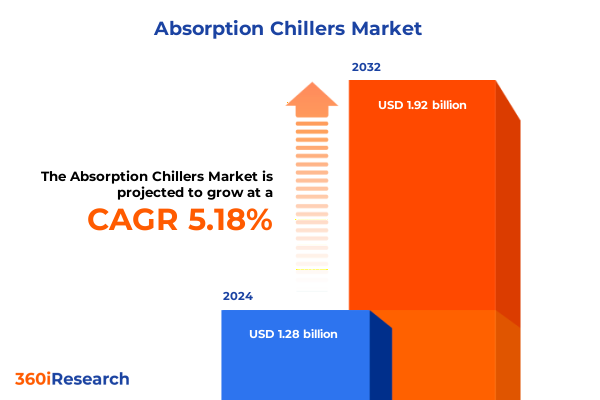

The Absorption Chillers Market size was estimated at USD 1.33 billion in 2025 and expected to reach USD 1.39 billion in 2026, at a CAGR of 5.31% to reach USD 1.92 billion by 2032.

Harnessing Thermal Innovation to Drive Sustainable and Efficient Cooling Systems Across Diverse Sectors with Absorption Chiller Technology

The relentless drive toward more sustainable industrial and commercial operations has thrust absorption chillers into the spotlight as an indispensable tool for modern cooling demands. By employing thermal energy sources such as waste heat or solar thermal, absorption chillers offer a compelling alternative to conventional electric-driven compression systems. Their fundamental principle harnesses the chemical affinity between refrigerant and absorbent to effect cooling without the high electrical loads and greenhouse gas emissions associated with traditional chillers. This trajectory aligns with corporate decarbonization targets and the increasing emphasis on circular energy flows within integrated plant environments.

Moreover, the adaptability of absorption chillers across diverse applications-from district energy networks to large-scale manufacturing plants-underscores their strategic relevance in a world grappling with energy volatility. As organizations confront stricter emissions regulations, fluctuating electricity costs, and the imperative to optimize asset performance, absorption chillers emerge as an innovative solution that advances both sustainability and operational resilience. By converting low-grade thermal sources into reliable cooling capacity, these systems redefine efficiency benchmarks while opening pathways for synergistic energy management across heating, ventilation, and air conditioning (HVAC) frameworks.

Navigating the Convergence of Environmental Regulations and Technological Breakthroughs Reshaping the Absorption Chiller Ecosystem

Recent years have witnessed a confluence of regulatory, environmental, and technological forces that are profoundly reshaping the absorption chiller industry. Stringent global mandates to curb carbon footprints have accelerated investment in low-emission cooling, prompting manufacturers to refine absorber materials, optimize thermodynamic cycles, and incorporate advanced control systems. Concurrently, breakthroughs in heat recovery technology enable integration of absorption chillers with combined heat and power configurations, unlocking higher overall energy yields. This synergy is pivotal for sectors such as petrochemicals and district energy, where reliability and efficiency directly impact production economics.

On the environmental front, the shift toward renewable heat sources, particularly solar thermal collectors, has catalyzed hybrid cooling models that pair traditional fuel-fired burners with renewables. These hybrid arrangements deliver flexible operation profiles, ensuring continuous cooling performance despite solar intermittency. In parallel, digitalization trends are giving rise to predictive maintenance regimes powered by IoT sensors and machine learning algorithms. By forecasting component wear and optimizing operational parameters in real time, digital absorption chillers minimize downtime, extend equipment lifespan, and safeguard return on investment.

Assessing the Strategic Ramifications of Recent United States Tariff Measures on Global Supply Chains and Chiller Market Dynamics

In mid-2025, new United States tariff measures imposed on imported components relevant to absorption chilling systems have introduced both challenges and opportunities across the supply chain. The additional duties on specialized heat exchanger plates and advanced valve assemblies have elevated procurement costs for original equipment manufacturers reliant on international suppliers. In response, several leading producers have diversified their sourcing strategies, relocating production of tariff-impacted parts to domestic or allied markets to mitigate margin erosion. This pivot has also prompted intensified collaboration between North American foundries and chiller fabricators to localize critical subassembly lines.

Meanwhile, a segment of the aftermarket services community has capitalized on tariff pressures by expanding in-country refurbishment offerings, reducing reliance on imported spares. At the same time, end users are revisiting total cost of ownership calculations to account for the combined effects of tariffs and ongoing energy efficiency incentives. Through transitional procurement models, many stakeholders are negotiating value-added agreements that include performance guarantees and technical support, thereby smoothing supply discontinuities and preserving operational timelines. This collective recalibration underscores the resilience of the absorption chiller market, demonstrating the capacity of industry participants to adapt strategically in the face of shifting trade policies.

