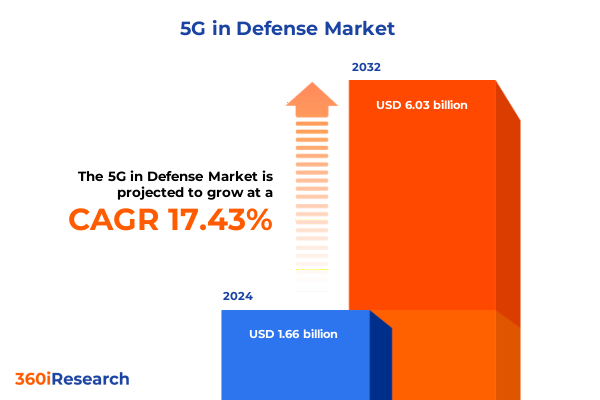

The 5G in Defense Market size was estimated at USD 1.95 billion in 2025 and expected to reach USD 2.28 billion in 2026, at a CAGR of 17.50% to reach USD 6.03 billion by 2032.

How advanced 5G capabilities, edge computing, and supply chain policy are jointly reshaping defense communications procurement, operations, and resilience

The arrival of mature 5G technology, converging edge compute, and hardened network orchestration has created a decisive inflection point for defense organizations globally. This executive summary synthesizes the operational, technical, and policy dynamics that are reshaping how militaries adopt and govern 5G capabilities across platforms, environments, and mission sets. It emphasizes practical tradeoffs between leveraging commercial ecosystems and hardening sovereign supply chains, and it foregrounds the interplay between capability acceleration and security assurance.

Across the military communications ecosystem, stakeholders are moving from experiment to integration, where pilot networks and testbeds are giving way to installation-wide private 5G deployments and tactical mobile solutions that must interoperate with legacy systems. As a result, program managers, acquisition authorities, and operational commanders now face tightly coupled requirements for spectrum access, vendor diversity, cyber resilience, and lifecycle sustainment. The synthesis that follows frames these pressures against evolving trade and industrial policy, highlighting where policy changes affect procurement pathways and where technological design choices drive operational outcomes. For decision-makers, this introduction situates the remainder of the summary as a pragmatic bridge between strategic intent and near-term acquisition choices, with attention to interoperability, risk mitigation, and mission assurance in contested environments.

Why open architectures, satellite-integrated 5G, and changing industrial policy are converging to fundamentally alter defense connectivity strategies and operational planning

Over the past three years, defense communications have undergone several transformative shifts that together are changing the calculus for how militaries plan, procure, and operate networked capabilities. Commercial-grade 5G has migrated from lab demonstrations to fieldable private networks and deployable tactical systems, which changes expectations for data volume, latency, and distributed processing at the tactical edge. This movement is accompanied by a strong institutional push toward open architectures and multi-vendor ecosystems, intended to reduce single-vendor dependencies and accelerate secure innovation through modular, software-driven RAN and core components. The U.S. government’s strategy to accelerate private 5G adoption at installations and encourage Open RAN experimentation has become a visible catalyst for this shift, signaling sustained institutional support for multi-vendor ecosystems and structured experimentation to validate operational readiness and security frameworks.

Concurrently, standards and systems-level integration have advanced to include satellite-based non-terrestrial network (NTN) support that extends coverage and resilience in austere areas. Standardization work in global fora has moved NTN from conceptual studies to actionable specifications, enabling tighter integration between terrestrial 5G and LEO/MEO satellite architectures. This evolution increases opportunities for resilient reach-back, distributed sensing, and over-the-horizon communications, while also introducing new operational design constraints such as orbital handover, Doppler compensation, and packetization across diverse links. Thus, the landscape is shifting from patchwork augmentation to coherent multi-domain connectivity strategies that must be designed, tested, and governed as integrated systems rather than point solutions.

Finally, these technology shifts are unfolding amid a more contested industrial and regulatory environment. Export controls, equipment prohibitions, and targeted tariffs are constraining supplier choices and accelerating reshoring and allied-coordinated supply efforts. In practice, this means program offices must plan for alternative sourcing, longer lead times for specialized components, and the potential need to adopt secure, domestically produced subsystems to preserve mission assurance. These elements together create a new baseline: capability acceleration enabled by software and standards, bounded by supply chain risk and geopolitical policy realities.

