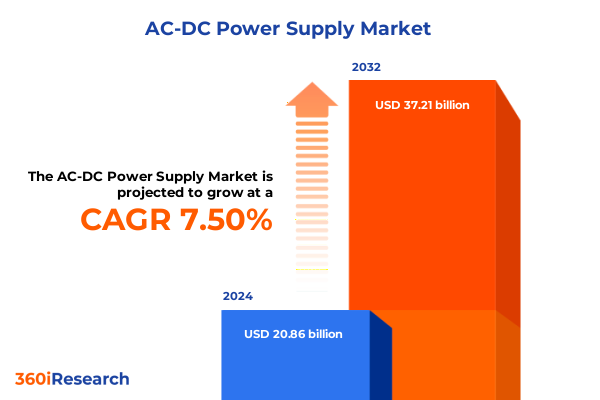

The AC-DC Power Supply Market size was estimated at USD 22.43 billion in 2025 and expected to reach USD 23.92 billion in 2026, at a CAGR of 7.49% to reach USD 37.21 billion by 2032.

Setting the Stage for Future-Ready AC-DC Power Supply Solutions That Define Performance, Reliability, and Evolution in Modern Electrified Systems

The AC-DC power supply landscape underpins virtually every modern electronic and electrical system, serving as the critical interface that converts alternating current from power grids into the direct current demanded by devices and applications. Robust performance, stringent safety requirements, and evolving regulatory environments together shape the design, deployment, and optimization of these power supplies. In recent years, the push for greater energy efficiency, the proliferation of digital power management, and the rise of new semiconductor materials have spurred manufacturers to rethink conventional architectures. Consequently, stakeholders across automotive, consumer electronics, healthcare, industrial, and telecommunications sectors must stay informed of both incremental improvements and disruptive innovations.

Against this backdrop, this executive summary provides a concise yet comprehensive overview of the forces shaping the AC-DC power supply market and highlights the strategic considerations that decision-makers should weigh. By introducing the key thematic areas-transformative technological shifts, the impact of recent United States tariffs, segmentation dynamics, and regional variations-this section sets the stage for an in-depth exploration. As organizations around the globe grapple with supply chain complexity and intensifying competition, an informed understanding of these fundamental drivers becomes indispensable for crafting resilient, future-ready power solutions.

Navigating the Convergence of Energy Efficiency Regulations, Digital Power Architectures, and Sustainable Practices Reshaping AC-DC Power Supply Dynamics

Rapid advancements in semiconductor technology, particularly the transition from silicon-based components to gallium nitride and silicon carbide devices, are redefining the efficiency and power density achievable in AC-DC converters. At the same time, regulatory mandates worldwide are raising the bar for energy consumption and harmonics performance, compelling original equipment manufacturers to integrate digital control loops and real-time monitoring capabilities. In parallel, the growing demand for electrification in transportation and renewable energy systems has driven the development of highly modular and scalable architectures, enabling manufacturers to tailor power solutions across a broad spectrum of voltages and power ratings.

Moreover, the convergence of telecommunications and edge computing has placed unprecedented emphasis on power reliability and thermal management, catalyzing the adoption of sophisticated cooling techniques and predictive maintenance frameworks. These transformative shifts extend beyond purely technical considerations, influencing business models as companies explore subscription-based maintenance services and collaborative R&D initiatives. Thus, the interplay between technological breakthroughs, sustainability objectives, and evolving customer expectations is fundamentally reshaping how AC-DC power supplies are designed, produced, and supported throughout their lifecycle.

Unpacking the Complex Ripple Effects of 2025 United States Tariff Policies on Supply Chain Costs, Vendor Strategies, and Competitive Positioning in AC-DC Markets

The United States’ imposition of revised tariff schedules in early 2025 has introduced a new layer of complexity to the AC-DC power supply value chain. Import duties applied to key components and subassemblies have elevated landed costs, leading many manufacturers to revisit sourcing strategies and explore nearshoring options. In response, supply chain managers are engaging in proactive vendor diversification, negotiating long-term contracts with clauses that mitigate upward price volatility, and leveraging strategic stockpiling to hedge against future tariff escalations.

Beyond cost implications, these tariffs have accelerated conversations around domestic manufacturing incentives and public–private partnerships aimed at strengthening local production capabilities. Some leading power module providers have already announced investments in U.S.-based facilities to capitalize on government rebate programs and secure access to skilled labor. At the same time, end users are recalibrating total cost of ownership analyses to account for potential supply interruptions and regional regulatory uncertainties. Collectively, these dynamics suggest that while short-term pricing pressures will persist, they may also serve as a catalyst for greater resilience and innovation within the domestic AC-DC power supply ecosystem.

Dissecting Output Power, Voltage, Input and Mounting Configurations to Reveal Pivotal Insights Driving Growth in Diverse AC-DC Power Supply Market Segments

A nuanced understanding of output power classifications reveals distinct opportunities and challenges across the high, medium, and low power segments. High power configurations, often deployed in electric vehicle charging infrastructure and industrial process control, demand robust thermal management and redundancy features, whereas medium power solutions dominate telecommunications equipment and advanced healthcare devices that require a balance between efficiency and form factor. Meanwhile, low power units are increasingly optimized for consumer electronics, where compact footprints and ultra-low standby losses are paramount.

