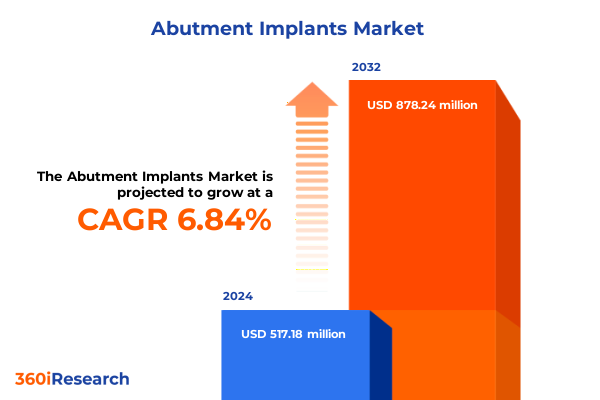

The Abutment Implants Market size was estimated at USD 551.18 million in 2025 and expected to reach USD 592.18 million in 2026, at a CAGR of 6.88% to reach USD 878.24 million by 2032.

Setting the Scene for Abutment Implant Market Dynamics with an Overview of Key Drivers, Innovations, and Competitive Imperatives

The abutment implant sector lies at the intersection of cutting-edge biomaterials and restorative dentistry, providing essential connectors that anchor crowns, bridges, and dentures to implant fixtures. These components not only bear occlusal loads but also influence soft tissue integration, making material selection, design precision, and manufacturing accuracy paramount. In this context, stakeholders across the value chain-from implant manufacturers to dental practitioners-seek comprehensive insights into technological advances, regulatory trends, and competitive drivers that shape the supply landscape.

Our analysis places these abutment solutions within the broader continuum of digital dentistry, where computer-aided design and manufacturing processes converge with biological science. As dentists increasingly adopt streamlined workflows and patient demand for minimally invasive procedures grows, understanding how these dynamics influence product innovation and procurement strategies becomes critical. Moreover, the accelerating move toward personalized care underscores the importance of tailored abutment geometries and high-performance materials that can deliver predictable clinical outcomes.

Uncovering the Transformative Technological, Regulatory, and Patient-Centric Shifts Redefining the Abutment Implant Sector

Rapid advancements in digital scanning, planning software, and additive manufacturing have redefined how abutment implants are designed, produced, and delivered. In particular, the rise of three-dimensional printing and streamlined CAD/CAM workflows has enabled more precise customization, reduced lead times, and lower-cost prototyping. Against this backdrop, material science has kept pace, extending beyond traditional titanium to incorporate high-strength zirconia in both monolithic forms and sophisticated multi-layer constructions that mimic natural dentition.

Regulatory agencies worldwide have also responded to these innovations with frameworks that balance patient safety and technological progress. Updated guidance on biocompatibility testing, implant component classification, and digital lab certification has reduced market entry barriers for agile innovators, while ensuring that new abutment designs meet rigorous quality standards. As a result, clinicians now have unprecedented access to a wider array of implant-to-abutment connection types-from internal hex configurations favored for rotational stability to ball connectors designed for specific prosthetic indications.

Furthermore, patient preferences are shifting toward less invasive protocols, fueled by growing expectations for same-day dentistry and digitally guided surgery. This has compelled implant manufacturers and dental laboratories to align their product roadmaps with end-user requirements, emphasizing trade-offs between cost efficiency and clinical performance. Overall, these transformative shifts are forging a new landscape in which agility, material diversification, and regulatory foresight are the defining pillars of success.

Assessing the Cumulative Impact of 2025 United States Tariff Measures on Abutment Implant Production, Supply Chains, and Cost Structures

Since the imposition of Section 301 tariffs on select imported medical device components, the abutment implant arena has grappled with escalating cost pressures that reverberate across supply chains. In 2025, these duties have reached their cumulative zenith, with effective rates that reflect both the original tariff schedules and subsequent adjustments. The outcome has been twofold: suppliers sourcing raw materials such as medical-grade titanium and multi-layer zirconia have confronted higher input prices, while original equipment manufacturers have navigated the tension between preserving margins and passing incremental costs to customers.