Unveiling Critical Segmentation Perspectives to Illuminate Design Variations and Application-Specific Trends Within the Absorption Chiller Sphere

Segmentation analysis reveals distinct dynamics within the absorption chiller market, beginning with design variations that range from the energy-focused single-effect units for smaller cooling loads to the ultra-efficient triple-effect systems that extract maximum thermal performance from high-temperature heat sources. Double-effect chillers continue to garner interest as a balanced option that combines modest capital outlays with substantial operating savings, especially where process heat streams exceed 150°C. Furthermore, power source segmentation highlights the growing appeal of direct fired models, which leverage fuel combustion for regions lacking centralized steam, alongside indirect fired and water-driven configurations that excel when paired with existing boiler or cooling tower infrastructures.

Component-level insights shed light on emerging improvements in condenser design, including microchannel advancements for higher heat rejection rates, and the incorporation of low-pressure evaporators to enhance vacuum stability and reduce crystallization risks. Expansion valve technologies are also evolving, with precision electronic actuators enabling finer control over refrigerant flow, improving system responsiveness under variable loads. Capacity tiers illuminate how installations between 100 kW and 500 kW have surged in educational campuses and mid-sized commercial establishments, while larger projects above 500 kW are increasingly driven by industrial complexes with abundant waste heat streams. Conversely, less than 100 kW units persist in niche residential conversions where solar thermal integration is prioritized.

Application segmentation underscores the diverse deployment of absorption chillers across commercial, industrial, and residential spheres. In office buildings and retail environments, end users prioritize quiet operation and lean mechanical footprints, whereas industrial biogas facilities and breweries exploit heat recovery from combustion engines to maintain chilled processes. Combined heat and power plants and district energy networks leverage large-scale absorption systems to optimize district cooling services, while geothermal and incinerator applications repurpose local thermal reservoirs. Specialty manufacturing, petroleum and chemical plants, and pulp mills continue to adopt absorption chillers for mission-critical processes that demand uninterrupted cooling under stringent purity constraints.

This comprehensive research report categorizes the Absorption Chillers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Design

- Power Source

- Capacity

- Applications

Deciphering Regional Demand Patterns and Infrastructure Drivers to Reveal Growth Opportunities Across Key Geographical Areas

Regional analysis highlights distinctive drivers across the Americas, Europe, Middle East & Africa, and Asia-Pacific markets. In North and South America, incentives tied to renewable energy adoption have spurred uptake of solar-hybrid absorption chillers, particularly in southwestern United States and select Brazilian industrial parks. Stakeholders in the EMEA region face a dual imperative: aligning with the European Green Deal’s decarbonization targets while addressing the water scarcity challenges of Middle Eastern markets, leading to a surge in water-driven chiller installations complemented by advanced water reclamation strategies.

Meanwhile, Asia-Pacific exhibits robust expansion as rapid urbanization and rising comfort cooling demands intersect with ambitious state-sponsored energy efficiency mandates. Chinese and Indian municipal authorities are integrating absorption chillers into district cooling schemes to alleviate peak electrical grid loads, while Australia and Japan show growing interest in direct-fired solutions that capitalize on abundant natural gas resources. Across all regions, federal and local policies emphasizing emissions reductions, energy security, and lifecycle cost management are molding procurement criteria, prompting cross-regional partnerships and knowledge transfer in project implementation.

This comprehensive research report examines key regions that drive the evolution of the Absorption Chillers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Stakeholders and Strategic Alliances That Are Shaping the Competitive Landscape of Absorption Chillers

Leading players in the absorption chiller landscape are fortifying their market positions through innovation, strategic alliances, and targeted service expansion. Industry stalwarts have invested in modular manufacturing facilities that expedite customization and reduce lead times. Collaboration between engineering consultancies and equipment suppliers has yielded turnkey solutions for combined heat and power deployments, enhancing customer value through integrated performance guarantees. Additionally, several manufacturers have engaged in joint ventures with material science partners to pioneer novel absorbent-refrigerant pairs, aiming to reduce crystallization risk and lower regeneration temperatures.

Parallel to product innovation, aftermarket service providers are differentiating through digital diagnostic tools that deliver remote monitoring dashboards, enabling real-time insights into chiller health metrics. Training academies specializing in absorption system maintenance have emerged, offering certification programs that bolster field technician expertise. Through these initiatives, companies are transitioning from transactional equipment sales to ongoing customer engagement models, underscoring the importance of lifecycle support in cultivating brand loyalty and maximizing system uptime.

This comprehensive research report delivers an in-depth overview of the principal market players in the Absorption Chillers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AGO GmbH Energie + Anlagen

- Broad Group

- Carrier Corporation

- Century Corporation

- Colibri BV

- EAW Energieanlagenbau GmbH

- Ebara Corporation

- Heinen & Hopman Engineering BV

- Hyundai Climate Control Co. Ltd.