How the 2025 tariff adjustments and expanded export controls are reshaping procurement risk, supplier roadmaps, and the resiliency calculus for defense 5G programs

Recent U.S. trade and export actions have materially impacted the supply chain dynamics that underpin defense 5G deployments. In late 2024 the United States announced tariff adjustments on specified technology inputs that took effect at the start of 2025, and the administration has since managed exclusions and reviews of those measures. These tariff changes, targeted at selected materials and upstream inputs, influence procurement cost structures for components used across telecom and semiconductor supply chains and create incentives for suppliers to re-evaluate manufacturing footprints and sourcing strategies. Programs that depend on specialized wafers, high-purity materials, or specific upstream items may therefore experience increased procurement complexity and require updated sourcing risk assessments to preserve schedule and sustainment.

Compounding the tariff environment, the U.S. government concurrently strengthened export controls focused on semiconductor manufacturing equipment, high-bandwidth memory, and certain design tools to curtail the unauthorised transfer of advanced capabilities. These export controls place additional constraints on the availability and transferability of cutting-edge fabrication equipment and software, and they have real implications for defense suppliers that rely on globally distributed manufacturing ecosystems. In aggregate, tariffs and export controls are driving a reconfiguration of supplier roadmaps: some vendors will localize production or seek allied fabrication partners, while others will prioritize secure design and software-based mitigations that reduce dependence on constrained hardware pathways.

Operationally, the combined effect is not merely price pressure. Rather, the policy suite increases the premium on early supplier engagement, conservative obsolescence planning, and validated alternative parts lists. It also deepens the strategic value of modular, software-upgradeable systems-where revisions and security patches can extend platform service life independent of tightly constrained hardware elements. For acquisition authorities, the path forward requires balancing near-term capability delivery against medium-term resilience investments in onshore capacity, allied industrial partnerships, and robust supply chain transparency measures.

How component choices, frequency bands, network typologies, deployments, and platform requirements collectively determine procurement tradeoffs and operational readiness for defense 5G

A robust segmentation framework is essential to translate capability demands into acquisition and programmatic choices. When viewed through a component lens, hardware, services, and software define distinct but interdependent decision spaces. Hardware decisions extend beyond generic radio equipment to include core networks, a diverse set of devices-from airborne terminals and vehicular terminals to soldier wearables-and radio access subsystems such as antennas and massive MIMO units, each carrying unique lifecycle and certification trajectories. Services choices determine whether capabilities are delivered as managed offerings or through professional services engagements that transfer expertise into the force. Software choices, including network management, security tooling, RAN-intelligent controller applications, anomaly detection, and software-defined networking with NFV, are the control plane through which resilience, observability, and rapid capability insertion occur.

Frequency considerations layer on top of component choices: high-band spectrum enables extreme throughput in limited coverage footprints, mid-band balances capacity and reach for many base and edge deployments, and low-band preserves broad coverage and penetrative communications in operationally challenging settings. Network type decisions further split into standalone and non-standalone models that carry different lifecycle, tethering, and integration implications for existing infrastructure. Deployment environment distinctions-from fixed installations such as airfields and ports to harsh deserts, extreme cold zones, tactical deployables, and dense urban operations-alter design priorities for robustness, shock tolerance, and rapid fielding. Similarly, platform-specific constraints across aircraft, ground vehicles, naval vessels, soldier systems, and space platforms demand tailored form factors, safety certifications, and EMI/EMC considerations that intersect with the broader system architecture.

Spectrum access models drive long-term accessibility and operational freedom. Exclusive licensed and government-allocated spectrum provide deterministic performance and security controls but increase coordination costs, while shared-licensed and unlicensed models can accelerate field experimentation and lower costs at the expense of guaranteed performance. Technology features such as eMBB, URLLC, mMTC, network slicing, sidelink, and non-terrestrial network integration each map to mission-driven use cases like base security, command and control, logistics, surveillance, and training. Finally, end-user perspectives-seen through Air Force, Army, and Navy operational vectors-illustrate how priorities shift from airborne ISR and long-range communications to armor-integrated connectivity and shipborne multi-domain linkages, demanding differentiated acquisition strategies and testing profiles.

