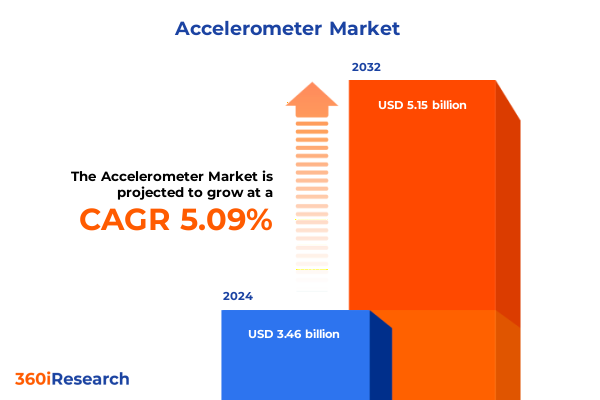

The Accelerometer Market size was estimated at USD 3.63 billion in 2025 and expected to reach USD 3.80 billion in 2026, at a CAGR of 5.14% to reach USD 5.15 billion by 2032.

Unveiling the Fundamental Importance of Advanced Accelerometer Technologies Revolutionizing Industrial and Consumer Applications in a Data-Driven World

Accelerometers are precision sensors that measure acceleration forces, offering invaluable data that underpins motion detection, orientation control, and vibration monitoring within diverse applications. From guiding inertial navigation systems in aerospace and defense platforms to enabling stability control in modern vehicles, these sensors form a critical technological foundation. Moreover, accelerometers have become ubiquitous in consumer electronics, powering user interface experiences in smartphones, wearables, and gaming controllers. Transitioning into Industrial Internet of Things (IIoT) environments, the adoption of accelerometers for machine health monitoring and predictive maintenance further underscores their transformative influence across manufacturing landscapes.

Transitioning to compact, cost-efficient designs has been made possible by advances in Micro-Electro-Mechanical Systems (MEMS) fabrication techniques, which allow accelerometers to be produced at scale with highly consistent performance characteristics. These MEMS accelerometers leverage silicon-based microstructures that deflect under applied forces, converting mechanical displacement into measurable electrical signals. The integration of piezoresistive and capacitive sensing modalities within MEMS platforms has expanded the functional scope of accelerometers, yielding devices that excel in both high-precision and high-g applications. Notably, North America maintains a leadership position in the accelerometer sector, buoyed by robust defense spending and a dense network of semiconductor innovators, while Asia-Pacific continues to accelerate adoption driven by booming consumer electronics and automotive markets

Emerging Innovations and Technology Convergences Transforming the Global Accelerometer Landscape Beyond Traditional Motion Sensing Applications

Artificial intelligence (AI) and machine learning (ML) have emerged as game-changing enablers in the evolution of accelerometer technology. By embedding signal-processing algorithms directly onto sensor hardware, accelerometers now perform real-time event classification, anomaly detection, and predictive analytics at the edge. This integration empowers industrial operators to preemptively identify equipment wear, forestalling potential failures and reducing unplanned downtime. In automotive safety systems, AI-enhanced accelerometers facilitate more accurate crash detection and adaptive airbag deployment strategies. These advancements are catalyzing a shift from reactive maintenance models toward condition-based monitoring frameworks that deliver substantial cost savings and operational efficiencies.

Simultaneously, the rapid expansion of the Internet of Things (IoT) ecosystem has fueled demand for ultra-low-power, miniaturized accelerometers that seamlessly integrate into wireless sensor networks. As 5G networks mature, edge computing architectures leverage accelerometer-generated data to support smart infrastructure applications, including intelligent traffic management, remote patient monitoring, and immersive augmented reality experiences. The convergence of low-latency connectivity and edge AI accelerometers enables continuous, high-fidelity motion tracking without burdening centralized data centers. This synergy of IoT proliferation and 5G edge capabilities is transforming raw acceleration data into actionable insights with unprecedented speed and scale.

Analyzing the Comprehensive Impact of 2025 United States Tariff Adjustments on the Accelerometer Supply Chain and Manufacturing Economics

On January 1, 2025, the Office of the United States Trade Representative implemented a 50% tariff on semiconductors imported from China, effectively doubling the previous rate under Section 301 of the Trade Act of 1974. This targeted increase directly impacts the cost structure of MEMS accelerometer manufacturers who rely on Chinese wafer foundries and packaging facilities. Additionally, tariffs on permanent magnets and other critical minerals were scheduled to rise by 25% in 2026, signaling cost pressures on high-g and piezoelectric accelerometer variants that utilize rare earth elements for sensitivity enhancement. These scheduled adjustments in 2025 and beyond are reshaping sourcing strategies and manufacturing footprints for sensor suppliers globally.

