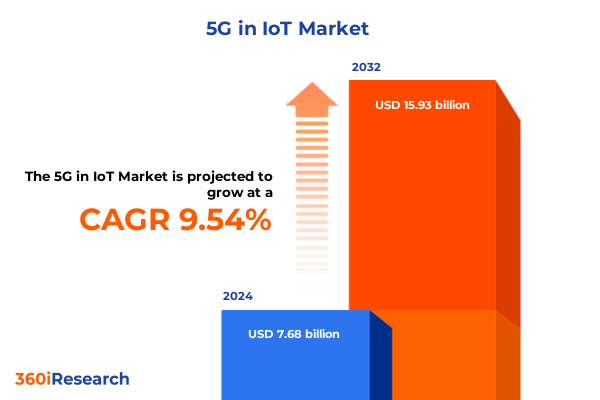

The 5G in IoT Market size was estimated at USD 8.39 billion in 2025 and expected to reach USD 9.16 billion in 2026, at a CAGR of 9.59% to reach USD 15.93 billion by 2032.

Exploring the Convergence of Fifth-Generation Connectivity and Internet of Things Innovations to Revolutionize Industrial and Consumer Applications

The convergence of fifth-generation wireless networks and the Internet of Things is redefining how enterprises and consumers alike interact with digital ecosystems. New capabilities inherent in 5G-such as ultra-reliable low-latency communications, massive machine-type connectivity, and enhanced mobile broadband-are enabling an unprecedented scale of device connections, real-time data processing at the network edge, and application experiences that were inconceivable under previous generations of connectivity.

As industries from manufacturing to healthcare begin to pilot and deploy private 5G networks alongside public operator infrastructure, the role of 5G in catalyzing widespread IoT adoption has become more pronounced. Organizations are leveraging network slicing for differentiated quality-of-service tiers, multi-access edge computing for local analytics, and advanced beamforming and massive MIMO implementations to achieve spectral efficiency gains and ensure reliable coverage in both urban and rural environments.

In parallel, driving factors such as the reduction in sensor costs, surging edge AI investments, and evolving cybersecurity requirements have contributed to the rapid maturation of the 5G IoT market. With enterprises seeking to transform operations, optimize resource utilization, and accelerate digital business models, the synergy between 5G’s technical promise and IoT’s data-driven use cases sets the stage for a transformative era in connectivity and automation.

Unveiling the Paradigm Shifts Driven by Ultra-Reliable Low-Latency Communications and Edge Computing in the IoT Ecosystem and Harnessing Network Slicing

The landscape of 5G-enabled IoT is experiencing paradigm shifts as network architectures evolve from monolithic, hardware-centric deployments toward software-driven, virtualized infrastructures. Operators and enterprises are adopting cloud-native core networks and disaggregated RAN architectures, harnessing containerized microservices and orchestration platforms to scale capacity dynamically and introduce AI-powered network optimization functions.

Moreover, Massive MIMO and beamforming technologies are unlocking new levels of spectral efficiency and user throughput by focusing radio energy precisely toward connected devices, thereby extending coverage in challenging environments and enhancing reliability for critical IoT applications such as autonomous vehicles and remote robotics. Concurrently, integration of multi-access edge computing at base stations and enterprise premises is reducing end-to-end latencies to the single-digit millisecond range, enabling mission-critical use cases like teleoperation, AR-assisted maintenance, and real-time quality control in manufacturing floors.

These foundational shifts are further supported by advanced network slicing and virtualization frameworks that allow service providers to tailor logical network instances with customized performance, security, and reliability characteristics. This capability empowers industries to adopt private network deployments for sensitive applications while maintaining interoperability with public 5G services, laying the groundwork for a more agile, resilient, and cost-effective IoT ecosystem.

Assessing the Compounded Effects of 2025 United States Tariffs on Supply Chains, Costs, and Innovation Dynamics in 5G IoT Deployments

Since the reimposition of tariff measures on Chinese-origin electronic components, telecom equipment, and IoT devices in 2021, U.S. import duties have steadily tightened supply chain economics across the 5G IoT ecosystem. Ericsson’s proactive expansion of North American manufacturing capacity-including a Texas facility and multiple R&D centers-helps mitigate these costs, yet executives have estimated a one-percentage-point margin impact per quarter directly attributable to tariff surcharges.

