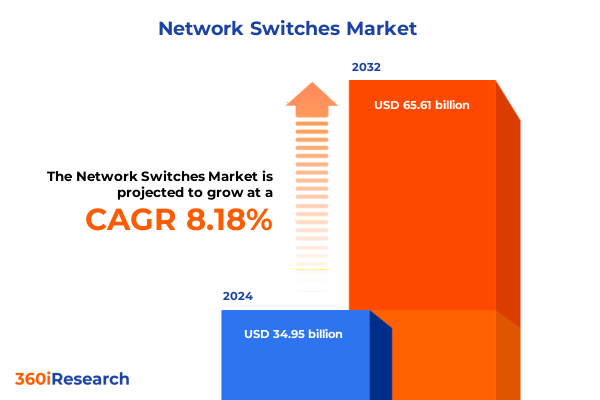

The Network Switches Market size was estimated at USD 37.60 billion in 2025 and expected to reach USD 40.53 billion in 2026, at a CAGR of 8.27% to reach USD 65.61 billion by 2032.

Discovering How Network Switching Fundamentals and Emerging Technological Trends Are Shaping Agile Digital Infrastructure in the Modern Enterprise

The landscape of digital connectivity is increasingly defined by the sophistication and agility of network switching solutions. Serving as the backbone of modern enterprise infrastructures, switches facilitate accelerated data flow, underpin cloud architectures, and enable real-time analytics that drive competitive advantage. As organizations navigate an era of heightened cybersecurity threats, rapid application deployment cycles, and unprecedented data volume growth, the role of the network switch extends far beyond a simple layer of connectivity. Instead, switches are now strategic enablers of digital transformation initiatives, providing the programmable instrumentation, automation capabilities, and resilience needed to support mission-critical operations.

Moreover, the evolution of network switches is tightly coupled with the broader shift toward software-defined architectures and cloud-native environments. Enterprises are demanding devices that not only deliver deterministic performance at scale but also integrate seamlessly with orchestration platforms, public and private cloud ecosystems, and advanced security frameworks. Consequently, the market has witnessed a proliferation of intelligent, intent-based switching solutions that leverage telemetry, analytics, and machine learning to optimize traffic flows and predict potential failures. In this context, decision-makers must comprehend both the foundational technology imperatives and the emerging trends that are shaping future deployments, ensuring that their networks remain resilient, adaptive, and cost-effective.

Exploring the Paradigm Shifts Driving Network Architecture Evolution Through Cloud Adoption, Artificial Intelligence, and Software Defined Networking Innovations

The network switching landscape is undergoing transformative shifts driven by a confluence of technological breakthroughs and changing enterprise requirements. One of the most significant drivers is the expansion of cloud computing, which demands switches capable of seamlessly transporting east-west traffic within and across data centers while maintaining consistent latency and throughput. This has spurred innovation in fabric architectures and spine-leaf topologies, ensuring that high-performance applications such as distributed databases and real-time analytics operate without bottlenecks.

Simultaneously, artificial intelligence and machine learning have permeated network operations, elevating the role of intent-based networking platforms that dynamically adjust configurations based on predefined policies and real-time insights. These intelligent solutions minimize manual intervention, accelerate incident response, and enhance overall reliability. Edge computing adds another layer of complexity, as switches are increasingly deployed in remote or branch locations to support IoT workloads, video surveillance, and localized analytics. This requires devices to be compact, energy-efficient, and equipped with robust security features that guard against both physical and cyber threats.

Furthermore, software-defined networking (SDN) and network function virtualization (NFV) continue to redefine how switching resources are allocated and managed. By decoupling the control plane from the data plane, enterprises gain unprecedented flexibility to instantiate virtual switches on demand, segment network traffic for micro-segmentation, and embed advanced security functions at the network edge. Finally, heightened regulatory requirements and evolving cybersecurity frameworks necessitate switches with comprehensive visibility, encryption capabilities, and compliance auditing features. Together, these transformative forces are establishing a new paradigm for network design, compelling organizations to adopt solutions that are programmable, secure, and inherently scalable.

Assessing the Broad Impact of 2025 U.S. Tariff Measures on Network Equipment Procurement, Cost Structures, and Strategic Procurement Models

In 2025, the United States implemented expansive tariff measures that introduced additional duties of up to 25 percent on a broad range of imported network hardware, including switches, routers, and related components. These policy actions have reverberated throughout enterprise procurement cycles, compelling organizations to reassess sourcing strategies and cost structures in response to elevated import expenses. As a result, many IT leaders have encountered unforeseen budgetary pressures and longer lead times, triggering a reevaluation of traditional capital outlay models and an exploration of alternative sourcing regions.

