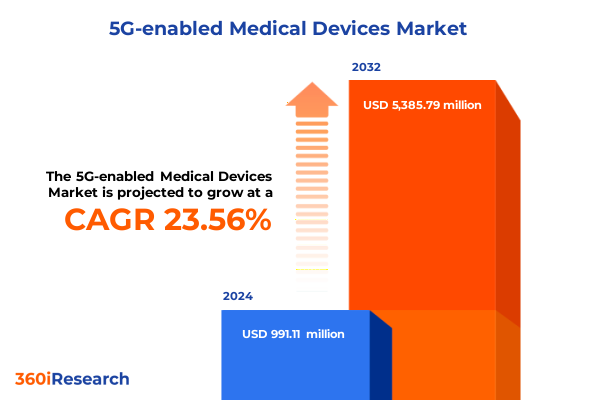

The 5G-enabled Medical Devices Market size was estimated at USD 1.22 billion in 2025 and expected to reach USD 1.51 billion in 2026, at a CAGR of 23.62% to reach USD 5.38 billion by 2032.

Pioneering the Intersection of Next-Generation Connectivity and Advanced Medical Technology to Revolutionize Patient Care and Healthcare Delivery

Across modern healthcare ecosystems, the convergence of ultra-low latency, massive device connectivity, and seamless data throughput has ushered in a new era of patient-centric care. As conventional networks strain to support the burgeoning volume and complexity of medical applications, 5G technology emerges as a catalyst for transformational change. With its ability to deliver end-to-end quality of service, network slicing, and enhanced security protocols, 5G is redefining how medical devices capture, transmit, and analyze clinical data in real time.

Within this context, medical device manufacturers and healthcare providers are exploring use cases that span remote patient monitoring, telemedicine, robotic surgery, and beyond. By leveraging 5G’s deterministic performance, critical applications such as continuous vital-sign monitoring and emergency teleconsultations can operate with unprecedented reliability. Moreover, the integration of edge computing with 5G networks is enabling localized analytics that reduce bandwidth demands and accelerate clinical decision-making. Consequently, stakeholders across the medical device value chain are reevaluating product roadmaps, organizational capabilities, and partnership strategies to harness these capabilities.

This executive summary provides a high-level overview of the key drivers, market segments, regional nuances, and competitive dynamics shaping the 5G-enabled medical device landscape. In the following sections, we explore the technological and regulatory shifts at play, assess the impact of recent tariffs, unveil critical segmentation insights, and offer actionable guidance for industry leaders.

Analyzing Key Technological, Regulatory, and Clinical Shifts That Are Driving the Evolution of 5G-Enabled Medical Devices in Healthcare Ecosystems

Healthcare is standing at the precipice of profound transformation driven by three converging forces: technological breakthroughs, evolving regulatory frameworks, and shifting clinical paradigms. Advances in antenna design, miniaturized sensors, and AI-driven analytics now enable medical devices to process complex data streams at the network edge. Furthermore, 5G network slicing permits dedicated bandwidth for high-precision modalities, ensuring that critical applications such as remote robotic interventions and continuous patient monitoring receive uncompromised performance.

Simultaneously, regulatory bodies are adapting certification pathways and interoperability standards to facilitate the safe introduction of connected devices within clinical workflows. Emerging guidelines emphasize cybersecurity resilience, data privacy, and cross-platform compatibility, encouraging manufacturers to embed robust encryption and device-management capabilities from inception. At the same time, healthcare systems are undergoing digital transformation initiatives aimed at improving operational efficiencies, reducing readmission rates, and expanding access to underserved populations via telehealth.

Consequently, medical device developers must navigate a rapidly shifting landscape where clinical requirements, network capabilities, and policy directives evolve in parallel. By adopting agile development methodologies and forging cross-industry partnerships with telecom operators, technology vendors, and academic institutions, stakeholders can accelerate innovation cycles and achieve faster time-to-value for 5G-enabled solutions.

