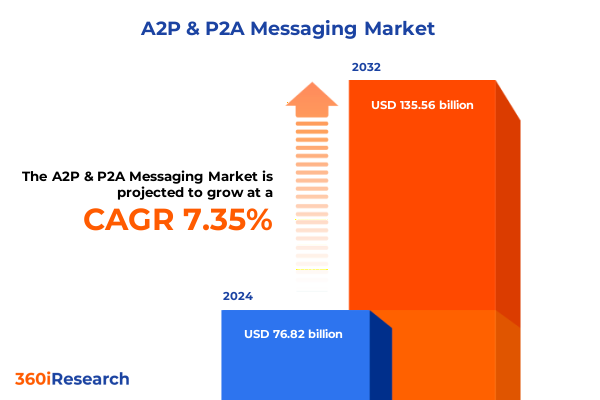

The A2P & P2A Messaging Market size was estimated at USD 82.54 billion in 2025 and expected to reach USD 88.07 billion in 2026, at a CAGR of 7.34% to reach USD 135.56 billion by 2032.

Introducing the Evolving Dynamics of Application to Person and Person to Application Messaging Highlighting Emerging Technologies and Market Drivers in 2025

In the rapidly evolving world of business communications, the convergence of application-to-person and person-to-application messaging is unlocking unprecedented opportunities for engagement. A2P messaging leverages channels such as SMS, MMS, RCS, and voice to deliver authentication codes, promotional alerts, transaction confirmations, and real-time notifications. Conversely, P2A messaging empowers users to initiate interactions through those same channels, facilitating services like customer support inquiries, feedback collection, and interactive voice broadcasts. Recognizing the interconnected nature of these paradigms is essential for executives aiming to optimize both outbound and inbound messaging flows.

As enterprises strive to differentiate themselves, the importance of seamless cross-channel orchestration has never been greater. The ability to transition organically between channels-deploying SMS for one-time passwords, RCS for rich conversational experiences, MMS for dynamic multimedia promotions, and voice for interactive notifications-constitutes a competitive necessity. Simultaneously, evolving privacy regulations and consent requirements are reshaping delivery practices, prompting organizations to enhance compliance frameworks and invest in robust message management systems.

Looking ahead to 2025, the market is poised to witness accelerated adoption of advanced messaging protocols, propelled by widespread 5G deployment and AI-driven personalization. Standard text alerts are evolving into contextually aware dialogues that blend conversational commerce with predictive analytics. This shift not only strengthens customer engagement but also streamlines internal processes through intelligent automation and real-time data insights. Executives must therefore align their strategic roadmaps with these emergent trends to harness the full potential of integrated messaging ecosystems.

Evaluating the Pivotal Technological and Regulatory Shifts Revolutionizing A2P and P2A Messaging Models and Driving Strategic Priorities for 2025

Messaging landscapes are undergoing transformative shifts, driven by technological innovation and heightened regulatory scrutiny. The rollout of rich communication services has expanded the possibilities for interactive, multimedia exchanges, enabling brands to elevate user experiences beyond traditional text. Artificial intelligence and machine learning have become instrumental in refining message personalization, predicting consumer behavior, and automating responses, thereby reducing operational overhead while improving engagement outcomes.

At the same time, global privacy regulations and evolving carrier policies are compelling organizations to adopt more stringent consent management practices. This shift requires sophisticated compliance engines that can track user permissions, manage opt-in and opt-out preferences, and adapt dynamically to new requirements. Meanwhile, the proliferation of omnichannel communication strategies demands cohesive integration across SMS, MMS, RCS, and voice platforms, ensuring that every touchpoint reinforces brand consistency, reliability, and security.

Furthermore, strategic partnerships with communication platform-as-a-service providers and specialized security firms are reshaping the industry landscape. These collaborations not only expand reach and scalability but also fortify fraud detection, deliverability, and regulatory alignment. As a result, enterprises that embrace these transformative shifts are better positioned to capitalize on new monetization avenues and foster deeper customer relationships in an increasingly competitive environment.

Analyzing the Cumulative Economic and Operational Impact of 2025 United States Tariffs on Global A2P and P2A Messaging Infrastructure and Partnerships

The imposition of new United States tariffs in 2025 has had a multifaceted impact on global messaging infrastructure and partnerships. Increased duties on communications equipment and network hardware have raised entry costs for both carriers and enterprises, prompting many organizations to reassess their procurement strategies. Supply chain adjustments have driven businesses to explore alternative vendors and regional hubs, seeking to contain capital expenditures while maintaining service quality and uptime.

Tariff-driven cost pressures have also led to a ripple effect across international carrier agreements. As outbound messaging traffic flows through multiple interconnect partners, incremental fees have emerged to offset increased import duties. Enterprises have had to negotiate revised rate cards and incorporate new surcharge line items into their billing frameworks, directly influencing the economics of both high-volume authentication campaigns and personalized marketing initiatives.

