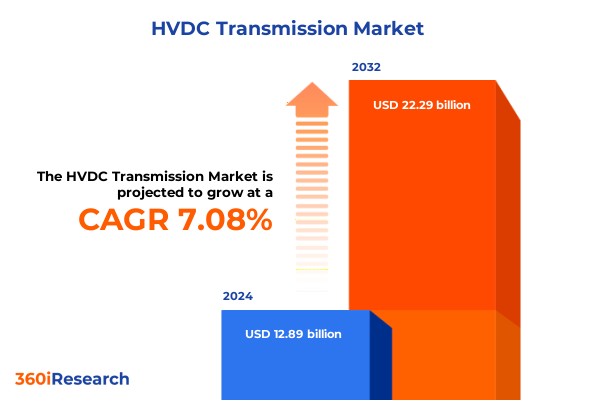

The HVDC Transmission Market size was estimated at USD 16.27 billion in 2025 and expected to reach USD 17.51 billion in 2026, at a CAGR of 8.14% to reach USD 28.15 billion by 2032.

Unveiling the Foundational Role of High Voltage Direct Current Transmission in Strengthening Grid Reliability and Renewable Energy Connectivity

The accelerating shift toward decarbonization and grid reliability over the past decade has positioned high voltage direct current (HVDC) transmission as a linchpin in modern power systems. As renewable energy sources proliferate across dispersed geographical locations, the imperative to transmit bulk power efficiently over extended distances has elevated HVDC solutions from a niche technology to a central component of national and international grid architectures.

In recent years, network operators and utilities have confronted the dual pressures of aging infrastructure and fluctuating generation patterns. These challenges have underscored limitations in traditional alternating current systems, particularly when integrating offshore wind farms and remote solar arrays into coastal and inland networks. Meanwhile, novel converter technologies and advanced control systems have matured, reducing converter station footprints and enhancing operational flexibility.

Against this backdrop, stakeholders across the value chain are reassessing transmission strategies to prioritize reliability, resilience, and cost control. The convergence of policy mandates for cleaner energy, ambitious carbon reduction targets, and heightened demand for stable grid performance has created a fertile environment for HVDC deployment. This introduction outlines the strategic imperatives driving market adoption, setting the stage for a comprehensive exploration of transformative shifts and policy impacts shaping the HVDC transmission landscape.

Examining Cutting-Edge Converter Innovations and Grid Interconnection Policies Driving the Evolution of HVDC Transmission

The landscape of HVDC transmission is undergoing transformative shifts fueled by converging technological breakthroughs and evolving regulatory frameworks. Innovations in voltage source converter (VSC) architectures, particularly modular multilevel converters, have unlocked new dimensions of control, enabling dynamic power flow management and black-start capabilities. These converters deliver superior harmonics performance and faster response times compared to traditional line commutated converters, which continue to serve in applications where cost considerations and existing infrastructure compatibility prevail.

Concurrently, advancements in high-capacity cable materials, such as cross-linked polyethylene and mass-impregnated insulation systems, are extending transmission distance capabilities while minimizing losses. The integration of real-time monitoring and digital twin platforms is facilitating predictive maintenance, optimizing asset availability, and reducing unplanned outages. These technical developments coincide with a shift toward multi-terminal VSC networks, which offer enhanced redundancy and facilitate the interconnection of dispersed renewable energy clusters.

Regulatory bodies and grid operators are also revising codes to accommodate HVDC interties, promoting synchronous and asynchronous coupling between adjacent systems. Through a combination of supportive policy measures and competitive power market designs, governments are incentivizing cross-border and interregional HVDC projects. Taken together, these transformative shifts signal an inflection point in how transmission systems are planned, commissioned, and operated.

Analyzing the Substantial Influence of 2025 United States Tariffs on Project Economics and Strategic Procurement in HVDC Endeavors

The implementation of United States tariffs in early 2025 has introduced a significant variable into HVDC project economics, influencing procurement strategies and supply chains. Tariffs applied to key components-including converter valves, power transformers, and specialized cable conductors-have elevated capital costs, prompting developers to reassess vendor sourcing and contractual terms. This policy adjustment follows a broader trend of seeking domestic content in critical energy infrastructure, aimed at bolstering local manufacturing and securing supply resilience.

