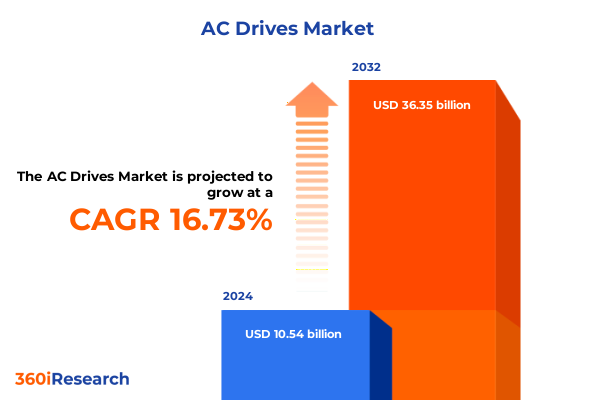

The AC Drives Market size was estimated at USD 12.04 billion in 2025 and expected to reach USD 13.76 billion in 2026, at a CAGR of 17.09% to reach USD 36.35 billion by 2032.

Setting the Stage for a Thorough Examination of AC Drives Market Dynamics and Emerging Technological Drivers Inspiring Industry Evolution

AC drives, also known as variable frequency drives or inverters, have become the cornerstone of modern motor control, enabling precise speed regulation, enhanced energy efficiency, and seamless integration into automated systems. As electrification and digital transformation sweep across manufacturing, infrastructure, and commercial sectors, AC drives are evolving beyond mere power conversion devices to become intelligent control hubs that deliver real-time data and predictive insights. Fundamental shifts in regulatory frameworks, sustainability mandates, and customer expectations are driving manufacturers to innovate at an unprecedented pace, embedding advanced features such as embedded IoT connectivity, cloud-based monitoring, and adaptive control algorithms.

In this context, an informed understanding of the AC drives landscape is essential for decision-makers aiming to navigate complexity and capitalize on emerging opportunities. The following executive summary provides a structured overview of market dynamics, technological enablers, regulatory impacts, and competitive forces. It offers stakeholders a concise yet comprehensive roadmap for aligning product portfolios, optimizing supply chains, and implementing growth strategies that respond to rising demands for efficiency, reliability, and data-driven performance optimization. By setting the stage for deeper analysis, this introduction underscores the critical role AC drives play in advancing industrial productivity and sustainability initiatives worldwide.

Uncovering the Transformative Shifts Redefining the AC Drives Landscape in Response to Digitalization and Automation Demands

In recent years, the AC drives sector has undergone a profound transformation driven by converging forces of digitalization, sustainability, and automation. The integration of smart sensors and advanced analytics into drive platforms has shifted the industry toward predictive maintenance models, reducing unplanned downtime and optimizing uptime across production lines. At the same time, the proliferation of Industry 4.0 frameworks has redefined interoperability standards, compelling manufacturers to adopt open communication protocols and software-driven architectures that facilitate seamless data exchange between drives, controllers, and enterprise systems.

Concurrently, global emphasis on carbon reduction and energy efficiency has spurred the development of power electronics with ever-higher conversion efficiencies and reduced harmonic distortion. Government incentives and tighter efficiency regulations have prompted accelerated adoption of medium voltage drives in heavy industry, while variable frequency drives featuring regenerative braking and energy recuperation capabilities are becoming ubiquitous in renewable energy applications and electric transportation infrastructure. Taken together, these transformative shifts are not only reshaping product roadmaps but also redefining value propositions, as suppliers compete to deliver holistic solutions that combine hardware, software, and service offerings in a unified ecosystem.

Evaluating the Cumulative Impact of Recent United States Tariff Measures Implemented in 2025 on the AC Drives Sector

The United States’ tariff regime enacted in early 2025 has introduced significant headwinds for AC drives manufacturers and end users, reshaping supply chains and pricing dynamics. Tariffs imposed on certain imported power electronic subassemblies have prompted companies to reassess their sourcing strategies, with many accelerating efforts to localize production of critical components or secure alternative suppliers in tariff-exempt regions. Heightened costs of raw materials and semi-finished assemblies have led to upward pressure on drive prices, challenging suppliers to mitigate impacts through design optimizations and value engineering.

Beyond direct import levies, ancillary consequences have emerged as upstream suppliers of semiconductor devices and power modules recalibrate their own supply networks in response to broader trade tensions. Some manufacturers are exploring vertically integrated models to bypass tariff exposure, investing in in-house assembly capabilities for key drive components. Simultaneously, collaborative arrangements with North American contract manufacturers are gaining traction as a means to navigate regulatory complexity. For end users, these developments underscore the importance of building supply chain resilience and maintaining clear visibility into cost structures to manage the evolving landscape of trade policy risks.