Voltage segmentation offers further granularity. Units delivering 5 volts continue to underpin a vast array of laptop chargers and portable electronics, while 12-volt modules are prevalent within automotive infotainment and certain consumer appliances. The emergence of higher voltage tiers such as 24 and 48 volts aligns closely with industrial factory automation and backbone telecommunications systems, where distribution efficiency and conductor sizing become critical design parameters. Complementing these distinctions, the input type segmentation differentiates single phase architectures suited for residential and light commercial applications from three phase topologies that excel in data center and heavy industrial environments.

Mounting preferences also carry strategic implications: DIN rail platforms facilitate streamlined installation in control cabinets, open frame modules integrate seamlessly into embedded systems, and wall mount configurations offer versatility for standalone deployments. Cooling methodologies further delineate market pathways, with forced air solutions addressing high-density, high-power contexts, liquid cooling emerging as a frontier in data center and telecom base station deployments, and natural convection remaining the choice for low-noise, low-power applications. Layering these technical criteria onto end use industry demands-from automotive subsegments such as advanced driver assistance and electric vehicles to telecommunications deployments spanning base stations and satellite communication-enables a comprehensive view of where innovation and investment should be prioritized.

This comprehensive research report categorizes the AC-DC Power Supply market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Output Power

- Output Voltage

- Input Type

- Mounting Type

- Cooling Method

- End Use Industry

Comparing Regional Drivers Across Americas, Europe Middle East & Africa, and Asia-Pacific to Illuminate Distinct Demand Patterns in AC-DC Power Supply Adoption

The Americas region continues to anchor global demand for AC-DC power supplies, with the United States leading investment in electric vehicle charging infrastructure and hyperscale data centers. Canada’s growth in renewable energy integration and Latin America’s gradual embrace of industrial automation underscore a varied landscape where energy policy and digital transformation converge. Shifting northward, enterprises are increasingly seeking localized supply chains to mitigate cross-border tariff exposure and enhance service responsiveness.

In Europe, stringent energy efficiency directives and harmonized regulatory frameworks are driving manufacturers toward next-generation low-loss designs, while Middle Eastern countries are directing investment into telecom infrastructure to support digital economies. Across Africa, telecom operators are exploring off-grid power solutions in response to grid instability and expanding network coverage. Transitioning to Asia-Pacific, surging demand in Mainland China and India reflects the rapid expansion of consumer electronics manufacturing, large-scale solar installations, and 5G network rollouts. Japan and South Korea are distinguished by early adoption of advanced semiconductor materials and high-reliability modules for mission-critical applications.

Regional variations in regulatory landscapes, infrastructure maturity, and end user priorities thus inform the geographic deployment of AC-DC power supply architectures. Stakeholders must tailor product roadmaps and go-to-market strategies to these nuanced drivers to capture market share and foster long-term relationships.

This comprehensive research report examines key regions that drive the evolution of the AC-DC Power Supply market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Market-Leading Enterprises Transforming AC-DC Power Supply Through Innovative Technologies, Strategic Alliances, and Operational Excellence

Leading manufacturers are leveraging diverse strategies to maintain competitive advantage and drive innovation across the AC-DC power supply sector. Enterprise H designs modular, scalable platforms with integrated digital telemetry, enabling clients to implement real-time performance monitoring and predictive maintenance. Company J, by contrast, focuses on proprietary GaN-based topologies that deliver superior efficiency and power density, targeting high-growth sectors such as electric vehicles and 5G infrastructure. Initiative K exemplifies a collaborative approach, forging strategic alliances with semiconductor vendors and system integrators to co-develop solution suites tailored for industrial automation.

Simultaneously, several key players have embarked on geographic expansion, establishing design centers and production facilities closer to major end markets to reduce lead times and reduce tariff exposure. Value-added services, such as extended warranty programs and customized thermal profiling, are increasingly used to differentiate product portfolios and deepen customer engagement. Through mergers and acquisitions, select firms seek to broaden their technology stack, integrating capabilities in power management ICs, advanced cooling systems, and embedded software. Collectively, these varied approaches illustrate a competitive environment where proactive R&D investment and agile supply chain management are critical to sustaining market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the AC-DC Power Supply market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AcBel Polytech Inc.

- Advanced Energy Industries Inc.

- Artesyn Embedded Technologies

- Bel Fuse Inc.

- Cincon Electronics Co. Ltd.

- Cosel Co. Ltd.

- CUI Inc.

- Delta Electronics Inc.

- Ericsson Power Modules AB

- Friwo Gerätebau GmbH

- FSP Group

- GlobTek Inc.

- Lambda Americas Inc.

- Lite-On Technology Corporation

- MEAN WELL Enterprises Co. Ltd.

- Murata Manufacturing Co. Ltd.

- Power Systems Inc.

- PULS GmbH

- RECOM Power GmbH

- TDK-Lambda Corporation

- Traco Power AG

- Vicor Corporation

- XP Power Ltd.

