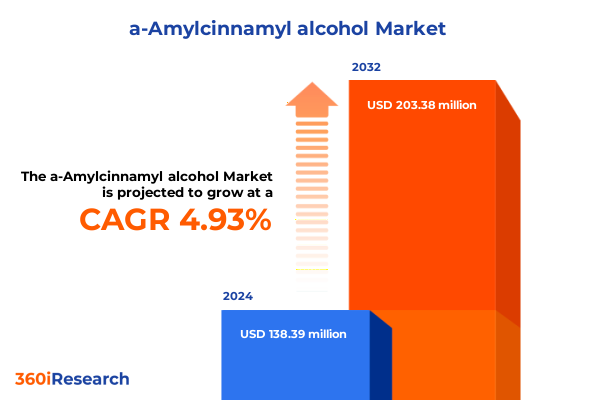

The a-Amylcinnamyl alcohol Market size was estimated at USD 145.09 million in 2025 and expected to reach USD 156.66 million in 2026, at a CAGR of 4.94% to reach USD 203.38 million by 2032.

Discover the Role and Versatility of Alpha-Amylcinnamyl Alcohol in Modern Industries Shaping Fragrance, Food, and Personal Care Markets

Alpha-Amylcinnamyl alcohol is a versatile aroma compound that serves as a cornerstone in an array of industries, from fragrances and personal care to cleaning products and food applications. Its characteristic cinnamon-like scent and functional properties make it a sought-after ingredient for formulating sophisticated fragrance profiles, enhancing flavor experiences, and improving product performance. As global consumer awareness around ingredient safety and sustainability intensifies, this compound’s natural origin and favorable regulatory status have elevated its significance among formulators and manufacturers.

In recent years, shifts in regulatory frameworks and technological advancements have converged to reshape how alpha-amylcinnamyl alcohol is sourced, produced, and deployed. Stricter guidelines under programs such as the European Union’s REACH initiative are prompting manufacturers to prioritize safer, less controversial chemicals in consumer products. Simultaneously, innovations in extraction methods and synthetic pathways are improving yield and consistency, thereby reducing production costs and environmental footprints.

Moreover, evolving distribution channels-driven by the rise of e-commerce platforms-are expanding market access and enabling niche brands to highlight unique ingredients like alpha-amylcinnamyl alcohol directly to consumers. This intersection of consumer demand for transparency, regulatory encouragement for sustainable formulations, and technological progress establishes the foundation for understanding the current landscape of this dynamic compound.

Unveiling the Transformative Trends Redefining the Alpha-Amylcinnamyl Alcohol Landscape Through Innovation, Regulation, and Consumer Demand

The landscape of alpha-amylcinnamyl alcohol has undergone transformative shifts propelled by surging consumer demand for natural ingredients and heightened environmental consciousness. As brands strive to align with eco-friendly narratives, manufacturers are exploring bio-based sourcing and green chemistry approaches to meet rigorous sustainability targets. This movement reflects a broader industry trend in which companies seek to reduce their environmental impact while bolstering brand authenticity in the eyes of discerning consumers.

Technological innovation further underpins these changes, as continuous flow reactors and advanced enzymatic catalysts revolutionize traditional batch production. By enabling precise process control and reduced energy consumption, these methods not only enhance product consistency but also unlock new possibilities for scaling sustainable manufacturing practices. Consequently, the cost differential between natural and synthetic variants is narrowing, broadening the compound’s appeal to diverse market segments.

Regulatory environments are simultaneously evolving. In North America and Europe, frameworks like the U.S. Toxic Substances Control Act and EU REACH regulation continue to tighten oversight on chemical safety, pushing formulators to adopt safer alternatives. At the same time, emerging markets in Asia-Pacific are implementing parallel regulatory regimes, underscoring a global pivot toward ingredient transparency and consumer protection. These combined forces of regulatory pressure, technological advancement, and shifting consumer values are fundamentally redefining the alpha-amylcinnamyl alcohol landscape.