In response, many participants have intensified efforts to diversify their supplier base, exploring opportunities to source domestically machined components and to qualify alternate international vendors outside tariff scope. At the same time, a subset of agile companies has accelerated reshoring initiatives, investing in local CNC milling centers and additive manufacturing hubs to dampen exposure to trade uncertainties. Although these strategies require significant capital outlays, they also promise greater supply chain resilience and shorten lead times, thereby partially offsetting the financial burden of higher duty rates.

Moreover, dental practices and hospital procurement teams are reevaluating purchasing protocols, engaging in more rigorous total-cost analyses that incorporate tariff-induced price escalations. This has led to increased negotiation leverage for high-volume distributors and group purchasing organizations, as they seek to consolidate orders and secure preferential terms. In tandem, some lab networks and specialty clinics are exploring direct-to-clinic models to bypass intermediaries and mitigate tariff pass-through. Collectively, these adaptations underscore the strategic imperative for stakeholders to proactively manage the tension between fiscal constraints and clinical excellence.

Extracting Key Segmentation Insights Illuminating How Material, Product Type, End User, Connection Type, and Distribution Channels Shape Market Trajectories

Material innovation remains at the forefront of abutment implant differentiation, as practitioners weigh the traditional reliability and osseointegration profile of titanium against the aesthetic advantages and biocompatibility of zirconia. Within the zirconia spectrum, monolithic geometries deliver robust performance at a competitive cost, while multi-layer constructs replicate natural tooth translucency and gradation, catering to patient demand for seamless restorative appearances. This material dichotomy informs manufacturing investments, with many producers expanding their sintering capacities and precision milling services to accommodate both alloy and ceramic streams.

Parallel to material considerations, product type segmentation reflects a bifurcation between off-the-shelf stock abutments and bespoke custom solutions. Stock variants offer broad compatibility and rapid availability, appealing to high-volume dental clinics that prioritize workflow efficiency. Conversely, custom abutments-engineered via CAD/CAM software and increasingly produced through 3D printing-grant implantologists the latitude to refine emergence profiles, optimize soft tissue management, and address complex anatomical scenarios with unparalleled precision.

End-user landscapes further shape product roadmaps, as dental clinics, hospital networks, and specialized implantology centers each present unique procurement priorities. Clinics often favor turnkey systems with streamlined ordering interfaces, while hospitals emphasize compliance and integration with in-house surgical platforms. Specialty clinics, focused on advanced indications such as full-arch rehabilitation, demonstrate a propensity for premium materials, tailored connector geometries, and supplier partnerships that deliver procedural support and training.

Connection type selection underscores the engineering trade-offs inherent in abutment design. Ball connectors facilitate overdenture retention systems, granting ease of maintenance, while internal hex junctions excel in rotational control and torque distribution, favored in single-tooth replacements. External hex interfaces, long established in implantology, persist in legacy systems and low-cost portfolios. Finally, distribution channels span direct tender contracts with large healthcare institutions, traditional distributor networks catering to regional labs, and burgeoning online platforms that offer digital ordering portals and on-demand technical assistance. Together, these segmentation insights illuminate how material, product, end-user, connection, and distribution vectors converge to define competitive positioning within the abutment implant sector.

This comprehensive research report categorizes the Abutment Implants market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material

- Product Type

- End User

- Connection Type

- Distribution Channel

Illuminating Regional Footprints Revealing How the Americas, Europe Middle East & Africa, and Asia-Pacific Markets Navigate Adoption Trends and Growth Imperatives

In the Americas, robust dental infrastructure, favorable reimbursement environments, and high procedural volumes underpin strong demand for both stock and custom abutments. Leading laboratories and implant chains continuously pilot digital integration initiatives, from fully guided implant placement to in-house milling, reinforcing the region’s role as a bellwether for technological adoption. Moreover, concentrated R&D networks in North America cultivate early-stage material innovations, setting performance benchmarks that ripple outward.

