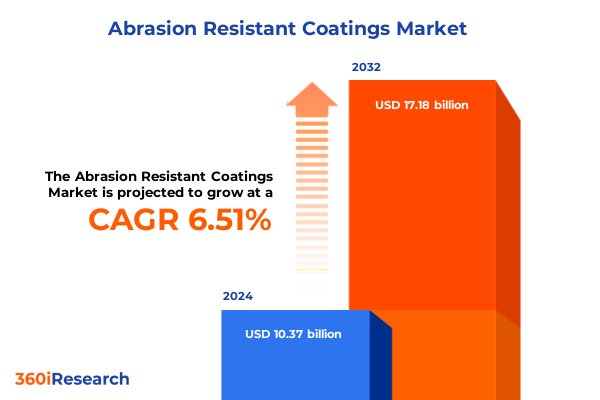

The Abrasion Resistant Coatings Market size was estimated at USD 11.06 billion in 2025 and expected to reach USD 11.71 billion in 2026, at a CAGR of 6.49% to reach USD 17.18 billion by 2032.

Unveiling the Critical Role of Abrasion Resistant Coatings in Addressing Intensifying Industrial Wear Challenges and Driving Technological Evolution

The evolution of abrasion resistant coatings has been propelled by intensifying industrial demands for enhanced durability, operational efficiency, and cost management. As end users across vital sectors encounter increasing wear and tear on machinery and components, the protective performance of these specialized coatings becomes indispensable. In addition to traditional considerations of longevity, the contemporary market places a premium on multifunctionality, regulatory compliance, and compatibility with emerging substrates, setting the stage for a deeper exploration of industry drivers and value propositions.

Moreover, manufacturers and end users alike are navigating a convergence of environmental regulations and sustainability imperatives that redefine product development priorities. By integrating advanced materials science with environmentally conscious processes, developers of abrasion resistant coatings can address stringent legislation while meeting customer expectations for performance and lifecycle impact. Consequently, an informed understanding of these foundational dynamics is essential for stakeholders seeking to capitalize on the opportunities and mitigate the challenges endemic to today’s abrasion resistant coatings landscape.

Examining Pivotal Transformations Reshaping the Abrasion Resistant Coatings Landscape Through Sustainability, Digitalization, and Advanced Material Innovations

The abrasion resistant coatings sector is undergoing transformative shifts driven by the intersection of sustainability, digitalization, and material science breakthroughs. Initially, a growing emphasis on eco-friendly chemistries and solvent-free application techniques has spurred the development of next-generation formulations that reduce volatile organic compound emissions and enhance recyclability. These advances not only address heightened regulatory scrutiny but also resonate with corporate sustainability commitments, reshaping procurement criteria across industries.

Simultaneously, digital technologies are redefining the design, application, and monitoring of coating processes. From simulation-based material optimization to in-situ sensor integration for real-time performance tracking, Industry 4.0 concepts are embedding intelligence into both production lines and coated assets. As a result, predictive maintenance becomes more accurate, waste and rework are minimized, and total cost of ownership considerations are increasingly data-driven. In tandem, innovations in nanotechnology and hybrid material systems are unlocking coatings with unprecedented hardness-to-weight ratios and adaptive surface functionalities, heralding a new era of high-performance protective solutions that cater to the most demanding operating environments.

Assessing the Comprehensive Impact of Recent United States Tariff Measures on Competitive Dynamics and Supply Chains in Abrasion Resistant Coatings Sector

United States tariff measures enacted in 2025 have introduced complex variables across raw material sourcing and competitive positioning for abrasion resistant coatings suppliers. By imposing additional duties on primary feedstocks such as nickel, chromium, and specialized powders, these tariffs have elevated input costs and prompted many manufacturers to reassess global procurement strategies. Consequently, supply chains have become more regionally oriented, with a renewed focus on nearshoring to mitigate duty burdens and logistical uncertainties.

Furthermore, the cumulative effect of these tariffs extends beyond cost implications, influencing strategic partnerships and joint venture models. Coating formulators and equipment providers are increasingly collaborating to secure raw material volumes through long-term agreements or equity stakes in upstream operations. Such alliances enhance supply stability while enabling co-development of tailored materials that align with regional regulatory frameworks. In addition, certain end users are leveraging vertical integration strategies to internalize critical processes, thereby insulating their operations from future tariff volatility and preserving margin structures.

Deriving Deep Insights from Multi-Dimensional Segmentation to Illuminate Critical Coating Technologies, End-Use Verticals, Materials, and Application Modes

A nuanced view of the abrasion resistant coatings market emerges when dissecting performance through integrated layers of technology, industry application, material composition, and method of deployment. In terms of coating technology, chemical vapor deposition variants-from ambient chamber processes to low-pressure and plasma-enhanced modalities-offer precise control over layer thickness and surface conformity, whereas electroplating options like hard chrome and nickel plating continue to deliver cost-effective, high-hardness finishes. Physical vapor deposition approaches, including both evaporation and sputtering, are favored for producing thin, uniform films on complex geometries, while thermal spray solutions-spanning flame spray, high-velocity oxy fuel, and plasma spray-address heavy-duty surface restoration needs. Each technology segment carries distinct cost structures, performance profiles, and lifecycle considerations, making the technology selection process highly dependent on specific application demands.