Evaluating the Cumulative Impact of 2025 United States Tariffs on Alpha-Amylcinnamyl Alcohol Supply Chains and Cost Structures

The introduction of 2025 trade measures by the United States has had a profound ripple effect on chemical supply chains, disproportionately impacting imported aroma compounds. Recent tariffs of 25% on select imports from Canada and Mexico, alongside a 10% duty on Chinese-sourced materials, have disrupted the cost structure of alpha-amylcinnamyl alcohol formulations. Though certain high-volume chemicals received exemptions, specialty aroma chemicals often fall outside these carve-outs, leaving downstream producers to absorb higher input costs.

Independent perfumers and small-scale fragrance houses have reported order delays and contract cancellations in response to tariff uncertainty. For instance, Brazil’s chemical exporters faced preemptive withdrawal of contracts valued in the billions, illustrating how anticipatory actions can magnify supply disruptions and finance complexities for global partners. Such dynamics underscore the vulnerability of smaller actors to geopolitical shifts and highlight the need for robust risk mitigation strategies.

Despite these headwinds, larger manufacturers and integrated chemical houses are renegotiating supply arrangements, seeking alternative sources, and leveraging domestic production capacities where feasible. In parallel, logistics providers are recalibrating freight networks to circumvent tariff chokepoints, though these workarounds often introduce additional transit times and costs. As trade policies continue to evolve, organizations that can adapt with agility and foresight will be best positioned to stabilize their operations and preserve margins.

Unlocking Deep Insights into Alpha-Amylcinnamyl Alcohol Applications Across Cleaning Products, Cosmetics, Food, Perfumes, and Pharmaceuticals

The multifaceted applications of alpha-amylcinnamyl alcohol span across a diverse matrix of end uses, each with distinct formulation requirements and performance criteria. Within the realm of cleaning products, the compound enhances household detergents and industrial cleaners by imparting a pleasant aroma that masks harsh chemical notes and elevates user satisfaction. In cosmetics and personal care, its adaptability shines through in hair care serums that demand both fragrance retention and mildness on the scalp, makeup formulations seeking novel scent profiles, and sophisticated skin care offerings that blend sensory appeal with functional benefits.

Turning to the food and beverage sector, alpha-amylcinnamyl alcohol serves as a savory or sweet flavor enhancer in artisanal bakery creations, gourmet sauces, and craft beverages. Its nuanced profile complements both savory notes and sugary compositions, offering a versatile palette for culinary innovation. Within the perfume industry, its injection into floral bouquets lends a cinnamon-infused twist to classic oriental accords and woody bases alike, enabling perfumers to sculpt unique olfactory narratives.

In pharmaceutical applications, the compound’s olfactory masking capabilities improve the palatability of oral formulations and the sensory experience of topical treatments. Whether formulated as injectable solutions, oral syrups, or dermatological creams, it aids in patient compliance by reducing off-putting medicinal odors. By understanding these differentiated application landscapes, stakeholders can tailor their development strategies to address the precise demands of each sector.

This comprehensive research report categorizes the a-Amylcinnamyl alcohol market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Application

- End-Use Industry

Revealing Key Regional Dynamics Driving Alpha-Amylcinnamyl Alcohol Adoption Across the Americas, Europe Middle East Africa, and Asia Pacific

Regional dynamics play a pivotal role in shaping the trajectory of alpha-amylcinnamyl alcohol utilization across the globe. In the Americas, robust demand for advanced household care products and clean-label personal care formulations has stimulated increased uptake of naturally derived aroma compounds. Regulatory bodies in the United States have also shown a propensity to favor safer chemical alternatives, creating incentives for manufacturers to incorporate ingredients like alpha-amylcinnamyl alcohol into their portfolios.

Across Europe, the Middle East, and Africa, stringent environmental and safety regulations under frameworks such as EU REACH and Middle Eastern GSO standards have elevated the bar for ingredient compliance. European formulators, in particular, are leveraging alpha-amylcinnamyl alcohol to meet consumer expectations for sustainability and performance, while North African markets are emerging as growth corridors for fragranced personal care and detergent solutions.

