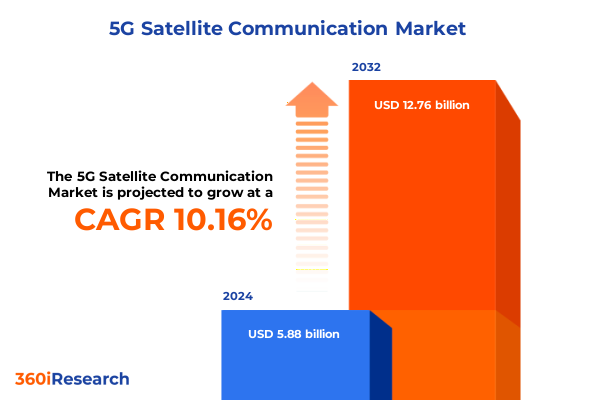

The 5G Satellite Communication Market size was estimated at USD 6.44 billion in 2025 and expected to reach USD 7.06 billion in 2026, at a CAGR of 10.24% to reach USD 12.76 billion by 2032.

Unlocking the Promise of 5G-Enabled Satellite Communication to Revolutionize Connectivity Across Diverse Industries Worldwide

The evolution of global connectivity has entered a pivotal phase as 5G technology converges with satellite communication to deliver seamless, high-speed coverage across terrestrial and non-terrestrial domains. In recent years, the explosion of data demand combined with the imperative to serve underserved regions has driven stakeholders to explore hybrid network architectures that leverage Low Earth Orbit and Geostationary satellites in concert with terrestrial 5G infrastructure. Consequently, organizations across industries are reassessing their connectivity strategies to harness the promise of ubiquitous coverage, reduced latency, and enhanced bandwidth.

Moreover, the integration of satellite and 5G platforms is catalyzing new use cases that extend beyond traditional broadcast and navigation services. From precision agriculture in remote locales to resilient emergency communications spanning oceans and jungles, the blended network model is unlocking opportunities previously constrained by geography. As spectrum regulators, equipment vendors, and service providers collaborate on interoperable standards, this once-siloed domain is coalescing around shared protocols designed to accelerate commercial adoption. This introduction sets the stage for an in-depth examination of the technological, regulatory, and economic forces reshaping the satellite-enabled 5G ecosystem, illuminating the strategic imperatives that will determine market leaders and challengers alike.

Charting the Evolution of 5G Satellite Networks Amidst Technological Breakthroughs and Emerging Service Models Reshaping Global Communications

Over the past decade, satellite communication has transitioned from a standalone niche into a cornerstone of the broader 5G network fabric. Advances in satellite miniaturization, digital beamforming, and high-throughput payloads have redefined what is technically feasible. As new constellations of Low Earth Orbit satellites enter operational service, they deliver reduced propagation delays that were once the preserve of fiber backhaul, thereby aligning closely with the low latency ambitions of 5G. At the same time, Geostationary platforms are being retrofitted with software-defined radios that enable dynamic resource allocation, effectively merging the resilience of fixed orbit assets with the flexibility demanded by next-generation services.

Furthermore, the rise of managed services and turnkey system integration has lowered barriers to entry for network operators. Integration and deployment specialists now offer end-to-end solutions that encompass site surveys, antenna installations, network management, and ongoing support. This shift toward service-centric offerings is complemented by emerging partnerships between satellite operators and traditional telecom carriers who seek to fill coverage gaps, particularly across rural and maritime environments. As open standards gain traction, interoperability and multi-orbit management become achievable objectives. Together, these transformative shifts underscore the interconnected nature of hardware, software, and service evolution that is redefining the global communications landscape.

Examining How Recent U.S. Tariff Adjustments Are Reconfiguring Supply Chains and Cost Structures Within the 5G Satellite Communications Ecosystem

The landscape of satellite-enabled 5G has been profoundly influenced by the cumulative effect of the 2025 tariff adjustments implemented by the United States. Policymakers introduced revised import duties targeting a range of telecommunication equipment, including amplifiers, antennas, modems, and transceivers used in ground stations and user terminals. These measures were intended to incentivize domestic production, yet they have concurrently introduced cost pressures that ripple throughout the value chain. Hardware manufacturers are reassessing component sourcing strategies, while service integrators navigate a tighter margin environment.

Consequently, many operators have responded by diversifying their supplier bases to mitigate potential bottlenecks. Firms specializing in integration and deployment are locking in longer-term contracts with multiple vendors to preserve continuity of service. Additionally, managed service providers are exploring flexible pricing mechanisms to absorb some of the tariff-induced increases, thereby shielding end users from abrupt disruptions in connectivity solutions. Regulatory bodies are monitoring the situation closely, balancing the goals of domestic industrial growth against the risk of hampering network expansion, particularly in underserved regions where satellite-backed 5G represents the primary route to digital inclusion.

Unveiling Critical Segmentation Perspectives Spanning Component Architecture Spectrum Allocation Orbits Applications and End-User Dynamics

A granular understanding of the market emerges when evaluating its diverse segments. From a component standpoint, hardware elements such as amplifiers, antennas, modems, and transceivers form the underlying infrastructure, while services are bifurcated into integration and deployment support alongside ongoing managed services. Software platforms add a critical layer, orchestrating network functions and enabling real-time performance analytics. Each category interacts synergistically to deliver comprehensive connectivity solutions that span remote and urban environments.