This comprehensive research report categorizes the 5G in Defense market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Frequency

- Network Type

- Deployment Environment

- Platform Type

- Spectrum Access Model

- Technology

- Application

- End User

Why regional industrial policy, allied coordination, and divergent regulatory approaches are essential determinants of supply chain resilience and interoperability in defense 5G

Regional dynamics shape supplier ecosystems, regulatory posture, and alliance-driven procurement strategies. In the Americas, defense programs increasingly emphasize private 5G adoption at installations, domestic manufacturing incentives, and close coordination between service acquisition offices and industry partners to accelerate secure technology transitions. The United States has leaned into onshoring, incentive programs for semiconductor production, and institution-level strategies to validate Open RAN and private network deployments at scale, which together influence partner procurement pathways across the hemisphere. Europe, the Middle East, and Africa are approaching 5G for defense through a combination of allied industrial coordination, national security reviews of supply chains, and investments in satellite constellations and edge compute to secure coverage in dispersed operational theaters. Allied interoperability and mutual defense considerations encourage harmonized assurance frameworks and joint testing regimes, while regional procurement patterns show selective adoption of Open RAN and private network architectures to reduce vendor concentration and strengthen resilience.

The Asia-Pacific region presents a mix of rapid commercial 5G growth, significant investments in satellite and space-based capabilities, and divergent national policies that influence vendor engagement. Several states in the region are pursuing indigenous capabilities or dual-sourcing strategies, and their industrial policies and export control posture can vary widely. For defense planners, this regional variation means that multinational programs must be engineered with flexible vendor-neutral interfaces and rigorous cross-border assurance measures. Across all regions, the principal strategic implication is the same: resilient capability requires aligning procurement, certification, and sustainment strategies with regional policy environments while leveraging allied partnerships to preserve interoperability and reduce single-source risk.

This comprehensive research report examines key regions that drive the evolution of the 5G in Defense market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

How supplier strategies that combine modular hardware, secure software orchestration, and onshore manufacturing commitments are directing defense 5G procurement and systems integration choices

Company behavior in the defense 5G sector reflects three concurrent imperatives: diversify supply chains, accelerate secure software capabilities, and demonstrate field-ready integration across multi-domain systems. Vendors that combine modular hardware with robust software orchestration, strong cybersecurity tooling, and proven field deployments are the most likely to attract prime system integrator and service-provider roles. At the same time, several suppliers are pursuing strategic localization of critical manufacturing and certification capabilities to align with government resilience initiatives and to preserve access to defense procurement pipelines. The enterprise landscape is therefore bifurcating: firms that can demonstrate secure, standards-compliant, and field-hardened Open RAN or NTN solutions position themselves favorably for installation modernization work, while specialty suppliers focused on ruggedized devices, soldier systems, and vehicular terminals are carving out important niches that intersect tightly with platform integrators.

From the program office perspective, strategic supplier engagement is shifting earlier in the acquisition lifecycle to enable co-development paths, shared testbeds, and transparent supply-chain attestations. This reduces integration surprises and accelerates sustainment planning. For operators, the critical capability differentiators are not just throughput and latency but system observability, secure lifecycle patching, and clear failure modes under contested conditions. Therefore, companies that provide demonstrable, red-team validated security capabilities coupled with open interfaces and predictable upgrade paths will increasingly win roles in multi-vendor, mission-critical deployments.

This comprehensive research report delivers an in-depth overview of the principal market players in the 5G in Defense market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Analog Devices, Inc.

- AT&T Inc.

- BAE Systems plc

- Cisco Systems, Inc.

- Cubic Corporation

- Deutsche Telekom AG

- Elbit Systems Ltd.

- Fujitsu Limited

- General Dynamics Corporation

- General Electric Company

- Grupo Oesía

- Honeywell International Inc.

- Huawei Technologies Co., Ltd.

- Hughes Systique Private Limited

- Intelsat S.A.

- INTRACOM DEFENSE S.A.

- L3Harris Technologies, Inc.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- NEC Corporation

- Nokia Corporation

- Northrop Grumman Corporation

- Oceus Networks

- Orange SA

- QUALCOMM Incorporated

- Raytheon Technologies Corporation

- Rheinmetall AG

- Rohde & Schwarz GmbH & Co. KG

- Saab AB

- Samsung Electronics Co., Ltd.

- Telefonaktiebolaget LM Ericsson

- Telefónica S.A.

- Telia Company AB

- Thales Group

- Verizon Communications Inc.

- Viasat, Inc.

- Wind River Systems, Inc.

Actionable steps for program managers and industry leaders to accelerate secure capability insertion, reduce vendor dependency, and preserve sustainment readiness in defense 5G deployments

Industry leaders and program managers must adopt an action-first posture that blends deliberate risk mitigation with rapid capability insertion. First, they should prioritize early, scenario-driven experimentation that validates Open RAN, private 5G, and NTN elements in representative operational environments; this reduces integration risk and surfaces security gaps before wide-area deployment. Concurrently, acquisition teams should embed supply chain due diligence and alternative sourcing clauses into contracts to limit single-vendor exposure and to accelerate replacement or re-hosting when upstream constraints appear. Third, program leads must insist on software-first architectures that decouple feature roadmaps from single hardware suppliers, enabling security patches and capability enhancements to be delivered through continuous integration and validated update pipelines.