In the Asia-Pacific region, rapid urbanization, rising disposable incomes, and a burgeoning middle class are driving significant expansion in personal care, perfumes, and food segments. Countries like China and India have witnessed a surge in demand for premium cosmetic products and artisanal flavors, propelling the adoption of specialty aroma chemicals. Additionally, regional manufacturers are increasingly investing in domestic production capabilities to mitigate import dependencies and align with local regulatory regimes.

This comprehensive research report examines key regions that drive the evolution of the a-Amylcinnamyl alcohol market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Leading Companies Advancing Alpha-Amylcinnamyl Alcohol Development Through Innovation Partnerships and Market Expansion Strategies

The competitive landscape of alpha-amylcinnamyl alcohol is defined by a blend of global fragrance houses, specialty chemical producers, and innovative biotech firms. Industry leaders such as Givaudan, International Flavors & Fragrances (IFF), and Firmenich maintain their dominance through extensive R&D investments and strategic mergers, leveraging large-scale production networks to ensure product consistency and supply security. Their integrated operations enable them to optimize cost structures and rapidly scale new sustainable variants to meet market demands.

Symrise stands out for its rigorous quality assurance protocols and dedication to traceable sourcing, exemplifying how transparency and sustainability can reinforce brand reputation and customer loyalty. Meanwhile, emerging entities specializing in synthetic and semi-synthetic pathways are challenging traditional supply models by offering cost-competitive alternatives that closely mimic natural profiles, thereby broadening access for mass-market applications.

Smaller, niche players and regional manufacturers contribute to the market’s dynamism by catering to specialized segments such as indie perfumers and eco-focused personal care brands. Their agility in customizing formulations and collaborating with research institutions often leads to innovative breakthroughs, which larger corporations subsequently integrate into their portfolios. This symbiotic ecosystem of major and niche companies ensures that alpha-amylcinnamyl alcohol continues to evolve in alignment with both consumer tastes and regulatory expectations.

This comprehensive research report delivers an in-depth overview of the principal market players in the a-Amylcinnamyl alcohol market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BASF SE

- BOC Sciences

- Firmenich International SA

- Givaudan SA

- International Flavors & Fragrances Inc.

- M&U International LLC

- Mane SA

- Robertet Group

- Sensient Technologies Corporation

- Sensient Technologies Corporation

- Symrise AG

- T. Hasegawa Co., Ltd.

- Takasago International Corporation

- Takasago International Corporation

Strategic Actionable Recommendations for Industry Leaders to Capitalize on Alpha-Amylcinnamyl Alcohol Opportunities and Navigate Emerging Challenges

To capitalize on the burgeoning opportunities within the alpha-amylcinnamyl alcohol market, industry leaders should adopt a multi-pronged strategy that balances innovation with risk mitigation. Firstly, investing in flexible production platforms-such as modular continuous flow reactors-can enable rapid switchovers between natural and synthetic feedstocks, safeguarding supply continuity amid tariff-driven disruptions and raw material volatility.

Secondly, forging strategic partnerships with upstream suppliers and research institutions can accelerate the development of sustainable sourcing solutions, whether through biocatalytic pathways or green chemistry collaborations. These alliances not only de-risk the supply chain but also bolster brand credibility in a marketplace where provenance and environmental stewardship are increasingly scrutinized.

Furthermore, companies should enhance their regulatory intelligence capabilities by establishing dedicated teams to monitor evolving global standards. Proactive engagement with industry bodies and regulatory agencies will provide early visibility into potential policy shifts, enabling organizations to adjust formulations and obtain necessary certifications ahead of competitors. Lastly, a targeted regional expansion roadmap-grounded in granular insights into the Americas, EMEA, and Asia-Pacific-will ensure that product launches and marketing initiatives resonate with local consumer preferences and compliance requirements.