Turning to spectrum allocation, the Ka-band and Ku-band have become the workhorses for high-throughput applications, whereas the L-band and S-band offer extended coverage with enhanced propagation characteristics conducive to mobility use cases. Moreover, the choice of orbit type plays a defining role: Geostationary Earth Orbit systems deliver wide-area coverage with stable footprint, while Low Earth Orbit and Medium Earth Orbit constellations prioritize low latency and dynamic handoff capabilities. These architectural decisions directly impact service quality, deployment complexity, and total cost of ownership.

Applications such as asset tracking, broadcasting, data backup and recovery, navigating and monitoring, and voice communication all leverage distinct slices of the satellite network, creating differentiated performance requirements. Finally, end users span automotive and transportation fleets seeking uninterrupted telematics, aviation and aerospace operators demanding mission-critical reliability, energy and utilities companies requiring secure data links, government and defense sectors upholding stringent security standards, maritime enterprises maintaining global reach, media and entertainment firms streaming content across continents, and telecom operators integrating non-terrestrial assets to bolster terrestrial infrastructure. The interplay between these segments highlights the multifaceted nature of the industry and the importance of tailored strategies for each stakeholder group.

This comprehensive research report categorizes the 5G Satellite Communication market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Spectrum

- Orbit Type

- Application

- End-User

Delving Into Regional Variations and Growth Drivers Across the Americas EMEA and Asia-Pacific Satellite Communication Markets

Regional dynamics play a pivotal role in shaping the uptake and evolution of satellite-enhanced 5G. In the Americas, national broadband initiatives and commercial partnerships have accelerated rollout efforts, particularly in rural North America where terrestrial networks struggle to reach remote subscribers. This environment has fostered significant investment in ground station facilities, encouraging the adoption of both Ka-band and Ku-band services. Meanwhile, in Latin America, operators are capitalizing on L-band resilience to support maritime and aviation segments along extensive coastlines.

Within Europe, the Middle East, and Africa, governments and multinational entities are coalescing around initiatives aimed at bridging the digital divide. European regulatory frameworks emphasize spectrum harmonization and network security, ensuring that Geostationary services complement emerging LEO constellations without interference. In the Middle East, sovereign wealth funds are channeling capital into domestic satellite ventures, while parts of Africa rely on managed service offerings to deliver essential telemedicine and educational applications.

Across Asia-Pacific, the sheer scale and diversity of markets have spurred innovative partnerships between regional satellite operators and local telecom carriers. The maritime industry in Southeast Asia, in tandem with resource extraction in Australia and energy infrastructure development in India, has driven robust demand for low-latency LEO solutions integrated with terrestrial 5G nodes. Regulatory bodies are increasingly open to licensing multiorbit services, creating a fertile environment for cross-border collaborations and public-private ventures.

This comprehensive research report examines key regions that drive the evolution of the 5G Satellite Communication market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players Driving Innovation Partnerships and Strategic Developments Shaping the 5G Satellite Communication Sphere

A handful of corporations and consortia are charting the course for 5G satellite communication through strategic alliances, technology investments, and expanded service portfolios. Satellite operators are investing in next-generation payloads that feature digital beamforming and inter-satellite optical links to reduce latency and enhance throughput. Notably, recent launches of large-scale constellations have underscored a collective commitment to convergence with terrestrial 5G, with several partners integrating network orchestration solutions to enable seamless user experiences.

In parallel, infrastructure vendors continue to innovate by developing compact, electronically steered antennas alongside modular ground station kits that simplify deployment in rural and mobile environments. Integration specialists are differentiating themselves with value-added services such as network analytics and automated fault detection, enabling clients to optimize performance without the need for in-house expertise. Additionally, cloud providers have entered the fray, offering edge compute capabilities co-located with ground stations to process data closer to the point of collection and mitigate bandwidth constraints.

Collaboration models are evolving beyond traditional supplier-customer relationships toward ecosystem-level partnerships. Consortia comprised of satellite, terrestrial, and software entities are co-developing standards for network slicing and quality-of-service management across multiple orbits. These joint ventures align risk and reward, expediting time-to-market while ensuring interoperability, security, and scalability across a heterogeneous communications landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the 5G Satellite Communication market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Airbus SE

- Amazon.com, Inc.

- Astrome Technologies Private Limited.

- Avanti Communications Group PLC

- Ericsson AB

- Eutelsat S.A.

- Future PLC

- Gilat Satellite Networks Ltd.

- Inmarsat Global Limited by Viasat Inc.

- L3Harris Technologies, Inc.

- Lockheed Martin Corporation

- MediaTek Inc.

- OHB SE

- Omnispace, LLC

- OQ Technology.

- Qualcomm Incorporated

- RTX Corporation

- SATELIO IOT SERVICES, S.L.

- SES S.A.

- Singapore Technologies Engineering Ltd.

- Telespazio S.p.A.