Europe, the Middle East & Africa present a tapestry of regulatory regimes and reimbursement systems that influence procurement decisions. Western European markets emphasize strict clinical certification and advanced clinician training, elevating the uptake of multi-layer zirconia solutions in premium segments. Meanwhile, emerging markets in the Middle East and Africa leverage government-led healthcare expansions to upgrade oral health infrastructure, generating incremental demand for cost-effective stock abutments and standardized implant kits.

Asia-Pacific demonstrates the fastest acceleration in abutment implant utilization, driven by rising middle-class dental care expenditures, expanding coverage through social insurance schemes, and rapid digitalization within leading dental metropolises. Regional manufacturers have capitalized on local demand to scale high-precision manufacturing facilities, while international suppliers intensify partnerships with domestic distributors to navigate import regulations and tariff regimes. Collectively, these regional dynamics reveal differentiated growth drivers, investment priorities, and partnership models essential for success across global markets.

This comprehensive research report examines key regions that drive the evolution of the Abutment Implants market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Innovators Driving Competitive Edge Through Product Development, Strategic Partnerships, and Market Expansion Tactics

Leading industry players have crystallized their competitive advantage through concerted investments in digital ecosystems, M&A activity, and advanced material research. Straumann has doubled down on its open digital platform strategy, integrating third-party design applications with proprietary milling services to offer end-to-end workflows. Dentsply Sirona has leveraged its interdisciplinary portfolio to bundle implant systems with imaging hardware and chairside milling, creating turnkey solutions that streamline clinician adoption.

Zimmer Biomet has pursued selective collaborations with specialized labs to co-develop custom abutment solutions tailored for complex reconstructions, while Nobel Biocare continues to advance its multi-layer zirconia offerings through proprietary sintering techniques that balance translucency with strength. BioHorizons has emerged as a formidable challenger by expanding its digital planning software and investing in automated post-processing equipment that delivers consistent connector geometries at scale.

Across the competitive spectrum, smaller innovators and specialized startups are differentiating through niche partnerships, surgical guidance integrations, and subscription-based service models. These firms frequently position themselves as agile responders to clinician feedback, iterating product designs in compressed timelines. Collectively, the strategic initiatives of these companies underscore the importance of portfolio diversification, technology licensing, and service orientation in capturing incremental share within the abutment implant landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Abutment Implants market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ACE Surgical Supply Co

- ADIN Dental Implant Systems Ltd

- Bicon LLC

- BioHorizons Inc

- Camlog Biotechnologies AG

- Cortex Dental Implants Industries Ltd

- Dentium Co Ltd

- Dentsply Sirona Inc

- DIO Implant Co Ltd

- Envista Holdings Corporation

- Glidewell Laboratories

- Henry Schein Inc

- Ivoclar Vivadent AG

- Keystone Dental Inc

- MegaGen Implant Co Ltd

- MIS Implants Technologies Ltd

- Neoss Ltd

- Nobel Biocare Services AG

- Osstem Implant Co Ltd

- Southern Implants

- Straumann Holding AG

- Sweden & Martina SpA

- Thommen Medical AG

- Zest Anchors LLC

- ZimVie Inc

Formulating Actionable Recommendations to Empower Industry Leaders with Innovative Strategies for Supply Chain Resilience and Digital Integration

To remain at the forefront of abutment implant innovation, industry leaders should prioritize the expansion of digital design-to-manufacturing capabilities, ensuring seamless integration between intraoral scanning, planning software, and production platforms. By investing in next-generation additive and subtractive technologies, manufacturers can accelerate custom solution delivery while optimizing material utilization and reducing waste.

Concurrent diversification of material portfolios is crucial; organizations that develop high-performance zirconia formulations alongside advanced titanium alloys will accommodate a broader spectrum of clinical preferences and procedural indications. Leaders should also explore strategic partnerships with laboratory networks and distributors to co-create bundled offerings that combine product, technical support, and training, thereby enhancing clinician loyalty and streamlining procurement pathways.