As a result, project stakeholders have shifted toward forging long-term partnerships with domestic equipment suppliers to mitigate tariff exposure and avoid cost overruns. Engineering, procurement, and construction contractors are increasingly embedding tariff allowances into project budgets, while exploring alternative materials and design optimizations to offset incremental expenses. Despite these cost pressures, the underlying demand for reliable HVDC connections to integrate renewable installations remains unaltered, preserving long-term project pipelines.

Moreover, developers are leveraging financial instruments such as hedging and cost-pass-through mechanisms within offtake agreements to distribute tariff-related risks between stakeholders. This collaborative approach to risk management has fostered greater transparency in supplier negotiations and contractual structures. As the industry adapts to the 2025 tariff framework, lessons learned during this adjustment period will inform future strategies for balancing total system costs with strategic imperatives for energy security and environmental sustainability.

Delving into Distinct Technology Converters Configurations and Application Scenarios That Define the Spectrum of HVDC Transmission Solutions

In analyzing market dynamics through the lens of technology, the dichotomy between line commutated converters and voltage source converters reveals divergent value propositions. While line commutated converters have established reliability and cost efficiency in traditional point-to-point interconnections, the ascendancy of voltage source converters-particularly modular multilevel converter variants-has reshaped applications requiring rapid control, reduced footprint, and black-start functionality. Within this category, two-level converters maintain relevance for lower-capacity installations, whereas modular multilevel converters dominate in high-capacity, multi-terminal networks.

Configuration-based segmentation further refines insight by distinguishing between monopolar systems, which offer streamlined design and ease of construction, and bipolar topologies, favored for their enhanced fault tolerance and balanced ground return currents. Homopolar arrangements, while less prevalent, serve specialized applications where common-pole ground return is operationally advantageous. The choice among these configurations hinges on project-specific criteria such as environmental constraints, redundancy requirements, and cost considerations.

From an application standpoint, the contrast between point-to-point links and multi-terminal architectures underscores the evolving complexity of modern grids. Point-to-point interconnects continue to facilitate high-capacity offshore-to-onshore transfers, yet multi-terminal networks are gaining traction in regions seeking to aggregate dispersed renewable clusters. Voltage level segmentation reveals that installations up to five hundred kilovolt remain widespread for short-distance connections, while higher voltage bands, including five hundred to six hundred kilovolt and above six hundred kilovolt, address long-distance transmission with optimized efficiency. Transmission distance considerations delineate between short-distance links, often under one hundred kilometers, and long-distance corridors extending several hundred kilometers. Finally, end-user segmentation differentiates industrial customers-such as resource-intensive manufacturing and mining operations-from utility-scale purchasers managing bulk power flow, each with distinct reliability and pricing priorities.

This comprehensive research report categorizes the HVDC Transmission market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Technology

- Configuration

- Voltage Level

- Transmission Distance

- Application

- End User

Exploring How Diverse Regional Drivers and Policy Frameworks Propel Varied HVDC Transmission Deployments Around the World

Regional nuances play a pivotal role in shaping the adoption trajectory of HVDC transmission, with each geography exhibiting unique drivers and barriers. In the Americas, accelerating investments in renewable integration alongside aging grid infrastructure have prompted major interconnection projects, particularly along coastal corridors and transnational links. Momentum is also building toward leveraging HVDC to support offshore wind hubs and enhance cross-state power exchanges, where regulatory alignment and market design reforms are progressively encouraging multi-terminal networks.

Across Europe, Middle East & Africa, regulatory cohesion-exemplified by cross-border harmonization initiatives in Europe-has fostered a collaborative environment for large-scale HVDC interconnectors. Landmark projects bridging Northern and Southern Europe illustrate the potential for asynchronous coupling to bolster energy security and balance intermittent generation. Meanwhile, the Middle East’s strategic focus on diversifying energy portfolios has elevated interest in HVDC transmission to transport solar power from desert plants to urban centers, while North African corridors are being evaluated to export renewable energy to European markets.

