to optimize portfolio composition, channel strategies, and customer engagement models.

Ultimately, success in this competitive arena will be defined by the ability to anticipate consumer priorities, drive sustainable innovation, and strengthen operational resilience. By synthesizing the key findings and strategic imperatives outlined in this report, market participants can chart a clear path forward, capitalizing on the opportunities presented by an increasingly immersive and connected television experience.

Empowering Stakeholders with Direct Access to Timely Research Expertise and Executive-Level Engagement to Facilitate Informed Investments and Growth Decisions in 4K Televisions

Are you ready to transform your strategic planning with unparalleled market intelligence on the ultrahigh-definition television sector? Connect directly with Ketan Rohom, Associate Director of Sales & Marketing, to gain exclusive insights and customized data tailored to your objectives. Through a personalized consultation, you can explore bespoke research packages, sample analyses, and advisory support designed to empower your investment and partnership decisions. Whether you’re evaluating technology roadmaps, assessing distribution strategies, or identifying growth opportunities in emerging segments, Ketan’s expertise will guide you in leveraging the full potential of the comprehensive market research report. Take the next step towards driving innovation and competitive advantage in the 4K television landscape by reaching out today.

- How big is the 4K TV Market?

- What is the 4K TV Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?