Despite these challenges, the market is adapting through innovation and strategic realignment. Messaging aggregators and CPaaS providers are investing in network optimization technologies and localized points of presence to mitigate latency and cost implications. This ongoing adaptation underscores the resilience of the messaging ecosystem, demonstrating that proactive tariff management and collaborative vendor ecosystems can sustain service reliability and preserve margins in a complex regulatory environment.

Uncovering Key Messaging Market Dimensions Through Multilayered Channel, Application, Industry Vertical, Enterprise Size, and Deployment Model Segmentation

When examined through a channel lens, the market reveals nuanced preferences and adoption patterns. Rich Communication Services has gained traction as enterprises recognize the value of group messaging and one-to-one conversational threads for customer experience. MMS continues to play a vital role for visually oriented campaigns, while SMS remains indispensable for critical alphanumeric alerts, long code two-way dialogues, short code high-volume blasts, and toll-free engagement options. Voice interactions, particularly IVR systems and voice broadcasts, further enrich the ecosystem by providing intuitive access to automated support and outbound reminders.

Assessing application scenarios highlights a clear division between security-focused and engagement-driven use cases. Authentication services, anchored by one-time passwords and two-factor validation, form the backbone of secure identity verification. Notification messages, including account alerts, appointment reminders, and shipping updates, ensure operational continuity. Promotional initiatives such as flash sales, loyalty rewards, and targeted marketing campaigns drive growth, while transactional communications-billing alerts, order confirmations, and password resets-safeguard revenue flow and customer confidence.

Delving into vertical landscapes and organizational scales uncovers further differentiation. Financial services, government, healthcare, retail and ecommerce, transportation and logistics, travel and hospitality, and utilities each present distinct messaging requirements driven by regulatory compliance, consumer expectations, and service criticality. Within these sectors, large enterprises often demand end-to-end integration and global reach, whereas small and medium businesses seek modular solutions and cost efficiency, whether delivered through medium, micro, or small enterprise tiers. Finally, deployment models vary from cloud-based agility to hybrid flexibility and on-premises control, giving organizations the freedom to align messaging strategies with IT governance and data residency mandates.

This comprehensive research report categorizes the A2P & P2A Messaging market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Channel

- Enterprise Size

- Deployment Model

- Application

- Industry Vertical

Delineating Regional Dynamics Influencing Messaging Adoption and Performance Across the Americas, Europe Middle East and Africa, and Asia Pacific Markets

Across the Americas, mature telecom infrastructures and robust regulatory frameworks have fostered a diverse messaging ecosystem. North American enterprises leverage advanced RCS capabilities to enrich customer journeys, while Latin American markets increasingly adopt SMS and voice as cost-effective conduits for mass notifications. Cross-border commerce, fueled by e-commerce expansion, drives demand for seamless transactional alerts and multilingual support, requiring providers to offer scalable, localized solutions that bridge regional nuances.

In Europe, the Middle East, and Africa, heterogeneous regulatory landscapes and varying levels of network modernization shape messaging strategies. Data privacy mandates in the European Union enforce strict consent protocols, prompting enterprises to refine opt-in mechanisms and compliance toolkits. At the same time, emerging markets in the Middle East and Africa capitalize on robust mobile penetration to deliver health, financial, and educational services via SMS and voice channels, often supported by partnerships with local mobile network operators to ensure reach and reliability.

The Asia-Pacific region stands as a hotbed of innovation, fueled by high smartphone adoption and rapidly evolving digital ecosystems. Brands leverage rich messaging formats for conversational commerce in urban centers while relying on SMS and voice for rural outreach and critical alerts. High-speed networks and progressive carrier alliances enable advanced features such as AI-driven chatbots and proactive customer support, accelerating the convergence of marketing, security, and service use cases across diverse market segments.

This comprehensive research report examines key regions that drive the evolution of the A2P & P2A Messaging market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Providers Shaping the Competitive Landscape with Innovative Solutions and Strategic Partnerships in A2P and P2A Messaging Ecosystems

Market dynamics are also shaped by the strategic initiatives of leading providers. One global CPaaS leader has invested heavily in AI-powered analytics and programmable messaging APIs, enabling clients to orchestrate complex workflows across channels. Another firm has distinguished itself through regional partnerships and localized infrastructure, reducing latency and compliance complexity for multinational customers. A third organization has captured market share by specializing in secure identity verification and anti-fraud measures, serving highly regulated industries with tailored authentication suites.

Other notable entrants have focused on voice broadcast optimization and interactive voice response capabilities, leveraging machine learning to enhance speech recognition and routing accuracy. A growing player in the rich messaging space has collaborated with mobile network operators to expand group messaging and interactive card features, further advancing consumer engagement models. Collectively, these companies underscore the competitive imperative of combining technological innovation with strategic alliances and vertical specialization to address evolving enterprise demands.

