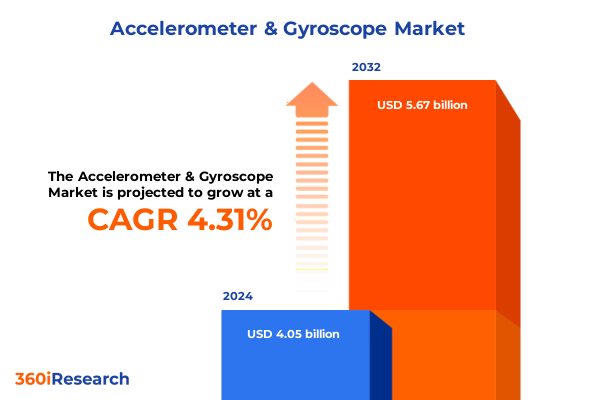

The Accelerometer & Gyroscope Market size was estimated at USD 4.23 billion in 2025 and expected to reach USD 4.52 billion in 2026, at a CAGR of 7.01% to reach USD 6.80 billion by 2032.

Unveiling the Critical Role of MEMS Accelerometers and Gyroscopes in Driving Next-Generation Motion Sensing Applications Across Key Industries Globally

In today’s rapidly evolving technological landscape, motion sensing has become a foundational capability across diverse industries, enabling applications that range from navigation assistance to predictive maintenance. Accelerometers and gyroscopes, the primary inertial sensors at the heart of this revolution, leverage microelectromechanical systems (MEMS) to translate physical movements such as acceleration, tilt, and rotation into electrical signals that can be processed in real time. Through shrinking form factors and simultaneous improvements in precision and power efficiency, these MEMS devices have transcended their early laboratory origins to become ubiquitous in consumer electronics, automotive systems, industrial machinery, healthcare equipment, and defence platforms.

Beyond basic motion detection, modern accelerometers and gyroscopes are integrated into complex sensor fusion architectures that combine data from multiple sources-including magnetometers, barometers, and global navigation satellite systems-to deliver high-fidelity orientation and positioning solutions. This convergence of technologies has unlocked new use cases in autonomous vehicles, industrial automation, wearable health monitors, and beyond. As such, understanding the technical foundations, application drivers, and ecosystem players behind MEMS accelerometer and gyroscope developments is critical for stakeholders seeking to capitalize on the next wave of growth and innovation in motion-based sensing solutions.

How Technological Advancements and Emerging Use Cases Are Revolutionizing Motion Sensing and Redefining Accelerometer and Gyroscope Applications Across Industries

Recent years have witnessed transformative shifts in both the technological underpinnings and end-user adoption of motion sensing solutions, fundamentally altering the accelerometer and gyroscope landscape. The proliferation of Internet of Things (IoT) networks and edge computing architectures has pushed sensor miniaturization and system-on-chip integration to new heights, enabling the embedding of multi-axis inertial measurement units (IMUs) into even the most size- and power-constrained devices. Consequently, consumer electronics and wearable applications now demand lower power budgets and higher dynamic ranges, compelling MEMS developers to refine process technologies and packaging techniques.

Simultaneously, the emergence of advanced driver assistance systems (ADAS) and the push towards vehicle autonomy have driven the integration of high-precision inertial sensors into next-generation automotive platforms. As automated features evolve from lane keeping to full self-driving capabilities, the reliance on robust sensor fusion algorithms that blend accelerometer and gyroscope data with radar, lidar, and camera inputs has increased exponentially. In parallel, industrial automation and robotics sectors are leveraging motion sensing for predictive maintenance, precise robotic guidance, and factory floor optimization. This confluence of automotive, industrial, and consumer advancements is accelerated further by artificial intelligence-based analytics, which can extract actionable insights from raw motion data and enhance real-time decision making.

Moreover, cross-industry collaborations and standardized interfaces are establishing common frameworks for sensor interoperability, while open-source development kits are democratizing access to high-performance inertial sensors. These trends underscore a broader movement towards system convergence, where MEMS accelerometers and gyroscopes are no longer standalone components but essential elements in comprehensive motion sensing ecosystems.