Strategic Imperatives for Industry Leaders to Capitalize on Technological Advancements, Regulatory Landscapes, and Evolving Customer Requirements in AC-DC Power Supply

To capitalize on the momentum generated by emerging materials and modular architectures, industry leaders should prioritize R&D initiatives that accelerate the integration of gallium nitride and silicon carbide devices into mainstream power converter designs. In tandem, sourcing strategies must evolve to incorporate dual-sourcing arrangements and nearshoring partnerships, thereby insulating operations from geopolitical disruptions and tariff fluctuations. Equally important is the adoption of digital power management platforms that enable remote monitoring, firmware over-the-air updates, and data-driven lifecycle optimization.

Moreover, organizations must engage proactively with regulatory bodies and standards committees to shape energy efficiency protocols and interoperability frameworks. Such participation not only ensures early visibility into forthcoming requirements but also positions companies as trusted contributors to industry best practices. To differentiate in crowded end use verticals, product roadmaps should emphasize domain-specific customization, whether through automotive-grade isolation features or healthcare-compliant electrical safety certifications. Finally, forging collaborative relationships with system integrators and channel partners will facilitate bundled solutions that address comprehensive application needs, elevating the value proposition and driving market penetration.

Outlining Rigorous Methodological Approaches Integrating Primary Research, Secondary Data Validation, and Expert Consensus to Ensure Robust AC-DC Power Supply Analysis

The research methodology underpinning this report combines rigorous primary and secondary approaches to deliver a balanced and validated perspective. Primary research entailed in-depth interviews with senior executives, design engineers, and procurement heads across OEMs, Tier 1 system integrators, and power module manufacturers. These discussions provided nuanced insights into technology adoption timelines, pain points in supply chain orchestration, and evolving end user expectations.

Secondary research sources included technical whitepapers from semiconductor consortia, regulatory filings, international energy efficiency directives, and patent databases, offering quantitative and qualitative data to triangulate findings. In addition, industry conferences and workshops served as platforms for real-time trend confirmation and competitor benchmarking. Data validation protocols involved cross-referencing vendor claims with third-party test results and soliciting peer reviews from independent subject matter experts. Together, these layered methodologies ensure the conclusions and recommendations articulated in this report reflect both the strategic intent and operational realities of the global AC-DC power supply market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our AC-DC Power Supply market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- AC-DC Power Supply Market, by Output Power

- AC-DC Power Supply Market, by Output Voltage

- AC-DC Power Supply Market, by Input Type

- AC-DC Power Supply Market, by Mounting Type

- AC-DC Power Supply Market, by Cooling Method

- AC-DC Power Supply Market, by End Use Industry

- AC-DC Power Supply Market, by Region

- AC-DC Power Supply Market, by Group

- AC-DC Power Supply Market, by Country

- United States AC-DC Power Supply Market

- China AC-DC Power Supply Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Summarizing Critical Market Trends, Strategic Insights, and Future Imperatives to Guide Stakeholders Through the Evolving AC-DC Power Supply Ecosystem

As the AC-DC power supply sector pivots toward higher efficiency, digital integration, and localized manufacturing, stakeholders must navigate a multifaceted landscape of technological advancements, regulatory imperatives, and shifting supply chain paradigms. Each of the discussed segments-from output power classifications to mounting configurations-reveals unique vectors for innovation, while regional and tariff-driven dynamics underscore the importance of strategic agility. Leading companies are already laying the groundwork through targeted R&D, strategic alliances, and expanded service offerings, setting new benchmarks for performance and reliability.

In conclusion, the confluence of advanced semiconductor materials, sustainability mandates, and geopolitical considerations has ushered in a transformative era for AC-DC power solutions. Organizations that proactively embrace these trends-through rigorous technology assessment, collaborative policy engagement, and customer-centric design-will be best positioned to capture value and drive long-term growth. This executive summary serves as a roadmap for stakeholders to evaluate emerging opportunities, refine strategic priorities, and forge resilient pathways forward in an increasingly complex global market.

Engage with Ketan Rohom to Secure Comprehensive AC-DC Power Supply Analysis and Propel Your Strategic Initiatives with Expertly Curated Market Intelligence

To obtain unparalleled visibility into the evolving AC-DC power supply landscape and empower your strategic decision-making, connect directly with Ketan Rohom, Associate Director of Sales & Marketing. Ketan Rohom combines deep market expertise with a commitment to client success, offering tailored consultations that align with your organizational priorities and technical requirements. Engaging with Ketan ensures you not only receive a comprehensive report packed with critical insights and actionable recommendations but also benefit from personalized guidance on implementing findings to drive growth, mitigate risk, and accelerate innovation.

Reach out to Ketan Rohom to secure your copy of the full AC-DC power supply market research report and unlock the in-depth analysis, executive summaries, and strategic frameworks necessary to stay at the forefront of industry developments. Act now to transform data into a competitive advantage and position your enterprise for sustained leadership in a rapidly evolving market ecosystem.

- How big is the AC-DC Power Supply Market?

- What is the AC-DC Power Supply Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?