- Johnson Controls International PLC

- Kawasaki Heavy Industries, Ltd

- Kirloskar Group

- LG Corporation

- Panasonic Corporation

- Robur Corporation

- Shuangliang Eco-Energy Systems Co., Ltd.

- Styne Group

- Thermax Limited

- World Energy Co., Ltd.

- YAZAKI Corporation

Implementing Actionable Strategies and Innovation Pathways to Propel Sustainable Performance and Market Leadership in Absorption Cooling

To capitalize on evolving market conditions, industry leaders should prioritize the integration of hybrid thermal sources with advanced control platforms. By embedding IoT-enabled sensors across critical components, operators gain visibility into real-time performance, facilitating proactive maintenance and dynamic load balancing. Investing in pilot programs that co-locate absorption chillers with renewable heat projects, such as concentrated solar thermal facilities, can demonstrate cost-effective pathways to net-zero cooling.

Furthermore, companies would benefit from forging partnerships with regional EPC firms to accelerate project delivery and tailor solutions to local energy frameworks. Establishing centers of excellence focused on absorbent research and system modeling will shorten innovation cycles, enabling rapid adoption of next-generation materials. From a commercial standpoint, developing flexible financing models-such as energy-as-a-service contracts-can unlock new customer segments by mitigating upfront capital barriers and aligning service fees with actual energy savings.

Elucidating Rigorous Research Techniques Utilized to Ensure Data Integrity and Comprehensive Analysis of Cooling System Technologies

This research employed a multi-pronged methodology to ensure the integrity and depth of insights presented. Primary interviews were conducted with a cross-section of manufacturers, end users, and engineering consultants to capture real-world perspectives on operational challenges and technology adoption drivers. Field surveys of installed systems provided granular data on performance parameters under varying ambient and load conditions.

Secondary research encompassed a thorough review of international regulatory frameworks, technical white papers, and patent filings to map emerging design trends. Component-level analysis integrated data from materials science publications to assess the viability of next-generation absorbent blends. Finally, regional expert interviews validated key assumptions related to supply chain adjustments following tariff changes, ensuring a grounded and actionable narrative throughout the report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Absorption Chillers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Absorption Chillers Market, by Component

- Absorption Chillers Market, by Design

- Absorption Chillers Market, by Power Source

- Absorption Chillers Market, by Capacity

- Absorption Chillers Market, by Applications

- Absorption Chillers Market, by Region

- Absorption Chillers Market, by Group

- Absorption Chillers Market, by Country

- United States Absorption Chillers Market

- China Absorption Chillers Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Consolidating Key Findings to Illustrate the Strategic Impact and Future Potential of Absorption Chiller Solutions in Evolving Markets

In consolidating the key findings, it is evident that absorption chillers stand at the forefront of sustainable cooling innovation, driven by environmental regulations, digitalization trends, and economic incentives for energy recovery. Tariff-induced supply chain realignments have underscored the importance of agile procurement and localized manufacturing strategies, while segmentation analysis has highlighted the diverse performance profiles across design, power source, component, capacity, and application dimensions. Regional insights demonstrate that tailored approaches-whether leveraging solar thermal in the Americas, advanced water usage strategies in EMEA, or district cooling integration in Asia-Pacific-are essential to maximize technology benefits.

As leading companies continue to refine their product portfolios and expand service capabilities, the competitive landscape will increasingly favor those who marry technical excellence with customer-centric financing models. Future growth will depend on collaborative innovation in absorbent chemistry, strategic partnerships across project lifecycles, and an unwavering focus on decarbonization goals. This multifaceted evolution positions absorption chillers not only as a compelling alternative to conventional systems but as a cornerstone technology for next-generation energy management.

Seize the Opportunity to Leverage In-Depth Cooling Market Expertise and Unlock Tailored Insights with a Comprehensive Absorption Chiller Research Partnership

For executives seeking a thorough understanding of how absorption chilling technology can shape energy-efficient cooling strategies, connecting with Ketan Rohom provides a direct line to specialized insights and custom research solutions. As Associate Director, Sales & Marketing at 360iResearch, Ketan Rohom can guide organizations through the nuances of chiller system selection, regulatory implications, and emerging trends. By partnering with him, decision-makers secure access to a comprehensive absorption chiller research report that distills complex market intelligence into actionable strategies tailored to unique operational needs. Engage with Ketan Rohom today to unlock the definitive resource on absorption chillers and elevate your organization’s cooling infrastructure initiatives

- How big is the Absorption Chillers Market?

- What is the Absorption Chillers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?