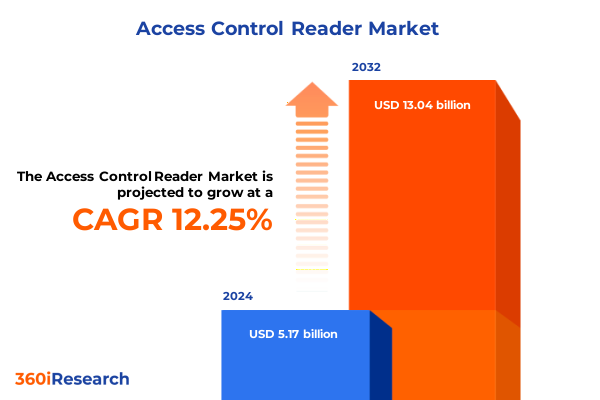

The Access Control Reader Market size was estimated at USD 5.77 billion in 2025 and expected to reach USD 6.45 billion in 2026, at a CAGR of 12.33% to reach USD 13.04 billion by 2032.

Setting the Stage for the Future of Access Control Reader Markets by Examining Core Drivers, Market Dynamics, and Emerging Innovation Trends

The access control reader market stands at a pivotal juncture, driven by the convergence of physical security requirements and digital transformation initiatives. As organizations seek to streamline identity verification and enforce robust access policies, the proliferation of advanced reader technologies has emerged as a core enabler. Recent trends underscore a shift away from legacy card-and-pin systems toward more secure and user-friendly modalities, reflecting broader industry demands for frictionless security and elevated threat detection capabilities.

In this evolving backdrop, stakeholders must navigate a complex ecosystem where traditional hardware capabilities intersect with software intelligence, cloud connectivity, and mobile integration. The advent of biometric authentication has raised the bar for security standards, while RFID and mobile-based solutions have redefined the user experience by minimizing touchpoints. At the same time, interoperability across enterprise access management platforms has become a critical requirement as organizations consolidate solutions and harmonize security policies across sites.

Against this dynamic canvas, competitive differentiation hinges on innovation that balances ease of deployment, cost-efficiency, and adaptive security. Understanding the interplay between emerging technologies, regulatory frameworks, and user expectations is essential for decision-makers looking to invest in next-generation access control infrastructures. This introduction sets the stage for a deeper exploration of the transformative forces shaping the market and the strategic insights needed to capitalize on emerging opportunities.

Uncovering How Rapid Technological Advancements, Evolving User Expectations, and Security Paradigms Are Redefining Access Control Reader Solutions Across Industries

Over the last several years, transformative shifts have fundamentally altered the access control reader landscape. Most notably, the rise of the hybrid workplace model has elevated demand for contactless and remotely managed authentication methods. Organizations are increasingly deploying cloud-native management platforms that enable administrators to configure and monitor access systems from anywhere, fostering operational resilience and reducing reliance on on-premises infrastructure.

Concurrently, advancements in artificial intelligence and machine learning have ushered in a new era of intelligent edge devices. Access control readers equipped with embedded analytics can now detect anomalous behavior, such as tailgating or credential spoofing, and trigger real-time alerts. This shift toward proactive security postures reflects broader cybersecurity imperatives, where zero-trust frameworks demand continuous verification and risk scoring rather than one-time authentication events.

Parallel to technological innovation, evolving privacy regulations have imposed stringent requirements on data protection and user consent. Manufacturers and integrators are thus investing in privacy-by-design approaches, ensuring that sensitive biometric and personally identifiable information remains encrypted throughout data capture, transit, and storage. As a result, the market is witnessing a convergence of compliance, convenience, and advanced threat mitigation that will continue to define competitive advantage.

