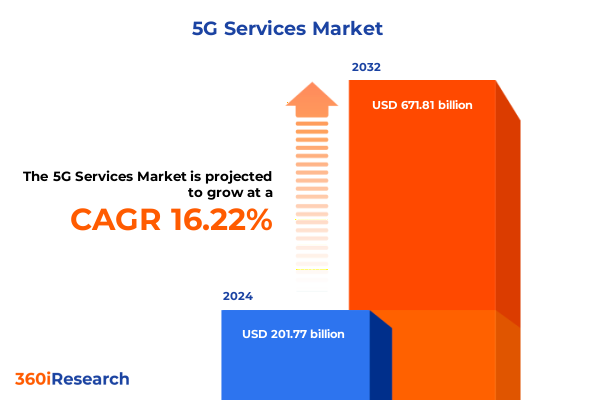

The 5G Services Market size was estimated at USD 231.88 billion in 2025 and expected to reach USD 266.48 billion in 2026, at a CAGR of 16.41% to reach USD 671.81 billion by 2032.

Understanding the Era of 5G Services: Unveiling Core Advantages, Strategic Imperatives, and Opportunities for Enterprise Transformation

Driven by unprecedented demand for high-speed, low-latency connectivity, the emergence of fifth-generation wireless technology is reshaping digital infrastructure and unlocking new possibilities across industries. As enterprises and service providers race to capitalize on the transformative potential of 5G, understanding the foundational principles and strategic imperatives has never been more critical. This introduction sets the stage for an in-depth exploration of how 5G services are redefining network architectures, fueling innovative use cases, and establishing new benchmarks for performance and reliability.

While early deployments focused on enhancing mobile broadband experiences for consumers, the current phase is characterized by a broader ecosystem expansion into manufacturing automation, smart cities, and mission-critical applications. This shift underscores the importance of comprehensively evaluating both technological enablers and market dynamics. By delineating the core attributes of 5G-ultra-reliable low-latency communication, enhanced mobile broadband, massive machine-type communication, and fixed wireless access-this section illuminates the foundational drivers propelling industry adoption and sets the context for subsequent strategic insights.

Charting the Evolution of Connectivity: How Network Architecture, Infrastructure Upgrades, and Policy Shifts Are Redefining 5G's Role in Digital Ecosystems

The landscape of wireless connectivity is undergoing a profound transformation driven by next-generation network architectures and evolving regulatory frameworks. Transitioning from non-standalone to standalone deployments enables service providers to leverage dedicated 5G cores, unlocking features such as network slicing and quality-of-service assurances tailored to specific use cases. Concurrently, the ascent of virtualization and software-defined networking has dramatically reduced capital expenditure requirements while enhancing the agility of network operations.

Moreover, the integration of edge computing resources at the network periphery is redefining latency-sensitive applications, paving the way for real-time analytics and control in sectors such as autonomous vehicles and industrial automation. Policy shifts, including spectrum reallocation and collaborative models between public and private stakeholders, have further catalyzed the expansion of 5G infrastructure. As a result, the interplay between technological breakthroughs and regulatory enablers is crafting a dynamic ecosystem that demands agile business models and strategic partnerships.

Assessing the Ripple Effects of 2025 United States Trade Policies on 5G Service Deployment, Supply Chains, and Competitive Positioning in North America

Recent trade measures enacted by the United States in early 2025 have introduced new tariff structures targeting critical telecommunications equipment imports. These levies have incrementally increased the cost basis for network operators and equipment vendors, compelling stakeholders to reassess supply chain logistics and procurement strategies. The ripple effect is particularly pronounced for components sourced from regions subject to elevated duties, prompting some enterprises to diversify supplier portfolios or accelerate local manufacturing initiatives to mitigate cost pressures.

In response to these developments, leading network operators have renegotiated contracts and implemented value engineering initiatives to preserve service rollout timelines and customer experience benchmarks. The necessity to balance cost containment with performance requirements has spurred investments in modular equipment architectures and open RAN technologies, which offer greater vendor flexibility and potential tariff circumvention. Consequently, the cumulative impact of these trade policies is reshaping competitive positioning within the North American 5G market, incentivizing innovation in both procurement and network deployment strategies.

Illuminating Key Market Segments by Component, Architecture, End-User Industry, and Application to Reveal Opportunities within the Expanding 5G Services Ecosystem

The component segmentation of the 5G services market elucidates two primary domains: the equipment segment, which encompasses the core network, radio access network, and transport network, and the services segment, which spans managed services and professional services. Analyzing equipment expenditures reveals that radio access network investments are accelerating as operators densify cell sites to meet escalating bandwidth demands. Concurrently, core network upgrades-driven by the migration to a cloud-native architecture-are garnering significant attention due to their role in enabling network slicing and advanced service orchestration. On the services front, managed services engagements are expanding as operators outsource end-to-end network operations to specialized partners, while professional services offerings focus on system integration, spectrum planning, and network optimization to ensure seamless launches.