In light of ongoing tariff fluctuations, establishing geographically distributed manufacturing footprints will safeguard supply continuity and enable more competitive pricing structures. Furthermore, channel strategies must adapt to the escalating influence of digital platforms by enhancing online ordering interfaces, offering transparent lead-time dashboards, and integrating virtual technical assistance. By coupling these tactical initiatives with robust data analytics-leveraging usage metrics, clinical outcomes tracking, and customer feedback-companies can refine their value propositions and drive sustained growth.

Detailing the Rigorous Research Methodology Underpinning Data Collection, Expert Consultations, and Analytical Frameworks Ensuring Comprehensive Insights

This study synthesizes findings from a multi-tiered research approach, combining extensive secondary research with principal interviews across key stakeholder cohorts. The secondary research phase entailed a thorough review of peer-reviewed journals, regulatory filings, proprietary patent databases, and conference proceedings to map technological advancements and evolving clinical protocols.

Primary research comprised structured discussions and in-depth interviews with over 50 implantologists, laboratory directors, procurement specialists, and distribution executives. These engagements provided qualitative context on adoption barriers, preference hierarchies, and procurement dynamics. All insights were triangulated through data cross-validation, ensuring consistency between end-user feedback and supply-side intelligence.

An advisory board of subject matter experts-including biomechanics researchers, material scientists, and regulatory consultants-reviewed preliminary drafts to validate technical assumptions, refine segmentation frameworks, and confirm alignment with current clinical standards. Analytical rigor was further reinforced by iterative quality checks and data integrity assessments, culminating in a comprehensive synthesis that underpins all strategic insights and recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Abutment Implants market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Abutment Implants Market, by Material

- Abutment Implants Market, by Product Type

- Abutment Implants Market, by End User

- Abutment Implants Market, by Connection Type

- Abutment Implants Market, by Distribution Channel

- Abutment Implants Market, by Region

- Abutment Implants Market, by Group

- Abutment Implants Market, by Country

- United States Abutment Implants Market

- China Abutment Implants Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Concluding Observations Emphasizing the Strategic Imperatives, Technological Advancements, and Collaborative Opportunities Shaping the Abutment Implant Future

The abutment implant sector stands at a critical juncture, characterized by material diversification, digital workflow integration, and shifting procurement paradigms shaped by global trade policies. Recent advancements in monolithic and multi-layer zirconia, alongside sophisticated CAD/CAM and 3D printing techniques, have elevated clinical possibilities and patient satisfaction. Simultaneously, evolving regulatory frameworks and cumulative tariff burdens continue to influence supply chain strategies and cost structures.

Segmentation analyses reveal that titanium and zirconia materials cater to distinct clinical needs, while custom and stock product types offer trade-offs between speed and personalization. End users-from dental clinics to specialty centers-exhibit unique procurement preferences, and distribution channels are fragmenting as online platforms gain traction. Regionally, the Americas lead with established digital ecosystems, EMEA balances regulatory rigor with emerging market potential, and Asia-Pacific drives rapid adoption through rising healthcare investments.

Key industry players are responding with targeted R&D, strategic partnerships, and expanded digital offerings, underscoring the competitive imperative to align product portfolios with clinician workflows. Actionable recommendations call for investments in local manufacturing resilience, advanced digital integration, and material innovation pipelines. Together, these observations crystallize the strategic roadmap for stakeholders aiming to navigate the dynamic abutment implant landscape and achieve sustainable growth.

Driving Your Next Strategic Move to Optimize Clinical Outcomes and Business Growth with Exclusive Abutment Implant Market Research from Ketan Rohom

To access the full depth of insights, detailed regional analyses, and strategic roadmaps that can elevate your organization’s competitive positioning, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan is ready to guide you through the report’s key findings, answer any questions about customization or licensing options, and facilitate a seamless purchasing process. Empower your team with the most comprehensive abutment implant market research available today.

- How big is the Abutment Implants Market?

- What is the Abutment Implants Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?