Analyzing the Complex Effects of the 2025 United States Tariff Policies on Supply Chains, Component Costs, and Competitive Positioning in Access Control Reader Ecosystem

The 2025 United States tariff policies have introduced notable complexities for access control reader manufacturers and end users alike. Following a series of revised duties on imported electronic components, supply chains have experienced elevated lead times and higher procurement costs. Providers reliant on international sourcing for printed circuit boards, specialized semiconductors, and biometric sensors have been compelled to reevaluate supplier portfolios and absorb or pass through additional expenses.

In response, many original equipment manufacturers have diversified their procurement strategies by nearshoring critical component production or consolidating orders to achieve volume discounts that offset incremental duties. Strategic alliances with domestic assemblers have also gained traction, fostering greater supply chain transparency and mitigating the risk of future tariff adjustments. Parallel investments in inventory buffering have provided a temporary hedge against disruptions, although carrying higher working capital requirements.

End users are feeling the impact through modest price adjustments and extended delivery schedules, yet the long-term effects may catalyze innovation. Vendors are accelerating development of modular architectures and patent-pending sensor designs that rely less on tariff-exposed technologies. Ultimately, the market is adapting to a new cost structure and exploring overseas expansion where local regulatory incentives can offset U.S. duties.

Diving Deep into Technology, Connectivity, Mounting Style, Distribution Channel, and End-Use Segments to Reveal Critical Insights Shaping Market Opportunities

A close examination of market segmentation offers clarity on where growth and innovation are most concentrated. In terms of technology, access control readers encompass biometric solutions, card-based readers, mobile-based readers, and RFID platforms. Biometric systems hold particular interest, segmented further into facial recognition, fingerprint, iris, and palm vein modalities. Each modality carries unique adoption drivers: facial recognition excels in high-throughput environments, fingerprint readers strike a balance between cost and reliability, iris scanners deliver superior resistance to spoofing, and palm vein authentication appeals where hygiene and user comfort are paramount.

Connectivity preferences reveal a bifurcation between wired and wireless readers. Wired devices remain common in installations seeking uninterrupted power and network stability, particularly in critical infrastructure sites. Conversely, wireless readers leverage battery-powered flexibility and ease of retrofit, promoting rapid deployments in legacy facilities and temporary access scenarios.

Mounting style segmentation encompasses handheld or portable readers as well as wall-mounted units. Portable readers find application in security patrols, mobile inspections, and event management, while wall-mounted devices serve as fixed checkpoints at building perimeters and interior zones. Distribution channels further differentiate how products reach end users, spanning traditional offline routes alongside online storefronts such as e-commerce marketplaces and manufacturer websites.

Finally, end-use analysis segments the market across sectors including banking and finance, commercial venues, education institutions, government installations, healthcare facilities, hospitality and leisure environments, industrial sites, residential complexes, and transportation hubs. Within commercial settings, demand patterns vary from malls to offices, retail stores, and warehouses. Educational deployments range from colleges and research institutes to dormitories and schools. Government adoption extends to civic buildings, law enforcement precincts, and military bases, while healthcare applications target hospitals, labs, pharmacies, and specialized clean rooms. Industrial installations cover factories, plants, logistics centers, and oil and gas facilities. These granular insights enable stakeholders to align product design, channel strategy, and service offerings with distinct customer needs.

This comprehensive research report categorizes the Access Control Reader market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Connectivity

- Mounting Style

- Distribution Channel

- End-Use

Mapping Regional Dynamics Across the Americas, Europe, Middle East & Africa, and Asia-Pacific to Illuminate Unique Demand Patterns, Regulatory Environments, and Growth Triggers

Regional dynamics play a defining role in shaping the trajectory of access control reader adoption around the world. In the Americas, strong enterprise investment in cloud-managed security solutions is driving modernization projects across corporate campuses, financial centers, and transportation infrastructure. Regulatory frameworks in the United States and Canada are accelerating upgrades to legacy systems, with an emphasis on compliance, cyber-physical integration, and pandemic-inspired contactless access.

