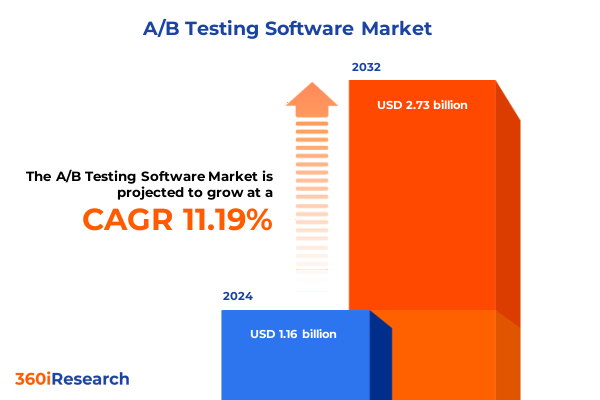

The A/B Testing Software Market size was estimated at USD 1.30 billion in 2025 and expected to reach USD 1.43 billion in 2026, at a CAGR of 11.17% to reach USD 2.73 billion by 2032.

Unlocking the Competitive Advantage Through Advanced A/B Testing Software: An Overview of Market Evolution and Strategic Significance

The imperative for data-driven decision-making has never been stronger as organizations strive to deliver engaging digital experiences that boost customer loyalty and revenue. A/B testing software has emerged as a cornerstone of this effort, enabling marketers, product managers, and developers to validate hypotheses, refine user journeys, and maximize conversion rates with scientific rigor. Today, 77% of companies worldwide employ A/B testing as part of their optimization stack, reflecting the technology’s critical role in reducing uncertainty and accelerating iterative improvement.

In recent years, the convergence of digital transformation initiatives and a relentless focus on user experience has propelled experimentation beyond simple headline and button tests. Businesses now integrate A/B testing into third-party analytics platforms, customer data management systems, and personalization engines to unlock deeper insights and foster a culture of empirical learning. Moreover, the integration of artificial intelligence is elevating experimentation from manual test setup and analysis to a streamlined process in which algorithms propose hypotheses, generate variants, and accelerate result interpretation.

As companies navigate rapidly shifting consumer behaviors and intensifying competition, the ability to test, learn, and adapt in real time distinguishes market leaders from followers. Low-code experimentation platforms have democratized access by enabling non-technical stakeholders to design tests, while hybrid deployment models reconcile the demands of privacy compliance with the need for granular performance measurement. Consequently, experimentation programs are no longer siloed initiatives-they are strategic imperatives for sustainable growth.

Navigating the Paradigm Shift How AI, Hybrid Models, and Privacy Regulations Are Redefining A/B Testing Strategies

The landscape of A/B testing software is undergoing a paradigm shift driven by breakthroughs in artificial intelligence, the rise of hybrid experimentation models, and increasingly stringent privacy regulations. AI-driven experimentation tools now go beyond automating sample splits; they analyze historical data to recommend high-impact variables, automate the generation of code and creative assets, and surface actionable insights with unprecedented speed and accuracy. This evolution is transforming experimentation from a tactical exercise into a continuous optimization engine that scales across departments and touchpoints.

Simultaneously, hybrid experimentation-unifying client-side and server-side testing under a single platform-is gaining traction as organizations seek both the agility of client-side tests for quick UI changes and the control of server-side tests for backend logic and data integrity. This approach mitigates the limitations of standalone methods, accelerates deployment cycles, and enhances collaboration between technical and non-technical teams.

At the same time, heightened privacy concerns and regulatory frameworks such as GDPR and CCPA are prompting companies to adopt privacy-conscious testing practices. These measures include anonymizing user identifiers, securing opt-in consent flows, and shifting sensitive data processing to server-side environments. Ethical AI testing practices-embedding transparency, fairness, and accountability into algorithmic decision-making-further ensure consumer trust and long-term brand reputation in an era where data ethics are paramount.

Assessing the Ripple Effects of 2025 U.S. Tariffs on IT Infrastructure Costs and A/B Testing Deployment Decisions

The introduction of expanded U.S. tariffs on technology imports in 2025 has reverberated across IT infrastructure procurement, compelling organizations to reassess their experimentation strategies and cost allocations. Enterprise-grade server prices have risen by as much as 12–20% as hardware vendors pass through increased duties on components from tariff-impacted regions, notably China and Taiwan. Small and medium cloud providers, lacking the purchasing leverage of hyperscalers, have been disproportionately affected and face margin compression as they navigate higher equipment costs without the option to immediately raise subscription fees.

In response, many enterprises have accelerated their migration toward public cloud services, shifting CAPEX-intensive on-premises refresh cycles into OPEX-driven subscription models. This transition helps insulate experimentation programs from unpredictable hardware price volatility, ensuring consistent test velocity and scalability. Yet, as cloud providers also navigate higher infrastructure costs, some customers may encounter incremental service price adjustments over time.