The cumulative impact of these tariffs has led to notable increases in equipment pricing. Industry analysts have forecasted that telecom and networking devices may experience cost escalations in the vicinity of 9 to 12 percent, directly affecting the economics of new switch deployments and refresh initiatives. Meanwhile, companies with significant component manufacturing or assembly operations in regions subject to the duties have reported tangible profit impacts, underscoring the imperative to diversify manufacturing footprints or offload tariff-exposed inventory ahead of levy enactment. For instance, leading equipment vendors have highlighted mid-single-digit margin contractions tied to tariff-related surcharges and have signaled potential price adjustments to end customers accordingly.

As these tariff policies persist, enterprises are shifting toward more flexible procurement paradigms, such as as-a-service models and consumption-based contracts. By converting capital-intensive refresh cycles into operational expenditures, organizations can achieve budgetary predictability and insulate themselves against future tariff volatility. Additionally, the emergence of regional distribution centers and dual-sourcing strategies is helping to mitigate lead-time risks, while collaborative vendor partnerships are enabling joint planning frameworks to ensure continuity of supply. Ultimately, the 2025 tariff landscape has accelerated the movement toward agile, risk-aware procurement processes that balance cost management with the need for cutting-edge networking infrastructure.

Unveiling Key Segmentation Insights That Illuminate Varied Types, Technologies, Ports, Applications, Channels, Customer Sizes, and End Users in Network Switching

A closer examination of network switch market segmentation reveals the nuanced drivers that define demand patterns across enterprise environments. The dichotomy between fixed port switches and modular switches shapes buyer preferences, as fixed port solutions-comprising managed, smart, and unmanaged variants-offer streamlined deployment with varying degrees of control, while modular architectures cater to large-scale operations requiring customizable port densities and line-card flexibility. Technological segmentation further highlights the distinction between Ethernet switches, Fibre Channel switches, MPLS (Multiprotocol Label Switching) switches, and optical packet switches, each tailored to specific use cases such as high-speed data center fabric, storage area networking, traffic engineering, and multi-service transport.

Port-based segmentation underscores the progression from fast Ethernet through gigabit and into ten-gigabit environments, reflecting the insatiable appetite for higher bandwidth and lower latency in modern applications. Application-based insights distinguish deployment in data center cores, where extreme performance and high port densities are paramount, from non-data center settings such as campus networks and branch locations, which prioritize ease of management and cost efficiency. Distribution channel analysis contrasts traditional offline channels, favored by organizations with established supply chains, against online channels that provide rapid lead times and competitive pricing. Furthermore, customer-size segmentation differentiates large enterprises, which demand extensive scalability and robust feature sets, from small and medium-sized businesses that seek a balance of performance and affordability, while the end-user spectrum spans banking, financial services and insurance, education, energy and utilities, government, healthcare, IT and telecommunications, manufacturing and industrial, retail, and transportation and logistics. Together, these segmentation lenses equip decision-makers with a comprehensive framework to align switch portfolios with organizational requirements, ensuring that each deployment optimally addresses capacity, performance, and lifecycle considerations.

This comprehensive research report categorizes the Network Switches market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Technology

- Switching Port

- Application

- Distribution Channel

- Customer Size

- End-user

Delivering Strategic Regional Perspectives on How the Americas, EMEA, and Asia-Pacific Are Shaping the Evolution of Network Switching Ecosystems

Regional dynamics exert a profound influence on how enterprises adopt and deploy network switching solutions. In the Americas, robust corporate spending on digital transformation initiatives and cloud migration projects has driven demand for high-performance switches capable of supporting hyperscale data centers and edge-enabled branch offices. The region’s emphasis on stringent cybersecurity standards has further propelled investments in switches with embedded threat-prevention capabilities and advanced encryption modules, enabling organizations to uphold compliance mandates while modernizing their infrastructures.

In Europe, the Middle East, and Africa, digital initiatives such as smart city deployments and government modernization programs are catalyzing the upgrade of legacy networks to next-generation switching fabrics. Organizations in this region are focusing on energy efficiency and sustainability, favoring switches with low-power consumption profiles and chassis designs that support modular upgrades to extend equipment lifecycles. Regulatory frameworks governing data sovereignty and cross-border traffic have also spurred adoption of local data center switches, fostering a diverse supplier ecosystem and elevating the importance of regional support and services.