Revealing Key Segmentation Insights by Voltage Phase Configuration End Use Industry Sales Channels Power Control and Speed Ranges

A nuanced understanding of market segmentation is essential to tailor product strategies and capture value across diverse applications and customer profiles. Voltage classification provides one of the primary lenses, with low voltage drives dominating commercial and light industrial settings due to their flexibility and lower initial investment requirements, while medium voltage drives are gaining ground in heavy process industries seeking higher power handling and improved energy efficiency. Phase configuration further differentiates applications, as single phase drives remain prevalent in residential and small commercial installations where simplicity and cost-effectiveness are priorities, whereas three phase drives serve as the backbone of industrial automation and large-scale infrastructure projects requiring robust torque control and smooth performance at higher capacities.

Meanwhile, end use industry segmentation highlights distinct value drivers across commercial, industrial, and residential markets. Commercial installations focus on HVAC efficiency and building automation, industrial clients prioritize process reliability and predictive service models, and residential users increasingly adopt variable frequency drives in home automation and energy management systems. Sales channel segmentation reveals direct sales approaches thriving in high-touch, solution-oriented markets, while distribution networks continue to excel in broader reach and aftermarket support. Power range differentiation shows that drives within the 0 to 75 kilowatt bracket capture the largest volume in light-duty applications, mid-range drives spanning 75 to 375 kilowatts are preferred for medium industrial systems, and high-power units above 375 kilowatts serve heavy infrastructure and process industries. Intriguingly, control method preferences vary by sector: servo mechanisms dominate precision manufacturing, variable frequency methods are widely adopted for general purpose speed regulation, and vector control technologies offer superior performance for demanding torque applications. Lastly, speed range segmentation underlines how applications with lower speed demands up to 500 rpm prioritize energy savings, mid-range systems between 500 and 1500 rpm balance throughput and control, and high-speed drives in excess of 1500 rpm support specialized processes requiring rapid acceleration and high productivity.

This comprehensive research report categorizes the AC Drives market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Phase

- Power Range

- Control Method

- Speed Range

- End Use Industry

- Sales Channel

Assessing Regional Variations and Growth Drivers Across the Americas Europe Middle East Africa and Asia Pacific for AC Drives

Regional dynamics play a pivotal role in shaping the AC drives market, with each geographic cluster presenting unique drivers, challenges, and growth trajectories. In the Americas, the United States leads with substantial investments in renewable energy projects, advanced manufacturing initiatives, and electrification of transportation, creating robust demand for both low and medium voltage drives. Mexico is emerging as a manufacturing hub due to nearshoring trends, while Brazil’s expanding industrial base drives uptake in heavy-duty process industries. Across the European, Middle Eastern, and African corridor, stringent environmental regulations and energy efficiency mandates are accelerating the replacement of legacy systems with modern drive solutions. Western Europe remains at the forefront of advanced drive integration, while the Middle East’s infrastructure investments and Africa’s mining sector expansion offer fertile ground for growth.

Turning to the Asia-Pacific region, rapid industrialization in countries such as China and India continues to fuel demand, particularly for cost-optimized low voltage drives. Japan and South Korea distinguish themselves through high adoption of smart factory frameworks and domestic innovation in power electronics. Southeast Asian nations are increasingly investing in automation to enhance competitiveness, and Australia’s mining and resource industries contribute significantly to medium voltage drive deployments. These regional insights emphasize the importance of tailoring go-to-market strategies to local regulatory environments, supply chain infrastructures, and end user priorities.

This comprehensive research report examines key regions that drive the evolution of the AC Drives market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Companies Driving Innovation Strategic Partnerships and Competitive Dynamics within the AC Drives Industry

The competitive landscape of the AC drives market is shaped by a mix of global conglomerates and specialized regional players, each leveraging unique strengths to advance their market position. Industry leaders are prioritizing research and development to introduce more efficient power conversion architectures, integrate advanced control algorithms, and embed IoT capabilities for remote condition monitoring. Strategic partnerships between technology firms and component manufacturers are delivering innovative modular platforms that reduce time to market and enable scalable production.

Furthermore, merger and acquisition activity is consolidating capabilities across the value chain, with some companies acquiring software specialists to bolster digital service offerings, while others are targeting niche drive manufacturers to expand their product breadth in specific voltage or power segments. Regional firms, particularly in the Asia-Pacific, are competing aggressively on cost and localized support, leveraging domestic supply networks and government incentives. Additionally, aftermarket service providers are emerging as key competitors, offering retrofit solutions, performance audits, and subscription-based maintenance models that extend lifecycle value for end users. These multifaceted competitive strategies underscore the importance of agility, innovation, and customer-centric solutions in maintaining and growing market share.

This comprehensive research report delivers an in-depth overview of the principal market players in the AC Drives market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- CG Power & Industrial Solutions Ltd.

- Danfoss A/S

- Dart Controls, Inc

- Delta Electronics, Inc.

- ElectroCraft, Inc.

- Emerson Electric Co.

- Finish Thompson Inc.

- Fuji Electric Co., Ltd.