Assessing How 2025 United States Tariff Policies on Telecommunications and Medical Equipment Imports Are Reshaping the 5G Medical Device Market Dynamics

In 2025, the U.S. government introduced a series of tariffs targeting critical components used in telecommunications and medical device manufacturing, including radio frequency modules and precision sensors. These measures were intended to bolster domestic production but have also elevated import costs for specialized hardware, creating a ripple effect across supply chains. Medical device OEMs reliant on overseas suppliers have encountered increased lead times and compressed margins, prompting many to reevaluate sourcing strategies and explore nearshore alternatives.

Moreover, heightened duties on network infrastructure elements have influenced the rollout timelines for private 5G networks within hospital campuses and research facilities. As a result, project budgets have expanded, compelling healthcare providers to prioritize high-impact use cases that can justify the incremental investment. Despite these headwinds, domestic manufacturing incentives and tax credits have emerged to partially offset increased component costs, incentivizing onshore production of connectivity modules and integration services.

Overall, the 2025 tariff landscape underscores the strategic tension between supply chain security and cost optimization. Industry participants are now balancing the benefits of diversified supplier ecosystems against the operational complexities of complying with evolving trade regulations. As the sector adapts, integrated strategies that blend local production, strategic inventory management, and collaborative manufacturing partnerships will prove essential for sustaining the momentum of 5G-enabled medical device adoption.

Uncovering Strategic Segmentation Perspectives That Illuminate the Diverse Product, Application, End User, Connectivity, and Network Dimensions of the Market

A comprehensive examination of the market reveals multiple interlocking dimensions that define product, application, end-user, connectivity, network, and component segmentation. From a product standpoint, diagnostic devices span imaging systems such as CT, MRI, and ultrasound, as well as laboratory platforms like blood and urinalysis analyzers, while point-of-care diagnostics deliver rapid results at the bedside. Monitoring devices cover cardiac applications in both home and hospital environments, glucose tracking through continuous and intermittent sensors, respiratory assessments for sleep apnea and spirometry, and vital-sign surveillance of blood pressure, heart rate, and temperature. Meanwhile, therapeutic solutions range from infusion pumps tailored for insulin delivery and pain management to advanced neurostimulators and respiratory therapy units including CPAP machines and ventilators.

In terms of application, 5G-enabled devices facilitate asset tracking through equipment positioning and wearable monitoring, support cold-chain oversight and inventory visibility, enable ambulance telehealth services and field hospital connectivity during disasters, and underpin chronic disease management, elderly care, and postoperative monitoring. Smart hospital initiatives leverage real-time location services for asset and patient tracking alongside workflow optimization for staff management. Telemedicine frameworks embrace emergency teleconsultations, AI-assisted video diagnostics, and virtual ICUs that centralize alarm management and remote surveillance.

Evaluating the connectivity landscape, solutions operate over non-standalone and standalone architectures across mmWave and sub-6 GHz bands as public, private, and hybrid network topologies. Component segmentation highlights the critical roles of antennas, modules for connectivity and power management, integrated sensors, analytics platforms, mobility applications, and consulting, integration, and maintenance services. This holistic segmentation approach illuminates the breadth of innovation opportunities and ensures tailored strategies across stakeholder groups.

This comprehensive research report categorizes the 5G-enabled Medical Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Connectivity Type

- Network Architecture

- Component

- Application

- End User

Elucidating Distinct Regional Dynamics in the Americas, Europe Middle East & Africa, and Asia-Pacific That Influence 5G Medical Device Adoption and Growth Trends

The Americas region boasts a mature 5G infrastructure, with several national carriers and private network initiatives piloting medical use cases in urban and rural settings alike. Leading academic medical centers and integrated delivery networks are collaborating with technology partners to deploy remote patient monitoring programs for chronic disease cohorts and expand teleconsultation services in underserved communities. Government funding mechanisms and public-private partnerships have further catalyzed trials of robotic surgical systems and immersive telepresence solutions, establishing a vibrant innovation ecosystem.

Across Europe, the Middle East, and Africa, regulatory harmonization efforts and NextGen EU recovery funds have accelerated the deployment of private 5G networks within hospital groups and research consortia. In the Gulf region, pilot projects are validating the use of high-bandwidth imaging diagnostics and mobile emergency response platforms, while North African universities are exploring low-cost 5G modules for decentralized laboratory diagnostics. Despite varied levels of network maturity, regional stakeholders are aligning on interoperability frameworks and cybersecurity guidelines to create a cohesive market environment.