- The Boeing Company

- Vox Media, LLC

- ZTE Corporation

Prescriptive Strategies and Best Practices for Stakeholders to Maximize Value From 5G Satellite Communication Deployments and Collaborations

Industry leaders can capitalize on emerging opportunities by adopting a multifaceted strategic approach. First, investing in agile payload architectures that support in-orbit software updates and reconfigurable beam patterns will enable differentiated service offerings without the need for costly hardware replacements. Furthermore, developing diversified supply chains with multiple sources for amplifiers, antennas, and modems can mitigate tariff shocks and ensure continuity of deployments.

Next, forging cross-industry partnerships-spanning satellite operators, telecom carriers, and cloud service providers-can unlock end-to-end solutions that incorporate edge processing, network analytics, and managed support. Embracing service-centric business models that blend integration, deployment, and maintenance services will enhance revenue streams and foster deeper customer relationships. Additionally, staying abreast of evolving spectrum policies and participating in standardization bodies will position organizations to influence regulations that impact Ka-band, Ku-band, L-band, and S-band allocations.

Finally, integrating security and resilience into network designs is essential. Implementing encryption frameworks, anti-jamming technologies, and redundant routing strategies will protect critical data flows for government, defense, and mission-critical enterprise applications. By aligning product roadmaps with these prescriptive strategies, stakeholders can secure a sustainable competitive advantage in the fast-moving 5G satellite communication landscape.

Detailing Rigorous Research Methodologies and Analytical Frameworks Underpinning the Comprehensive Review of 5G Satellite Communication Trends

The insights presented are grounded in a rigorous research process encompassing both primary and secondary methodologies. Initially, an extensive literature review was conducted, drawing from regulatory filings, industry white papers, technical journals, and public disclosures from satellite and telecommunications organizations. This was supplemented by quantitative data triangulated through analyst databases, operator reports, and trade association publications to ensure a comprehensive baseline of technological and market context.

Primary research included in-depth interviews with senior executives, engineering experts, network architects, and policy advisors across satellite operators, ground segment vendors, and service integrators. These conversations provided firsthand perspectives on deployment challenges, pricing pressures, and unmet service requirements. A series of validation workshops was convened, assembling cross-functional stakeholders to vet preliminary findings and refine key themes.

Analytical frameworks such as Porter’s Five Forces, SWOT analysis, and technology roadmapping were applied to dissect competitive dynamics, segment attractiveness, and innovation trajectories. Furthermore, the study leveraged scenario planning to evaluate the implications of tariff shifts, regulatory changes, and emergent business models. This methodological rigor ensures that the research not only captures current realities but also anticipates future inflection points in the satellite-enabled 5G communications arena.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our 5G Satellite Communication market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- 5G Satellite Communication Market, by Component

- 5G Satellite Communication Market, by Spectrum

- 5G Satellite Communication Market, by Orbit Type

- 5G Satellite Communication Market, by Application

- 5G Satellite Communication Market, by End-User

- 5G Satellite Communication Market, by Region

- 5G Satellite Communication Market, by Group

- 5G Satellite Communication Market, by Country

- United States 5G Satellite Communication Market

- China 5G Satellite Communication Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing Key Takeaways and Forward-Looking Reflections on the Future Trajectory of 5G Satellite Communication

This comprehensive review illustrates the convergence of satellite and 5G technologies as a transformative force reshaping global connectivity paradigms. By exploring the technological shifts in payload architecture, the implications of U.S. tariff policies, and the intricate segmentation of hardware, spectrum, orbit, application, and end-user domains, a holistic view of the market landscape emerges. Regional variations further underscore the tailored approaches required to address diverse regulatory climates and use-case demands.

Key players have demonstrated that strategic alliances, agile product roadmaps, and service-oriented models are crucial to unlocking growth and maintaining competitiveness. Actionable strategies-such as investing in software-defined payloads, diversifying supply chains, and engaging in spectrum policy dialogues-provide a clear blueprint for organizations seeking to capitalize on this dynamic ecosystem. The robust research methodology underpinning these insights ensures confidence in the findings and recommendations.

Looking ahead, the path to success lies in continuous innovation, ecosystem collaboration, and adaptive regulatory engagement. As networks evolve to incorporate multiple orbits and spectrum bands, stakeholders who align their strategies with these forward-looking imperatives will be best positioned to shape the future of ubiquitous, resilient, and high-performance connectivity.

Secure Your Competitive Edge Today by Engaging With Our Research Expert to Unlock In-Depth Intelligence on 5G Satellite Communication Opportunities

For unparalleled insights into the dynamic realm of 5G satellite communication and to secure tailored guidance rooted in rigorous analysis, reach out to Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch). Engage directly to explore how our comprehensive research can empower your organization with the intelligence needed to make strategic decisions, optimize investments, and stay ahead of competitors. Contacting Ketan will unlock exclusive access to in-depth data, expert commentary, and bespoke recommendations designed to accelerate your success in a rapidly evolving market. Take the next step toward differentiating your offerings and future-proofing your enterprise by arranging a personalized briefing today

- How big is the 5G Satellite Communication Market?

- What is the 5G Satellite Communication Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?