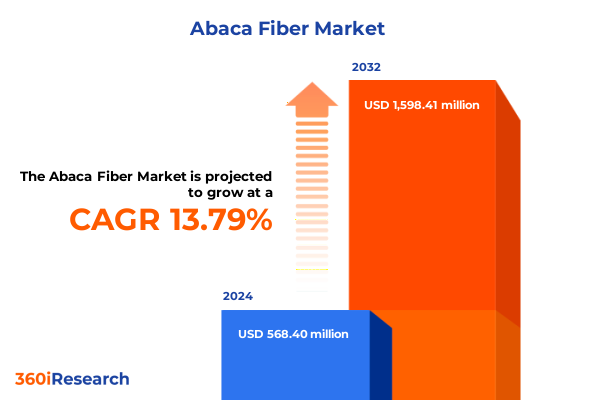

The Abaca Fiber Market size was estimated at USD 645.49 million in 2025 and expected to reach USD 732.23 million in 2026, at a CAGR of 13.83% to reach USD 1,598.41 million by 2032.

Unveiling the Critical Role and Unrivaled Advantages of Abaca Fiber Amidst Shifting Global Demand and Sustainability Trends

The Abaca Fiber market has emerged as an essential component within the sustainable materials ecosystem, offering unique mechanical strength and biodegradability that cater to diverse industrial needs. Derived from Musa textilis, commonly known as Manila hemp, abaca has gained recognition for its high tensile strength and resistance to saltwater, positioning it as a preferred resource in textiles, specialty papers, and composite reinforcement. The convergence of environmental imperatives and performance-driven applications has further elevated abaca’s status as a strategic alternative to synthetic fibers.

Amid growing regulatory scrutiny on single-use plastics and petrochemical-based materials, manufacturers and end users are actively seeking renewable and eco-friendly substitutes. Abaca, with its inherent qualities and adaptability across multiple end-use industries, aligns seamlessly with sustainability mandates while enabling product differentiation through its natural aesthetic and performance characteristics. By understanding the foundational attributes and emerging demand drivers of the abaca industry, stakeholders can anticipate shifts in supply chain dynamics and capitalize on new opportunities that balance environmental responsibility with economic viability.

How Innovative Extraction Technologies and Strategic Collaborations Are Revolutionizing Supply Chains and Driving Abaca Fiber Adoption Across Industries

The landscape of the Abaca Fiber market is undergoing profound transformation as advances in extraction technologies, heightened focus on circular economy principles, and strategic collaborations converge to redefine traditional value chains. Innovations in mechanical decortication and eco-friendly chemical processes have improved fiber yield and quality, reducing reliance on energy-intensive methods and minimizing chemical waste. Consequently, producers are achieving higher productivity while meeting rising eco-compliance standards, driving broader acceptance among high-end specialty applications.

In parallel, the integration of abaca into hybrid composites for automotive and construction sectors has accelerated, unlocking new revenue streams and reinforcing the fiber’s status as a performance material. Partnerships between research institutions and industrial players are fostering novel uses of abaca pulp in lightweight panels and biodegradable packaging solutions. The emergence of digital traceability systems is further enhancing transparency across the value chain, enabling buyers to verify sustainability credentials and origin provenance. As these developments coalesce, the abaca ecosystem is poised to evolve from a niche niche raw material provider to a central pillar in the sustainable materials economy.

Assessing the Ripple Effects of 2025 US Tariff Adjustments on Abaca Fiber Supply Chains Cost Structures and Strategic Sourcing Decisions

In early 2025, the United States Government implemented revised tariff measures targeting certain natural fiber imports, with abaca-based products among the affected categories. These adjustments introduced incremental duties that have directly affected landed costs for importers of bleached and unbleached abaca pulp, specialty papers, and yarn twine ropes. As a result, US-based converters and original equipment manufacturers have been compelled to reassess procurement strategies, exploring alternative sources or engaging in direct sourcing partnerships with Philippine growers to mitigate cost escalation.

Although the duty revisions have introduced short-term pricing pressures, they have also catalyzed investments in domestic processing capabilities and bilateral trade negotiations aimed at tariff relief. Several US port authorities have reported increased throughput of abaca shipments to facilities equipped with specialized handling infrastructure, underscoring the industry’s adaptability. Meanwhile, end users are reevaluating total cost of ownership models, factoring in sustainability premiums and supply chain resilience. This recalibration is driving collaborations between growers, processors, and trade associations to advocate for equitable tariff structures and streamlined customs procedures that preserve competitive access to high-quality abaca fiber.