- Harmonic Drive LLC

- Hiconics Drive Technology Co. Ltd

- Honeywell International Inc.

- Johnson Controls International PLC

- Kirloskar Electric Company

- Mitsubishi Electric Corporation

- Nidec Corporation

- Parker Hannifin Corporation

- Rockwell Automation, Inc.

Formulating Actionable Strategic Recommendations for Industry Leaders to Capitalize on Emerging Trends and Mitigate Market Disruptions

For industry leaders seeking to capitalize on evolving market conditions, a series of targeted strategic actions can ensure sustained growth and resilience. Prioritizing investment in modular, scalable drive architectures will enable rapid customization while maintaining cost efficiencies across low and medium voltage segments. Strengthening supply chain resilience through diversified sourcing and strategic partnerships with local contract manufacturers will mitigate the impact of trade policy fluctuations.

Moreover, embedding advanced analytics and connectivity features within drive platforms can unlock new service revenue streams through predictive maintenance offerings and performance optimization contracts. Cultivating strong relationships with end users via collaborative pilot programs and tailored training initiatives will foster deeper customer loyalty and facilitate seamless adoption of complex automation solutions. Leveraging regional market intelligence to align product development roadmaps with specific regulatory requirements and energy efficiency targets will further enhance competitive positioning. Finally, forging alliances with industry consortia and participating in standards development can shape future interoperability frameworks, ensuring that your organization remains at the forefront of technological innovation and policy evolution.

Detailing the Robust Research Methodology Employed Including Data Collection Approaches and Analytical Frameworks Applied

This research combined rigorous primary and secondary methodologies to ensure comprehensive and reliable insights. Primary data collection involved structured interviews with senior executives at drive manufacturers, distributors, OEMs, and end users across key industries. These interviews provided qualitative perspectives on technological priorities, purchasing criteria, and competitive dynamics. Concurrently, a detailed survey of procurement and engineering professionals quantified adoption rates, anticipated upgrade cycles, and emerging feature requirements.

Secondary data sources included trade association publications, regulatory filings, and specialized engineering journals to validate technology trends and policy impacts. Supply chain analysis was performed through in-depth mapping of component flows and tariff exposures, supplemented by expert consultations with logistics and procurement specialists. The research team applied robust triangulation techniques, cross-referencing multiple data points to minimize bias and confirm consistency. Advanced analytical frameworks, including Porter’s Five Forces, SWOT analysis, and scenario modeling, were leveraged to identify strategic imperatives. All findings were peer reviewed by independent technical advisors to ensure accuracy and applicability for decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our AC Drives market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- AC Drives Market, by Type

- AC Drives Market, by Phase

- AC Drives Market, by Power Range

- AC Drives Market, by Control Method

- AC Drives Market, by Speed Range

- AC Drives Market, by End Use Industry

- AC Drives Market, by Sales Channel

- AC Drives Market, by Region

- AC Drives Market, by Group

- AC Drives Market, by Country

- United States AC Drives Market

- China AC Drives Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1272 ]

Synthesizing Critical Findings into a Cohesive Conclusion Emphasizing Strategic Implications for Stakeholders in AC Drives

The review of AC drives market dynamics reveals a sector at the intersection of technological innovation, regulatory change, and evolving customer expectations. Intelligent drive platforms are reshaping how motors are controlled, monitored, and maintained, while energy efficiency imperatives and trade policy headwinds are redefining cost structures and supply chain strategies. Segmentation analyses demonstrate that no single solution fits all needs; instead, success lies in offering tailored drive configurations that address specific voltage, phase, power, and control requirements.

Regional perspectives highlight the necessity of local market expertise, as growth drivers, regulatory frameworks, and infrastructure investments vary significantly across the Americas, Europe Middle East Africa, and Asia-Pacific. Competitive analysis underscores that leading players are those who integrate hardware excellence with software-driven services, leverage strategic alliances to broaden capabilities, and maintain agility in navigating tariff and regulatory complexities. Ultimately, stakeholders that align their product roadmaps, partnership strategies, and operational models with these insights will be best positioned to capture emerging opportunities and drive long-term value creation in the AC drives market.

Discover How Partnering with Associate Director Ketan Rohom Can Unlock Comprehensive AC Drives Market Intelligence and Drive Strategic Success

To explore the full breadth of insights, detailed data tables, proprietary analyses, and actionable market intelligence on AC drives, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing. Engaging with Ketan will unlock access to a comprehensive market research report that guides strategic decision-making in an increasingly dynamic and competitive environment. Connect with Ketan to discuss tailored research packages, in-depth region-specific add-ons, custom scenario modeling, and ongoing advisory support designed to address your organization’s unique challenges and objectives. Secure your copy of the AC Drives market research report today to gain a competitive edge through rigorous analysis and expert recommendations from industry professionals.

- How big is the AC Drives Market?

- What is the AC Drives Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?