Comprehensive Research Methodology Detailing Data Sources, Analytical Frameworks, and Quality Assurance Procedures Ensuring Report Integrity

This research synthesized primary interviews with senior executives across fragrance houses, chemical manufacturers, and regulatory consultancies, complemented by secondary analysis of public filings, trade data, and industry reports. Proprietary databases provided transaction-level insights into supply flows and pricing trends, while market segmentation frameworks were validated through cross-referencing application-focused case studies.

Quantitative data on regional consumption patterns and tariff impacts were derived from governmental customs records and trade association publications. Meanwhile, qualitative assessments of technological advancements and sustainability initiatives were informed by white papers published by leading biotechnology and chemical engineering organizations. All data sources underwent rigorous triangulation to ensure accuracy and relevance.

Analytical methodologies included a SWOT evaluation for each major application segment, a cross-country comparative analysis of regulatory frameworks, and scenario planning to assess the resilience of supply chains under various tariff and policy environments. Quality assurance protocols encompassed dual-review processes for all data inputs and iterative validation sessions with subject matter experts, ensuring that findings are robust, transparent, and actionable.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our a-Amylcinnamyl alcohol market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- a-Amylcinnamyl alcohol Market, by Product Type

- a-Amylcinnamyl alcohol Market, by Application

- a-Amylcinnamyl alcohol Market, by End-Use Industry

- a-Amylcinnamyl alcohol Market, by Region

- a-Amylcinnamyl alcohol Market, by Group

- a-Amylcinnamyl alcohol Market, by Country

- United States a-Amylcinnamyl alcohol Market

- China a-Amylcinnamyl alcohol Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 636 ]

Synthesizing Insights and Future Perspectives on Alpha-Amylcinnamyl Alcohol to Guide Strategic Decision Making and Market Positioning

Throughout this executive summary, we have uncovered how alpha-amylcinnamyl alcohol’s unique aromatic properties and functional versatility position it as a pivotal ingredient across multiple industries. From shifts in consumer preferences towards natural and sustainable compounds to the evolving tapestry of regulatory and trade landscapes, the compound’s trajectory reflects broader market transformations.

Key segmentation insights reveal that diverse applications-from cleaning solutions and personal care products to gourmet flavors and pharmaceutical formulations-demand tailored approaches to sourcing and processing. Regional considerations further underscore how the Americas, EMEA, and Asia-Pacific each present distinct regulatory environments, consumer expectations, and supply chain dynamics.

Competitive analyses highlight a landscape in which global fragrance giants coexist with agile niche players, collectively driving innovation in both natural and synthetic domains. Actionable recommendations centered on flexible production, strategic partnerships, regulatory vigilance, and regional market alignment provide a roadmap for organizations seeking to harness the full potential of alpha-amylcinnamyl alcohol. Ultimately, the convergence of these insights offers a comprehensive foundation for stakeholders to make informed decisions and achieve sustained market growth.

Connect with Ketan Rohom to Access Exclusive Alpha-Amylcinnamyl Alcohol Market Intelligence and Drive Strategic Growth with Expert Insights

Engaging with Ketan Rohom opens the door to tailored insights that empower your strategic positioning in the a-Amylcinnamyl alcohol domain. Through a personalized consultation, Ketan can guide you in aligning product development with emerging consumer preferences, navigating tariff complexities, and leveraging regional market dynamics to optimize your supply chains and distribution networks.

By connecting directly with Ketan, you gain access to the full scope of our comprehensive market research report, which is meticulously crafted to illuminate the most critical trends, competitive strategies, and actionable recommendations for your organization. This conversation ensures that you receive the clarity and expert interpretation needed to translate data into decisive actions that drive growth.

Take the next step toward strengthening your market intelligence and securing a competitive edge. Reach out to Ketan Rohom today to schedule a discussion on how our research can fuel your decision-making processes and support your long-term objectives in the rapidly evolving a-Amylcinnamyl alcohol market.

- How big is the a-Amylcinnamyl alcohol Market?

- What is the a-Amylcinnamyl alcohol Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?