The Asia-Pacific market exhibits dynamic growth driven by rapid urbanization, 5G rollouts, and the rise of edge computing use cases such as autonomous vehicles, industrial automation, and immersive media. Enterprises across APAC are prioritizing low-latency, high-availability switching solutions to underpin these mission-critical applications. At the same time, the push for network convergence-integrating data, voice, and video over unified infrastructures-has intensified demand for switches that can efficiently handle converged traffic while maintaining quality of service. Cross-border trade policies and local manufacturing initiatives continue to shape supply-chain strategies, compelling vendors to establish regional assembly facilities and accelerate time to market.

This comprehensive research report examines key regions that drive the evolution of the Network Switches market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Network Switch Manufacturers and Innovators Driving Competition and Technological Advancement in the Global Networking Arena

The competitive landscape for network switches is characterized by the presence of established incumbents and innovative challengers, each vying for leadership in performance, feature set, and total cost of ownership. Among the key players, one global vendor commands significant mindshare with its extensive portfolio spanning campus, data center, and cloud networking solutions, leveraging deep integration with orchestration platforms and advanced telemetry to deliver intent-based networking capabilities at scale. This vendor’s commitment to open standards and programmability has fostered a vibrant ecosystem of partners and third-party applications.

A second market leader distinguishes itself through a focus on high-performance, cloud-native switches optimized for large-scale data center deployments, with particular emphasis on artificial intelligence and machine learning workloads. This company reported that AI-related revenue contributed substantially to its latest quarterly performance, reflecting its success in positioning its Ethernet technologies as the infrastructure backbone for AI-driven applications. Meanwhile, a third vendor has carved out a niche in the MPLS and service provider segment, offering carrier-grade switches that combine extensive protocol support with deterministic performance and advanced traffic engineering.

Additional players are gaining traction by emphasizing software-defined features, security integration, and competitive pricing models. Strategic partnerships between switch manufacturers and cloud service providers are becoming increasingly common, enabling co-engineered solutions that simplify multi-cloud connectivity. Furthermore, several emerging companies are advancing optical packet switching and white-box switching architectures, challenging traditional pricing paradigms and accelerating the adoption of disaggregated networking models. As the market continues to evolve, these diverse competitive approaches are driving relentless innovation and empowering customers with an expanding array of deployment options.

This comprehensive research report delivers an in-depth overview of the principal market players in the Network Switches market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ALE International

- Allied Telesis, Inc.

- Amphenol Corporation

- ANTAIRA TECHNOLOGIES, LLC

- Arista Networks, Inc.

- Axis Communications AB by Canon Inc.

- B & H Foto & Electronics Corp

- Broadcom Inc.

- Buffalo Americas, Inc.

- Cisco Systems, Inc.

- Comark Technology Co.,Ltd.

- D-Link Systems, Inc.

- Dell Technologies Inc.

- Emerson Electric Co.

- Ependion (formerly Beijer Group)

- Extreme Networks, Inc.

- Fortinet, Inc.

- FS.COM

- Fujitsu Limited

- Grandstream Networks, Inc.

- Hewlett Packard Enterprise Company

- Honeywell International Inc.

- Huawei Technologies Co., Ltd.

- LANTRONIX, INC.

- Larch Networks Ltd.

- LINKOH

- Linksys Holdings, Inc.

- MICROCHIP TECHNOLOGY INCORPORATED

- Monoprice, Inc.

- NEC Corporation

- NETGEAR Inc.

- New H3C Technologies Co., Ltd.

- Nippon Telegraph and Telephone Corporation

- Nvidia Corporation

- Omnitron Systems Technology, Inc.

- Perle Systems Limited

- Pica8 Software Inc.

- PLANET Technology Corporation

- QNAP Systems, Inc.

- SALZ Automation GmbH

- SENAO NETWORKS INC.

- Siemens AG

- SonicWall, Inc.

- STORDIS GmbH

- TRENDnet, Inc.

- VVDN Technologies

Offering Strategic, Action-Oriented Recommendations to Help Industry Leaders Optimize Network Infrastructure Investments and Navigate Emerging Market Challenges

Industry leaders seeking to maintain a competitive edge must adopt a multifaceted approach that balances technological adoption with prudent financial and operational strategies. First, diversifying the supplier base by incorporating both global vendors and regional manufacturers can mitigate supply-chain disruptions and reduce dependency on any single source. In conjunction with this, extending refresh cycles through firmware updates, proactive maintenance, and strategic spares management can reduce capital outlays and defer expenses in periods of tariff-induced price volatility.