Assessing the Comprehensive Impact of 2025 United States Tariffs on the Global Accelerometer and Gyroscope Supply Chain and Cost Structures

In 2025, the United States implemented a series of targeted tariffs on imported semiconductor components, including key MEMS accelerometers and gyroscopes sourced from major manufacturing hubs. These levies, aimed at bolstering domestic production and securing critical supply chains, have resulted in elevated landed costs for foreign‐sourced sensors, prompting companies to reassess procurement strategies and inventory management. Margins have been compressed for original equipment manufacturers who rely heavily on low‐cost imports, particularly in high-volume consumer electronics and automotive segments where even marginal cost increases can significantly affect pricing competitiveness.

To mitigate these impacts, several stakeholders have explored reshoring initiatives and partnerships with domestic MEMS foundries, seeking to localize production and reduce exposure to tariff volatility. Additionally, some suppliers have adopted dual-sourcing strategies, splitting orders between domestic and international fabs to balance cost and continuity. While these adaptations offer resilience against trade policy fluctuations, they also demand new capital investments in qualification processes and logistics infrastructure. On a broader scale, the tariffs have accelerated discussions around regional supply chain diversification and the development of alternative manufacturing ecosystems in allied countries. Such shifts may redefine global market shares in the years ahead, as companies weigh the long-term benefits of supply chain security against the immediate costs of transition.

In-Depth Segmentation Analysis Reveals Critical Application, Product, End User, Distribution, and Technology Dynamics Shaping the Motion Sensor Market Landscape

An examination of the accelerometer and gyroscope market through multiple segmentation lenses reveals nuanced dynamics shaping product design, customer choices, and distribution strategies. When focusing on applications, aerospace & defense usage is subdivided into avionics, guidance systems, and navigation systems, each demanding rigorous reliability and performance under extreme conditions. Automotive applications center on advanced driver assistance systems, navigation platforms, and telematics modules, where ADAS itself is further refined into precise airbag deployment sensors, electronic stability control mechanisms, and lane departure warning devices. In consumer electronics, gaming consoles break down into handheld and home console uses, laptops span gaming models and ultrabooks built for portability, smartphones split into Android and iOS variants, tablets occupy a shared space between productivity and media consumption, and wearable devices encompass fitness trackers alongside sophisticated smartwatches. Healthcare applications draw on diagnostic equipment, patient monitoring systems, and wearable health monitors, while industrial users rely on condition monitoring setups, process automation controls, and robotics guidance.

Shifting the perspective to product types, inertial measurement units form a cornerstone category, divisible into 6-axis and 9-axis IMUs that combine accelerometers, gyroscopes, and magnetometers for full spatial orientation. Meanwhile, MEMS accelerometers themselves offer multi-axis, single-axis, and tri-axial configurations to strike different balances between cost, complexity, and sensitivity. MEMS gyroscopes complement these options with single-axis and tri-axis variants, enabling developers to optimize for specific motion detection use cases. From an end-user vantage point, the market splits into aftermarket channels, where replacement and upgrade cycles drive volume and direct OEM relationships that influence product roadmaps and long-term collaborations.

Distribution channels further diversify the market, as some suppliers emphasize direct sales models to support customized solutions, while others leverage established distributors and online retailers to capture broad industrial and consumer reach. Finally, a technology segmentation underscores the role of sensor architecture, distinguishing capacitive types, which can be built with differential or single-plate designs, from optical and thermal sensors and piezoelectric units based on PZT or quartz materials. Each technology choice brings its own trade-offs in sensitivity, temperature stability, and cost, prompting manufacturers to tailor their offerings for specific verticals and performance requirements.

This comprehensive research report categorizes the Accelerometer & Gyroscope market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Axis And Fusion

- Application

- End User

- Distribution Channel

Regional Market Dynamics Uncovered: Analyzing Distinct Trends, Drivers, and Challenges Shaping the Accelerometer and Gyroscope Market Across Americas EMEA APAC

Regional insights within the accelerometer and gyroscope sector illustrate how localized factors influence demand patterns and technology adoption. In the Americas, the convergence of a strong automotive industry focused on ADAS and electric vehicles, coupled with substantial aerospace & defense budgets, has created robust demand for high-precision inertial sensors. Regulatory frameworks supporting autonomous vehicle testing and certification have further incentivized investment in MEMS accelerometer and gyroscope R&D, while established consumer electronics hubs continue to integrate advanced motion sensing into next-generation devices.