Building on the technological prism, the diversity of end-use industries underscores the market’s breadth. Aerospace sectors demand ultra-lightweight, high-temperature-resistant coatings for turbine components, while automotive applications prioritize cost-efficient, abrasion-resistant layers that enhance mileage and part longevity. Construction and manufacturing environments often require robust coatings to safeguard equipment against particulate erosion and mechanical abrasion. Meanwhile, marine vessels navigate saline-induced wear, oil and gas infrastructure contends with both mechanical and chemical abrasion, and power generation assets face cyclical stresses that necessitate tailored protective solutions. Each vertical exhibits its own operational imperatives and regulatory landscapes, prompting a spectrum of coating material choices.

Turning to the coating material axis reveals a balance between rigidity and resilience. Ceramic-based formulations deliver extreme hardness and thermal stability but often entail higher application complexities. Composite systems blend ceramic and polymer phases to achieve synergistic benefits, whereas metal coatings leverage dense crystalline structures for superior load-bearing capacity. Polymer-based options, including advanced thermosets, provide elasticity and chemical resistance, catering to substrates prone to cyclic deformation. Finally, application method serves as a decisive factor, with electrochemical deposition enabling uniform coatings in recessed areas, physical deposition delivering ultra-clean surfaces in vacuum environments, and spray applications offering versatility across on-site or in-situ refurbishing contexts. Together, these segmentation dimensions form an interdependent matrix that informs both strategic positioning and operational decision making.

This comprehensive research report categorizes the Abrasion Resistant Coatings market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Coating Technology

- End Use Industry

- Coating Material

- Application Method

Exploring Regional Divergences and Growth Trajectories Across the Americas, EMEA, and Asia-Pacific in the Abrasion Resistant Coatings Arena

A geographically focused assessment of abrasion resistant coatings indicates pronounced variances in market dynamics and adoption trajectories. Across the Americas, established industries such as automotive, oil and gas, and heavy manufacturing drive steady demand for protective coatings, supported by mature supply chains and regulatory frameworks that emphasize environmental stewardship. Meanwhile, Latin American infrastructure projects present incremental opportunities for refinish and maintenance services, with local producers adapting global best practices to regional cost structures.

Conversely, Europe, the Middle East and Africa showcase a blend of stringent regional standards and rapid industrial expansion. The European Union’s rigorous chemical regulations and sustainability directives incentivize the adoption of low-emission, high-performance coatings, while the Middle East’s investment in petrochemical facilities fuels demand for erosion-resistant solutions. In Africa, mineral processing plants seek durable surface treatments to extend equipment life in abrasive environments, often turning to international partners for technical expertise.

Looking east, the Asia-Pacific region exhibits the highest growth momentum driven by large-scale infrastructure development, automotive electrification trends, and expanding power generation capacities. China’s ongoing industrial modernization initiatives prioritize surface treatments that optimize asset utilization and reduce maintenance downtime, whereas India’s burgeoning manufacturing base requires scalable application methods. Similarly, Southeast Asian shipbuilding yards and mining operations increasingly leverage high-velocity thermal spray and advanced electroplating techniques to secure long-term operational reliability.

This comprehensive research report examines key regions that drive the evolution of the Abrasion Resistant Coatings market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Strategic Initiatives and Competitive Positioning of Leading Players Steering Innovation and Market Penetration in Abrasion Resistant Coatings

Leading participants in the abrasion resistant coatings ecosystem have asserted market influence through concerted R&D investment, strategic collaborations, and targeted mergers and acquisitions. These firms continually expand their intellectual property portfolios by developing proprietary formulations that push the boundaries of hardness, adhesion, and functional integration. Partnerships with academic institutions and consortiums have also accelerated material innovation cycles, particularly in areas such as nanoscale layering and self-healing coating systems.

Simultaneously, many of these players are pursuing geographic and segmental diversification to capture emerging end-use opportunities. By establishing regional application centers and localized manufacturing footprints, they enhance customer proximity and responsiveness while mitigating tariff exposures. Furthermore, alliances with equipment suppliers have yielded integrated service models that combine surface preparation, coating application, and post-treatment diagnostics-creating value-added propositions that resonate with large-scale industrial clients seeking turnkey solutions. Collectively, these strategic moves reinforce the competitive positioning of leading firms and set new benchmarks for performance and service excellence.

This comprehensive research report delivers an in-depth overview of the principal market players in the Abrasion Resistant Coatings market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Akzo Nobel N.V.

- Arkema S.A.

- Axalta Coating Systems Ltd.