Asia-Pacific continues to lead in large-scale commercial rollouts, driven by government-mandated smart hospital mandates and ambitious digital health agendas. Major economies are integrating 5G capabilities into national healthcare strategies, emphasizing AI-powered diagnostic engines and edge computing infrastructure. In addition, cross-border research collaborations are investigating remote surgical interventions, with surgical robotics trials connecting specialists between city centers and remote clinics via dedicated network slices. These regional dynamics underscore the necessity of adaptable market approaches that reflect local policies, infrastructure capabilities, and clinical priorities.

This comprehensive research report examines key regions that drive the evolution of the 5G-enabled Medical Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Players and Innovators That Are Shaping Competitive Strategies, Partnerships, and Technological Breakthroughs in 5G Medical Device Development

The competitive environment is characterized by a blend of established healthcare conglomerates, telecommunications giants, specialized medical device firms, and nimble startups forging cross-industry alliances. Traditional device manufacturers have partnered with network operators to embed connectivity into legacy platforms, while chipset providers and module vendors are collaborating with clinical technology specialists to co-engineer next-generation solutions. Emerging players are differentiating through vertical integration, offering combined hardware-software subscriptions and managed network services designed specifically for healthcare settings.

Collaborations between semiconductor firms and leading hospitals have produced specialized 5G modules optimized for medical imaging and real-time analytics. At the same time, system integrators are expanding their footprints by providing end-to-end services that span network design, device certification, and user training. Venture capital activity has also intensified, channeling investment into startups focused on AI-assisted telemedicine, portable diagnostic units, and remote robotic platforms. As a result, M&A transactions and strategic alliances remain active as larger entities acquire niche innovators to round out their technology portfolios and accelerate market entry.

In this dynamic landscape, competitive differentiation hinges on the quality of clinical validation, the robustness of cybersecurity measures, and the scalability of network deployments. Organizations that excel in co-developing solutions, securing regulatory approvals, and offering comprehensive service ecosystems are poised to capture leading positions in the evolving 5G medical device market.

This comprehensive research report delivers an in-depth overview of the principal market players in the 5G-enabled Medical Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Baxter International Inc.

- Becton, Dickinson and Company

- Bharti Airtel Limited

- Boston Scientific Corporation

- China Mobile Limited

- Deutsche Telekom AG

- Fibocom Wireless Inc.

- GE Healthcare Technologies Inc.

- General Electric Company

- Intel Corporation

- Johnson & Johnson

- Koninklijke Philips N.V.

- Medtronic plc

- Quectel Wireless Solutions Co., Ltd.

- Samsung Electronics Co., Ltd

- Siemens Healthineers AG

- Sierra Wireless, Inc.

- Swisscom AG

- Telefónica, S.A.

- Vodafone Group Public Limited Company

- ZTE Corporation

Delivering Insightful Guidance That Enables Healthcare Leaders to Harness 5G Medical Device Innovations for Sustainable Competitive Advantage

To maximize the potential of 5G-enabled medical devices, industry stakeholders should pursue targeted partnerships with mobile network operators and cloud service providers to guarantee dedicated connectivity and priority performance for clinical applications. Additionally, aligning product roadmaps with emerging interoperability standards will facilitate seamless integration into electronic health record systems and hospital information platforms. As network costs and tariff pressures persist, diversifying supplier ecosystems and investing in modular, software-defined hardware will enable organizations to manage risk and adapt to shifting trade agreements.

Furthermore, embedding advanced cybersecurity measures-such as zero-trust frameworks and continuous threat monitoring-will be critical for safeguarding patient data and maintaining regulatory compliance. Healthcare leaders should also cultivate internal talent and new operating models that bridge clinical expertise, networking engineering, and data analytics. This cross-functional alignment will shorten development cycles and ensure that solutions address real-world clinical use cases.