In parallel, a comprehensive Executive Order issued on April 2, 2025, established a baseline 10% tariff on all imports, with higher country-specific duties applied to nations with significant trade imbalances. Notably, certain categories-such as semiconductors, electric vehicles, and selected automation components-remain subject to additional duties, creating layered cost burdens for accelerometer supply chains. Exemptions are granted for U.S.-origin content exceeding 20% of the product’s value, prompting firms to revise bill-of-materials strategies and invest more heavily in domestic fabrication capabilities. The unpredictability of these layered tariffs has necessitated dynamic procurement planning and closer collaboration with customs specialists to mitigate financial risks.

Collectively, the cumulative effect of targeted semiconductor duties and universal baseline tariffs has spurred a wave of manufacturing reshoring and strategic diversification among accelerometer suppliers. Companies are exploring alternative foundry partnerships in Southeast Asia and Europe while accelerating capacity expansions within North America. These shifts aim to reduce exposure to tariff volatility, secure supply continuity, and capture incentives under domestic semiconductor incentive programs. In turn, efforts to regionalize production are expected to yield more resilient supply chains, albeit with initial capital outlays and transitional complexities that require careful execution and long-term planning.

Deriving Strategic Insights from Multidimensional Segmentation of the Accelerometer Market Across Industries, Technologies, and Channels

Understanding the complex interplay of end-use industries, sensor technologies, axes of measurement, output modalities, measurement ranges, and distribution channels offers a panoramic view of strategic growth pockets in the accelerometer arena. In aerospace defense, high-g piezoelectric accelerometers serve as critical inputs for missile guidance and flight instrumentation, while capacitive MEMS variants offer lightweight navigation support in unmanned aerial vehicles. The automotive sector bifurcates into navigation, safety, and stability control systems, with high-precision gyroscopic and accelerometric sensors fused for advanced driver assistance. Consumer electronics capitalize on wearables, tablets, and smartphones to demand increasingly compact, power-efficient accelerometers. The healthcare domain employs medical monitoring devices and wearable health trackers, requiring biocompatible sensor packaging and ultra-low-power operation. Industrial applications span machine health monitoring, robotics, and vibration analysis, emphasizing multi-axis, temperature-stable sensor designs.

Diving deeper into sensor technology reveals that MEMS accelerometers, whether capacitive or piezoresistive, dominate high-volume segments, while piezoelectric solutions find niche roles in environments demanding extreme shock tolerance. Three-axis sensors lead in multifunctional configurations, yet single and dual-axis devices remain indispensable for cost-sensitive or application-specific use cases. Regarding output type, analog accelerometers still serve legacy control systems, whereas digital interfaces facilitate seamless integration with modern microcontrollers and edge processors. Range-wise, sub-2g sensors match consumer and medical needs, mid-range devices address general-purpose industrial monitoring, and above-10g variants cater to automotive crash sensing and aerospace shock detection. Finally, distribution channels present a mix of direct OEM partnerships, aftermarket sales, distributor networks, and e-commerce platforms, each demanding tailored logistics, support structures, and pricing models.

This comprehensive research report categorizes the Accelerometer market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Sensor Technology

- Axis

- Output Type

- Measurement Range

- End Use Industry

- Distribution Channel

Key Regional Dynamics Shaping Accelerometer Adoption in the Americas, EMEA, and Asia-Pacific Markets with Distinct Industry Drivers

In the Americas, the United States and Canada continue to lead in accelerometer adoption, driven by heavy investments in aerospace and defense platforms, burgeoning electric vehicle production, and rapid uptake of smart manufacturing initiatives. Government incentives supporting semiconductor fabrication and domestic sensor assembly have reinforced regional supply security, while established distribution networks ensure broad availability of both analog and digital accelerometer solutions. Meanwhile, Latin American markets are witnessing gradual integration of vibration monitoring systems in oil and gas operations, though logistical and regulatory hurdles remain areas of focus.

Europe, Middle East & Africa (EMEA) display distinct adoption patterns shaped by mature automotive manufacturing hubs in Germany and the United Kingdom, advanced robotics clusters in Scandinavia, and growing smart city deployments across Gulf Cooperation Council nations. Regulatory mandates for enhanced vehicle safety features are accelerating MEMS accelerometer integration into pedestrian detection and collision avoidance systems. At the same time, Middle Eastern investments in high-tech industrial parks are creating new opportunities for sensor suppliers to collaborate with defense and healthcare innovators.