Moreover, leaders should invest in shared lab environments and allied testbeds to accelerate interoperability certifications and to reduce duplication of validation efforts across services and partner nations. They should also fund workforce development that places network engineers, cyber defenders, and platform integrators into co-located cross-functional teams during rollout phases to shorten feedback loops. Lastly, while pursuing innovation, decision-makers must maintain conservative contingency planning for sustainment-maintaining qualified alternative parts lists, long-lead component forecasts, and costed plans for domestic or allied production mobilization. Together these steps will create a pragmatic balance between rapid operational advantage and durable mission assurance.

Research methodology combining primary stakeholder engagements, standards validation, scenario-based risk modeling, and supplier resilience scoring to ensure actionable and reproducible findings

This research synthesis used a mixed-methods approach combining primary and secondary inputs to ensure analytic rigor and operational relevance. Primary inputs included structured interviews with program officers, systems engineers, and security architects from multiple services and allied partners, along with workshops that validated architecture assumptions in representative operational scenarios. Secondary research drew from public federal strategy documents, regulatory notices, standards-body releases, and verified industry demonstration reports to map technology trends and policy inflection points.

Analytical methods incorporated scenario-based risk modeling, technology capability mapping, and supplier resilience scoring to identify stress points in procurement and sustainment pathways. Validation steps included cross-referencing standards developments and government strategy releases to ensure recommended mitigations align with current policy and acquisition authorities. Where possible, technical descriptions were anchored to normative standards and official government strategy artifacts to maintain traceability and to enable program offices to reproduce test conditions and acceptance criteria in live acquisition settings. Finally, sensitivity analyses were performed to test how tariffs, export controls, and supply chain disruptions could alter vendor availability and component lead times, producing the risk-mitigating recommendations summarized earlier.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our 5G in Defense market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- 5G in Defense Market, by Component

- 5G in Defense Market, by Frequency

- 5G in Defense Market, by Network Type

- 5G in Defense Market, by Deployment Environment

- 5G in Defense Market, by Platform Type

- 5G in Defense Market, by Spectrum Access Model

- 5G in Defense Market, by Technology

- 5G in Defense Market, by Application

- 5G in Defense Market, by End User

- 5G in Defense Market, by Region

- 5G in Defense Market, by Group

- 5G in Defense Market, by Country

- United States 5G in Defense Market

- China 5G in Defense Market

- Competitive Landscape

- List of Figures [Total: 21]

- List of Tables [Total: 3021 ]

A pragmatic conclusion on capturing operational advantage from 5G while balancing supply chain risk, standards integration, and resilient acquisition practices

The accelerating adoption of 5G capabilities across defense environments offers an unprecedented operational promise: faster decision cycles, distributed sensing at scale, and new modes of force multiplication. Yet this promise is coupled with complex dependencies-on diverse supplier ecosystems, evolving standards for NTN and Open RAN, and a shifting policy landscape shaped by tariffs and export controls. The net conclusion is pragmatic: 5G is no longer an experimental frontier for defense; it is an operational imperative that requires deliberate, risk-aware acquisition and engineering practices.

Decision-makers should therefore prioritize integrated approaches that combine early validation, supplier diversification, software-centric architectures, and cross-domain interoperability testing. When these elements are synchronized with informed policy navigation-anticipating tariff effects, export control regimes, and certification constraints-forces can capture the operational advantages of 5G while limiting systemic exposure. The roadmap ahead is not frictionless, but with disciplined program design and allied cooperation it is attainable and strategically decisive.

Purchase the comprehensive market research report and secure priority briefings, tailored datasets, and advisory engagement with the Associate Director of Sales & Marketing

This market research report is available for purchase and licensing. To obtain the full, referenced report, detailed datasets, and tailored briefings that translate strategic findings into executable plans, please contact Ketan Rohom, Associate Director, Sales & Marketing. A direct engagement will provide access to customizable delivery options, bundled advisory sessions, and enterprise licensing terms to support procurement, technology roadmaps, and programmatic acquisitions. Engage now to secure priority briefings, request bespoke segmentation deep-dives, and arrange a demonstration of methodological artifacts and raw data that underpin the analysis in this executive summary.

- How big is the 5G in Defense Market?

- What is the 5G in Defense Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?