In the Asia-Pacific region, robust demand growth and ambitious renewable deployment targets are driving an uptick in long-haul HVDC lines. China’s domestic expansion continues at pace, underpinned by ultra-high voltage projects surpassing six hundred kilovolt, while Southeast Asian nations explore submarine links to harness offshore wind. Australia’s evolving policy landscape is catalyzing inter-state HVDC backbones to integrate remote solar and battery storage resources, reflecting a convergence of policy support and industry innovation.

This comprehensive research report examines key regions that drive the evolution of the HVDC Transmission market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Technology Providers and Engineering Collaborators Shaping the Future of HVDC Transmission Networks

A handful of global and regional equipment suppliers and engineering firms are spearheading innovation in HVDC transmission. These entities have established their leadership through a combination of pioneering technology patents, turnkey project executions, and demonstrated operational excellence. Collaborations between converter manufacturers, cable producers, and engineering, procurement, and construction contractors have crystallized integrated value propositions that address performance, reliability, and lifecycle cost considerations.

Notably, firms specializing in voltage source converter technology have expanded their portfolios to include modular designs with standardized submodules, reducing commission times and enhancing scalability. Meanwhile, companies rooted in line commutated converter expertise continue to optimize their platforms for large-scale point-to-point applications, integrating advanced digital monitoring to improve availability. On the cable front, manufacturers offer a spectrum of products ranging from cross-linked polyethylene extruded lines to mass-impregnated paper-insulated systems, each tailored to application-specific thermal and electrical requirements.

Engineering teams with deep HVDC experience are leveraging digital twins and asset management platforms to provide predictive maintenance services and lifecycle optimization. Strategic alliances between these service providers and grid operators are solidifying comprehensive solutions that encompass planning, design, installation, and operations. Collectively, these leading companies are setting new benchmarks for efficiency, reliability, and environmental performance in HVDC transmission deployments.

This comprehensive research report delivers an in-depth overview of the principal market players in the HVDC Transmission market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Abengoa S.A.

- American Superconductor Corporation

- ATCO Ltd.

- Delta Electronics, Inc.

- Doble Engineering Company

- Emerson Electric Co.

- General Electric Company

- Hitachi Ltd.

- Hyosung Heavy Industries

- LS ELECTRIC Co., Ltd.

- Mitsubishi Electric Corporation

- Nexans

- NKT A/S

- NR Electric Co., Ltd.

- Prysmian Group

- Schneider Electric SE

- Siemens AG

- Sumitomo Electric Industries Ltd.

- TBEA Co., Ltd.

- TDK Electronics AG

- Texas Instruments Incorporated

- Toshiba Corporation

- TransGrid Solutions Inc.

Implementing Integrated Procurement Strategies and Advanced Digital Tools to Maximize ROI and Mitigate Risks in HVDC Projects

Industry leaders seeking to capitalize on the HVDC opportunity should pursue a multifaceted strategy that aligns technological selection with regulatory landscapes and financing structures. Firstly, early engagement with converter and cable manufacturers to explore modular designs can reduce lead times and facilitate incremental capacity expansion. By prioritizing vendors offering scalable submodules, project teams can future-proof investments against evolving demand profiles and regulatory requirements.

Simultaneously, developers should establish cross-functional task forces that integrate legal, financial, and technical experts to navigate tariff frameworks and local content regulations. Proactive risk allocation mechanisms within offtake agreements or EPC contracts will mitigate exposure to tariff fluctuations and supply chain disruptions. Furthermore, collaboration with grid operators and regulatory bodies at the project conception stage can streamline permitting processes and secure alignment on interconnection standards.

To bolster operational performance, asset owners are encouraged to integrate digital twin technologies and advanced sensor networks, enabling condition-based maintenance and real-time performance optimization. Leveraging data analytics for failure mode analysis and lifecycle cost modeling will not only enhance reliability but also support the case for investment by quantifying total cost of ownership. Finally, fostering partnerships across the ecosystem-spanning technology suppliers, financial institutions, and research institutions-will accelerate knowledge transfer, reduce technology risk, and sustain momentum toward resilient, sustainable HVDC infrastructure deployments.