Nokia has similarly adjusted its profit outlook, citing increased costs of antennas, RF components, and connectivity modules that contribute between €50 million and €80 million in reduced 2025 earnings as a result of the duties imposed on core network hardware. Beyond equipment vendors, mobile network operators and system integrators face average tariff-driven price hikes of 10–20% on network elements, complicating capital expenditure planning and potentially slowing the pace of new rollouts if stockpiling strategies prove insufficient.

As OEMs and enterprises navigate these headwinds, strategic responses have included diversification of supplier bases, relocation of assembly operations to tariff-exempt jurisdictions, and increased emphasis on software upgrades and network virtualization-which are less exposed to goods-based duties. While the cumulative effects through mid-2025 have elevated total landed costs for 5G IoT solutions, these measures are fostering more resilient supply chain structures and accelerating the adoption of modular, software-oriented deployments to offset hardware price volatility.

Delineating the Multifaceted Market Segmentation Landscape to Illuminate Strategy Between Offerings, Technologies, Applications, and Deployment Models

The market for 5G-enabled IoT can be dissected through intertwined lenses of product offerings, technological enablers, application domains, and deployment paradigms. On the offering front, hardware spans antenna systems and RF units through advanced sensors and edge compute modules, while services embrace both managed network operations and specialized professional integration support. Software layers comprise network functions virtualization stacks, device management platforms, orchestration frameworks, and security suites tailored for IoT lifecycles.

This comprehensive research report categorizes the 5G in IoT market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Technology

- Application

- Deployment Mode

Navigating the Regional Tapestry of 5G IoT Adoption Across the Americas, EMEA, and Asia-Pacific to Inform Customized Growth Strategies

Regional dynamics highlight distinct drivers and barriers across geographies. In the Americas, aggressive spectrum allocations and private network incentives are accelerating industrial IoT pilots in sectors from utilities to logistics, with leading operators offering turnkey solutions that integrate cloud-native core functionality and edge compute locations to support latency-sensitive use cases.

This comprehensive research report examines key regions that drive the evolution of the 5G in IoT market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Innovators and Strategic Partnerships Shaping the Competitive 5G IoT Supply Chain and Ecosystem Dynamics

A competitive analysis reveals that Ericsson, Nokia, Huawei, Qualcomm, Samsung, Cisco, and Intel are at the forefront of 5G IoT innovation. Ericsson’s early mover advantage in Massive MIMO and virtual RAN solutions underpins significant market traction in North America, while Nokia’s AirScale portfolio and orchestration software are gaining ground in multi-vendor network environments. Huawei continues to lead in end-to-end private network offerings, capitalizing on its integrated core, RAN, and device ecosystem globally. Qualcomm is expanding its role from chipset supplier to edge AI platform provider, as evidenced by recent acquisitions and strategic partnerships to embed machine learning capabilities on IoT endpoints. Samsung has distinguished itself through comprehensive private network solutions and pioneering RedCap trials in automotive manufacturing with Hyundai, showcasing real-world use cases for compact IoT devices on dedicated 5G networks. Cisco and Intel further differentiate through enterprise-grade security platforms and interoperable edge compute modules designed for multi-vendor environments, reinforcing the importance of open ecosystems in supporting large-scale IoT rollouts.

This comprehensive research report delivers an in-depth overview of the principal market players in the 5G in IoT market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AT&T Inc.

- BCE Inc.

- BT Group PLC

- Capgemini SE

- China Mobile International Limited

- China Telecom Corporation Limited

- China Unicom (Hong Kong) Limited

- Cisco Systems, Inc.

- e&

- F5, Inc.

- Huawei Investment & Holding Co., Ltd.

- Jio Platforms Limited by Reliance Industries Limited

- Juniper Networks, Inc.

- KDDI CORPORATION

- NEC Corporation

- Nokia Corporation

- Orange SA

- Qualcomm Technologies, Inc.

- Rogers Communications

- Sequans Communications S.A.

- Sierra Wireless, Inc. by Semtech Corporation

- SIMCom Wireless Solutions Limited

- Sunrise Communications AG

- Telefonaktiebolaget LM Ericsson

- Telefónica, S.A.