In Asia-Pacific, consumer electronics giants in China, Taiwan, South Korea, and Japan are the principal drivers of accelerometer demand, owing to massive smartphone, wearable, and tablet production volumes. Southeast Asian countries such as Vietnam and India are emerging as compelling manufacturing alternatives, combining supportive policy frameworks with competitive labor costs. Additionally, rapid expansion of industrial automation and renewable energy projects in Australia and Southeast Asia has intensified the need for high-reliability, multi-axis accelerometers for condition monitoring and predictive maintenance use cases.

This comprehensive research report examines key regions that drive the evolution of the Accelerometer market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading MEMS and Sensor Manufacturers Steering the Competitive Accelerometer Market with Strategic Investments and Acquisitions

A review of leading market participants reveals Bosch as the dominant MEMS sensor supplier, with a comprehensive portfolio spanning motion, environmental, and pressure sensors. The company’s smart sensor offerings have delivered consistent revenue growth through end-market diversification and intensified R&D investments in next-generation motion detection solutions. Broadcom and Qorvo remain influential in RF MEMS technologies, indirectly impacting accelerometer manufacturers by steering substrate and filter component availability in mobile and IoT devices. TDK InvenSense continues to maintain a solid position in consumer electronics motion sensors, benefitting from longstanding design wins in wearables and gaming peripherals.

Analog Devices, STMicroelectronics, TDK InvenSense, NXP Semiconductors, and Honeywell International constitute a core group of accelerometer-centric companies collectively setting performance benchmarks. Analog Devices is renowned for high-end inertial measurement units tailored to aerospace and defense applications, while STMicroelectronics has strengthened its MEMS portfolio through manufacturing partnerships and technology licensing. NXP Semiconductors and Honeywell International leverage their broader automotive and industrial automation footprints to embed accelerometers within holistic safety and control platforms. Murata Manufacturing, TE Connectivity, Kionix, and Sensonor further enhance competitive breadth by addressing specific niche applications, from wireless sensor networks to high-shock environments.

Notably, STMicroelectronics announced on July 24, 2025, the acquisition of a significant portion of NXP’s sensor business for up to $950 million. This transaction is expected to bolster STMicro’s MEMS-based sensor capabilities, particularly in automotive safety and industrial monitoring segments. The strategic move underscores the ongoing consolidation trend among semiconductor companies seeking to expand their accelerometer and MEMS portfolios at scale and enhance supply chain resilience amid shifting trade policies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Accelerometer market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Analog Devices, Inc.

- Dytran Instruments, Inc.

- Honeywell International Inc.

- Infineon Technologies AG

- Kionix, Inc.

- Kistler Group AG

- LITEF GmbH

- MEMSIC Inc.

- Micro‑chip Technology Inc.

- Murata Manufacturing Co., Ltd.

- NXP Semiconductors N.V.

- Omron Corporation

- ON Semiconductor Corp.

- Panasonic Corporation

- Robert Bosch GmbH

- Rockwell Automation, Inc.

- ROHM Co., Ltd.

- Safran Colibrys S.A.

- Seiko Epson Corporation

- Sensirion AG

- Silicon Sensing Systems Ltd.

- STMicroelectronics N.V.

- TDK Corporation

- Texas Instruments Incorporated

- TE Connectivity Ltd.

Actionable Strategic Imperatives for Industry Leaders to Accelerate Growth, Enhance Innovation, and Optimize Supply Chain Resilience

Industry leaders must cultivate supply chain agility by diversifying sourcing partnerships and ramping up flexible production networks that can seamlessly pivot between geographic regions. Collaboration with local semiconductor foundries, as well as investment in captive MEMS assembly facilities, can mitigate exposure to sudden tariff adjustments and logistical bottlenecks. Equally important is the establishment of advanced analytics frameworks to forecast component lead times, optimize inventory buffers, and facilitate rapid decision-making under uncertainty.

On the product innovation front, organizations should accelerate the integration of AI-driven signal processing and sensor fusion capabilities, enabling near-instantaneous interpretation of multi-axis acceleration data. By embedding tinyML engines and low-power processing cores directly within accelerometer packages, companies can deliver differentiated solutions that capture edge intelligence and generate higher value per device. This approach not only enhances end-user experience in applications such as real-time motion tracking and condition monitoring but also unlocks new revenue streams through software-enabled service offerings.