Outlining the Rigorous Mixed Methodology Integrating Primary Expert Interviews and Technical Benchmarking for Holistic HVDC Market Insight

The research underpinning this report combines qualitative and quantitative methods to ensure a robust and objective analysis. Primary data were collected through structured interviews with industry executives, technology experts, and regulatory officials, providing insider perspectives on strategic challenges and emerging opportunities. Insights gleaned from these dialogues were triangulated against secondary data sourced from technical journals, government publications, and corporate white papers, ensuring a balanced view of market dynamics.

To map technology adoption trends, we performed a comparative assessment of converter platforms and cable materials, benchmarking performance metrics such as efficiency, reliability, and lifecycle costs. Case studies of landmark HVDC projects worldwide were evaluated to extract best practices in design, construction, and operation. Our segmentation framework was validated through expert workshops, aligning definitions across technology types, configurations, applications, voltage levels, transmission distances, and end-user categories.

Secondary research included a thorough review of policy documents, tariff schedules, and interconnection codes to assess regulatory impacts on project viability. Data normalization techniques were applied to harmonize terminology and performance indicators across diverse sources. The final analysis underwent peer review by an internal panel of subject-matter specialists, ensuring methodological rigor and the relevance of findings to strategic decision-making in the HVDC transmission landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our HVDC Transmission market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- HVDC Transmission Market, by Component

- HVDC Transmission Market, by Technology

- HVDC Transmission Market, by Configuration

- HVDC Transmission Market, by Voltage Level

- HVDC Transmission Market, by Transmission Distance

- HVDC Transmission Market, by Application

- HVDC Transmission Market, by End User

- HVDC Transmission Market, by Region

- HVDC Transmission Market, by Group

- HVDC Transmission Market, by Country

- United States HVDC Transmission Market

- China HVDC Transmission Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1431 ]

Summarizing Strategic Drivers and Emerging Opportunities That Will Define Resilient and Low-Carbon HVDC Transmission Pathways

The trajectory of HVDC transmission is intrinsically linked to the global pursuit of cleaner, more reliable power systems. Technological innovations, from modular multilevel converters to advanced cable insulations, are enabling unprecedented flexibility and efficiency in long-distance power transfer. Although policy interventions-such as the 2025 United States tariffs-have introduced cost complexities, they have also stimulated domestic supply partnerships and risk management frameworks that will inform future infrastructure development.

Looking ahead, the interplay between multi-terminal architectures and digital ecosystem integrations promises to redefine grid resilience and renewable integration strategies. Regional disparities in policy support and grid modernization initiatives will continue to shape deployment patterns, with the Americas, Europe, Middle East & Africa, and Asia-Pacific each charting distinct pathways. Key companies will play a pivotal role in translating technological advances into scalable, reliable systems that meet evolving energy demands.

Ultimately, stakeholders that embrace modular, scalable designs, collaborative partnerships, and data-driven operations will unlock the full potential of HVDC technology. This executive summary provides a strategic roadmap for navigating the complexities of the HVDC landscape and positioning organizations to lead the next wave of transmission innovation.

Elevate HVDC Transmission Strategies with Personalized Guidance from Our Sales and Marketing Expert Ketan Rohom

Engaging with our research offerings offers unparalleled depth, enabling decision-makers to capitalize on the technological momentum reshaping HVDC transmission networks globally. Ketan Rohom, Associate Director of Sales & Marketing, stands ready to guide stakeholders through the intricacies of our comprehensive report. By partnering with Ketan, clients gain tailored support, exclusive insights into strategic developments, and customized intelligence that accelerates project planning and implementation.

Connecting directly with Ketan ensures prioritization of your unique requirements, whether refining capital expenditure plans or defining grid expansion strategies. His expertise in articulating the most impactful findings will streamline procurement, ensuring timely access to critical data and supporting materials. Prospects benefit from transparent discussions around report scope, methodological rigor, and the latest industry intelligence, all aligned to organizational objectives.

This dialogue transcends a simple transaction, cultivating a collaborative approach where Ketan bridges the gap between market complexity and actionable knowledge. Under his stewardship, enterprises navigate tariff landscapes, regulatory shifts, and evolving technical standards with confidence. To secure your copy of the HVDC Transmission Market research report and unlock comprehensive analysis, contact Ketan Rohom today - set your organization on a trajectory of informed decision-making and competitive advantage.

- How big is the HVDC Transmission Market?

- What is the HVDC Transmission Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?