Longer term, the tariffs have driven broader supply chain diversification efforts, with leading IT vendors expanding manufacturing footprints into Mexico, Vietnam, and select U.S. states to mitigate exposure. This realignment is fostering resilience but entails logistical complexities and upfront investment. As a result, organizations are adopting blended infrastructure strategies-balancing accelerated cloud adoption with extended lifecycle management of existing on-premises assets to optimize total cost of ownership.

Unlocking Targeted Growth In-Depth Insights Across Deployment Modes Testing Types Organization Sizes Industry Verticals and Platforms

The A/B testing market can be dissected along multiple dimensions, each offering strategic insights into customer requirements and vendor positioning. Deployment mode remains a critical differentiator: some organizations favor cloud-based solutions for their elastic scalability and minimal maintenance overhead, with providers offering hybrid cloud, private cloud, and public cloud options to meet diverse security and compliance needs. Conversely, entities with strict data governance mandates may deploy on-premises solutions, hosting experimentation platforms on physical servers or virtual private servers to retain full control over sensitive user data.

Test type specialization also shapes market dynamics. Single-variable A/B tests and multi-page experiments address straightforward optimization scenarios, while multivariate testing-leveraging fractional or full factorial designs-enables pinpointed evaluation of multiple concurrent changes. Split URL testing, whether parameter-based or path-based, caters to site-wide architecture experiments where altering entire page layouts yields deeper insights into user flows.

Organizational size further influences purchasing behavior: large enterprises typically require enterprise-grade feature sets, robust security certifications, and white-glove service support. Small and medium enterprises, including micro, small, and medium segments, often prioritize low-code interfaces, predictable pricing, and rapid onboarding to maximize ROI within limited IT budgets.

Vertically, industry-specific functionality drives differentiation. Financial services, encompassing banking and insurance, demand strict audit trails and encryption. Healthcare organizations, from hospitals to pharmaceutical firms, require HIPAA-compliant experimentation. IT services and telecom operators seek integrations with DevOps pipelines, while media and entertainment companies focus on digital asset management for broadcast and streaming content. Retailers-both brick-and-mortar and online-aim to optimize checkout funnels, whereas travel brands, including airlines and hotels, refine booking journeys. Platform support differentiates further: Android and iOS native experimentation faces distinct SDK requirements, while desktop and mobile web tests leverage JavaScript libraries optimized for performance.

This comprehensive research report categorizes the A/B Testing Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Deployment Mode

- Test Type

- Platform

- Organization Size

- Industry Vertical

Emerging Market Dynamics Across the Americas EMEA and Asia-Pacific Shaping A/B Testing Software Adoption and Innovation Trends

Regional considerations play a pivotal role in shaping experimentation strategies and vendor offerings. In the Americas, a mature market profile characterized by early cloud adoption and robust digital maturity has fostered demand for advanced AI-driven testing capabilities and integrated personalization suites. Decision-makers in North America often prioritize compliance certifications, enterprise-grade SLAs, and strategic vendor partnerships that align with broad digital transformation roadmaps.

Europe, the Middle East, and Africa (EMEA) present a more nuanced landscape, heavily influenced by data privacy regulations such as GDPR. Organizations in this region are increasingly adopting server-side experimentation and privacy-first solutions to reconcile regulatory mandates with optimization goals, spurring demand for hybrid deployment options and on-premises installations in highly regulated markets.

Asia-Pacific, meanwhile, stands out for its rapid digitalization and emergence of new growth markets. Companies across Southeast Asia and the Pacific Islands are leveraging experimentation to capitalize on rising internet penetration and burgeoning e-commerce activity, while established markets like Australia, Japan, and South Korea exhibit sophisticated use cases, integrating A/B testing into omnichannel and mobile-first strategies. Localized support, multi-language interfaces, and partnerships with regional systems integrators are key success factors for vendors seeking to expand in APAC.

This comprehensive research report examines key regions that drive the evolution of the A/B Testing Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Unveiling the Competitive Landscape From Legacy Experimentation Platforms to Innovative AI-Driven Challenger Brands

A competitive cohort of global and niche players defines the A/B testing software ecosystem. Legacy pure-play vendors continue to refine core experimentation engines, while broader digital experience platforms have embedded testing capabilities within larger bundles. Optimizely remains prominent for its robust feature set and enterprise support, whereas VWO has gained traction among mid-market firms for its intuitive interface and bundled heatmaps and session replay tools. Adobe Target’s deep integration with the Experience Cloud appeals to organizations seeking end-to-end marketing orchestration.

Meanwhile, Google Optimize provides a compelling entry point for existing marketing stack users, leveraging seamless integration with Google Analytics. Up-and-coming specialists such as Fibr AI and Wisepops are pushing AI-driven insight generation and automated hypothesis creation, challenging established players with agility and innovation. In addition, media and entertainment giants like Warner Bros. Discovery now embody the broader appeal of experimentation, as HBO Max’s recent adoption of A/B thumbnail testing demonstrates how streaming platforms leverage these tools to optimize viewer engagement.