In Europe, Middle East & Africa, the interplay of stringent environmental and safety regulations is driving adoption of motion sensors in industrial automation, ultra-efficient HVAC systems, and next-level smart grid applications. Defense modernization programs and a growing focus on unmanned aerial systems also fuel aerospace and defense segments. Regional manufacturing initiatives in Eastern Europe and the Gulf states are emerging as cost-effective production alternatives, attracting partnerships aimed at localizing key MEMS technologies.

Asia-Pacific remains a powerhouse for consumer electronics and mobile device manufacturing, with leading smartphone, gaming console, and wearable producers headquartered in the region. Competitive production costs, expansive supply chain networks, and government incentives for semiconductor fabs have cemented the region’s role as a manufacturing epicenter. At the same time, rapid industrialization in Southeast Asia and continued growth in robotics and factory automation across China and Japan are boosting demand for industrial-grade accelerometers and gyroscopes.

This comprehensive research report examines key regions that drive the evolution of the Accelerometer & Gyroscope market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Landscape Overview: Profiling Leading Accelerometer and Gyroscope Manufacturers and Their Strategic Innovations, Partnerships, and Market Positioning

A detailed competitive review of the accelerometer and gyroscope market highlights a diverse array of key players pursuing differentiated strategies across product innovation, go-to-market models, and strategic alliances. Some established semiconductor manufacturers focus on expanding their MEMS portfolios through multi-axis IMU solutions and enhanced sensor fusion firmware, while others pursue acquisitions to fill gaps in technology or geographic coverage. Dedicated MEMS specialists are concentrating on ultra-low-power designs tailored for wearable and IoT endpoints, where battery life and size constraints are paramount.

Partnerships between sensor vendors and software firms are increasingly common, enabling integrated motion sensing and analytics platforms for automotive, industrial, and healthcare customers. Collaboration initiatives aim to streamline integration, reduce development cycles, and deliver turnkey solutions that simplify adoption for system integrators. Meanwhile, several emerging companies are targeting high-growth niches-such as next-generation AR/VR headsets and robotics swarms-by offering customizable MEMS packages with specialized performance characteristics. Across the competitive landscape, the race for higher bandwidth, lower noise floors, and enhanced environmental tolerance continues to shape product roadmaps and alliances.

This comprehensive research report delivers an in-depth overview of the principal market players in the Accelerometer & Gyroscope market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- STMicroelectronics International N.V.

- Robert Bosch GmbH

- TDK Corporation

- Analog Devices, Inc.

- Murata Manufacturing Co., Ltd.

- NXP Semiconductors N.V.

- Infineon Technologies AG

- ROHM Co., Ltd.

- Honeywell International Inc.

- Northrop Grumman Corporation

- KVH Industries, Inc.

- Silicon Sensing Systems Limited

- Seiko Epson Corporation

- TE Connectivity Ltd.

- Adafruit Industries, LLC

- ALTHEN GmbH Mess und Sensortechnik

- Dytran Instruments by Hottinger Brüel & Kjær

- Emcore Corporation

- Fizoptika Malta

- Gladiator Technologies, Inc.

- ifm electronic gmbh

- InnaLabs Limited

- iXblue by Exail SAS

- Japan Aviation Electronics Industry, Ltd.

- KaiTuo Precise Instrument Co., Ltd.

- Kistler Instrumente AG

- OMEGA Engineering, Inc.

- Safran S.A.

- Sumitomo Precision Products Co., Ltd.

Strategic Recommendations for Industry Leaders to Navigate Supply Chain Complexities, Technological Disruptions, and Market Evolution in Motion Sensor Technologies

In response to complex market dynamics, industry leaders should undertake a multifaceted strategic approach that balances innovation with operational resilience. First, investing in advanced sensor fusion algorithms and machine learning capabilities will unlock higher levels of accuracy and predictive power, especially in safety-critical automotive and industrial applications. At the same time, diversifying component sources by establishing relationships with regional MEMS foundries can mitigate tariff-related risks and reduce lead times in volatile supply environments.

To accelerate time to market, manufacturers may explore modular platform strategies that offer pre-validated hardware and software building blocks, enabling faster integration into end-user systems. Strengthening partnerships with software ecosystem providers will also facilitate seamless end-to-end solutions, enhancing value propositions for customers. On the product side, prioritizing ultra-low-power sensor variants and hybrid architectures that combine multiple sensing modalities within a single package can address emerging demands in wearables, AR/VR, and remote monitoring. Concurrently, beefing up after-sales support and calibration services reinforces brand reputation and fosters long-term customer loyalty.