Architectural segmentation underscores the divergence between non-standalone and standalone implementations. Non-standalone frameworks, which leverage existing 4G infrastructure to bootstrap early deployments, continue to dominate initial rollouts. However, the transition to standalone architectures is gaining momentum, driven by the need for enhanced flexibility and service differentiation. As vendors and operators chart upgrade paths, standalone networks are becoming the strategic focal point for delivering on low-latency and ultra-reliable use cases.

Delving into end-user industry segmentation reveals a diverse tapestry of adoption patterns. In the automotive sector, 5G-enabled vehicle-to-everything applications are progressing from pilot phases to commercial trials, while banking, financial services, and insurance firms are exploring secure low-latency connectivity for transaction processing and mobile payments. Consumer electronics makers are embedding 5G capabilities into next-generation devices, and energy and utilities providers are piloting smart grid solutions. Parallel initiatives in government and public sector agencies focus on emergency response networks, while healthcare, IT and telecom, manufacturing, media and entertainment, and retail verticals each present unique use case requirements and ROI profiles.

Application segmentation further highlights the multifaceted nature of 5G services. Enhanced mobile broadband continues to drive consumer adoption, whereas fixed wireless access is emerging as a viable alternative to fiber in underserved regions. Massive machine-type communication underpins large-scale IoT deployments in smart cities and industrial monitoring, and ultra-reliable low-latency communication is foundational for mission-critical applications in healthcare, transportation, and public safety.

This comprehensive research report categorizes the 5G Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Architecture

- Application

- End-User Industry

Exploring Regional Dynamics and Market Drivers across the Americas, Europe Middle East & Africa, and Asia-Pacific in the Accelerating 5G Services Revolution

The Americas region exhibits a robust trajectory, with North American operators spearheading commercial 5G service rollouts and fostering a competitive environment that accelerates infrastructure investments. The U.S. market, in particular, has prioritized mid-band spectrum auctions and private network initiatives, enabling diverse use cases across manufacturing automation and enterprise campuses. Meanwhile, Canada and Latin America are progressing through phased deployments, leveraging partnerships to overcome geographical challenges and address digital inclusion goals.

Europe, the Middle East, and Africa present a heterogeneous landscape, where established economies in Western Europe are advancing standalone architectures and promoting cross-border spectrum harmonization. In contrast, emerging markets in Eastern Europe and select Middle Eastern nations are capitalizing on cost-effective deployment models, including open RAN, to leapfrog traditional rollouts. Africa’s telecom providers are also exploring fixed wireless access to bridge connectivity gaps in rural communities, underpinned by targeted regulatory reforms and public-private collaborations.

In Asia-Pacific, adoption rates are among the highest globally, driven by early spectrum auctions and supportive policy frameworks. Countries such as South Korea and Japan have achieved extensive coverage, fostering 5G-enabled smart factory trials and immersive media experiences. China continues to drive scale through domestic manufacturing capabilities and state-backed infrastructure programs, while Southeast Asian markets are tailoring 5G strategies to address urbanization pressures and digital services growth. Across the region, ecosystem partnerships between network operators, semiconductor vendors, and application developers are amplifying the transformative potential of 5G services.

This comprehensive research report examines key regions that drive the evolution of the 5G Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Established Players Shaping the 5G Services Landscape through Strategic Partnerships, Technology Investments, and Service Excellence

Leading stakeholder profiles reveal a blend of traditional telecommunications equipment vendors, chipset manufacturers, service providers, and emerging innovators shaping the 5G services landscape. Global infrastructure vendors are enhancing their portfolios through strategic acquisitions and alliances, integrating cloud-native core solutions, and expanding open RAN product lines to cater to diverse operator requirements. Chipset specialists are focusing on system-on-chip advancements to reduce power consumption and support multi-gigabit throughput, thereby enabling a new class of consumer and industrial devices.

Telecom operators are forging partnerships with hyperscale cloud providers to deploy network functions in distributed environments, accelerating the rollout of network slicing and customized enterprise services. Meanwhile, specialized managed service firms are differentiating through outcome-based contracts, leveraging analytics and AI-driven automation to optimize network performance and customer experience. New entrants, particularly in the private 5G segment, are targeting vertical-specific solutions, collaborating with equipment vendors and system integrators to deliver turnkey offerings for manufacturing, logistics, and critical infrastructure.

Across this dynamic competitive arena, the convergence of technology evolution and strategic collaboration is generating a rich tapestry of innovation. As cloud-native architectures mature and regulatory frameworks evolve, companies that demonstrate agility in partner ecosystems and a relentless focus on end-to-end service excellence will be best positioned to capitalize on the next wave of 5G-enabled growth.

This comprehensive research report delivers an in-depth overview of the principal market players in the 5G Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AT&T Inc.

- Bharat Sanchar Nigam Limited

- Bharti Airtel Limited

- Deutsche Telekom AG

- DISH Network Corporation

- NTT Group

- SK Telecom Co., Ltd.

- Telefónica, S.A.

- Verizon Communications Inc.