This comprehensive research report delivers an in-depth overview of the principal market players in the A2P & P2A Messaging market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AT&T Inc.

- Beepsend AB

- China Mobile Limited

- ClearSky Technologies LLC

- Genesys Telecommunications Laboratories, Inc.

- Infobip Ltd.

- OpenMarket, Inc.

- Orange S.A.

- Proximus Group

- Route Mobile Limited

- SAP SE

- Silverstreet BV

- Sinch AB

- Soprano Design Pty Ltd

- Syniverse Technologies LLC

- Tanla Platforms Limited

- Tata Communications Limited

- Twilio Inc.

- Tyntec Ltd.

- Vonage Holdings Corp.

Delivering Tactical Strategies and Practical Roadmaps for Messaging Industry Leaders to Capitalize on Emerging Opportunities and Mitigate Emerging Risks

Industry leaders should prioritize the integration of rich messaging formats into core engagement strategies. By augmenting traditional SMS and voice channels with RCS capabilities, organizations can deliver interactive experiences that resonate with digitally savvy consumers. Concurrently, investments in AI-driven personalization engines will enhance message relevance, optimize send times, and drive measurable lift across authentication, notification, promotional, and transactional campaigns.

To manage cost pressures and compliance risks, executives should also establish cross-functional governance frameworks. Aligning legal, IT, and marketing teams around a unified messaging policy ensures adherence to global privacy standards and carrier requirements. Additionally, forging strategic partnerships with CPaaS providers and security specialists will expedite access to advanced deliverability, fraud detection, and analytics tools. By balancing channel diversification with rigorous compliance measures, enterprises can both mitigate emerging risks and capitalize on untapped revenue streams.

Outlining a Robust and Transparent Research Approach Combining Primary Insights, Secondary Data, and Analytical Rigor for Messaging Market Evaluation

This analysis is grounded in a rigorous research approach that balances primary insights with comprehensive secondary data. Extensive interviews were conducted with senior executives, technology architects, and industry analysts to capture firsthand perspectives on messaging innovation, operational challenges, and future priorities. These discussions were supplemented by an in-depth review of publicly available policy documents, carrier white papers, and academic studies to ensure a well-rounded understanding of regulatory and technical developments.

Data validation and triangulation were achieved through cross-referencing multiple information sources and employing a structured segmentation framework. Market themes were assessed across channel modalities, application use cases, industry verticals, enterprise sizes, and deployment models to reveal nuanced patterns. Qualitative insights were further enriched with case study analysis, highlighting best practices and lessons learned from leading organizations. This robust methodology underpins the credibility and actionable value of the findings presented throughout this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our A2P & P2A Messaging market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- A2P & P2A Messaging Market, by Channel

- A2P & P2A Messaging Market, by Enterprise Size

- A2P & P2A Messaging Market, by Deployment Model

- A2P & P2A Messaging Market, by Application

- A2P & P2A Messaging Market, by Industry Vertical

- A2P & P2A Messaging Market, by Region

- A2P & P2A Messaging Market, by Group

- A2P & P2A Messaging Market, by Country

- United States A2P & P2A Messaging Market

- China A2P & P2A Messaging Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3339 ]

Synthesizing Core Findings to Illuminate Strategic Imperatives and Future Trajectories Within the Evolving A2P and P2A Messaging Landscape

The findings of this report crystallize a clear vision for the next phase of A2P and P2A messaging evolution. Rich communication channels, AI-powered personalization, and omnichannel orchestration emerge as pivotal drivers of competitive advantage. At the same time, regulatory shifts and cost pressures underscore the imperative for agile compliance frameworks and strategic vendor partnerships.

Looking forward, enterprises must embrace a holistic messaging strategy that spans authentication, notification, promotional, and transactional use cases while tailoring approaches to regional dynamics and vertical-specific requirements. By doing so, organizations can unlock new engagement paradigms, optimize operational efficiencies, and build resilient ecosystems capable of adapting to shifting market forces. This synthesis of insights and strategic imperatives offers a roadmap for stakeholders to navigate an increasingly complex messaging landscape with confidence and clarity.

Engaging with Ketan Rohom to Unlock Comprehensive A2P and P2A Market Intelligence and Empower Strategic Decision Making Through a Detailed Report

We invite you to secure your access to unparalleled market intelligence by connecting directly with Ketan Rohom, an industry veteran who leads sales and marketing initiatives for our research offerings. His extensive understanding of messaging ecosystems ensures that you receive tailored insights, practical recommendations, and strategic foresight for driving growth in A2P and P2A communications.

Reach out today to arrange a personalized briefing and discover how this comprehensive report can empower your organization to anticipate market shifts, optimize channel investments, and strengthen customer engagement frameworks for sustained competitive advantage. Let Ketan guide you through actionable findings and equip you with the data-driven strategies needed to chart a confident path forward.

- How big is the A2P & P2A Messaging Market?

- What is the A2P & P2A Messaging Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?