Unraveling Market Dimensions Through Product, Application, End Use Industry, and Extraction Method Segmentation for Targeted Insights

The Abaca Fiber market is shaped by a nuanced segmentation across product types, applications, end-use industries, and extraction methods, each offering a distinct lens to evaluate growth trajectories and investment priorities. When examining product types, stakeholders gain clarity on the relative contributions of bleached and unbleached pulp, papers, and yarn twine ropes, shedding light on demand patterns driven by manufacturing specifications and end-market requirements. Within the application segment, rope cordage stands out for its maritime and industrial usage, while specialty papers-spanning computer ribbons and tea bag filter papers-underscore abaca’s versatility in precision and hygiene-critical contexts.

Moving deeper, end use industry analysis reveals that consumer goods products leverage abaca’s tactile properties for premium packaging and artisanal goods, while industrial sectors exploit its durability for filtration and reinforcement. Packaging applications capitalize on its biodegradability to meet eco-label criteria, and the textile realm integrates abaca yarns for high-value, sustainable fabrics. Finally, the extraction method lens-differentiating chemical and mechanical processes-offers insights into cost structures, environmental footprints, and quality variances. By synthesizing these segmentation layers, decision makers can identify white spaces, optimize resource allocation, and tailor go-to-market strategies that align with specific product and application demands.

This comprehensive research report categorizes the Abaca Fiber market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Application

- End Use Industry

- Extraction Method

Mapping Regional Variations and Regulatory Influences That Define Competitive Dynamics and Growth Opportunities Across the Americas EMEA and APAC

Geographic dynamics play a pivotal role in shaping the competitive landscape of the Abaca Fiber market, reflecting disparities in production capabilities, regulatory frameworks, and demand profiles across key regions. In the Americas, the United States and Canada are intensifying efforts to incorporate abaca-based assets into sustainable supply chains, buoyed by government incentives for bio-based materials and corporate pledges on carbon neutrality. Latin America, albeit a smaller player in abaca sourcing, is witnessing nascent ventures aimed at cultivating fiber for domestic textile and packaging applications.

Across Europe, the Middle East, and Africa, stringent REACH and Ecolabel regulations are propelling demand for certified organic abaca pulp and papers, while North African and Gulf markets show early interest in abaca composites for infrastructure reinforcement. In the Asia-Pacific region, the Philippines continues to dominate production with established plantation networks and processing hubs, supplying global export markets. Concurrently, Japan, China, and Australia are investing in downstream R&D to expand abaca’s role in advanced textiles and biodegradable films. This regional mosaic highlights the importance of tailored market entry tactics and localized partnerships to capture growth potential in a diversified global context.

This comprehensive research report examines key regions that drive the evolution of the Abaca Fiber market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Navigating the Competitive Arena Where Vertically Integrated Leaders and Niche Innovators Forge Alliances to Drive Abaca Fiber Market Leadership

The competitive field of the Abaca Fiber market is characterized by a blend of vertically integrated conglomerates, specialized processors, and emerging start-ups driving innovation across the value chain. Leading producers are leveraging their agronomic expertise to optimize plantation yields and standardize fiber quality through rigorous testing protocols. Meanwhile, paper mill operators with dedicated abaca lines are enhancing processing capabilities to produce high-end specialty papers for computer ribbons and food-grade filter applications.

A growing number of mid-sized entities are differentiating through niche offerings, such as organically certified mechanical pulp and customized twine formulations for premium rope cordage markets. Partnerships between fiber growers and downstream composite manufacturers are also proliferating, enabling co-development of high-performance materials for automotive and marine sectors. This evolving competitive landscape underscores the strategic imperative for both established players and newcomers to invest in R&D, forge alliances, and refine value propositions that address specific application requirements and sustainability benchmarks.

This comprehensive research report delivers an in-depth overview of the principal market players in the Abaca Fiber market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Allied Botanical Corporation

- Asia Pacific Fibers Corporation

- Bananatex GmbH

- Chandra Prakash & Company

- Ching Bee Trading Corporation

- Erin Rope

- Freeman Mfg. & Supply Co.

- Green Banana Paper S.L.

- Hainan Modern Abaca Technology Co. Ltd.