- Telekom Deutschland GmbH

- Telit Cinterion

- Telstra Group Limited

- u-blox AG

- Verizon Communications Inc.

- Vodafone Group PLC

Empowering Industry Leaders with Tactical Roadmaps to Leverage 5G IoT Innovations While Mitigating Supply Chain and Regulatory Challenges

Industry leaders should cultivate flexible supply chain strategies by diversifying components sourcing, leveraging regional assembly hubs, and engaging in co-innovation with suppliers to reduce tariff exposure while ensuring compliance with evolving trade regulations. Investment in cloud-native and virtualized architectures will support faster service rollouts and lower total cost of ownership by decoupling software upgrades from hardware refresh cycles. Companies should adopt a modular private network strategy to address specific industrial use cases-ranging from remote asset monitoring to collaborative robotics-while maintaining seamless interoperability with public 5G networks through standardized APIs and orchestration interfaces. Building upon this foundation, embedding edge AI capabilities into IoT devices and network nodes can optimize data processing, enhance security with real-time anomaly detection, and enable predictive maintenance workflows that drive operational efficiencies. Finally, leaders must engage proactively with regulators, standards bodies, and industry consortia to shape spectrum policies, cybersecurity frameworks, and data governance guidelines that ensure equitable market development and safeguard ecosystem resilience.

Outlining the Rigorous Dual-Phase Research Approach Combining Primary Interviews and Secondary Data Analysis to Validate 5G IoT Market Insights

This study deployed a dual-phase research blueprint blending in-depth primary interviews with executives across leading network vendors, service providers, and system integrators, alongside a comprehensive review of secondary sources including company filings, regulatory documents, and industry publications. Quantitative data was triangulated through supply chain surveys and equipment shipment trackers to validate trends in hardware adoption and regional deployment velocities. A cross-functional expert panel assessed technological trajectories-focusing on virtualization, edge computing, and AI integration-to ensure methodological rigor and decision-grade reliability. Case studies of private network rollouts and tariff mitigation strategies were synthesized to illustrate pragmatic responses under real-world constraints. All findings were iteratively verified with external advisors to reconcile disparate data streams and solidify the strategic implications presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our 5G in IoT market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- 5G in IoT Market, by Offering

- 5G in IoT Market, by Technology

- 5G in IoT Market, by Application

- 5G in IoT Market, by Deployment Mode

- 5G in IoT Market, by Region

- 5G in IoT Market, by Group

- 5G in IoT Market, by Country

- United States 5G in IoT Market

- China 5G in IoT Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Synthesizing the Strategic Imperatives and Emerging Opportunities in 5G-Enabled IoT to Chart a Path Forward for Stakeholders and Innovators

As 5G networks transition from initial rollout to full-fledged service ecosystems, the integration of IoT at scale will redefine business processes, consumer experiences, and societal infrastructures. The convergence of ultra-low-latency communications, massive machine connectivity, and edge AI capabilities heralds new operational paradigms across manufacturing, healthcare, transportation, and beyond. Success in this arena hinges on orchestrating modular network architectures, resilient supply chain frameworks, and data-centric security postures that can adapt to tariff and regulatory dynamics. By embracing private network deployments alongside public operator services, and fostering strategic collaborations across hardware, software, and service domains, stakeholders can unlock the transformative potential of 5G-enabled IoT and position themselves at the vanguard of digital innovation.

Take the Next Step in Securing Your Competitive Advantage by Partnering with Ketan Rohom to Acquire the Comprehensive 5G IoT Market Research Report

Ready to fortify your strategic positioning in the rapidly evolving 5G IoT landscape? Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure access to the comprehensive 5G IoT market research report that synthesizes the latest industry trends, tariff impacts, segmentation deep dives, regional analyses, and actionable recommendations. Equip your team with the insights needed to make data-driven decisions, anticipate regulatory shifts, and outpace competitors with forward-looking strategies that leverage next-generation connectivity. Contact Ketan to discuss how this extensive research can be tailored to your organizational priorities and unlock new growth opportunities within the 5G-enabled IoT ecosystem

- How big is the 5G in IoT Market?

- What is the 5G in IoT Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?