Across Europe, the Middle East, and Africa, regulatory heterogeneity yields a mosaic of requirements that influence product specifications and deployment models. The European Union’s data protection directives demand privacy-centric designs, while Middle Eastern markets exhibit robust demand for large-scale, government-led smart city initiatives. African nations present a diverse tapestry of emerging opportunities, where mobile-based credentials are gaining traction in regions with limited fixed network infrastructure.

In the Asia-Pacific region, rapid urbanization and robust investment in public safety infrastructure underpin strong growth. China’s vast installed base of RFID and biometric readers benefits from local manufacturing economies of scale, while Southeast Asian hubs are advancing multi-modal deployments to address tourism, transportation, and commercial expansion. India’s renewed focus on secure identification and digital public goods has further catalyzed demand for interoperable, standards-driven access control systems.

This comprehensive research report examines key regions that drive the evolution of the Access Control Reader market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Access Control Reader Manufacturers and Innovators to Highlight Strategic Initiatives, Collaborative Ventures, and Competitive Differentiators Driving Market Leadership

Leading players in the access control reader domain are showcasing a blend of organic innovation and strategic collaboration to maintain competitive positioning. Established manufacturers are investing heavily in research and development to integrate artificial intelligence at the edge, enhancing threat detection and anomaly analytics. At the same time, partnerships with cloud service providers are enabling seamless remote management and firmware-as-a-service offerings that expand recurring revenue models.

Medium-sized innovators are making targeted acquisitions of niche biometric sensor startups to broaden their product portfolios and accelerate time-to-market. Collaborative ventures with network infrastructure vendors and systems integrators have proven effective in delivering end-to-end solutions that encompass hardware, middleware, and managed services. Meanwhile, technology startups are leveraging open-architecture principles to disrupt legacy ecosystems and offer developers robust APIs for customized workflows.

Across the competitive landscape, emphasis on cyber-resilience and interoperability remains a unifying theme. Several key companies have achieved certifications under stringent international security frameworks, reinforcing customer confidence. Furthermore, cross-sector alliances are emerging, where physical security vendors partner with enterprise software firms to deliver unified identity and access management platforms that blur the lines between physical and logical controls.

This comprehensive research report delivers an in-depth overview of the principal market players in the Access Control Reader market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Advanced Card Systems Ltd.

- Allegion PLC

- AMAG Technology, Inc.

- Assa Abloy Group

- Avigilon Corporation by Motorola Solutions, Inc.

- Axis Communications AB

- Brivo Systems, LLC

- dormakaba International Holding AG

- DUALi Inc.

- Gallagher Group

- Honeywell International Inc.

- IDEMIA Group

- Identiv, Inc.

- Johnson Controls International PLC

- Mantra Softech (India) Pvt. Ltd.

- Napco Security Technologies, Inc.

- NEC Corporation

- Nedap N.V.

- Panasonic Corporation

- Paxton Access Ltd.

- phg Peter Hengstler GmbH + Co. KG

- Realtime Biometrics

- Robert Bosch GmbH

- SALTO Systems, S.L.

- Schneider Electric SE

- Siemens AG

- Suprema Inc.

- Thales Group

- Vanderbilt, LLC

Outlining Targeted Strategies and Best Practices for Industry Stakeholders to Capitalize on Market Disruptions, Optimize Product Offerings, and Enhance Operational Resilience

To navigate the evolving terrain of access control reader technology, industry leaders should adopt a multi-pronged strategy that balances innovation, resilience, and customer centricity. First, organizations must prioritize the development of open, standards-based architectures that facilitate integration with identity management platforms and IoT ecosystems. This approach not only future-proofs deployments but also lowers barriers for third-party applications and analytics.

Second, diversification of the supply chain is critical in light of tariff uncertainties and geopolitical tensions. By establishing relationships with regional component suppliers and contract assemblers, companies can mitigate delays, reduce duty exposure, and maintain service levels. Additionally, during product design phases, sourcing decisions should incorporate risk assessments that anticipate potential policy shifts and logistics constraints.