Through strategic acquisitions and partnerships, vendors are expanding their ecosystems. Integrations with customer data platforms, tag management systems, and personalization engines are increasingly table stakes, underscoring the importance of seamless data flows and unified customer profiles to drive contextual experiments and deliver measurable business impact.

This comprehensive research report delivers an in-depth overview of the principal market players in the A/B Testing Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AB Tasty, Inc

- Adobe Inc.

- Algolia, Inc.

- BENlabs

- ClickFunnels

- Convert Insights Inc.

- Crazy Egg, Inc.

- Dynamic Yield by Mastercard Inc.

- Google LLC by Alphabet Inc.

- Heyflow GmbH

- Instapage, Inc. by airSlate Inc.

- Kameleoon

- LaunchDarkly

- Leadpages (US), Inc. by Redbrick Technologies Inc.

- Microsoft Corporation

- MoEngage, Inc.

- Omniconvert SRL

- Optimizely

- Oracle Corporation

- SiteSpect, Inc.

- Split Software, Inc.

- Statsig, Inc.

- Unbounce Marketing Solutions Inc.

- Webtrends Optimize

- Wingify Software Pvt. Ltd.

Driving Sustainable Growth Through Strategic Adoption of AI Hybrid Experimentation and Privacy-First Practices

Organizations aiming to stay at the forefront of digital optimization must embrace a series of strategic imperatives. First, investing in AI-powered experimentation platforms will accelerate hypothesis generation and insight extraction, enabling teams to iterate faster while reducing reliance on manual analysis. Second, adopting hybrid experimentation architectures ensures both rapid UX testing at the client layer and robust data governance in server-side environments.

Third, privacy and ethical considerations must be embedded within testing workflows. Establishing transparent data handling policies, securing opt-in consent mechanisms, and opting for encrypted data pipelines will safeguard compliance and build customer trust. Fourth, aligning experimentation roadmaps with broader digital transformation initiatives-such as personalization, automation, and DevOps integration-will amplify impact and foster cross-functional collaboration.

Finally, organizations should continuously invest in upskilling internal teams, fostering an experimentation mindset that values curiosity, statistical rigor, and data literacy. By combining technology, process, and people-focused approaches, industry leaders can sustainably scale their optimization programs and maintain a competitive edge.

Ensuring Analytical Rigor Through Integrated Primary Interviews Secondary Literature Review and Data Triangulation

This report synthesizes findings from a hybrid research methodology designed to deliver comprehensive market insights. We conducted primary interviews with key decision-makers across enterprise, mid-market, and cloud provider segments to capture real-world experimentation use cases, procurement criteria, and cost sensitivities. Concurrently, an extensive review of vendor documentation, analyst whitepapers, and regulatory guidelines informed our understanding of feature roadmaps and compliance trends.

Secondary research encompassed peer-reviewed journals, industry newsletters, and reputable news sources to validate emerging patterns such as AI-driven testing, hybrid deployment models, and regional regulatory impacts. Data triangulation techniques were employed to cross-verify quantitative trends against qualitative insights, ensuring robustness. All information has been anonymized and aggregated to preserve confidentiality and maintain analytical integrity.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our A/B Testing Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- A/B Testing Software Market, by Deployment Mode

- A/B Testing Software Market, by Test Type

- A/B Testing Software Market, by Platform

- A/B Testing Software Market, by Organization Size

- A/B Testing Software Market, by Industry Vertical

- A/B Testing Software Market, by Region

- A/B Testing Software Market, by Group

- A/B Testing Software Market, by Country

- United States A/B Testing Software Market

- China A/B Testing Software Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2703 ]

Harnessing Innovation and Adaptability to Establish A/B Testing as a Cornerstone of Digital Transformation

In an era defined by rapid technological advancement and evolving consumer expectations, A/B testing software has transcended its role as a tactical optimization tool to become a strategic enabler of growth. The confluence of AI-driven experimentation, hybrid deployment architectures, and privacy-conscious frameworks underscores the industry’s maturation and the necessity for continuous innovation.

As U.S. tariff-induced infrastructure cost pressures accelerate cloud adoption and supply chain realignments, organizations must adapt their experimentation strategies to sustain velocity and cost discipline. Segmentation by deployment, test type, organization size, industry vertical, and platform capability provides a granular roadmap for targeted investments. Meanwhile, regional dynamics and competitive developments point to differentiated go-to-market approaches.

By embracing these insights and translating them into actionable roadmaps, decision-makers can harness experimentation to drive personalized experiences, enhance customer satisfaction, and secure lasting market leadership.

Secure Your Competitive Edge Today by Contacting Ketan Rohom to Access the Full A/B Testing Software Market Research Report

Ready to leverage these insights to drive your organization’s growth and outperform competitors? Connect with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, to secure a comprehensive copy of this in-depth market research report and access expert guidance tailored to your strategic objectives

- How big is the A/B Testing Software Market?

- What is the A/B Testing Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?