Simultaneously, enterprises should evaluate as-a-service and consumption-based delivery models that convert capital expenditures into predictable operating expenses, fostering greater agility in budget management. By leveraging turnkey managed solutions, organizations can shift the burden of lifecycle management and support to specialized providers, freeing internal teams to focus on core innovation. To enhance network resiliency, embedding automation and orchestration frameworks that streamline configuration management, patching, and compliance auditing is essential, as it minimizes manual errors and accelerates incident response times.

Finally, a comprehensive security-first posture must be integrated at the switch level, with advanced threat prevention, real-time analytics, and zero-trust segmentation capabilities baked into the network fabric. Aligning switch deployment strategies with overarching digital transformation roadmaps requires cross-functional collaboration between IT, security, and business stakeholders, ensuring that infrastructure investments directly enable broader organizational goals. By pursuing these actionable recommendations, industry leaders can solidify a network foundation that is cost-effective, secure, and aligned with emerging technological imperatives.

Describing the Comprehensive Research Approach, Data Collection Techniques, and Analytical Framework Employed to Generate In-Depth Market Insights

The insights presented in this report are the result of a rigorous research methodology combining both qualitative and quantitative techniques. Primary research comprised in-depth interviews with key stakeholders including network architects, IT operations leaders, procurement specialists, and end-user organizations across diverse verticals. These engagements provided firsthand perspectives on procurement drivers, deployment challenges, and future requirement roadmaps.

Secondary research involved a comprehensive review of vendor white papers, product collateral, technical datacommunications journals, and recent regulatory publications. Publicly available financial disclosures and earnings calls were analyzed to assess strategic priorities and investment trends. Additionally, industry conferences and webinars were examined to capture real-time developments in open source initiatives, interoperability frameworks, and emerging vendor alliances.

Data synthesis and analysis employed a triangulation approach, cross-referencing insights from primary interviews, secondary sources, and macroeconomic indicators to ensure the robustness of key findings. An analytical framework was applied to identify market dynamics, segmentation shifts, and regional nuances, supplemented by expert panel reviews to validate assumptions and refine strategic recommendations. This multi-layered methodology ensures that the conclusions drawn within this report are both comprehensive and actionable for decision-makers operating in complex network ecosystems.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Network Switches market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Network Switches Market, by Type

- Network Switches Market, by Technology

- Network Switches Market, by Switching Port

- Network Switches Market, by Application

- Network Switches Market, by Distribution Channel

- Network Switches Market, by Customer Size

- Network Switches Market, by End-user

- Network Switches Market, by Region

- Network Switches Market, by Group

- Network Switches Market, by Country

- United States Network Switches Market

- China Network Switches Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1590 ]

Summarizing Key Findings and Highlighting Critical Takeaways to Inform Strategic Decision-Making in Network Switching Environments

The convergence of digital transformation imperatives, advanced security requirements, and evolving procurement landscapes is redefining the network switch market. Organizations face a complex interplay of factors-from the adoption of AI-enabled fabrics and cloud-native architectures to the management of tariff-driven cost pressures and supply-chain realignments. The segmentation analysis underscores the importance of aligning switch selection with specific use cases, whether it be the ultra-high bandwidth demands of data centers or the cost-effective scalability required for campus and branch networks.

Regional perspectives reveal that no single strategy fits all; leaders must tailor their approaches to local regulatory frameworks, sustainability goals, and technology adoption curves. Meanwhile, the competitive environment continues to breed innovation, with established vendors and emerging players advancing programmable, secure, and feature-rich switching solutions. By synthesizing these insights, decision-makers can develop holistic network strategies that balance performance, agility, and total cost of ownership, ultimately supporting enterprise objectives in an increasingly interconnected world.

Engage with Ketan Rohom to Secure Comprehensive Network Switch Market Intelligence and Drive Your Infrastructure Strategy Forward Today

Unlock the full breadth of strategic network switch insights by partnering with Ketan Rohom, whose expertise in sales and marketing strategy will guide you through tailored solutions that align with your organizational objectives. Engaging Ketan opens the door to a comprehensive, customizable research experience that addresses your specific infrastructure challenges, from advanced switch selection and deployment to cost optimization and risk mitigation strategies. By working directly with Ketan, you will gain early access to proprietary intelligence, detailed competitive landscapes, and forward-looking recommendations that empower your team to make decisive, data-driven investments. Take this opportunity to bridge knowledge gaps, de-risk procurement decisions, and accelerate your digital transformation journey with a market research report designed for immediate impact. Reach out today to secure your copy and start transforming your network infrastructure strategy.

- How big is the Network Switches Market?

- What is the Network Switches Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?