Furthermore, executives should prioritize strategic alliances across the IoT ecosystem to co-develop end-to-end platforms that seamlessly incorporate accelerometers with complementary sensor modalities, secure connectivity layers, and cloud-based analytics. Engaging in consortiums or industry working groups can ensure alignment on interoperability standards, accelerate certification cycles, and expand addressable market opportunities. Concurrently, forging partnerships with key end-use customers-ranging from automotive OEMs to medical device manufacturers-will enable co-creation of bespoke sensor modules that adhere to stringent regulatory and performance requirements.

Transparent Research Methodology Highlighting Rigorous Primary and Secondary Data Collection and Analytical Frameworks Ensuring Report Credibility

This research report synthesizes both primary and secondary data sources to deliver a robust analytical framework. Primary research includes in-depth interviews with senior executives at leading MEMS and sensor firms, expert insights from system integrators, and discussions with end-users across aerospace, automotive, healthcare, and industrial verticals. Secondary research encompasses a comprehensive review of public company filings, government trade policies, regulatory announcements, technical standards publications, and peer-reviewed academic journals.

Quantitative analyses are underpinned by a bottom-up segmentation approach, in which discrete product shipments and revenue contributions are mapped against end-use applications, sensor technologies, and geographic regions. Triangulation methods validate critical data points through cross-referencing of multiple data sets, including trade databases, customs statistics, and industry consortium reports. A dedicated panel of technical advisors corroborates key findings and provides forward-looking perspectives on emerging materials, process innovations, and integration architectures.

Rigorous quality control procedures, including data validation checks and sensitivity analyses, ensure the credibility and reproducibility of conclusions. The research team continuously monitors tariff updates, supply chain developments, and technological breakthroughs to maintain the report’s relevance throughout publication and beyond.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Accelerometer market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Accelerometer Market, by Sensor Technology

- Accelerometer Market, by Axis

- Accelerometer Market, by Output Type

- Accelerometer Market, by Measurement Range

- Accelerometer Market, by End Use Industry

- Accelerometer Market, by Distribution Channel

- Accelerometer Market, by Region

- Accelerometer Market, by Group

- Accelerometer Market, by Country

- United States Accelerometer Market

- China Accelerometer Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2385 ]

Concluding Reflections on Accelerometer Market Evolution and the Pivotal Role of Technological Advancements in Future Industry Trajectories

The accelerometer market has entered a new phase of technological maturation, characterized by the marriage of miniaturization, artificial intelligence, and resilient supply chain designs. As tariffs and trade dynamics continue to exert pressure on cost structures, strategic localization of manufacturing and dynamic sourcing will be indispensable to maintaining competitive advantage. Concurrently, the relentless pursuit of edge intelligence and low-power processing empowers sensor innovators to unlock richer data-driven applications across consumer electronics, automotive safety systems, and industrial automation frameworks.

Looking ahead, the fusion of accelerometer data with complementary sensor inputs-such as gyroscopes, magnetometers, and environmental sensors-will pave the way for integrated inertial measurement solutions that support autonomous logistics, precision agriculture, and smart infrastructure initiatives. Institutions that effectively blend hardware expertise with software-enabled analytics will capture disproportionate value and lead the next wave of sensor-driven digital transformations.

Ultimately, the accelerometer industry stands at the nexus of physical motion and digital intelligence, with the potential to revolutionize how machines monitor themselves, how vehicles navigate, and how end-users interact with technology. The insights presented in this report offer a comprehensive blueprint for navigating this dynamic landscape, reinforcing the imperative to innovate, collaborate, and adapt in order to thrive in the years to come.

Secure Your In-Depth Accelerometer Market Intelligence by Engaging with Ketan Rohom to Advance Strategic Decision Making and Investment Planning

As the complexities of supply chains, technological developments, and regulatory frameworks continue to evolve in the accelerometer market, having timely and comprehensive intelligence is more crucial than ever. By partnering with Ketan Rohom, you gain direct access to expert guidance that equips your team with deep-dive analyses, actionable insights, and bespoke support tailored to your strategic objectives. Engage in a collaborative dialogue to refine your market entry approaches, validate your investment criteria, and capitalize on emerging growth opportunities. Take the next decisive step toward securing your competitive edge by connecting with Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch) to obtain the full research report, designed to empower your organization with the clarity and confidence needed to drive impactful decisions and sustainable success.

- How big is the Accelerometer Market?

- What is the Accelerometer Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?