- HartmannForbes Inc

- HerMin Textile

- Italfil Expo Bags Company Limited

- Kobe Abaca Pulp & Paper Co. Ltd.

- Manila Hemp Company Ltd.

- MAP Enterprises

- Peral Enterprises

- PSPI Pulp Specialties Philippines Inc.

- PT Perkebunan Nusantara III Persero

- Selinrail International Trading

- Specialty Pulp Manufacturing Inc.

- Tag Fibers Inc

- The Fiber World

- Wigglesworth & Co. Limited

- Yzen Handicraft Export Trading

- Zhejiang Baijiahong Technology Co. Ltd.

Implementing Strategic Initiatives in Agri Innovation Collaboration and Circularity to Secure Sustainable Growth and Competitive Advantage in Abaca Fiber

Industry leaders seeking to capitalize on the momentum within the Abaca Fiber market should prioritize the integration of advanced agronomic practices to ensure consistent fiber quality and supply security. Establishing traceable supply chains via blockchain or digital tagging can enhance transparency, foster consumer trust, and command premium positioning in sustainability-conscious end markets. Concurrently, investing in pilot-scale trials for hybrid composite materials will unlock new application frontiers and differentiate product portfolios through performance claims backed by empirical data.

Collaboration is essential: forging joint ventures between growers, processors, and end users can streamline R&D pathways and facilitate co-investment in specialized processing infrastructure. Proactive engagement with trade associations and regulatory bodies will help shape equitable tariff frameworks and expedite certifications. Finally, embedding circularity principles-such as recycling post-consumer abaca-based materials and valorizing extraction by-products-will not only reduce environmental impact but also generate alternative revenue streams, solidifying long-term competitive advantage.

Outlining a Rigorous Mixed Methodology Incorporating Primary Interviews Secondary Research and Proprietary Analytics for Robust Market Insights

Our research approach synthesizes both primary and secondary data sources to ensure comprehensive coverage and analytical rigor. Primary insights were obtained through interviews with plantation managers, mill operators, and end users across key geographies, complemented by surveys that probed procurement challenges and emerging application needs. Secondary research encompassed industry publications, regulatory filings, and technical white papers on fiber extraction and processing technologies to contextualize market developments and benchmark best practices.

Data triangulation was employed to cross-verify findings, ensuring consistency between qualitative stakeholder perspectives and quantitative datasets. A proprietary scoring framework rated extraction methods, application viability, and regional risk factors, enhancing the objectivity of strategic recommendations. Throughout the process, stringent validation protocols were applied, including peer reviews by domain experts and iterative feedback sessions with industry participants, to uphold accuracy and relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Abaca Fiber market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Abaca Fiber Market, by Product Type

- Abaca Fiber Market, by Application

- Abaca Fiber Market, by End Use Industry

- Abaca Fiber Market, by Extraction Method

- Abaca Fiber Market, by Region

- Abaca Fiber Market, by Group

- Abaca Fiber Market, by Country

- United States Abaca Fiber Market

- China Abaca Fiber Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Summarizing the Strategic Imperatives of Sustainability Performance and Policy Adaptation That Will Drive Abaca Fiber’s Role in the Bioeconomy Over the Coming Decade

Abaca Fiber’s unique combination of mechanical strength, environmental compatibility, and application flexibility positions it at the forefront of sustainable materials innovation. As the market evolves in response to regulatory shifts, technological breakthroughs, and changing consumer preferences, stakeholders who anticipate transformations and deploy strategic initiatives will secure leadership positions. The 2025 tariff adjustments underscore the necessity of resilient supply chains and proactive policy engagement, while segmentation and regional analysis reveal targeted pathways for growth beyond traditional uses.

By synthesizing competitive intelligence, segmentation insights, and actionable recommendations, organizations can chart a course that balances performance imperatives with sustainability objectives. The future of abaca extends beyond its historical role in rope and cordage; it is set to redefine material standards across packaging, industrial, and consumer applications, catalyzing a transition toward a more circular bioeconomy.

Act Now to Secure Exclusive Access to Comprehensive Global Abaca Fiber Market Insights and Propel Your Strategic Decisions Beyond the Competition

To explore this report’s full depth of data, trends, and strategic insights on the global Abaca Fiber market, reach out to Ketan Rohom (Associate Director, Sales & Marketing) today to secure your copy of the comprehensive analysis and deliver unparalleled value to your team.

- How big is the Abaca Fiber Market?

- What is the Abaca Fiber Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?