- Vodafone Group Plc

- ZTE Corporation

Strategic Roadmap for Industry Leaders to Maximize 5G Service Adoption, Optimize Infrastructure Investments, and Enhance Competitive Differentiation

Industry leaders should prioritize an agile network deployment strategy that incorporates incremental upgrades from non-standalone to standalone architectures, allowing for rapid scalability and service differentiation. By leveraging virtualized network functions and containerized core components, operators can reduce time-to-market while maintaining cost efficiency. Furthermore, integrating edge computing nodes in proximity to high-demand applications will ensure that latency-sensitive services meet stringent quality benchmarks, thereby unlocking new revenue streams.

In addition, forging multi-stakeholder alliances is essential for holistic ecosystem development. Collaboration between equipment vendors, system integrators, cloud providers, and industry consortia can streamline interoperability testing and accelerate standards adoption. Leaders must also cultivate partnerships with vertical end-users to co-create solutions tailored to specific operational challenges, thereby reinforcing customer loyalty and driving premium service uptake.

From a procurement perspective, diversifying supply chains and adopting open interface frameworks will mitigate geopolitical risks and reduce dependence on single-source vendors. Organizations should also invest in workforce upskilling initiatives to develop in-house expertise in 5G network management, automation, and data analytics. Such capabilities are critical for sustaining service quality as networks evolve in complexity.

Finally, embedding data-driven insights into decision-making processes will empower leadership teams to dynamically adjust deployment roadmaps based on real-time performance metrics and shifting market conditions. Continuous evaluation of capex allocations, revenue potential by service tier, and user behavior analytics will ensure that investments are aligned with strategic priorities and deliver measurable returns.

Methodological Blueprint Detailing Data Sources, Analytical Frameworks, and Validation Processes Employed to Ensure Rigor and Reliability in 5G Services Research

The research approach combines primary qualitative interviews with senior executives, network architects, and technology partners, alongside extensive secondary research encompassing industry whitepapers, regulatory publications, and patent filings. Primary engagements were structured to validate market drivers, gauge adoption roadmaps, and uncover emerging use cases, while secondary sources provided contextual data on spectrum allocation, policy developments, and vendor offerings.

A rigorous analytical framework underpins the study, integrating PESTEL analysis to assess macroeconomic and regulatory influences, Porter’s Five Forces to evaluate competitive intensity, and a technology readiness assessment to benchmark vendor maturity. Segmentation analyses were conducted following a bottom-up methodology, mapping key components, architectural models, end-user industries, and applications to corresponding market dynamics. Regional breakdowns were developed by synthesizing operator rollouts, spectrum releases, and public-private partnership initiatives across each geography.

To ensure data accuracy and reliability, findings were triangulated through cross-verification of interview insights with publicly available financial reports, vendor press releases, and regulatory filings. Potential biases were mitigated by incorporating diverse perspectives from both incumbents and disruptors, while ongoing peer reviews throughout the research lifecycle upheld methodological integrity.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our 5G Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- 5G Services Market, by Component

- 5G Services Market, by Architecture

- 5G Services Market, by Application

- 5G Services Market, by End-User Industry

- 5G Services Market, by Region

- 5G Services Market, by Group

- 5G Services Market, by Country

- United States 5G Services Market

- China 5G Services Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Synthesis of Core Findings Highlighting Strategic Imperatives, Emerging Trends, and Future Outlook Shaping the 5G Services Market Trajectory

This executive summary has distilled key insights concerning the technological evolution, market segmentation, and regional dynamics shaping the 5G services domain. By examining component and architectural paradigms alongside tariff-driven cost considerations, it underscores the complexity of strategic decision-making in a rapidly evolving ecosystem. The interplay between policy measures and infrastructure investments highlights the need for adaptive procurement strategies and collaborative partnerships that can navigate both regulatory landscapes and supply chain constraints.

Looking ahead, the convergence of ultra-reliable low-latency communication, edge computing, and network slicing will catalyze transformative applications in sectors ranging from healthcare and automotive to media and manufacturing. As competitive pressures intensify, organizations that balance technology innovation with operational agility and data-driven governance will emerge as market leaders. The insights herein provide a strategic foundation for navigating the opportunities and challenges of the 5G era, empowering decision-makers to craft resilient roadmaps and capitalize on the next wave of digital transformation.

Connect with Ketan Rohom to Unlock Comprehensive Insights on 5G Services Market Trends, Strategic Opportunities, and Tailored Research Solutions Today

To explore tailored insights and gain a competitive edge in the rapidly evolving 5G services market, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan brings a wealth of industry expertise and a deep understanding of emerging trends, ensuring you receive the most relevant data and strategic guidance for your organization’s objectives.

Engaging with Ketan will allow you to unlock comprehensive research solutions that address your specific challenges, from optimizing network deployments to identifying high-potential verticals. Connect today to discover how our market research report can inform your investment decisions, accelerate time-to-market, and support sustainable growth in the 5G era.

- How big is the 5G Services Market?

- What is the 5G Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?