Third, a focus on user experience will differentiate offerings in a crowded field. Enhancing mobile-centric workflows, optimizing biometrics for speed and accuracy, and simplifying administrative interfaces will drive adoption across sectors. Finally, embedding cybersecurity best practices throughout the product lifecycle-from secure boot and encrypted communication to automatic vulnerability patching-will build trust and ensure compliance across international markets.

Explaining the Rigorous Multimodal Research Methodologies Employed to Ensure Data Reliability, Market Insights Validity, and Comprehensive Assessment of Access Control Reader Trends

This analysis draws upon a structured combination of primary and secondary research methods designed to deliver robust, actionable insights. Primary research included in-depth interviews with senior security architects, procurement officers, and integrators across key industries, providing firsthand perspectives on technology adoption, procurement criteria, and emerging pain points. Quantitative surveys captured data on feature preferences, deployment cycles, and regional purchasing patterns, enabling statistical triangulation with qualitative findings.

Secondary research leveraged a curated repository of industry publications, government regulations, and trade association reports to validate market trends and contextualize regional dynamics. Proprietary databases and patent analyses informed the assessment of innovation pipelines and technology roadmaps. All data points underwent rigorous cross-validation through a bottom-up approach, ensuring consistency between macro-level indicators and micro-level stakeholder feedback.

Rigorous data quality protocols, including source verification, trend consistency checks, and peer reviews, were applied throughout the research lifecycle. This multimodal methodology ensures that the insights within this report reflect both the current state of the market and emerging trajectories over the near term.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Access Control Reader market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Access Control Reader Market, by Technology

- Access Control Reader Market, by Connectivity

- Access Control Reader Market, by Mounting Style

- Access Control Reader Market, by Distribution Channel

- Access Control Reader Market, by End-Use

- Access Control Reader Market, by Region

- Access Control Reader Market, by Group

- Access Control Reader Market, by Country

- United States Access Control Reader Market

- China Access Control Reader Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Summarizing Key Findings on Market Evolution, Technological Innovations, and Strategic Drivers That Will Shape the Future Trajectory of Access Control Reader Adoption

In summary, the access control reader market is being reshaped by a confluence of digital transformation, heightened security requirements, and evolving user expectations. Technological advances in biometrics, wireless connectivity, and edge analytics are driving new standards for convenience and resilience. At the same time, regulatory imperatives and tariff pressures are prompting stakeholders to rethink supply chains, data protection approaches, and regional strategies.

Segmentation analysis reveals distinct value propositions across technology modalities, connectivity types, mounting styles, distribution channels, and end-use sectors, underscoring the importance of targeted product development. Regional insights highlight the necessity of aligning solutions with localized regulatory landscapes and deployment models. Competitive profiling illustrates that sustained leadership will require continuous innovation, strategic alliances, and a steadfast focus on cybersecurity and interoperability.

The strategic recommendations provided herein offer a roadmap for navigating the shifting landscape, from embracing standards-based architectures to diversifying supply chains and prioritizing user-centric design. By applying these insights, industry participants can position themselves to capitalize on growth opportunities and maintain a competitive edge in an increasingly dynamic market environment.

Take the Next Step to Secure Your Competitive Advantage by Engaging with Ketan Rohom for Tailored Insights and the Full Access Control Reader Market Report

To acquire a comprehensive view of emerging trends, competitive dynamics, and strategic levers in the access control reader market, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan brings deep expertise in physical security technologies and can provide tailored guidance on how the insights in this report apply to your organization’s strategic priorities. By engaging directly, you can receive a customized briefing that aligns with your unique market challenges and investment goals. Secure your copy of the full market research report today to ensure you have the actionable intelligence needed to stay ahead in an evolving security landscape.

- How big is the Access Control Reader Market?

- What is the Access Control Reader Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?