- BASF Coatings GmbH

- BASF SE

- Berger Paints India Limited

- Bodycote plc

- Hardide Coatings Ltd.

- Hempel A/S

- Jotun A/S

- Jyoti Innovision Private Limited

- Kansai Paint Co., Ltd.

- Kirloskar Corrocoat Private Limited

- Nippon Paint Holdings Co., Ltd.

- PPG Industries, Inc.

- Praxair Surface Technologies, Inc.

- RPM International Inc.

- Saint-Gobain Performance Plastics Corporation

- Sika AG

- The Sherwin-Williams Company

Actionable Strategic Imperatives for Industry Leaders to Capitalize on Technological Advances, Regulatory Shifts, and Supply Chain Resilience in Abrasion Resistant Coatings

Industry leaders can adopt a series of actionable strategies to navigate the complex abrasion resistant coatings environment and reinforce sustainable growth trajectories. A foremost priority involves embedding digital twins and advanced analytics into the coating lifecycle, thereby transforming maintenance programs from reactive to predictive and unlocking measurable operational gains. Equally important is the pursuit of greener chemistries and closed-loop manufacturing practices that address both regulatory pressures and ESG commitments without compromising performance.

Moreover, companies should strengthen supply chain resilience through diversified sourcing and long-term supplier partnerships, particularly for critical raw materials such as rare earth elements and specialty alloys. Joint development agreements with material providers can secure preferential access to novel powders and precursors, fostering differentiation in high-value market segments like aerospace and power generation. In parallel, investing in workforce upskilling programs-covering topics from surface engineering to digital process control-ensures that organizations possess the technical talent necessary to deploy cutting-edge coating technologies effectively.

Detailing a Robust Research Framework Combining Qualitative and Quantitative Approaches to Ensure Comprehensive Analysis of Abrasion Resistant Coatings Trends

The research underpinning this analysis integrates both qualitative and quantitative methodologies to deliver a holistic view of the abrasion resistant coatings landscape. Primary research included structured interviews with decision makers spanning coating formulators, equipment manufacturers, and end users, providing direct insights into evolving preferences, challenges, and innovation roadmaps. These interactions were augmented by in-depth case studies that examined successful application models across key verticals such as aerospace and oil and gas.

Secondary research encompassed a thorough review of patent filings, technical white papers, and regulatory filings to track material science advancements and compliance trends. Additionally, supply chain mapping exercises identified critical nodes of raw material procurement and distribution, highlighting potential vulnerabilities and strategic opportunities. Throughout the process, triangulation was employed to validate findings, ensuring coherence between interview perspectives, documented evidence, and market observations. This rigorous approach underlines the reliability and depth of the analytical framework presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Abrasion Resistant Coatings market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Abrasion Resistant Coatings Market, by Coating Technology

- Abrasion Resistant Coatings Market, by End Use Industry

- Abrasion Resistant Coatings Market, by Coating Material

- Abrasion Resistant Coatings Market, by Application Method

- Abrasion Resistant Coatings Market, by Region

- Abrasion Resistant Coatings Market, by Group

- Abrasion Resistant Coatings Market, by Country

- United States Abrasion Resistant Coatings Market

- China Abrasion Resistant Coatings Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Synthesizing Key Findings to Reinforce Strategic Priorities and Future Outlook for Stakeholders in the Evolving Abrasion Resistant Coatings Industry

The collective insights distilled in this executive summary underscore the complex interplay of technological innovation, regulatory evolution, and strategic imperatives shaping the abrasion resistant coatings sector. From the advent of environmentally aligned formulations to the integration of digital tools for performance monitoring, the industry is charting a path toward more sustainable, efficient, and resilient protective solutions. Simultaneously, regional variations and tariff implications necessitate agile strategies that adapt to shifting supply chain dynamics and policy landscapes.

As market participants refine their segmentation approaches and intensify R&D efforts, the competitive stakes continue to rise. Companies that successfully harness material science breakthroughs, forge collaborative alliances, and embed data-centric decision making will establish leadership positions in the years ahead. Ultimately, a balanced emphasis on operational excellence, regulatory compliance, and customer-centric innovation will determine which organizations secure enduring success in this rapidly evolving domain.

Engage Directly with Ketan Rohom to Unlock Bespoke Abrasion Resistant Coatings Market Intelligence Tailored to Your Strategic Objectives

To delve deeper into actionable insights and secure a comprehensive market research report tailored to your strategic objectives in the abrasion resistant coatings domain, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing. By engaging with Ketan, you will gain privileged access to proprietary analyses, industry-leading benchmarks, and customized recommendations designed to sharpen your competitive edge. His expertise and collaborative approach will ensure that your organization benefits from the most relevant and impactful data-driven guidance. Don’t miss this opportunity to transform market intelligence into strategic advantage-connect with Ketan Rohom today and accelerate your decision-making with unparalleled insights.

- How big is the Abrasion Resistant Coatings Market?

- What is the Abrasion Resistant Coatings Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?