Finally, pilot projects targeting high-value indications-such as remote cardiac monitoring for complex arrhythmias or AI-driven diagnostic imaging in rural hospitals-will deliver compelling proof points that justify broader rollouts. By measuring clinical outcomes, operational efficiencies, and return on investment, organizations can build the business case for scaled deployments and establish their reputations as pioneers in the digital health revolution.

Detailing a Rigorous Research Framework That Integrates Primary Expert Interviews, Comprehensive Secondary Data, and Quantitative Analyses to Validate Insights

This research employed a multi-tiered approach integrating primary and secondary data sources to ensure comprehensive market coverage and analytical rigor. Primary insights were obtained through in-depth interviews with industry veterans, including senior executives from device manufacturers, network operators, healthcare providers, and regulatory authorities. These interviews were structured to validate key market drivers, adoption barriers, and technology roadmaps.

Secondary research encompassed a thorough review of peer-reviewed journals, government reports, telecom standards documentation, and patent filings to map the evolving technology landscape. Data points were triangulated across multiple sources to confirm accuracy and remove potential biases. Quantitative analyses were conducted using proprietary models that assess market segmentation, regional deployment scenarios, and the financial implications of tariff adjustments.

Finally, findings underwent internal peer review and external expert validation to ensure objectivity and credibility. This rigorous methodology underpins the insights, regional assessments, and strategic recommendations presented in this report, providing stakeholders with a robust foundation for informed decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our 5G-enabled Medical Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- 5G-enabled Medical Devices Market, by Product Type

- 5G-enabled Medical Devices Market, by Connectivity Type

- 5G-enabled Medical Devices Market, by Network Architecture

- 5G-enabled Medical Devices Market, by Component

- 5G-enabled Medical Devices Market, by Application

- 5G-enabled Medical Devices Market, by End User

- 5G-enabled Medical Devices Market, by Region

- 5G-enabled Medical Devices Market, by Group

- 5G-enabled Medical Devices Market, by Country

- United States 5G-enabled Medical Devices Market

- China 5G-enabled Medical Devices Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 8427 ]

Synthesizing Key Findings and Forward-Looking Perspectives to Equip Decision-Makers with Actionable Direction for Future 5G Medical Device Initiatives

The confluence of 5G network capabilities, evolving regulatory standards, and clinical demand is poised to reshape the medical device industry. As connectivity converges with advanced sensing, artificial intelligence, and edge computing, healthcare organizations can unlock new models of care delivery that improve patient outcomes and operational efficiency. At the same time, tariff adjustments and supply chain realignments highlight the necessity of agile sourcing strategies and collaborative manufacturing ecosystems.

Moving forward, success will depend on stakeholders’ ability to co-innovate across traditional industry boundaries, invest in cybersecurity-hardened infrastructure, and validate clinical value through targeted pilot programs. By focusing on interoperable solutions that integrate seamlessly into existing workflows, organizations can accelerate adoption and demonstrate measurable benefits. Furthermore, regional nuances-from spectrum availability in the Americas to smart hospital mandates in Asia-Pacific-underscore the value of adaptable market approaches and local partnerships.

Ultimately, this executive summary underscores the imperative for healthcare and technology leaders to embrace 5G-enabled medical devices as a cornerstone of digital transformation. By aligning strategic initiatives with the opportunities and challenges outlined herein, stakeholders can chart a clear path toward innovation, resilience, and long-term growth.

Contact Ketan Rohom to Explore How Comprehensive Market Intelligence on 5G Medical Devices Can Empower Your Strategic Decisions and Drive Business Growth

We invite you to engage with Ketan Rohom, Associate Director of Sales & Marketing, to gain unparalleled insights into the rapidly evolving world of 5G-enabled medical devices. Through a personalized consultation, you will discover how this transformative report can inform your strategic planning, fortify your competitive positioning, and unlock new opportunities at the intersection of next-generation connectivity and healthcare innovation. Don’t miss the chance to secure exclusive data, actionable recommendations, and future-proof analyses that will guide your organization toward sustainable growth and market leadership in this dynamic sector.

- How big is the 5G-enabled Medical Devices Market?

- What is the 5G-enabled Medical Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?