Finally, staying attuned to evolving regulatory landscapes and participating in industry standards bodies will ensure that new products remain compliant and interoperable, reducing market entry barriers and supporting global expansion initiatives.

Robust Research Framework and Methodological Approach Underpinning Comprehensive Analysis of the Global Accelerometer and Gyroscope Market Report

The findings presented in this executive summary derive from a robust research framework that combined exhaustive secondary research, primary interviews with domain experts, and rigorous data validation techniques. Initially, comprehensive desk research was conducted to map the competitive landscape, track recent mergers and acquisitions, and collate product specifications from leading semiconductor vendors. Publicly available technical papers, patent databases, and regulatory filings were analyzed to identify trends in MEMS fabrication methods and packaging innovations.

Subsequently, a series of structured interviews with veterans from automotive OEMs, consumer electronics manufacturers, industrial automation integrators, and defense procurement officers provided firsthand perspectives on adoption drivers, technical requirements, and procurement challenges. Feedback from these interviews informed the segmentation schema and guided deeper dives into critical verticals such as aerospace, healthcare, and wearable devices.

To ensure accuracy, quantitative data on shipment volumes, unit pricing trends, and regional production capacities were triangulated across multiple sources, including supply chain databases and market intelligence platforms. Qualitative insights were aligned with these figures to build a holistic view of the market. Finally, the segmentation framework was stress-tested against real-world case studies to validate its applicability across diverse use cases and geographies.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Accelerometer & Gyroscope market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Accelerometer & Gyroscope Market, by Product Type

- Accelerometer & Gyroscope Market, by Technology

- Accelerometer & Gyroscope Market, by Axis And Fusion

- Accelerometer & Gyroscope Market, by Application

- Accelerometer & Gyroscope Market, by End User

- Accelerometer & Gyroscope Market, by Distribution Channel

- Accelerometer & Gyroscope Market, by Region

- Accelerometer & Gyroscope Market, by Group

- Accelerometer & Gyroscope Market, by Country

- United States Accelerometer & Gyroscope Market

- China Accelerometer & Gyroscope Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Concluding Insights Summarizing Market Dynamics, Emerging Opportunities, and Strategic Imperatives for Accelerometer and Gyroscope Stakeholders Worldwide

In summary, accelerometers and gyroscopes stand at the forefront of modern motion sensing, powering innovations across automotive autonomy, industrial automation, consumer electronics, and beyond. The landscape is rapidly evolving, driven by miniaturization, advanced sensor fusion, regional supply chain realignments, and emerging regulatory standards. Key segmentation insights underscore the diversity of application requirements-from avionics and ADAS to gaming consoles and medical devices-while regional nuances highlight distinct growth trajectories in the Americas, EMEA, and Asia-Pacific markets.

Industry players are navigating tariff-induced cost pressures by diversifying production strategies and forging strategic partnerships, even as they race to deliver ultra-precise, low-power sensor solutions. Competitive dynamics center on the integration of AI-driven analytics, modular hardware-software platforms, and comprehensive calibration services. As the market matures, success will hinge on the ability to anticipate end-user demands, embrace cross-industry collaborations, and maintain agility in the face of shifting trade policies and technological disruptions.

Overall, the insights outlined in this summary offer a clear path for stakeholders to align product roadmaps, enhance supply chain resilience, and capture new opportunities in the next wave of motion sensing innovation.

Engage with Ketan Rohom to Unlock In-Depth Market Intelligence, Drive Strategic Growth, and Secure Your Comprehensive Accelerometer and Gyroscope Industry Report Today

For a deeper understanding of the evolving dynamics within the accelerometer and gyroscope industry and to harness critical market intelligence, we encourage you to connect with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. His expertise will guide you through tailored insights on emerging opportunities, competitive positioning, and strategic imperatives drawn from our comprehensive market research report, helping your organization capitalize on the latest technological advances and regional trends. Reach out today to secure your copy of the full report and equip your team with the actionable data necessary to drive innovation and growth in motion sensing technologies.

- How big is the Accelerometer & Gyroscope Market?

- What is the Accelerometer & Gyroscope Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?